Get the free how-to-file-a-claim-for-unemployment-insurance. ...

Get, Create, Make and Sign how-to-file-a-claim-for-unemployment-insurance

How to edit how-to-file-a-claim-for-unemployment-insurance online

Uncompromising security for your PDF editing and eSignature needs

How to fill out how-to-file-a-claim-for-unemployment-insurance

How to fill out how-to-file-a-claim-for-unemployment-insurance

Who needs how-to-file-a-claim-for-unemployment-insurance?

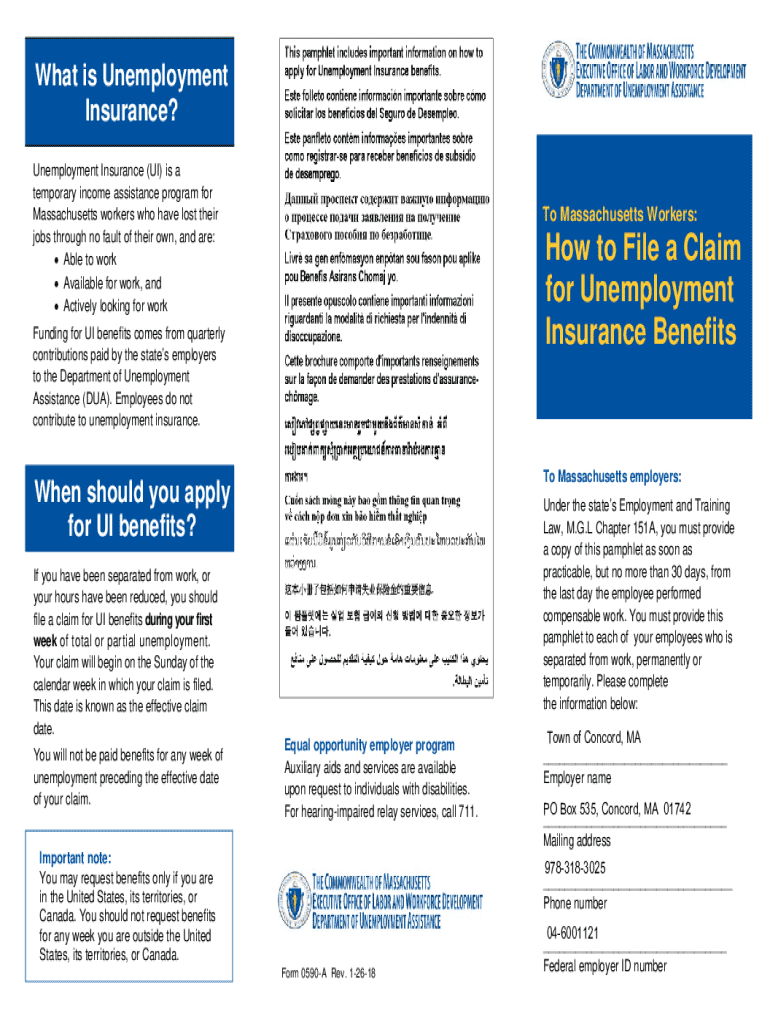

How to file a claim for unemployment insurance form

Understanding unemployment insurance

Unemployment insurance is a crucial safety net for individuals who find themselves without work. This program is designed to provide temporary financial assistance to those who have lost their jobs through no fault of their own. The primary purpose of unemployment insurance is to help sustain individuals as they seek new employment opportunities, thus playing a significant role in the overall economic stability.

The unemployment insurance program serves millions of workers across the United States, making it a vital component of the social safety net. It helps prevent financial degradation during job loss, ensuring individuals can cover essential expenses while they search for new employment. Without this program, many workers would face extreme hardship, and the economy could experience a ripple effect as consumer spending declines.

Determining your eligibility for unemployment insurance

Before filing a claim, it’s essential to assess whether you meet the eligibility criteria for unemployment insurance. Generally, you must have a certain amount of work history within a specified timeframe and earn wages above a minimum threshold. Employment conditions such as layoffs, business closures, or company downsizing usually fulfill the basic criteria for eligibility.

However, there are special circumstances where individuals may qualify even if they don't fit the standard criteria. For instance, self-employed individuals can sometimes claim benefits if they have lost work due to a qualifying reason. During the COVID-19 pandemic, additional measures were taken, expanding eligibility to wider groups, including gig workers and freelancers.

To assess your specific situation, consider using our interactive eligibility quiz available on the pdfFiller site, which can provide immediate insights.

Gathering necessary documentation

A crucial step in filing your claim for unemployment insurance is gathering the right documentation. You’ll need personal identification documents, such as your Social Security number or driver's license, to confirm your identity. Employment records including W-2 forms and recent pay stubs will also be necessary to provide evidence of your work history.

