Get the free Irrigation Pricing Rebate Scheme

Get, Create, Make and Sign irrigation pricing rebate scheme

How to edit irrigation pricing rebate scheme online

Uncompromising security for your PDF editing and eSignature needs

How to fill out irrigation pricing rebate scheme

How to fill out irrigation pricing rebate scheme

Who needs irrigation pricing rebate scheme?

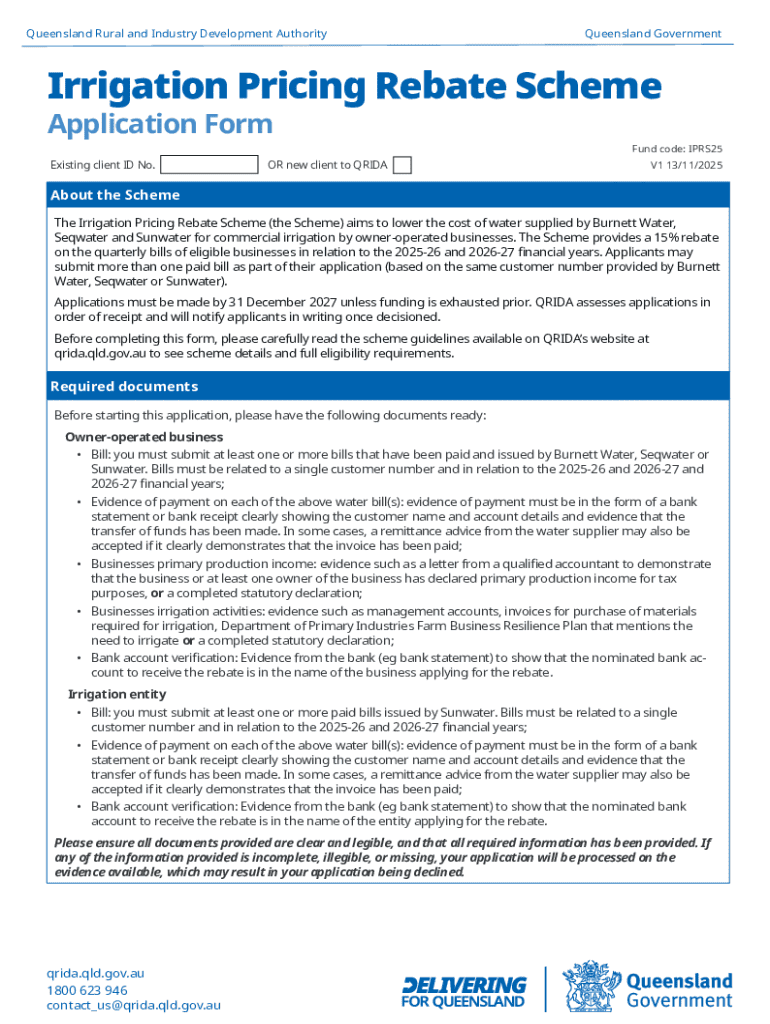

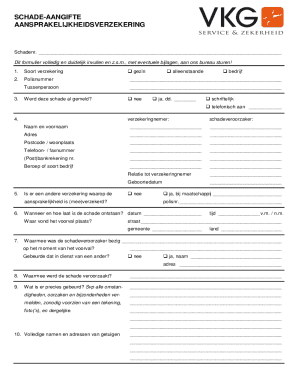

Understanding the Irrigation Pricing Rebate Scheme Form

Understanding the irrigation pricing rebate scheme

The Irrigation Pricing Rebate Scheme is designed to help primary producers and agricultural businesses offset the costs associated with their irrigation practices. By providing financial support through rebates, the scheme aids farmers in maintaining sustainable practices while increasing productivity.

This scheme is particularly essential for regions heavily dependent on irrigation, as it can greatly reduce operational expenses. The involvement of the government in subsidizing irrigation costs highlights its commitment to supporting agricultural sustainability and local economies.

Eligibility criteria for the scheme

To participate in the Irrigation Pricing Rebate Scheme, applicants must meet certain eligibility criteria. Typically, this includes being a registered primary producer actively utilizing irrigation systems for agricultural purposes. Both full-time and part-time farmers may qualify, but they must demonstrate that a significant portion of their business is reliant on irrigated agriculture.

