Get the free PARCEL FEE CERTIFICATE

Get, Create, Make and Sign parcel fee certificate

How to edit parcel fee certificate online

Uncompromising security for your PDF editing and eSignature needs

How to fill out parcel fee certificate

How to fill out parcel fee certificate

Who needs parcel fee certificate?

Parcel Fee Certificate Form: A Comprehensive How-to Guide

Understanding the parcel fee certificate form

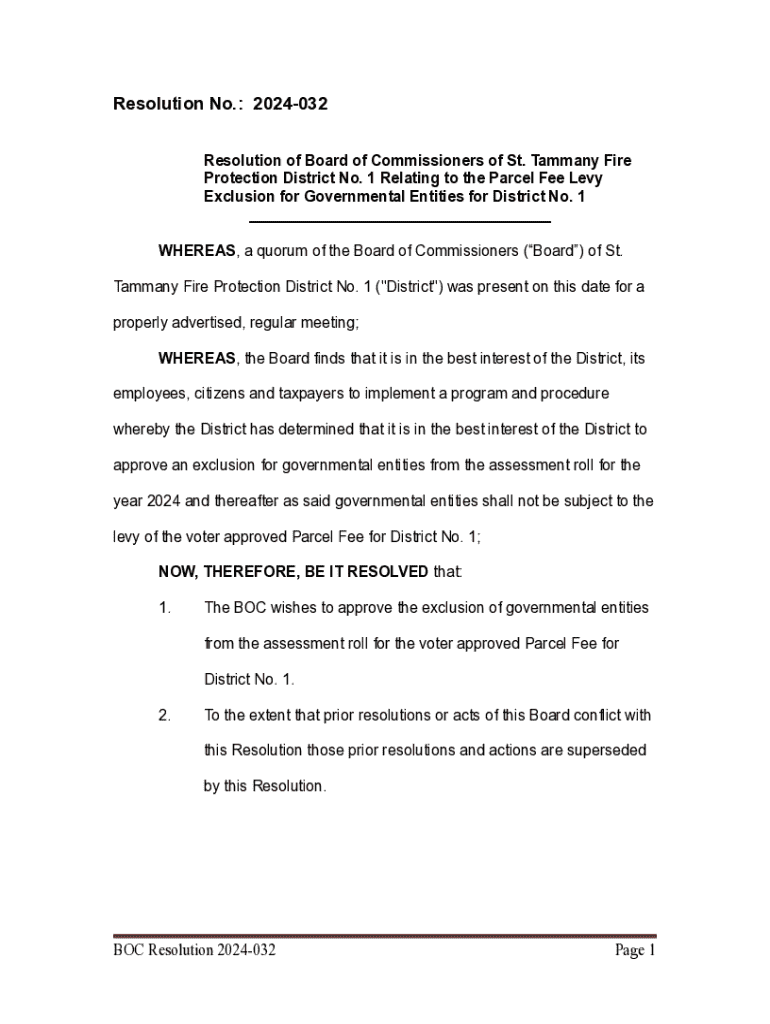

A parcel fee certificate form is a crucial document used primarily in real estate and property transactions. It serves to certify that all fees associated with a specific parcel of land—such as taxes, assessments, and utilities—are up to date, thus protecting the interests of both buyers and sellers. Obtaining this certificate is essential for ensuring that the transaction process proceeds smoothly, preventing any unforeseen liabilities for the new property owner.

Various situations may necessitate a parcel fee certificate. For instance, if you're purchasing a new home, the lender might require the certificate to confirm that all financial obligations have been settled. Similarly, if you are selling a property, having a current certificate can enhance buyer confidence and streamline negotiations.

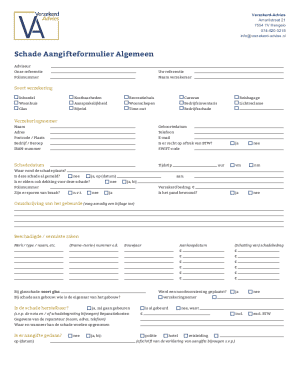

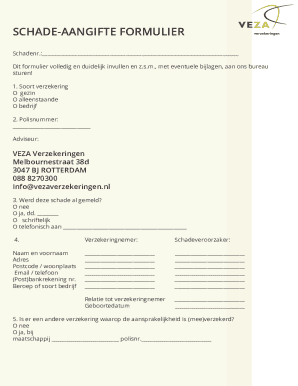

Key components of a parcel fee certificate typically include the address of the property, the parcel number, a list of paid and outstanding fees, and the certificate's date of issuance. Ensuring accuracy in these details is vital as any discrepancies can lead to significant delays in property transactions or, worse, financial loss.

Types of parcel fee certificates

There are several types of parcel fee certificates, catering to different needs. The most commonly used is the standard parcel fee certificate, which is sufficient for most residential and commercial property transactions. It outlines all significant financial obligations linked to a property and verifies that these are current. This certificate is typically obtained from the local jurisdiction or relevant authority.

In recent years, electronic parcel fee certificates have gained traction due to their convenience. These digital certificates can be issued quickly and may be easier to store and share. For specific scenarios, specialty parcel fee certificates may be required, such as for tax lien sales or other unique property situations. These are tailored documents that address particular circumstances affecting the accurate reporting of parcel fees.

Who needs a parcel fee certificate?

While parcel fee certificates are primarily associated with real estate, various stakeholders benefit from obtaining one. Individuals such as homeowners, buyers, and sellers often require these certificates during property transactions to ensure that all pertinent financial obligations are met. This helps avoid disputes and creates a smoother transfer process.

