Comprehensive Guide to Non-Homestead Affidavit DOCX Template Form

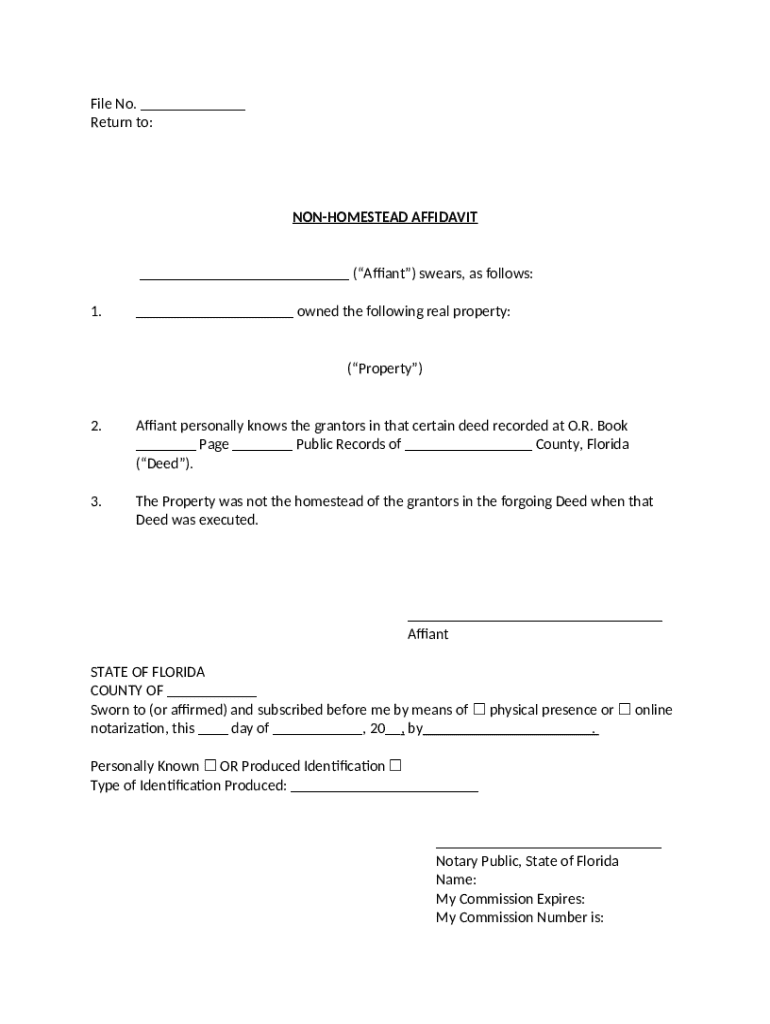

Overview of Non-Homestead Affidavit

A non-homestead affidavit is a legal document required for property owners who do not occupy their property as their primary residence. This affidavit plays a crucial role in property tax assessments, helping local authorities to determine the tax rates applicable to different properties. Accurate documentation is essential because it ensures that property owners pay the correct amount of taxes based on their property's classification.

Having precise information in a non-homestead affidavit can mean significant savings for property owners, as inaccuracies may lead to over-assessment and excessive property taxes. Additionally, a correctly filed affidavit helps maintain transparency and integrity in the property assessment process.

Understanding the Non-Homestead Affidavit

A non-homestead affidavit serves as a declaration by the property owner that the property in question is not their primary residence. This is critical for various administrative purposes, including the accurate determination of property tax classifications. While homestead affidavits are filed by property owners claiming a primary residence exemption, a non-homestead affidavit indicates that the property generates rental income or is simply a secondary residence.

Difference from homestead affidavit: Homestead affidavits typically qualify the property for tax relief, while non-homestead affidavits do not.

Who needs to file: Property owners who rent out their property, or those owning vacation homes, should file a non-homestead affidavit.

Exploring the Non-Homestead Affidavit DOCX Template

The non-homestead affidavit DOCX template is a structured document designed to simplify the affidavit-filing process. The template is pre-formatted to ensure that all necessary information is captured, significantly reducing the chances of errors. It includes designated fields for personal information, property details, and affidavit declarations which makes it user-friendly.

Utilizing this template offers numerous benefits over manual submission. A template not only saves time but also minimizes the risk of forgetting important details. With pdfFiller’s platform, users can easily access the non-homestead affidavit template, ensuring that they always work with the latest version of the form.

