Get the free Consumers Lodge Multiple FDCPA Claims Against GC ...

Get, Create, Make and Sign consumers lodge multiple fdcpa

Editing consumers lodge multiple fdcpa online

Uncompromising security for your PDF editing and eSignature needs

How to fill out consumers lodge multiple fdcpa

How to fill out consumers lodge multiple fdcpa

Who needs consumers lodge multiple fdcpa?

Consumers Lodge Multiple FDCPA Forms: A Comprehensive Guide

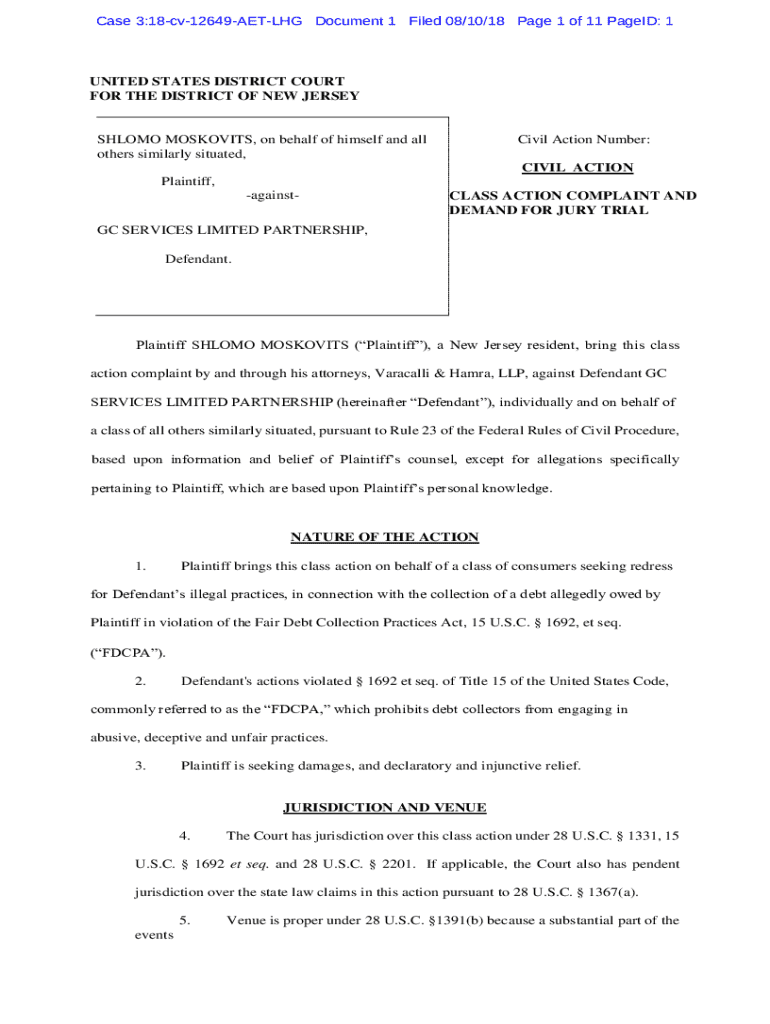

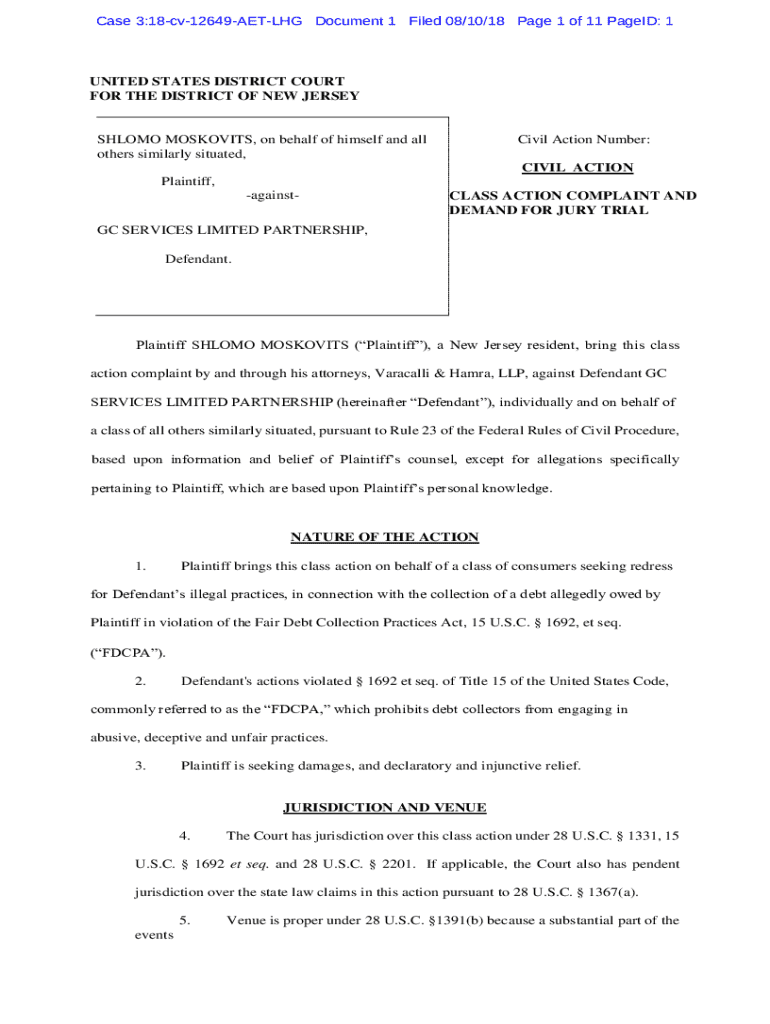

Understanding the FDCPA

The Fair Debt Collection Practices Act (FDCPA) is a federal law designed to protect consumers from abusive debt collection practices. Enacted in 1977, the FDCPA prohibits debt collectors from engaging in unfair, deceptive, and misleading practices. One of its core protections is that it restricts how and when debt collectors can contact individuals, thereby empowering consumers to manage their debt situations more effectively. Understanding the FDCPA is essential for anyone dealing with debt collection, as it provides a foundation for asserting consumer rights.

The significance of the FDCPA cannot be overstated. The law not only aims to protect consumers from harassment and intimidation by debt collectors but also sets clear guidelines for collectors to follow. This includes mandating that debt collectors provide consumers with information regarding the debt owed, the exact balance, and whom the debt is owed to. These rights ensure an informed and fair interaction between consumers and collectors, making it a crucial element in financial management.

Enforcement of the FDCPA primarily falls under the jurisdiction of the Federal Trade Commission (FTC) and private individuals may also sue debt collectors for violations. State agencies can additionally regulate and enforce consumer protection laws that may address debt collection practices more stringently. Together, these bodies ensure that consumers maintain their rights and that compliance is monitored effectively.

Importance of lodging multiple FDCPA forms

