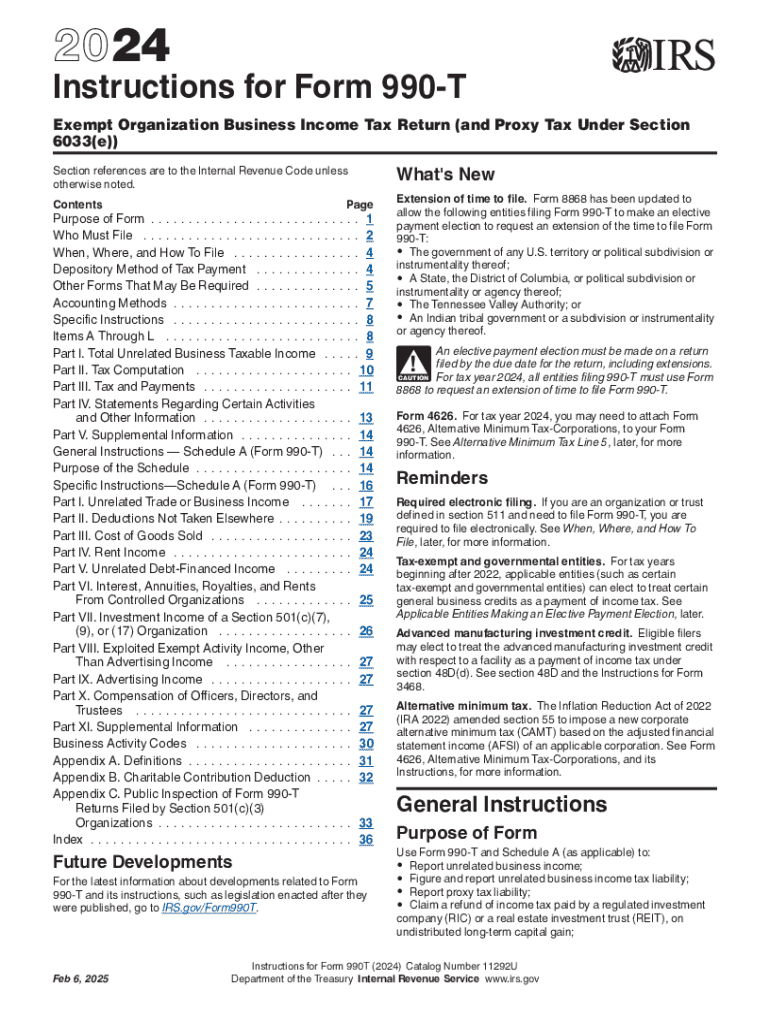

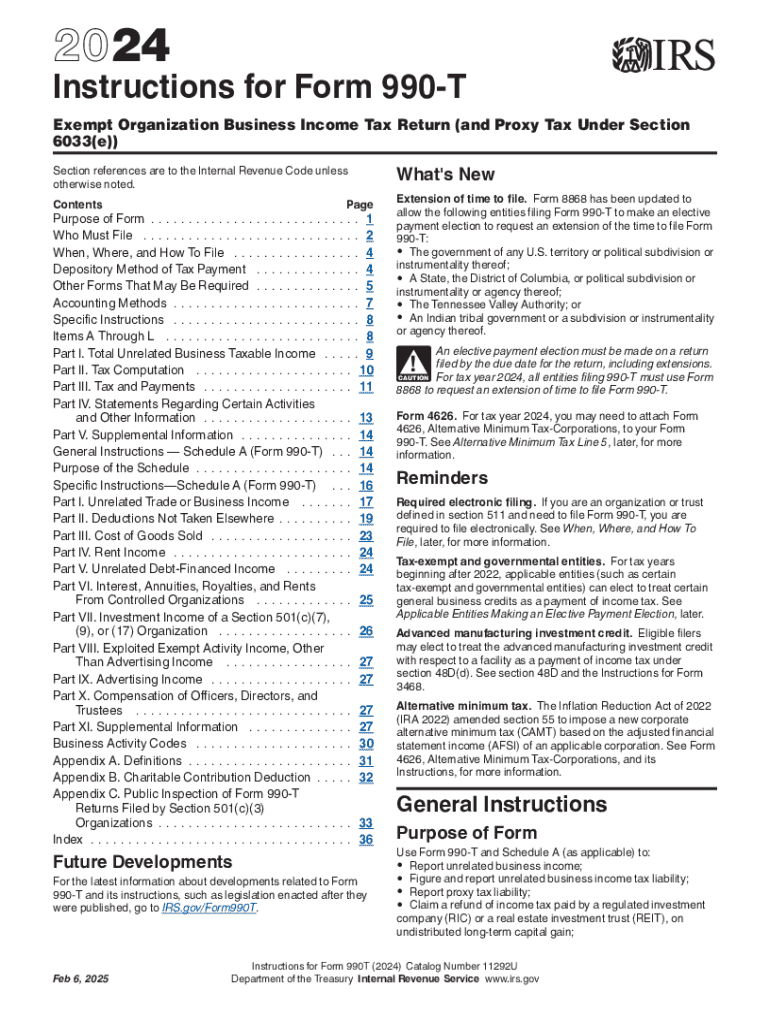

IRS Instructions 990-T 2024-2026 free printable template

Get, Create, Make and Sign IRS Instructions 990-T

How to edit IRS Instructions 990-T online

Uncompromising security for your PDF editing and eSignature needs

IRS Instructions 990-T Form Versions

How to fill out IRS Instructions 990-T

How to fill out 2024 instructions for form

Who needs 2024 instructions for form?

2024 Instructions for Form: A Comprehensive Guide

Overview of 2024 instructions

Following the 2024 instructions for form filing is crucial for ensuring compliance with tax regulations. Accuracy in following these guidelines can save you time and reduce the risk of penalties. The 2024 tax season has introduced several changes that users need to be aware of, making it even more vital to understand the specific requirements laid out in the instructions.

The primary purpose of this form is to facilitate the seamless completion and submission of your tax returns, catering to individuals, businesses, and varying filing statuses. It helps determine your tax obligations accurately and ensures you maximize credits and deductions available for your circumstances.

Key dates for submission and compliance

Filing taxes on time is essential to avoid penalties. The major deadlines for the 2024 tax season are as follows:

Additionally, be aware of late filing penalties, which can accrue at a rate of 5% of the unpaid taxes each month, up to 25%. Familiarize yourself with these key dates to ensure compliance and mitigate liabilities during the filing process.

Detailed steps for filling out the form

Filing your taxes using the form involves several distinct steps that ensure your submission is accurate and complete. Below are the essential steps:

Be vigilant in reviewing your form. Utilizing tools like pdfFiller enhances accuracy checks, allowing you to verify entries easily and make necessary edits.

Common errors and how to prevent them

Common mistakes, such as incorrect Social Security Numbers or math errors, can derail your filing experience. Understanding them can prevent headaches down the line. The impacts of these errors include delays in processing, possible audits, and penalties.

Proactively avoiding these common pitfalls ensures a smoother experience for all users, especially residents in states with unique tax regulations like California.

Do you need to file? Eligibility considerations

Before diving into the form filling process, assess whether you are required to file based on your income level, filing status, and other personal circumstances.

Assessing your eligibility correctly will streamline the filing process and help you avoid unnecessary complications.

What's new for 2024