Businesses, including real estate agents and logistics companies, also rely on parcel fee certificates. These professionals utilize the certificates for due diligence when assisting clients in buying or selling properties. Furthermore, government agencies and municipalities may require parcel fee certificates in the context of property tax assessments, zoning changes, or resolving disputes over land ownership.

Steps to obtain a parcel fee certificate

Obtaining a parcel fee certificate involves a series of steps that ensure you gather the necessary information and complete any required processes efficiently. First, it’s crucial to assess your needs—determine the certificate's purpose and any specific requirements set forth by your municipality or relevant authorities.

Next, gather all the necessary information regarding the property, including address details, parcel ID, and relevant ownership or necessity documentation. Ensuring you have accurate data is essential for smooth processing. Once you’re prepared, choose an appropriate platform for submission. Utilizing a cloud-based solution like pdfFiller provides the benefits of easy editing, collaboration, and secure document management.

Once on your chosen platform, fill out the form by entering all the required information accurately. It’s advisable to double-check your entries to avoid mistakes. After completion, submit your application either online or via traditional mail, noting the expected timeframes for processing. With pdfFiller, you can track the status of your submission in real-time, providing peace of mind during the waiting period.

Managing your parcel fee certificate

Once you have obtained your parcel fee certificate, effective management is necessary to avoid any complications in the future. Keeping track of submission status can prevent unnecessary delays. If amendments to an existing certificate are required—perhaps due to incorrect information or a change in ownership—knowing how to edit it is essential. Utilizing tools that allow for real-time updates can significantly enhance this process.

Understanding the fees associated with obtaining or maintaining a parcel fee certificate is another critical aspect. Fees can vary widely depending on jurisdiction and can also include costs for expedited processing. Always familiarize yourself with these charges to budget accordingly and avoid surprises.

Common challenges and solutions

Navigating the complexities of a parcel fee certificate can present challenges. A common problem is submitting incomplete or incorrect information, which can halt the application process. To mitigate this issue, a helpful checklist before submission can ensure that all required data is collected and verified.

Delays in certificate issuance are another frustration many encounter. In such cases, it is critical to understand the normal timeframes and what to do if a certificate takes longer than expected. Regularly communicating with the issuing authority can provide insights into any holdups and facilitate quicker resolutions.

Best practices for using a parcel fee certificate

To ensure the smoothest experience with your parcel fee certificate, best practices should be employed. First, maintain easy access to your certificate, whether through a digital cloud storage solution or a physical file. This ensures you can quickly reference it during real estate transactions or other formal engagements.

Deciding between digital and physical copies also plays a role in effective management. While digital copies are more accessible and easier to share, having a physical copy on hand can be beneficial when conducting in-person meetings or inspections. Always consider the context of your transaction when deciding which format to use.

Real-world applications of parcel fee certificates

Parcel fee certificates have a profound real-world impact on property transactions. Real estate transactions often leverage the certificate to verify that there are no outstanding fees that could jeopardize the sale. For instance, buyers looking to secure a mortgage may be required to present a current parcel fee certificate demonstrating that the property has no unresolved financial obligations.

Testimonials from users of pdfFiller’s solutions highlight efficiency and convenience in managing these documents. Users have noted that the ability to easily edit and share their parcel fee certificates has simplified their property dealings and fostered strong trust between buyers and sellers, showcasing the platform’s vital role in property management.

Additional tools and features from pdfFiller

In addition to simplifying the process of obtaining a parcel fee certificate, pdfFiller offers a wealth of additional tools that enhance your document management capabilities. One standout feature is the eSigning capability, ensuring secure transactions that adhere to digital standards. This feature allows users to sign documents electronically, which is especially useful in fast-paced real estate transactions.

Collaboration tools are another advantage for teams managing multiple properties or clients. With pdfFiller, stakeholders can work together seamlessly, sharing and editing documents in real-time. Furthermore, cloud storage benefits ensure that your parcel fee certificate and other important documents are easily accessible from any location, giving teams and individuals confidence in their document management strategies.

Frequently asked questions (FAQ)

When seeking a parcel fee certificate, various questions often arise. For instance, many individuals inquire about the typical processing time for obtaining such a certificate. Generally, this can range from a few days to several weeks based on local regulations, but utilizing platforms like pdfFiller can expedite the process significantly.

Another common question pertains to the ability to edit a parcel fee certificate after submission. Typically, once submitted, alterations can only be performed through the issuing authority, emphasizing the importance of accuracy during the initial filling process. Lastly, many wonder whether legal assistance is necessary for the parcel fee certificate procedure; in most cases, understanding the form and ensuring accurate information suffices, but consulting a lawyer can be helpful for more complex situations.

Final thoughts on the parcel fee certificate form

Conclusively, understanding and efficiently using the parcel fee certificate form is crucial for ensuring successful property transactions. By following the steps outlined in this guide, you set yourself up for minimal hindrances in the property transfer process. It’s important to utilize reliable platforms like pdfFiller that streamline document creation, management, and collaboration.

As you delve into the world of real estate, take advantage of additional offerings from pdfFiller which can simplify your overall document management strategy. Keep informed, stay organized, and approach the parcel fee certificate process with confidence to ensure a smooth transition in all your property dealings.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find parcel fee certificate?

Can I edit parcel fee certificate on an iOS device?

How do I edit parcel fee certificate on an Android device?

What is parcel fee certificate?

Who is required to file parcel fee certificate?

How to fill out parcel fee certificate?

What is the purpose of parcel fee certificate?

What information must be reported on parcel fee certificate?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.