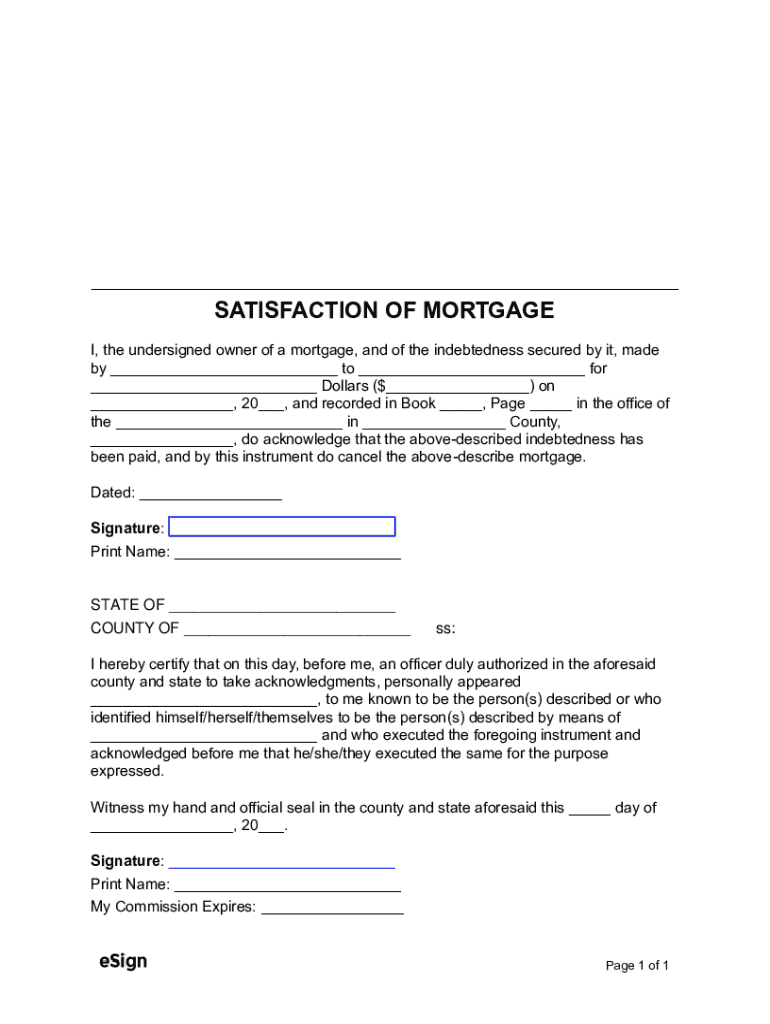

Get the Free Mortgage Release Form (Satisfaction of Mortgage)

Get, Create, Make and Sign mortgage release form satisfaction

How to edit mortgage release form satisfaction online

Uncompromising security for your PDF editing and eSignature needs

How to fill out mortgage release form satisfaction

How to fill out mortgage release form satisfaction

Who needs mortgage release form satisfaction?