Additionally, you must articulate the reason for your unemployment. Be truthful and detailed in your explanation, as this can affect your eligibility. To ensure a smooth filing process, take time to organize your documents systematically, verifying that all information is current and accurate. Decide whether you prefer digital formats or physical copies, keeping in mind that digital documentation can streamline the process.

How to apply for unemployment insurance

Now that you have your documentation in order, it’s time to file your claim for unemployment insurance. The process begins with accessing the online application portal specific to your state. Each state has its own procedures and requirements, so it is essential to use the correct portal to avoid delays.

Once on the portal, you will need to provide your personal information accurately, including your name, contact information, and Social Security number. Next, detail your employment history, listing all relevant jobs, your roles, and dates of employment. When asked to specify the reason for your unemployment, provide a thorough, truthful answer, as this can play a significant role in the decision-making process.

After completing all sections, make sure to thoroughly review your application for any errors, as common mistakes can lead to delays. Once satisfied, submit your application and keep a copy for your records.

By being vigilant and thorough, you’ll increase your chances of a smooth application process.

What happens after you file a claim?

Once your unemployment insurance claim is filed, it goes into a processing phase. On average, claims can take about two to three weeks to process; however, this varies by state and can be affected by various factors such as application volume and documentation issues. Therefore, be prepared for potential delays where more complex cases could extend the timeframe.

During this time, it's essential to keep track of your claim status online, as many state agencies provide online portals for this purpose. Applicants can expect to receive communication regarding their claim status through their preferred method, whether it be email, text, or traditional mail. Understanding the frequency and nature of updates can help ease concerns during this waiting period.

How to appeal a denied claim

Receiving a denial for unemployment insurance can be disheartening, but it’s important to know that you have the right to appeal. Claims can be denied for various reasons, such as insufficient work history or failure to meet state-defined eligibility requirements. As such, understanding the reason for your denial is the first step in crafting a strong appeal.

Review the denial notice thoroughly to comprehend the specific reasons behind the decision. Gather supporting evidence that counters the claims made in the denial notice, such as additional employment records or proof of job search activities. File your appeal within the timeframe specified in the notice, ensuring all necessary documentation accompanies your submission. A compelling appeal can significantly enhance your chances of a successful outcome.

To bolster your appeal, consider including any documentation that substantiates your claim, such as correspondence with your employer or records of job applications.

Additional support and resources

In addition to the resources available online, locating your state-specific unemployment insurance office can provide personalized support. These local agencies can assist you with filing your claim, answer questions, and guide you through the benefits process. Each state has different offices with their own processes, so ensure to find the one relevant to your residence.

Moreover, as unemployment insurance policies may have been adjusted due to extraordinary events like the COVID-19 pandemic, it’s vital to stay updated on any special measures or broader eligibility criteria that state agencies might adopt. Many states offer workshops or informational webinars, providing valuable insights into navigating the unemployment claims process.

Frequently asked questions (FAQs)

If you have questions about how to file a claim for unemployment insurance, you’re not alone. Here are some frequently asked questions that may help clarify the process. Understanding these common questions is crucial for ensuring a smooth application experience and enhancing your confidence in navigating this significant process.

Tools to simplify your unemployment insurance claims process

Navigating the unemployment insurance claims process can be facilitated through various tools offered on the pdfFiller platform. Our interactive claim form helper guides you through the nuances of completing the unemployment claims form accurately, ensuring accuracy and completeness in your application.

In addition to our claim form helper, we offer eSignature solutions that expedite the process of submitting forms, while our document management features enable you to keep all necessary documentation organized and easily accessible. By simplifying the claims process through these user-friendly tools, you can focus more on your job search and less on administrative tasks.

User success stories and case studies

Real stories from past claimants illustrate the positive impact of knowing how to file a claim for unemployment insurance efficiently. These testimonials highlight individuals who have navigated the process successfully, leveraging resources to ensure their applications were strong, well-supported, and met the necessary requirements.

From those who learned from their initial mistakes, such as not providing complete employment history, to individuals who became proactive in documenting their case with supporting materials, these experiences carry valuable lessons. They exemplify the importance of attention to detail and the need to understand the system to achieve success.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in how-to-file-a-claim-for-unemployment-insurance?

How do I edit how-to-file-a-claim-for-unemployment-insurance straight from my smartphone?

Can I edit how-to-file-a-claim-for-unemployment-insurance on an Android device?

What is how-to-file-a-claim-for-unemployment-insurance?

Who is required to file how-to-file-a-claim-for-unemployment-insurance?

How to fill out how-to-file-a-claim-for-unemployment-insurance?

What is the purpose of how-to-file-a-claim-for-unemployment-insurance?

What information must be reported on how-to-file-a-claim-for-unemployment-insurance?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.