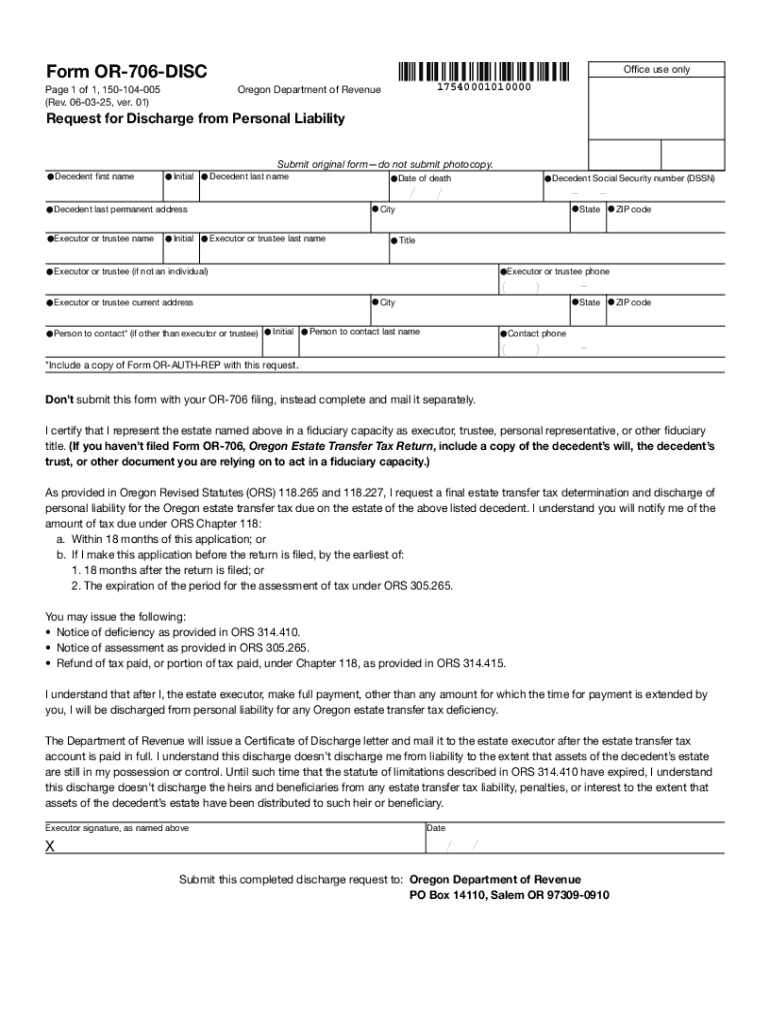

Get the free Form OR-706-DISC, Request for Discharge from Personal Liability, 150-104-005

Get, Create, Make and Sign form or-706-disc request for

How to edit form or-706-disc request for online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form or-706-disc request for

How to fill out form or-706-disc request for

Who needs form or-706-disc request for?

