IRS Publication 962 2025-2026 free printable template

Show details

Are you eligible to claim the EITC for 2024?

Here are the rules to claim the credit . . .The EITC is for working people who earn less

than $66,819. This year, the amount of the

credit you could receive

pdfFiller is not affiliated with IRS

Get, Create, Make and Sign IRS Publication 962

Edit your IRS Publication 962 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your IRS Publication 962 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

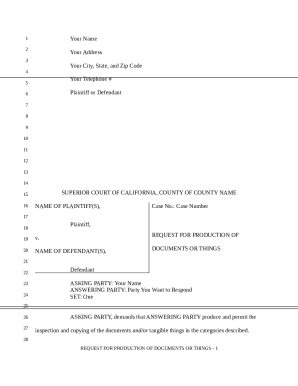

How to edit IRS Publication 962 online

To use our professional PDF editor, follow these steps:

1

Log in to account. Click on Start Free Trial and sign up a profile if you don't have one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit IRS Publication 962. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

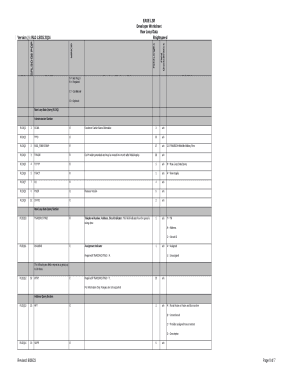

IRS Publication 962 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out IRS Publication 962

How to fill out publication 962 rev 1-2025

01

Obtain a copy of publication 962 rev 1-2025 from the official source.

02

Read the introduction and purpose section to understand the context of the publication.

03

Follow the formatting guidelines provided in the document.

04

Fill out each section methodically, ensuring that all required fields are completed.

05

Review any instructions related to submissions or additional documentation needed.

06

Double-check all entries for accuracy before finalizing the document.

07

Submit the completed publication as per the provided submission guidelines.

Who needs publication 962 rev 1-2025?

01

Researchers looking to reference or comply with industry standards.

02

Organizations needing to report according to the guidelines provided.

03

Regulatory bodies that require adherence to specific procedures outlined in the publication.

04

Professionals seeking to ensure best practices in their work.

Fill

form

: Try Risk Free

People Also Ask about

How to make the 962 election?

In addition to direct owners, a section 962 election can be made by an individual U.S. shareholder who is considered, by reason of section 958(b), to own stock of a foreign corporation owned (within the meaning of section 958(a)) by a domestic pass-through entity, including a partnership or an S corporation.

Can I file form 8962 online?

You can electronically file Form 8962, Premium Tax Credit (PTC), along with your federal income tax return. Filing electronically is the easiest way to file a complete and accurate tax return.

How does a 962 election work?

HOW A SECTION 962 ELECTION WORKS. When a U.S. individual makes a Section 962 election, the taxpayer is treated as owning the CFC through a fictitious domestic corporation. This enables the taxpayer to benefit from the 21-percent corporate tax rate as well as the Section 250 deduction (for GILTI purposes only).

What is a 962?

962.. Accident - Injuries. 962H.. Hit & Run - Injuries. 963.

Where is Form 8962?

Form 8962 is available on the IRS website and is free to download. 5 If you're filing taxes using electronic tax filing software, this form should be generated for you as you navigate through the program's questionnaire format.

How do I make a 962 election on my 1040?

How do I generate the federal election for Section 962 in a 1040 return using worksheet view? Go to the General > Federal Election worksheet. Select Section 21 - Individual Shareholder of a Controlled Foreign Corp to be Taxes at Corp Rate. In Lines 1-7 - Section 962, enter all applicable information.

Do you need form 8962 to file taxes?

You don't have to fill out or include Form 8962, Premium Tax Credit, when you file your federal taxes. Keep your Form 1095-A with your other tax records.

What is 962 form?

An IRC 962 election is an election to be taxed as a Corporation. And, most taxpayers would not want to elect to be treated as a corporation and then become double taxed. Then, came the Tax Cuts and Jobs Act TCJA — and the introduction of GILTI and FDII.

Who can make a Section 962 election?

In addition to direct owners, a section 962 election can be made by an individual U.S. shareholder who is considered, by reason of section 958(b), to own stock of a foreign corporation owned (within the meaning of section 958(a)) by a domestic pass-through entity, including a partnership or an S corporation.

What happens if I didn't receive my 8962 form?