Eligible businesses may include crop producers, livestock farmers, and horticulturists, among others. Essential documentation may include proof of water usage, tax declarations related to agricultural income, and compliance records. Familiarization with these requirements is crucial for a successful application.

Key components of the irrigation pricing rebate scheme form

Navigating the irrigation pricing rebate scheme form requires careful attention to its structure. The form is typically divided into various sections, each aimed at collecting specific information necessary for processing the application. Providing accurate details is paramount, as incorrect entries can lead to delays or even rejection.

Here are some of the key sections you’ll encounter in the form:

Also, applicants must be prepared to submit supporting documentation alongside the form. This may include proof of irrigation practices, business registration details, and various other documents which substantiate the claims made within the application. Statutory declarations are essential as they provide a legal affirmation of the details presented.

Completing the irrigation pricing rebate scheme form

Filling out the irrigation pricing rebate scheme form can seem daunting, but following a structured approach makes the process more manageable. Begin with a step-by-step guide, ensuring each section is completed thoroughly and accurately. Here’s how you can streamline your application process:

Common mistakes include submitting forms without necessary signatures or missing documents. Pay special attention to the format and submission guidelines, as each application must adhere to specific standards. Depending on your preference, you can submit either online or in paper format, but be mindful of the deadlines associated with each submission method.

Post-submission considerations

Once your application for the irrigation pricing rebate scheme has been submitted, it's important to understand what happens next. Generally, applicants can expect a response within a pre-defined timeline, but this can vary based on the volume of submissions received and the complexity of individual cases.

Understanding the rebate calculation is also crucial. Rebate amounts are determined based on several factors, including the volume of water used and specific regional guidelines. To ensure transparency, many applicants wonder how to check the status of their applications which can typically be done through the agency's online portal or contact services.

Troubleshooting and appeals process

If your application for the irrigation pricing rebate scheme is rejected, don’t lose hope. Understanding the reasons for rejection is the first step toward resolving issues. Common reasons include missing documentation or discrepancies in provided information. If you feel your application was unjustly denied, pursuing an appeal is an available option.

The appeals process usually requires a formal written request, along with supporting evidence to substantiate your claims. It's beneficial to consult specific guidelines provided by the evaluating agency. Additionally, support services are available to assist applicants in navigating both the application and appeals processes.

Owner-operated business clarifications

Participation as an owner-operated business in the irrigation pricing rebate scheme carries specific definitions and requirements. An owner-operated business generally means a farming operation where the owner actively engages in the daily operations, significantly contributing to labor and management.

The eligibility hinges on the type of labor contributed by the owner. This can include everyday farming tasks, decision-making, and financial management. Understanding how these factors influence eligibility can prevent potential application challenges.

Additional information for applicants

As you navigate the irrigation pricing rebate scheme, several important tax considerations must be factored in. The rebate may impact your tax obligations, so documenting your primary production income carefully is vital. Consulting with a tax professional can provide further clarity on how rebates are treated under current tax laws.

Additionally, having adequate evidence regarding your irrigation operations is critical. Required documentation may include water usage records, invoices, and any relevant contracts related to your watering practices. Clear and organized evidence can significantly bolster your application and expedite the processing of claims.

Helpful tools and resources

Navigating your irrigation pricing rebate scheme form doesn't have to be a chore. Utilizing interactive tools can enhance your application experience. Online resources like pdfFiller provide document management solutions that streamline the filling out, signing, and editing process.

From eSigning to collaborative tools, pdfFiller allows you to manage your documents easily and securely, all from a cloud-based platform. Features such as templates, editing options, and workflow automation simplify document preparation, enabling you to focus more on your agricultural endeavors.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find irrigation pricing rebate scheme?

How do I edit irrigation pricing rebate scheme online?

How do I fill out irrigation pricing rebate scheme using my mobile device?

What is irrigation pricing rebate scheme?

Who is required to file irrigation pricing rebate scheme?

How to fill out irrigation pricing rebate scheme?

What is the purpose of irrigation pricing rebate scheme?

What information must be reported on irrigation pricing rebate scheme?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.