Comprehensive Guide to Form OR-706-DISC Request for Form

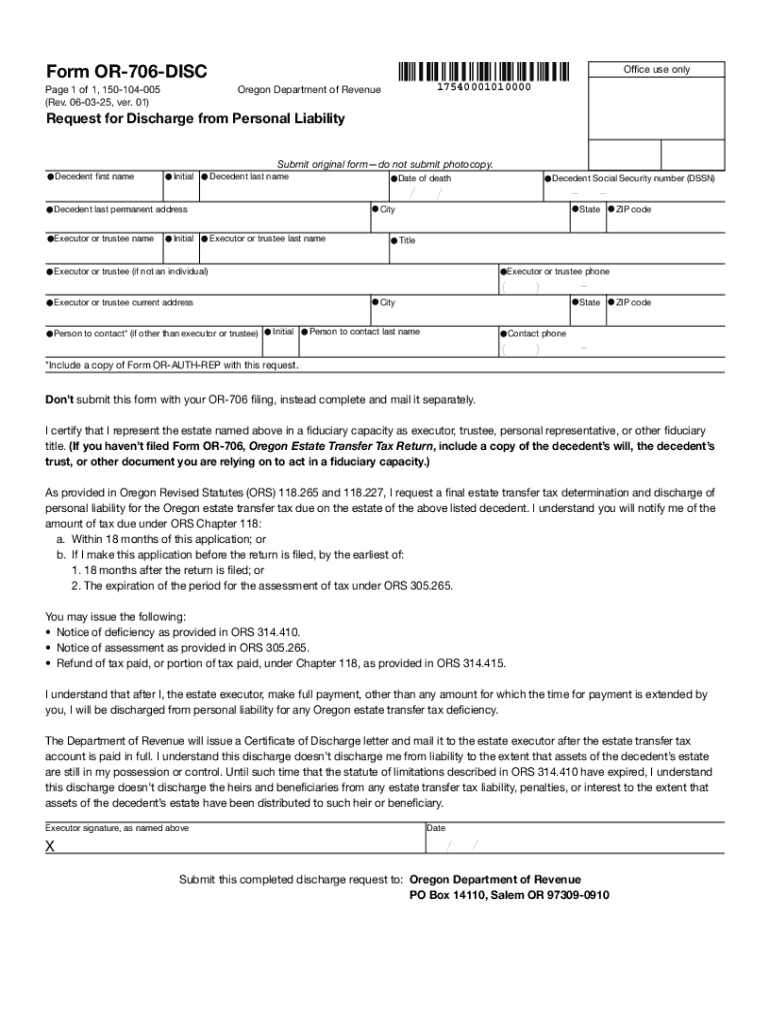

Overview of form OR-706-DISC

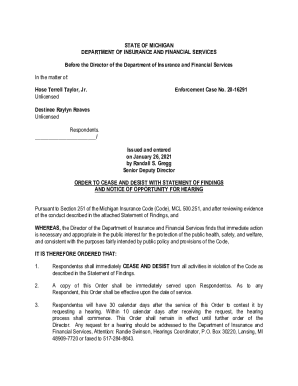

Form OR-706-DISC serves as a crucial document for individuals and businesses needing to report specific financial data in a legal context. This form is particularly essential for organizations engaged in relevant business activities, allowing them to comply effectively with tax regulations and other legal requirements. Its importance cannot be overstated, as it facilitates accurate reporting and transparency, thereby minimizing the risk of penalties associated with misreporting.

Primarily, it targets individuals and businesses operating within industries such as financial services, real estate, and those requiring proper tax documentation. Understanding this form is vital for stakeholders who must ensure compliance with state or federal regulations, making it a necessity for legal advisors, business owners, and individual taxpayers alike.

Key features of form OR-706-DISC

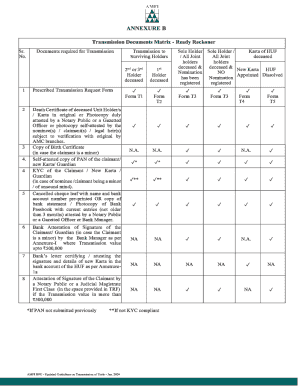

Form OR-706-DISC features unique aspects that distinguish it from other related forms. Key fields typically include applicant information, financial statements, and compliance declarations. Each of these components requires meticulous attention to detail, ensuring that all information presented is accurate and reflective of the applicant's financial standing.

Unlike simplified forms, OR-706-DISC demands comprehensive financial data. Characteristics that set it apart include the necessity for verifiable financial disclosures and potential implications for tax obligations. Understanding these differences is critical for users who might be familiar with less complex forms but need clarity within the more detailed aspects of OR-706-DISC.

Step-by-step instructions for filling out form OR-706-DISC

Gather required information

Before starting to fill out Form OR-706-DISC, it is imperative to gather all necessary personal and business data. Key information includes:

Detailed walkthrough of each section

Section 1: Applicant Information

In this section, carefully enter your personal information. Confirm each detail, as inaccuracies here could result in penalties. For example, if your name is John Doe, ensure it matches exactly as it appears on your legal documents, including any suffixes if applicable.

Section 2: Financial data requirements

This critical section requires you to detail your financial standing. You may need to reference previous tax returns, income statements, and expense reports that demonstrate your financial activity over the past year. Accuracy in reporting is paramount as discrepancies could lead to audits or fines.

Section 3: Signatures and date

Proper signatures are not just a formality; they validate the information provided. Ensure every required signatory reviews the document thoroughly before signing, as missing signatures can render your filing incomplete, leading to delays or rejections. Double-check that the date affixed aligns with the current postal submission or electronic filing date.

Editing and managing your form with pdfFiller

pdfFiller offers robust editing tools that simplify the management of Form OR-706-DISC. The platform allows users to upload their form directly for seamless editing and adjustments. Once uploaded, you can modify text, add annotations, or fill in fields without the hassle of reprinting or rescanning.

