Get the free Tax-Return-Instructions.pdf

Get, Create, Make and Sign tax-return-instructionspdf

Editing tax-return-instructionspdf online

Uncompromising security for your PDF editing and eSignature needs

How to fill out tax-return-instructionspdf

How to fill out tax-return-instructionspdf

Who needs tax-return-instructionspdf?

Your Complete Guide to the Tax-Return-InstructionsPDF Form

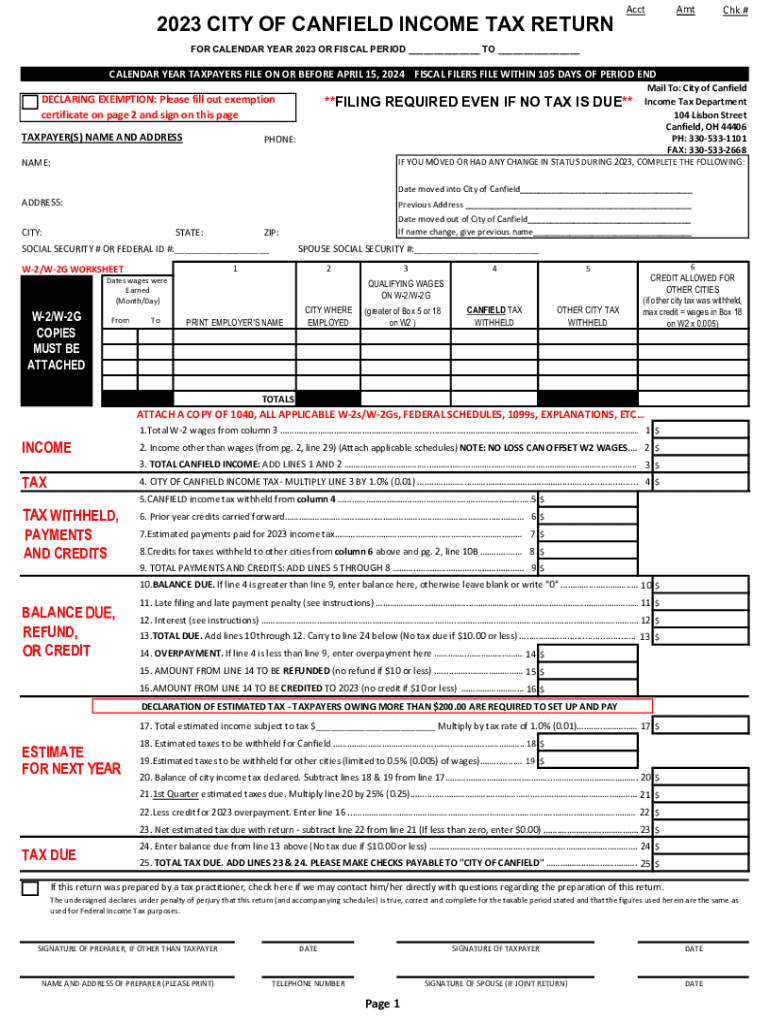

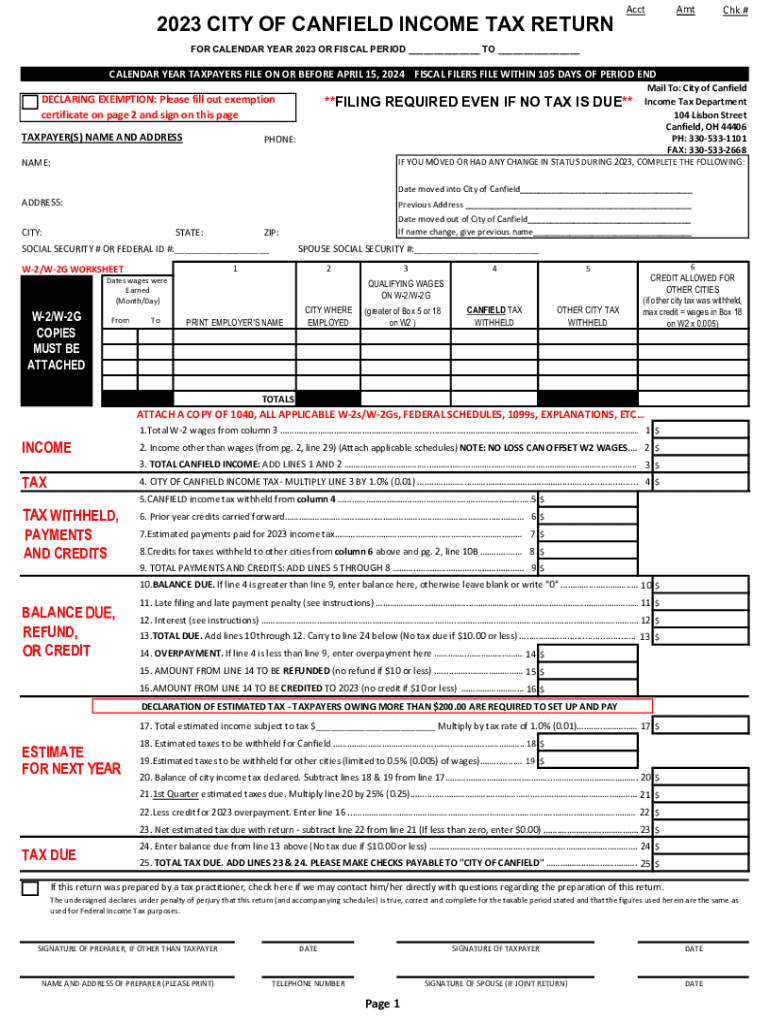

Overview of tax return forms

A tax return form is a document submitted by individuals and businesses to report income, calculate tax liability, and claim deductions or exemptions. Understanding this form is crucial, as it lays the foundation for your financial duties to the government.

Accurate submission is vital to avoid penalties and ensure you receive any eligible refunds. Tax forms vary based on different needs, including personal, business, and investment returns.

Navigating the tax-return-instructionspdf form

The tax-return-instructionspdf format is a structured document that makes it convenient for users to fill out their returns electronically. PDF formats are universally accepted, making it easy to share and print.

Key information required on the tax-return-instructionspdf form includes personal information, income details, deductions, credits, and tax liability calculations. This form plays a significant role in accurately representing your financial situation to the IRS.

Step-by-step instructions for completing the form

Completing the tax-return-instructionspdf form begins with gathering necessary documents. For a smooth experience, assemble everything before you start filling out the form.

The essential documents include income statements like W-2s and 1099s, your prior year tax return for reference, and receipts for any deductions. Once you have collected these documents, you can begin filling out the form.

To fill out the tax-return-instructionspdf form, access the PDF and start entering your personal information. Then, report your income sources accurately, documenting deductions and calculating any credits. Finally, perform a thorough review to ensure no mistakes are present.

Editing and customizing your tax-return-instructionspdf form

Editing the tax-return-instructionspdf form can be straightforward with pdfFiller. This platform allows users to upload their PDFs and make necessary changes easily.

