Get the free Notice to Creditors in Tennessee: Requirements and Deadlines

Get, Create, Make and Sign notice to creditors in

Editing notice to creditors in online

Uncompromising security for your PDF editing and eSignature needs

How to fill out notice to creditors in

How to fill out notice to creditors in

Who needs notice to creditors in?

Notice to creditors in form: A comprehensive guide

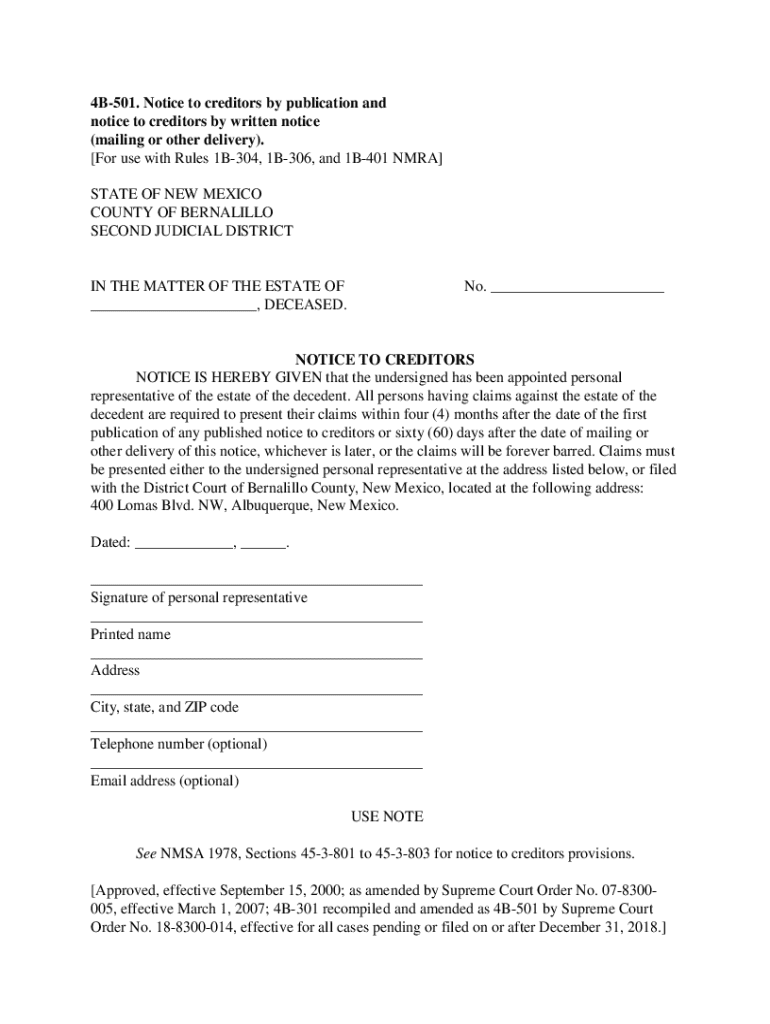

Understanding the notice to creditors

A notice to creditors is a formal document issued to notify creditors about a debtor's situation, particularly during estate administration, bankruptcy proceedings, or business liquidation. Its primary purpose is to inform creditors of their rights and provide them with essential information on how to submit claims for outstanding debts against the debtor's estate or business.

Notifying creditors is crucial in legal matters as it ensures transparency and gives creditors the opportunity to assert their claims within appropriate legal timeframes. Without this notification, creditors may miss out on recovering their debts, which can lead to legal complications for both the debtor and the creditors.

Types of notices to creditors

There are predominantly two types of notice to creditors: individual and general notices. An individual notice is addressed directly to specific creditors, while a general notice is publicly posted or published so that all potential creditors are informed. The choice between these two can depend on the nature of the debts and the number of creditors involved.

Common scenarios requiring a notice to creditors include:

Essential elements of a notice to creditors

To be effective and legally compliant, a notice to creditors must include several key elements. These include vital information about the debtor and clear instructions for creditors.

Using appropriate legal language is essential for compliance. It's advisable to review state-specific regulations when drafting this document.

The process of creating a notice to creditors

Creating a notice to creditors might seem daunting, but with a step-by-step approach, it can be managed efficiently. Here’s how to do it:

Effective communication is key. Consider using straightforward language to ensure that all recipients can easily comprehend the information.

Filling out the notice to creditors form

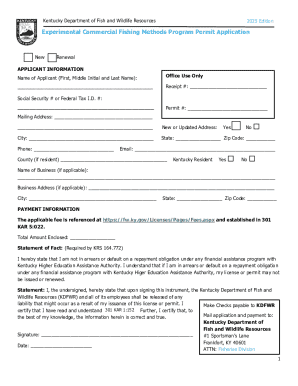

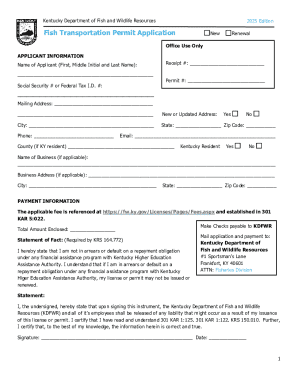

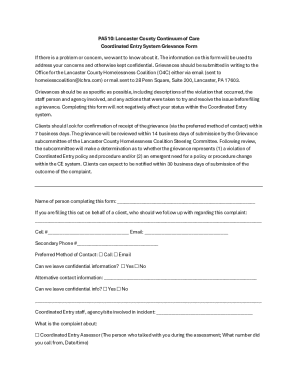

Utilizing interactive tools simplifies the process of completing a notice to creditors form. Platforms like pdfFiller provide intuitive templates that guide users through each step, making it easy to fill out online.