Consumers often find themselves dealing with multiple debts from various creditors, making it necessary to lodge multiple FDCPA forms. But why is it important to take such a step? When a consumer lodges an FDCPA form for each debt or creditor, they ensure comprehensive documentation of every situation. This approach is vital for protecting one's rights against possible aggressive collection tactics.

Certain scenarios might require lodging multiple forms, such as having debts linked to different creditors or different types of debts. For instance, if you have outstanding medical bills as well as credit card debts, it may be wise to file separate FDCPA forms for each situation. This ensures that each creditor is aware of the consumer's rights and the legitimacy of the debt being pursued. By doing this, consumers can assert their rights more effectively and reduce the chances of intimidation or wrongful collection practices.

Understanding the types of FDCPA forms is also essential. Common forms include debt validation letters and cease-and-desist letters, each serving specific purposes. The debt validation letter requests the debt collector to provide evidence of the debt, while the cease-and-desist letter instructs the collector to stop contacting the consumer altogether. By lodging the appropriate forms, consumers can gain control over their financial situation and reinforce their rights under the FDCPA.

Pre-submission preparation

Before lodging any FDCPA form, it's critical to gather necessary information. This includes detailed particulars such as the name of the debt collector, the specific debts in question, and any personal identifiers needed for processing. Having comprehensive documentation can significantly impact the outcome of disputes. For example, if a consumer can provide evidence of prior communications or payment history, it strengthens their case against potential harassment or invalid claims.

Also, reviewing all relevant documentation is equally important. This could involve compiling financial records, correspondence between the consumer and the creditor, and recordings of phone calls if applicable. The more evidence a consumer provides, the stronger their case remains. This preparation stage can help consumers avoid issues or delays when submitting FDCPA forms, ensuring all relevant information is at hand when needed.

