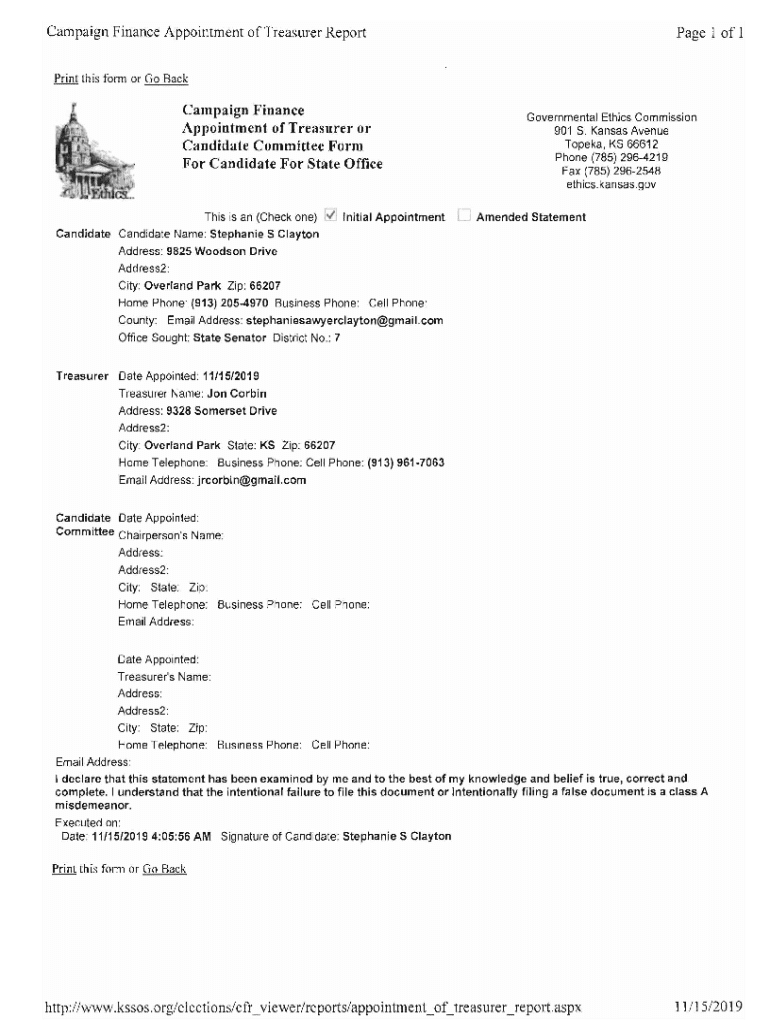

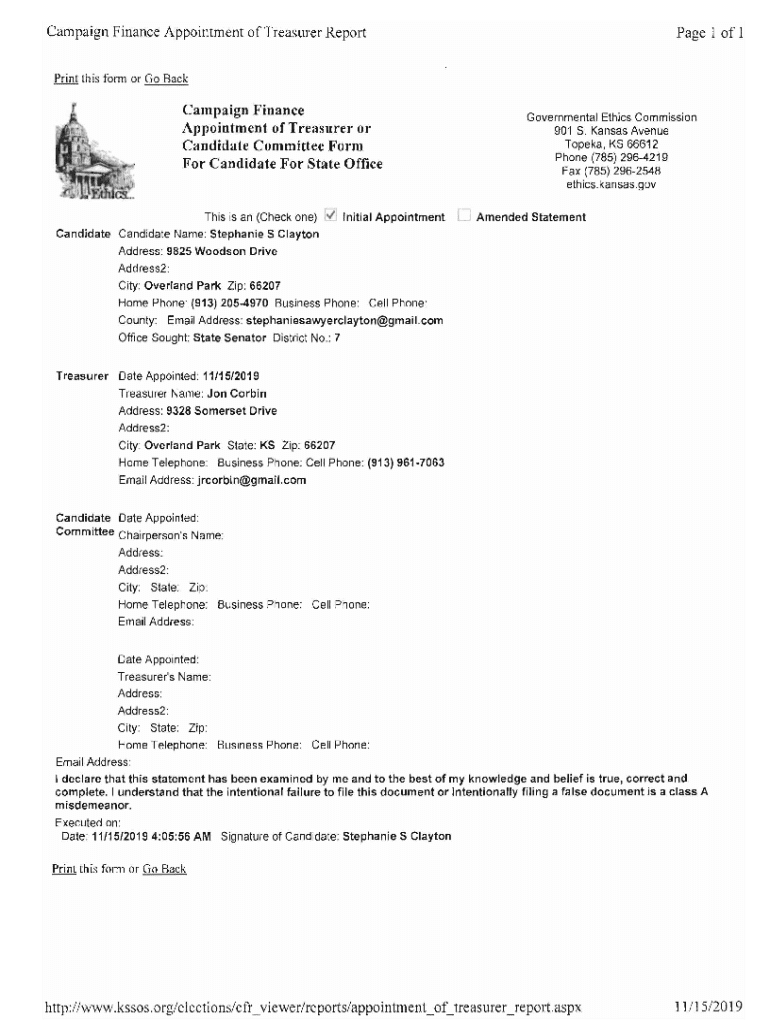

Get the free This is an (Check one) L-I Initial Appointment - ethics ks

Get, Create, Make and Sign this is an check

Editing this is an check online

Uncompromising security for your PDF editing and eSignature needs

How to fill out this is an check

How to fill out this is an check

Who needs this is an check?

