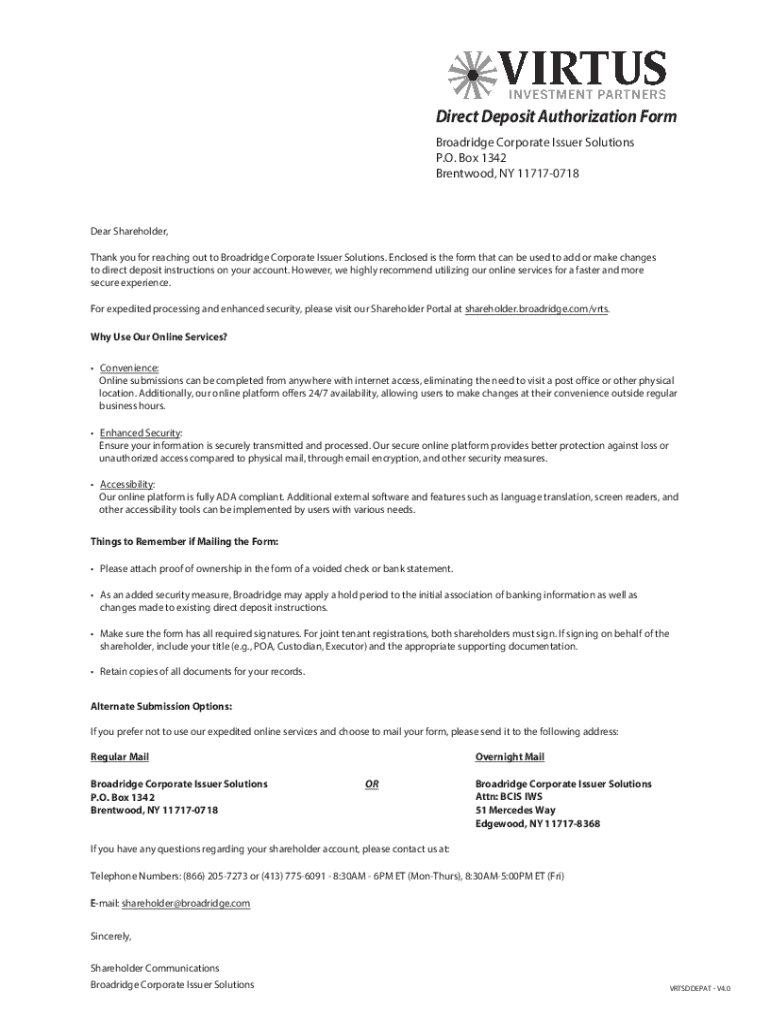

Get the free Direct Deposit Authorization Form - Shareholder Portal

Get, Create, Make and Sign direct deposit authorization form

Editing direct deposit authorization form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out direct deposit authorization form

How to fill out direct deposit authorization form

Who needs direct deposit authorization form?

A comprehensive guide to direct deposit authorization forms

Understanding direct deposit authorization forms

A direct deposit authorization form is a document that allows individuals to authorize their employer or any other entity to deposit their paychecks or payments directly into their bank account. This method of payment offers numerous advantages, primarily centered around convenience and security. By filling out this form, recipients can eliminate the need for physical checks, ensuring their funds are available directly to them without unnecessary delays.

The importance of direct deposit authorization forms extends beyond personal convenience. They enhance financial security, reduce the chances of check theft, and often result in quicker access to funds, allowing individuals to manage their finances more effectively. Additionally, reduction in paper checks promotes an environmentally friendly approach, demonstrating a commitment to sustainable practices.

Key components of a direct deposit authorization form

A complete direct deposit authorization form typically includes several essential components to ensure seamless processing and accuracy. This starts with personal identification information, which usually comprises the individual's name, contact details, and address. This information confirms the identity of the authorized individual and facilitates communication.

Next, bank account details are crucial. This includes the account number and routing number, which ensure that funds are deposited into the right account at the correct financial institution. In cases where the authorization form is connected to employment, employment details like the employer’s name and contact information might also be necessary. Finally, to finalize the authorization, a consent and signature section allows the individual to formally agree to the terms of the direct deposit.

Step-by-step guide to completing your direct deposit authorization form

**Step 1: Gather your information** - Before starting, collect all relevant documents such as your bank statement and employment information. This will simplify the process, making it smoother and more efficient.

**Step 2: Fill out the personal information section** - Begin by entering your name, address, and contact details accurately. These details are mandatory and should match those associated with your bank account.

**Step 3: Entering bank account information** - When inputting your bank account number and routing number, double-check for accuracy. Small mistakes could lead to deposit failures. Common errors include transposing numbers or using the incorrect routing number.

**Step 4: Review employment information** - Should your form be linked to your job, ensure you provide the correct employer's name and contact information to facilitate processing.

**Step 5: Sign and date the authorization** - Remember that your signature is a legal indication that you consent to the direct deposit arrangement. Always date your form, as it may be necessary for recordkeeping and legal purposes.

Tips for submitting your direct deposit authorization form

Submitting your direct deposit authorization form accurately is crucial. Here are some best practices to consider:

Timelines for processing can vary but typically range from a few days to a couple of weeks. Keeping a close eye on your bank account during this period will help confirm the successful setup of your direct deposit.

Common issues and how to resolve them

Despite the best efforts to complete and submit your direct deposit authorization form, issues can sometimes arise. Common problems reported include delays in fund deposits, which may be caused by timing or processing errors in payroll systems.

Another frequent issue is mismatched account information. Before submitting, it is essential to double-check your bank account details to prevent incorrect deposits. If you need to change bank accounts after submission, promptly inform your employer or the organization managing your payment method.

If you encounter problems, don’t hesitate to reach out to customer support from your bank or employer. Being proactive can significantly reduce the stress associated with potential delays or issues.

Using pdfFiller to manage your direct deposit authorization form

Managing your documents, such as a direct deposit authorization form, can be effortless with tools like pdfFiller. This platform offers intuitive features designed to simplify the process of filling out and submitting forms.

With pdfFiller, users can edit and customize their direct deposit forms easily. Its robust eSignature feature allows for quick and secure approvals, reducing delays in processing. Whether you are working independently or as part of a team, pdfFiller facilitates document sharing and feedback, making collaboration seamless.

FAQs about direct deposit authorization forms

Here are some frequently asked questions surrounding direct deposit authorization forms:

Real-life scenarios and user experiences

Many users have benefitted from using direct deposit authorization forms, citing convenience and security as primary advantages. By eliminating the need for physical checks, they have found peace of mind knowing their funds are secure and accessible. Testimonials showcase that the process has become significantly streamlined through the use of services like pdfFiller.

Examples of effective submission methods involve utilizing digital platforms like pdfFiller, which allow users to fill out, send, and receive confirmation of their forms in real time. The resultant efficiency not only mitigates anxiety around payment schedules but also fosters positive relationships between employees and their employers.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my direct deposit authorization form directly from Gmail?

How do I edit direct deposit authorization form on an iOS device?

How do I complete direct deposit authorization form on an Android device?

What is direct deposit authorization form?

Who is required to file direct deposit authorization form?

How to fill out direct deposit authorization form?

What is the purpose of direct deposit authorization form?

What information must be reported on direct deposit authorization form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.