In response to the rejection of an electronically filed return that's missing the Form 8962, individuals may refile a complete return by completing and attaching Form 8962 or a written explanation of the reasons for its absence.

Why did I get a CP09 notice?

Why Did I Receive IRS Notice CP09? You received notice CP09 because the IRS determined that you could be eligible for the Earned Income Tax Credit (EITC) but did not claim it on your tax return. If you are eligible, it could result in a tax refund. The amount of the anticipated refund is also included in the notice.

Why did I get a letter about EIC?

We sent you a letter (notice) because our records show you may be eligible for the EITC but didn't claim it on your tax return. First, find out if you qualify for EITC by following the steps shown in your notice. You can find out more about What You Need to Do and What we Will Do by using one of the links below.

What is a CP09 form from the IRS?

Complete Earned Income Credit Worksheet on Form 15111, Earned Income Credit (CP09)PDF of the notice. If the worksheet confirms you're eligible for the credit, Sign and date the Form 15111PDF. Mail the signed worksheet in the envelope provided with your notice.

Do individuals pay Gilti tax?

GILTI does not only apply to individual taxpayers but also applies to US businesses who have an interest in foreign companies as well.

Who is eligible for a 962 election?

In addition to direct owners, a section 962 election can be made by an individual U.S. shareholder who is considered, by reason of section 958(b), to own stock of a foreign corporation owned (within the meaning of section 958(a)) by a domestic pass-through entity, including a partnership or an S corporation.

Why make a 962 election?

When a U.S. individual makes a Section 962 election, the taxpayer is treated as owning the CFC through a fictitious domestic corporation. This enables the taxpayer to benefit from the 21-percent corporate tax rate as well as the Section 250 deduction (for GILTI purposes only).

What is Section 962?

962 allows an individual U.S. shareholder to make an annual election to be taxed as a C Corporation on certain specific income earned by its foreign subsidiary (including GILTI). By making this election, the shareholder may claim an indirect foreign tax credit for foreign taxes the corporation paid.

How do I know if I claimed EITC?

You'll need to check your 1040 form to know if you've claimed either or both of the credits. It'll be on EIC line 27a, ACTC line 28.

What is a CP09 form?

taxdefense. 8 months ago. Not all IRS notices are bad. If you receive IRS Notice CP09, you could be due a refund because you failed to claim a tax credit you may be eligible to receive.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

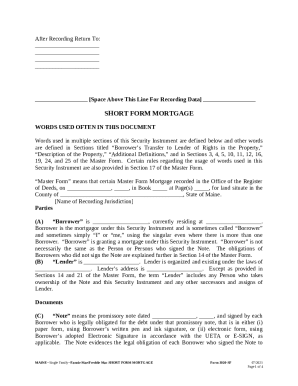

How can I send IRS Publication 962 for eSignature?

Once you are ready to share your IRS Publication 962, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

How do I edit IRS Publication 962 on an iOS device?

You can. Using the pdfFiller iOS app, you can edit, distribute, and sign IRS Publication 962. Install it in seconds at the Apple Store. The app is free, but you must register to buy a subscription or start a free trial.

Can I edit IRS Publication 962 on an Android device?

You can. With the pdfFiller Android app, you can edit, sign, and distribute IRS Publication 962 from anywhere with an internet connection. Take use of the app's mobile capabilities.

What is publication 962 rev 1-2025?

Publication 962 rev 1-2025 is an official document published by the IRS that provides guidelines and forms for specific tax-related procedures, likely focusing on issues such as tax reporting and compliance.

Who is required to file publication 962 rev 1-2025?

Entities or individuals who meet certain tax criteria outlined by the IRS, typically involving specific income thresholds or business activities, are required to file publication 962 rev 1-2025.

How to fill out publication 962 rev 1-2025?

To fill out publication 962 rev 1-2025, taxpayers should gather the required information, follow the instructions provided in the publication, and ensure that all relevant sections are completed accurately.

What is the purpose of publication 962 rev 1-2025?

The purpose of publication 962 rev 1-2025 is to provide taxpayers with a comprehensive guide for reporting specific financial information to ensure compliance with federal tax laws.

What information must be reported on publication 962 rev 1-2025?

Information that must be reported on publication 962 rev 1-2025 includes income details, deductions, credits, and any other relevant financial data necessary for accurate tax reporting.

Fill out your IRS Publication 962 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IRS Publication 962 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.