Step-by-step instructions for filling out the non-homestead affidavit

Filling out the non-homestead affidavit is straightforward when using the DOCX template. Here’s a breakdown of the primary sections you need to complete:

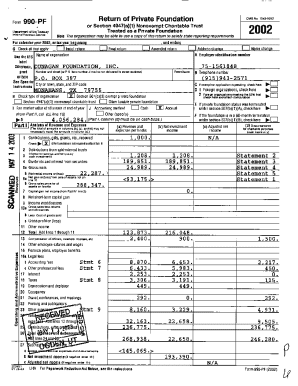

Personal Information: Enter relevant details including your name, address, and contact information.

Property Details: Provide the property's address, type, and any relevant identifiers, such as parcel numbers.

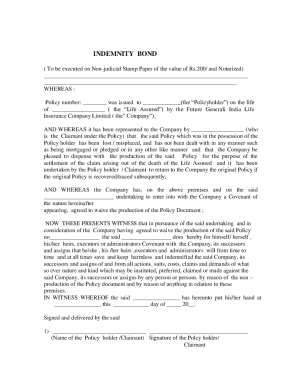

Affidavit Declarations: Confirm the non-homestead status of your property by signing and dating the affidavit.

To ensure the accuracy of your affidavit, it’s critical to provide truthful and precise information. Common mistakes to avoid include leaving blank fields, entering incorrect property addresses, and failing to sign the document. Double-checking your entries before submission can save you time and potential hassle.

Editing and customizing the non-homestead affidavit

Once you have filled out the template, pdfFiller offers various editing tools to customize your non-homestead affidavit. Users can adjust formatting, add notes, or include comments as necessary.

These editing features are invaluable because they enhance the readability of the document, ensuring that all parties understand the content clearly. Users can also highlight specific sections or draw attention to critical information, making it easier for tax authorities to process the affidavit quickly.

eSigning the non-homestead affidavit

Incorporating an eSignature on your non-homestead affidavit is crucial for validating the document. eSigning within the pdfFiller platform is a simple and secure process, ensuring your affidavit holds legal weight.

To eSign your affidavit, simply navigate to the relevant section in the pdfFiller interface, where you can create or upload your signature. This step is legally recognized and can expedite the processing of your application significantly. Keep in mind that some jurisdictions have specific legal stipulations regarding eSignatures, so it’s advisable to understand these requirements before proceeding.

Collaborating on the non-homestead affidavit

If you're working with a team to complete your non-homestead affidavit, pdfFiller provides collaborative features that allow multiple users to work on the document. You can invite team members to review and provide input on the affidavit, enhancing the overall quality of the submission.

With real-time collaboration features, each team member can make adjustments, add comments, and track changes, ensuring that the final document is comprehensive and accurate. This collaborative approach not only streamlines the process but helps incorporate diverse perspectives, which can be particularly beneficial when dealing with complex property situations.

Submitting the non-homestead affidavit

Once your non-homestead affidavit is complete, the next step is submission. You generally have options for online submission or mailing a hard copy. The online option is often faster and more secure, allowing for quicker processing by tax authorities.

It’s vital to keep track of your submission status, especially if you opt for mail. Many jurisdictions offer tracking services for mailed documents. Stay informed about deadlines to ensure that your affidavit is submitted on time to avoid penalties or additional taxes.

Managing your non-homestead affidavit documents

After submission, effective management of your non-homestead affidavit documents is essential. pdfFiller allows users to store and organize their affidavit files within its platform, ensuring easy access when needed.

Utilizing pdfFiller’s cloud storage also provides peace of mind with secure online access to your documents, facilitating easy sharing with relevant authorities. This capability is particularly useful for property owners who may need to reference their affidavits in future tax assessments or disputes.

Resources for further assistance

For those needing additional guidance on non-homestead affidavits, a wealth of resources is available. pdfFiller’s support includes helpful links and FAQs regarding non-homestead affidavits. Furthermore, local property tax offices can also provide clarification and additional resources tailored to your specific jurisdiction.

If you encounter challenges while filling out the form or need direct assistance, pdfFiller support is always an invaluable resource, ensuring that you get the help you need when dealing with your non-homestead affidavit.

Additional form choices

Property owners may find it beneficial to explore related property tax forms aside from the non-homestead affidavit. pdfFiller’s extensive land-use forms database makes it easy to navigate through various options to select the correct form needed based on your individual property circumstances.

By utilizing the right forms, property owners can ensure compliance with local regulations while maximizing their eligibility for any potential tax benefits. Always check for updates in local tax law to stay informed about any changes that may affect your filings.