Using the editor is straightforward. Simply drag and drop to add new text fields where required or select existing fields for adjustments. Additional tools, such as highlighting and stamps, help illustrate critical information or add additional notes that need attention.

eSigning options for form OR-706-DISC

The legal standing of eSignatures has become increasingly recognized, making them a viable option for signing Form OR-706-DISC. With pdfFiller, users can utilize eSignatures that meet regulatory standards, ensuring the validity of the document even in electronic format. This flexibility allows busy individuals to sign documents securely from anywhere.

When using pdfFiller for eSigning, make sure to follow these simple steps: upload your document, designate the signatory fields, and apply your electronic signature. Confirm that all parties have access to the signed version and maintain records for security purposes.

Collaborating on form OR-706-DISC

Collaboration is simplified through pdfFiller, particularly for team members or advisors involved in completing Form OR-706-DISC. Users can share access to the document, enabling real-time editing and feedback. This functionality ensures that all stakeholders can contribute without the cumbersome process of emailing versions back and forth.

The platform’s live collaboration features allow team members to comment, revise, and track changes efficiently. By doing so, potential mistakes can be addressed in real-time, thereby ensuring that the final submission is accurate and complete.

Common mistakes to avoid with form OR-706-DISC

Filling out Form OR-706-DISC can lead to several common mistakes that could compromise the submission. Some frequent errors include inaccurate personal details, failure to include all necessary financial statements, and missing signatures. Moreover, neglecting to double-check calculations can also result in erroneous reporting.

Best practices to ensure accuracy include confirming all personal information, cross-referencing financial data with original documents, and conducting a thorough review before submission. It’s also advisable to utilize pdfFiller’s editing tools to catch potential errors automatically.

Managing multiple versions of form OR-706-DISC

One of the notable strengths of pdfFiller is its version control system, which efficiently manages multiple iterations of Form OR-706-DISC. Users can track changes made over time, ensuring that important modifications are documented and easily retrievable.

This management capability facilitates transparency across collaborations. As different team members may interact with the form, maintaining organization is crucial. Users can revert to prior versions if needed, creating a safety net against potential errors in the latest iteration of the document.

Interactive tools available on pdfFiller

pdfFiller provides a suite of interactive tools that enhance the document management experience for Form OR-706-DISC. Users can access calculators to help simplify complex financial computations required for accurate reporting. Additionally, templates tailored specifically for this form can streamline the preparation process, cutting down on tedious entry tasks.

These tools allow users to focus on content accuracy and quality rather than manual data entry. Leveraging these features can lead to a more efficient and stress-free experience while preparing necessary documentation for compliance.

Additional support and resources

Navigating the complexities of Form OR-706-DISC becomes manageable through pdfFiller’s extensive support services. Users can access articles, how-tos, and even customer support for personalized assistance during the completion process. This reliable support framework is particularly beneficial for new users or those with specific queries regarding their filings.

Furthermore, pdfFiller regularly updates resources to aid users in understanding the form's requirements better, providing community insights and expert tips for successful filing.

Customer success stories

Numerous users have successfully navigated the complexities of Form OR-706-DISC using pdfFiller. Testimonials highlight the platform's effectiveness in minimizing errors, and making filing straightforward. Many have reported significant time savings and enhanced collaboration when using the platform, attributing successful compliance to the convenient tools available.

Case studies showcase real-life scenarios where pdfFiller helped teams streamline their document preparation process, leading to quicker turnaround times and more accurate filings. such success stories illustrate the tangible benefits of utilizing pdfFiller.

Navigating related forms and publications

Users of Form OR-706-DISC may also encounter other forms required for a comprehensive financial reporting scheme. Quick links embedded within pdfFiller guide users to similar forms, facilitating a broader understanding of document requirements.

Additionally, pdfFiller provides a wealth of resources related to documentation management, ensuring users remain well-informed about laws and revisions that might affect their filings. This approach reduces the stress associated with managing multiple form submissions.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete form or-706-disc request for online?

How do I edit form or-706-disc request for straight from my smartphone?

How can I fill out form or-706-disc request for on an iOS device?

What is form or-706-disc request for?

Who is required to file form or-706-disc request for?

How to fill out form or-706-disc request for?

What is the purpose of form or-706-disc request for?

What information must be reported on form or-706-disc request for?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.