Step-by-step guide to lodging multiple FDCPA forms

Filing multiple FDCPA forms may feel overwhelming, but following a step-by-step approach can simplify the process. Start by selecting the right forms for each unique situation. Depending on whether your issues involve harassment, incorrect billing, or validation requests, access the appropriate templates on pdfFiller's platform.

When filling out the forms, be precise and avoid common mistakes such as omitting important details or making typographical errors. pdfFiller features tools that allow you to edit forms easily and add any necessary annotations or additional documentation. After finalizing the forms, signing electronically has become straightforward with pdfFiller, making eSignatures legally valid under the FDCPA. Lastly, ensure your forms are submitted either online or via certified mail; this provides an official record to follow up on.

Post-submission: what to expect

After lodging your FDCPA forms, it's essential to stay alert for follow-up notifications. Consumers should generally expect responses from creditors within a reasonable timeframe. Understanding your consumer rights after submission is crucial. Should a collector violate the FDCPA, consumers maintain the right to take legal action. Document any improper response, such as continued contact or unsubstantiated claims, as this information will be vital if further action becomes necessary.

In many cases, once FDCPA forms are lodged, consumers find relief from aggressive collection tactics as collectors become more cautious due to the documentation provided. It stands as a powerful reminder of the rights established under the act. However, if collectors fail to adhere to the act even after forms are lodged, seeking legal counsel or guidance from organizations dedicated to consumer rights may be your next step.

Common questions and best practices

Throughout the FDCPA process, numerous questions may arise. For instance, consumers often wonder about the timeline for responses or the implications of not hearing back from a creditor after submitting an FDCPA form. It's advisable to keep meticulous records, noting down submission dates and communications for future reference. This diligent practice can help protect your rights and provide supporting evidence if needed.

By staying organized and informed, consumers can better navigate potential hurdles in resolving debt-related issues. Making use of pdfFiller's features allows users to ensure they have interactive access to their documents, making submission easier and more efficient.

Utilizing pdfFiller for an enhanced experience

For individuals and teams focused on comprehensive document management, utilizing pdfFiller for lodging FDCPA forms provides many advantages. This cloud-based platform allows easy access to necessary forms anytime, from anywhere, thus streamlining the entire process. Teams can collaborate on FDCPA-related tasks, ensuring that all documentation is thorough and complete.

Additionally, pdfFiller offers interactive tools that enhance the accuracy of responses and forms filed. Leveraging these tools can avoid common pitfalls and ensure that consumer rights are well represented throughout the documentation process. By utilizing this platform, users can maximize their ability to manage consumer-related documentation with ease and efficiency.

Real-life examples

Many consumers have successfully lodged multiple FDCPA forms to assert their rights and rectify wrongful collection actions. For instance, one individual reported facing harassment from two different creditors over the same debt. By knowing their rights and filing separate FDCPA forms for both creditors, they were able to clearly communicate that they were aware of legal protections and would not tolerate further harassment. This led to a cessation of contact from both creditors, illustrating the importance of being proactive.

In another case, a consumer compiled documented evidence—including previous communications and payment receipts—when submitting multiple forms. This thorough approach not only facilitated the resolution of their issues promptly but also empowered them to take further legal steps should the creditors fail to comply with FDCPA regulations. These case studies underscore the effectiveness and necessity of lodging multiple FDCPA forms, showing other consumers how assertively managing their rights can lead to positive outcomes.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send consumers lodge multiple fdcpa for eSignature?

How do I make changes in consumers lodge multiple fdcpa?

How do I edit consumers lodge multiple fdcpa on an iOS device?

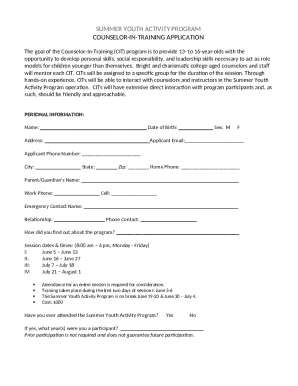

What is consumers lodge multiple fdcpa?

Who is required to file consumers lodge multiple fdcpa?

How to fill out consumers lodge multiple fdcpa?

What is the purpose of consumers lodge multiple fdcpa?

What information must be reported on consumers lodge multiple fdcpa?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.