This is a check form: Your comprehensive guide

Understanding the check form

A check form is a document utilized in financial transactions to authorize the transfer of funds from one bank account to another. Each check form acts as a written order to a financial institution, instructing it to pay a specified amount of money from the issuer's account to the payee. In the world of finance, check forms hold immense significance due to their widespread acceptance as a secure method of payment.

The importance of check forms extends across multiple dimensions: they not only serve as a record of payments made but also provide legal backing in financial disputes. Commonly used in various industries, from retail to real estate, check forms remain a reliable payment option. Additionally, the legal aspects associated with issuing check forms can impact both personal and corporate finances, thus understanding them is crucial.

Types of check forms

Different situations call for different types of check forms. Understanding these types can aid in selecting the most appropriate form for any given transaction. Personal check forms represent payments made by individual account holders and typically include unique features such as personal account details.

In contrast, business check forms are specifically designed for companies, incorporating features tailored to business needs, such as company branding or additional fields for tax identification. Electronic check forms, or eChecks, utilize digital verification processes and are becoming increasingly popular due to their convenience. Specialized check forms, such as payroll or government checks, fulfill specific roles, ensuring compliance with applicable regulations.

Filling out a check form: Step-by-step instructions

Filling out a check form requires attention to detail and the gathering of necessary information beforehand. Start by collecting required details such as the payee's name, the amount to be paid, and any special instructions. Selecting the appropriate check form template that suits your transaction type is equally important.

Here's a step-by-step approach to completing the check form:

Checking for accuracy

Once you have filled out the check form, review it thoroughly before handing it over. A complete walkthrough of your check helps avoid mistakes that could lead to payment discrepancies. Use this comprehensive checklist for identifying potential errors:

Best practices also include maintaining records of your check forms. This can be crucial when it comes time for audits or when verifying payments. Being organized helps in keeping financial records accurate, especially if working within teams.

Editing and customizing check forms

The ability to edit check forms allows you to tailor the documents for specific transactions or needs. Whether you wish to change the design, add fields, or ensure compliance with legal requirements, customization is key. pdfFiller provides users with various templates and design features that allow for effective editing of check forms.

Collaboration is vital when handling finances, so using a platform that allows team members to contribute can streamline the process. You can utilize pdfFiller’s tools to make necessary edits and track changes made by different team members, ensuring transparency and ease of communication.

eSigning check forms: A step-by-step guide

The rise of digital transactions has led to the increased use of electronic signatures, which offer numerous benefits such as speed, convenience, and security. When using pdfFiller, signing a check form electronically is streamlined and efficient.

Follow these steps to eSign your check form:

Managing check forms on pdfFiller

Effective management of check forms requires a structured approach. Within pdfFiller, users can store and organize their check forms efficiently through the creation of folders and tagging systems. This ensures quick and easy retrieval of documents when needed.

Collaborating with team members is also facilitated by the platform, allowing everyone involved in the process to navigate through check forms effortlessly. Better yet, users can track changes made to forms over time, providing a clear version history that is vital in contexts where financial accountability is paramount.

Troubleshooting common issues with check forms

Even with meticulous preparation, users can run into occasional issues with check forms. Understanding common error messages and their resolutions is essential for maintaining workflow efficiency. pdfFiller allows users to troubleshoot such issues, providing quick fixes to enhance user experience.

Frequently asked questions regarding check form usage reveal common concerns such as difficulties with eSigning or managing versions. General inquiries also include how to approach background check authorizations or connecting with service providers for payments related to specific programs such as caregiver services.

Additional considerations for next steps

Moving from check forms to other financial documents involves a thorough understanding of various document types and their uses. For individuals or businesses looking to integrate check forms with other systems, compatibility with accountancy software is often essential. Ensuring seamless transitions between financial documents can lead to more efficient operations.

Payment processing tools are also critical, as they enable faster transaction methods that can complement traditional check forms. Those using pdfFiller will find many options available for pairing check forms with digital accounting solutions, enhancing overall financial management.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit this is an check from Google Drive?

How do I complete this is an check on an iOS device?

How do I fill out this is an check on an Android device?

What is this is an check?

Who is required to file this is an check?

How to fill out this is an check?

What is the purpose of this is an check?

What information must be reported on this is an check?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.