Get the free Microfinance as a Tool to Empower Women Entrepreneurs in Ivory ...

Get, Create, Make and Sign microfinance as a tool

How to edit microfinance as a tool online

Uncompromising security for your PDF editing and eSignature needs

How to fill out microfinance as a tool

How to fill out microfinance as a tool

Who needs microfinance as a tool?

Microfinance as a Tool Form: A Comprehensive How-to Guide

Understanding microfinance: A comprehensive overview

Microfinance refers to financial services that are provided to low-income individuals or those lacking access to conventional banking services. These services include microloans, savings accounts, and even insurance products designed to empower people economically.

The historical context of microfinance dates back to the late 1970s, primarily driven by the need to alleviate poverty in developing countries. Dr. Muhammad Yunus, often called the father of microfinance, started lending small amounts to impoverished artisans in Bangladesh, demonstrating that low-income individuals are capable of repaying loans.

Key principles of microfinance revolve around providing financial services tailored to the needs of the underserved. It focuses on building trust and fostering a sense of community among borrowers, often through group lending techniques.

The impact of microfinance on economies has proven significant. By facilitating access to capital, microfinance stimulates entrepreneurship, promotes savings habits, and encourages investments, thus fostering economic development.

The role of microfinance in empowering individuals and communities

Successful microfinance initiatives often illustrate its potential in transforming lives. For instance, the Grameen Bank model in Bangladesh has provided millions of dollars in loans to small business owners, especially women, resulting in reduced poverty levels and enhanced family welfare.

Testimonials from beneficiaries of microfinance services frequently emphasize the newfound confidence and financial literacy that come with access to funds. Many report enhanced living conditions, enabling children’s education, and initiating small businesses.

The psychological impact of financial inclusion can’t be overstated. It not only provides material benefits but also instills a sense of dignity and empowerment, helping individuals to break the cycle of poverty.

Microfinance models: Selecting the right approach

Microfinance products can vary widely based on community needs. Key offerings include microloans, which help individuals start or expand businesses; savings and deposit accounts that promote financial literacy; and insurance options that safeguard families against unforeseen risks.

Choosing the right model ensures that financial services are both relevant and impactful. It's vital to conduct a comparative analysis of global microfinance institutions to identify approaches that best serve specific communities.

Steps to accessing microfinance services

Before diving into microfinance, it's important to identify your needs. Assess whether you're seeking funds for a business startup, education, or another project, as this will guide your approach.

Researching local microfinance institutions is essential. Utilize online platforms that compare services, interest rates, and terms. Community recommendations can also provide insights into the best local options.

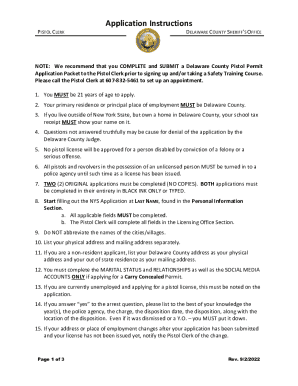

The application procedure generally requires identification, business plans, and financial history. Preparing a strong application increases your chances of approval. For successful submissions, keep documents organized and clearly convey your purpose.

Navigating the microfinance process: From application to disbursement

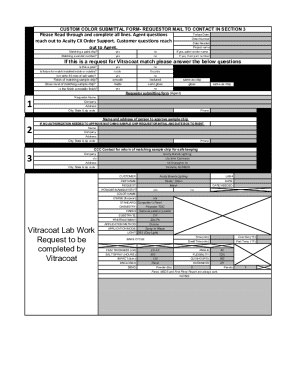

Understanding application forms is crucial for effective microfinance access. Key sections typically include personal information, financial history, and purpose of the loan. Frequent mistakes include incomplete sections or lack of clarity, which can lead to rejection.

Expect varied approval timelines, as this can depend on the institution and the type of loan applied for. Once approved, managing disbursement and using funds effectively becomes essential to ensure sustainability and business growth.

Enhancing microfinance with technology

In recent years, digital platforms have revolutionized microfinance, making services more accessible. From online application portals to mobile banking solutions, technology has streamlined the microfinance process.

eSignature and document management solutions have also simplified traditional paperwork, ensuring faster processing times. Tech-driven success stories, such as M-Pesa in Kenya, illustrate how technology can enhance financial inclusion.

Collaborative financing: Working with teams for greater impact

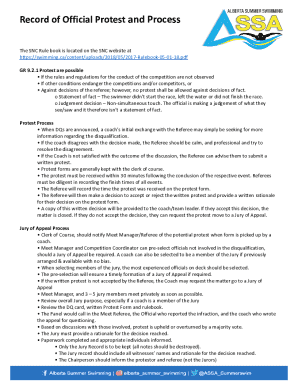

Group lending mechanisms foster solidarity and trust among borrowers, often leading to higher repayment rates. Understanding how these systems work can significantly impact your microfinance journey.

Moreover, building partnerships with non-profits and government agencies can enhance resources. Engaging social enterprises and impact investors may also create more robust financing options for communities.

Managing microfinance finances: Best practices

Creating a budget is vital for sustainability in microfinance. Start by documenting all income sources and expenses to get a comprehensive picture of your financial landscape.

Utilizing tools for tracking expenses and income can facilitate effective financial management. Developing repayment strategies early on ensures financial health and supports your initiative's longevity.

Expanding the reach: Microfinance as a tool for social change

Microfinance plays a pivotal role in advancing gender equality. Many programs specifically target women, empowering them to contribute economically and socially to their communities.

In addition, as the world confronts climate change, microfinance can promote sustainable lending practices that support environmentally-friendly ventures. Advocating for policy changes can help further solidify the role of microfinance in social change.

Future trends in microfinance: Preparing for tomorrow

As the microfinance landscape evolves, new models are emerging that leverage technology and community engagement. Innovations in analytics and customer service are expected to shape the future of microfinance.

Additionally, global economic changes, such as fluctuating interest rates and international trade dynamics, will influence microfinance trends. Stakeholders must stay vigilant in adapting strategies to maximize their impact.

Interactive tools for learning and management

Utilizing digital tools like pdfFiller can streamline the management of microfinance forms, enhancing user experience. Features like document editing, eSignature, and collaboration enable a seamless application process.

Accessing templates tailored for microfinance applications allows individuals to begin the documentation process quickly. Collaboration features make it easier for teams to manage projects efficiently, further driving impactful outcomes in microfinance.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit microfinance as a tool from Google Drive?

How can I get microfinance as a tool?

Can I edit microfinance as a tool on an iOS device?

What is microfinance as a tool?

Who is required to file microfinance as a tool?

How to fill out microfinance as a tool?

What is the purpose of microfinance as a tool?

What information must be reported on microfinance as a tool?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.