While editing, you'll have the ability to utilize pre-filled fields, making data entry quicker. You can also add annotations for clarity, which is particularly useful if sharing the document with others or keeping personal notes.

Signing and submitting your tax return

After completing your tax-return-instructionspdf form, the next step is to sign it. eSigning through pdfFiller ensures that the process is secure and efficient.

You have multiple options for submission. Electronic filing (e-filing) is becoming increasingly popular for its speed and convenience. Alternatively, you can mail a printed version of your completed form. Don't forget to retain a confirmation of submission for your records.

Managing and storing tax return documents

Once your tax return is submitted, managing your return documents is essential. pdfFiller provides functionalities to organize these records seamlessly.

Creating folders for different tax years and sharing necessary documents with tax professionals can streamline your future tax preparations. With pdfFiller, you can access your documents anytime and from anywhere.

Common issues and troubleshooting

Filling out the tax-return-instructionspdf form may present some common challenges. Recognizing these issues early can save you time and frustration.

Typical mistakes include miscalculating entries, omitting important documentation, or failing to review the form before submission. Establishing a checklist before submitting your form can be incredibly helpful.

Tips for maximizing your tax return

To maximize your tax return, it's crucial to understand eligible deductions and credits. Strategies that relate to dependents, educational expenses, and investment losses can enhance your refund significantly.

Employing the tools available through pdfFiller can also help you achieve better accuracy while navigating tax forms. Make sure to refer to possible credits and deductions relevant to your specific tax situation to maximize your benefits.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send tax-return-instructionspdf for eSignature?

Where do I find tax-return-instructionspdf?

How do I execute tax-return-instructionspdf online?

What is tax-return-instructionspdf?

Who is required to file tax-return-instructionspdf?

How to fill out tax-return-instructionspdf?

What is the purpose of tax-return-instructionspdf?

What information must be reported on tax-return-instructionspdf?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.