The 2024 tax season has brought several changes in tax laws that will impact how you complete your form. One notable update includes new deductions or credits that can significantly affect your tax liabilities. For example, changes in the law may introduce business credits that can be claimed by small business owners in California.

These changes are crucial, as not knowing about them can mean missing out on significant savings.

Selecting the correct form for your needs

Choosing the right form is essential to ensuring accurate filing. The IRS offers several types of forms, including various schedules. These include Schedule X for certain deductions and credits which may apply differently based on your specific situation.

Choosing the correct form influences not only compliance but also the possibility of maximizing your refunds and credits. Use guidelines provided in the instructions to ascertain the right fit for your filing situation.

Utilizing pdfFiller for a seamless filing experience

pdfFiller is designed to streamline the form filling process. Its features for editing, signing, and managing forms provide users with a comprehensive solution. Users can edit PDFs, insert e-signatures, and manage documents all from one cloud-based platform.

These features make pdfFiller a must-have for anyone preparing to file the 2024 instructions for form.

Specific scenarios: who should use this form?

Understanding who should utilize the form can help clarify its purpose further. Various scenarios warrant different approaches to filing, such as first-time filers, business owners, and families with dependents.

Addressing these situations can guide users in understanding how best to utilize the form and submit it accurately.

FAQs about filing with the 2024 form

Addressing common questions and concerns helps demystify the filing process. Users often have queries regarding specific instructions that can be intricate.

Clarifications on these topics will ensure a more confident approach to filing while minimizing errors, enhancing the overall filing experience.

Wrap-up: ensuring a smooth filing process

To recap, ensuring a smooth filing process begins with understanding the instructions for form submission. Knowing deadlines, gathering necessary information, and utilizing tools like pdfFiller can enhance accuracy and efficiency.

Take advantage of the resources available within pdfFiller to facilitate the preparation of your tax return. Aim for a stress-free tax season by being well-prepared and informed.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in IRS Instructions 990-T without leaving Chrome?

Can I create an electronic signature for signing my IRS Instructions 990-T in Gmail?

How can I edit IRS Instructions 990-T on a smartphone?

What is 2024 instructions for form?

Who is required to file 2024 instructions for form?

How to fill out 2024 instructions for form?

What is the purpose of 2024 instructions for form?

What information must be reported on 2024 instructions for form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.