To complete your notice, follow these detailed instructions:

Pay attention to avoid common pitfalls, such as failing to include adequate details or missing the deadline for claims submissions.

Filing and distributing the notice to creditors

Once the notice to creditors is drafted and finalized, it’s time for filing and distribution. Filing usually involves submitting the notice to the relevant authorities, such as the probate court or a bankruptcy court, depending on the specifics of the case.

You can distribute the notice through various methods, including:

Whichever method you choose, accurate records of distribution are essential for future claims management.

Tracking responses from creditors

After distributing the notice to creditors, tracking responses becomes paramount. Keeping organized records allows you to manage claims submissions effectively.

Each claim received should be documented meticulously, noting the details of the creditor, the amount claimed, and the date of receipt. This will not only ensure a smooth claims process but will also help in negotiations or disputes that may arise.

Establishing clear communication channels with creditors can simplify this process. Regular updates or confirmations regarding claims status can help maintain transparency and foster goodwill.

Frequently asked questions (FAQs)

Several common queries arise during this process, including concerns about deadlines and implications. Here are a few frequently asked questions:

Related documents and templates

Utilizing templates can significantly ease the drafting process of a notice to creditors. Here’s a look at essential related documents:

Conclusion: Managing your legal documents effectively

Organized documentation is invaluable for anyone navigating financial obligations, particularly concerning notices to creditors. Utilizing platforms like pdfFiller offers easy access to templates, legal forms, and tools for managing legal documents efficiently.

With pdfFiller, users can seamlessly edit PDFs, eSign, collaborate, and manage documents from a single cloud-based platform, alleviating the burdens associated with legal documentation.

About pdfFiller

pdfFiller is dedicated to empowering individuals and teams with comprehensive document solutions. As a cloud-based platform, pdfFiller provides tools facilitating document creation, editing, signing, and management. By streamlining the process of dealing with complex documents, users can focus on what really matters—efficiently managing their financial and legal responsibilities.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my notice to creditors in in Gmail?

How can I send notice to creditors in to be eSigned by others?

How do I fill out notice to creditors in on an Android device?

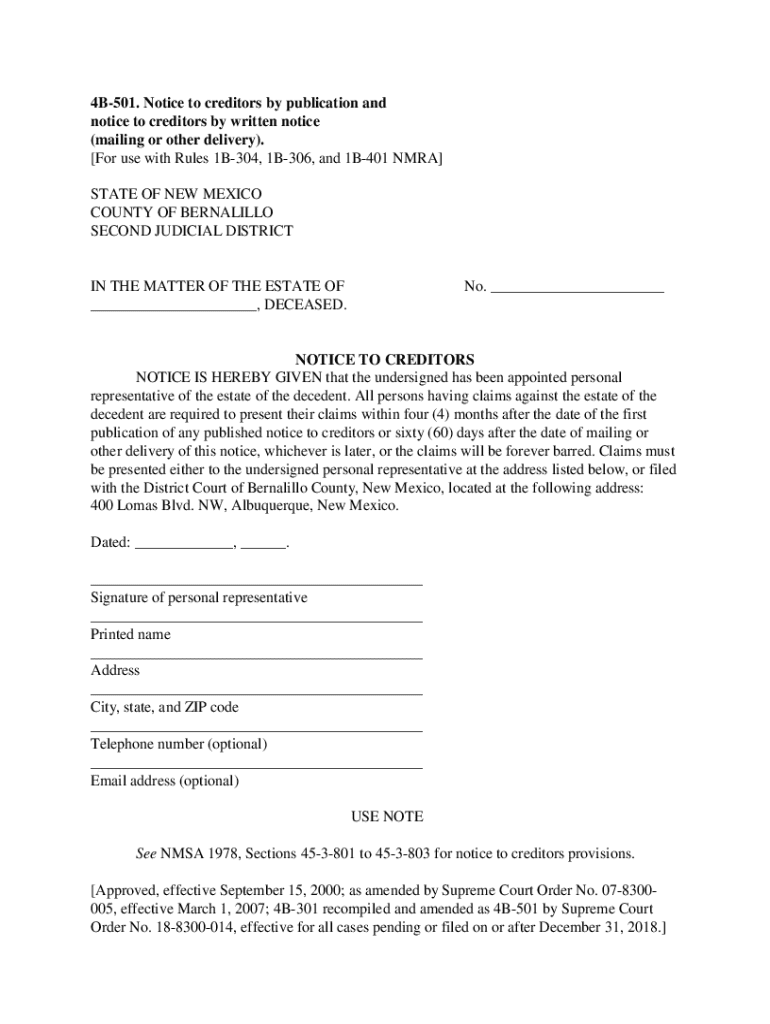

What is notice to creditors?

Who is required to file notice to creditors?

How to fill out notice to creditors?

What is the purpose of notice to creditors?

What information must be reported on notice to creditors?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.