Understanding the Mortgage Release Form Satisfaction Form

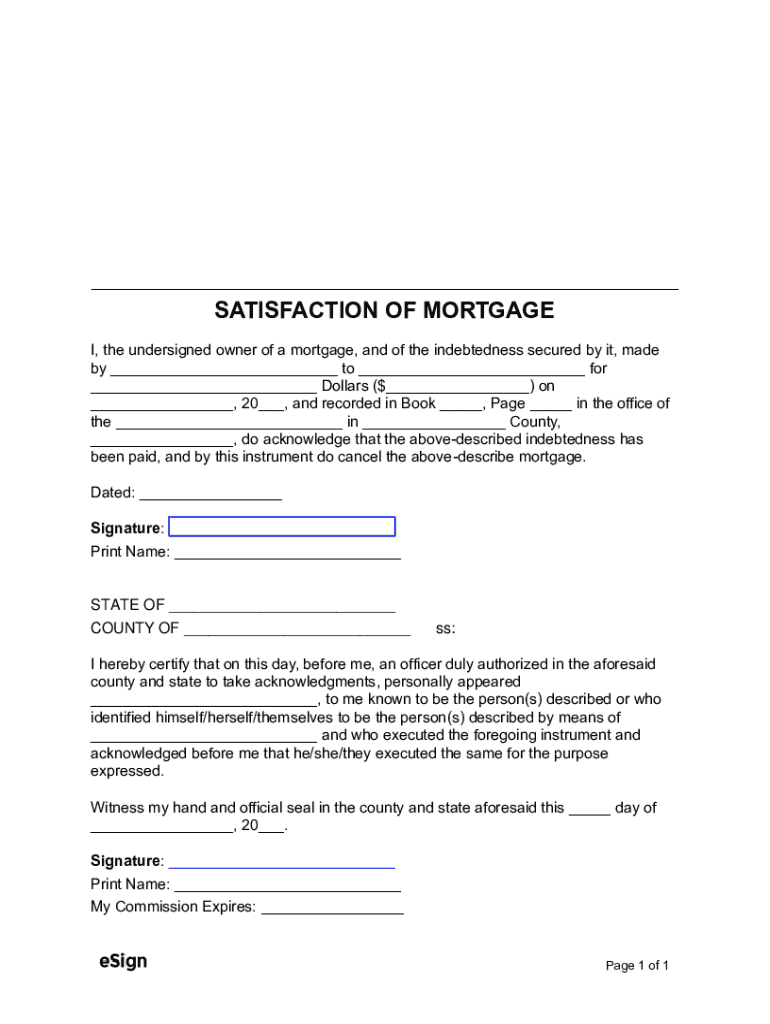

Understanding the mortgage release form

A mortgage release form, also known as a satisfaction form, is a legal document that signifies the repayment of a mortgage and the release of the lien by the lender. This essential document is critical in the mortgage process, as it confirms that the borrower has fulfilled their financial obligations and that the property is no longer encumbered by the mortgage. Without this form, homeowners may encounter significant challenges when attempting to sell or refinance their property.

Key terminology related to mortgage releases includes the term 'satisfaction of mortgage,' which refers specifically to the lender's acknowledgment that all payments have been made in accordance with the loan agreement, rendering the mortgage fully satisfied. It's important to distinguish between a mortgage release and a deed of reconveyance. While both serve to release the lender’s interest in the property, a deed of reconveyance is typically used in states with a trust deed, whereas a mortgage release is used where mortgages are the primary financing instrument.

When is a mortgage release form needed?

There are various scenarios where a satisfaction form becomes necessary. Most commonly, this is required when a borrower has made the final payment on their mortgage, effectively concluding their repayment term. However, other situations may also require its submission, such as selling a property where an existing mortgage must be cleared from the title before transfer.

The distinction between early payment satisfaction and the completion of a loan is crucial; early payment satisfaction may be due to a prepayment clause in the mortgage terms, while completion signifies the end of a full amortization period. Additionally, eligibility for a mortgage release can be affected by factors like potential prepayment penalties or specific lender stipulations that must be met before the release can be granted.

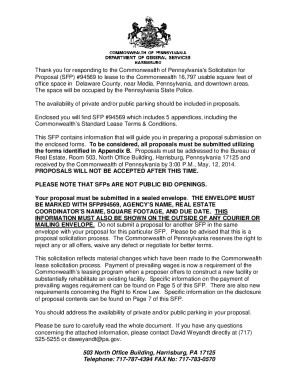

How to obtain a mortgage release form

Obtaining a mortgage release form typically involves directly reaching out to your lender or financial institution. Most lenders will have a dedicated process or department to handle these requests. You can also find downloadable versions of satisfaction forms online through various resources, ensuring you choose one that complies with your state’s regulations.

When requesting the document, include all pertinent information, such as your loan number, property address, and any identification numbers associated with the mortgage. It may be helpful to inquire if additional documentation is required during the request process to avoid delays in receiving your form.

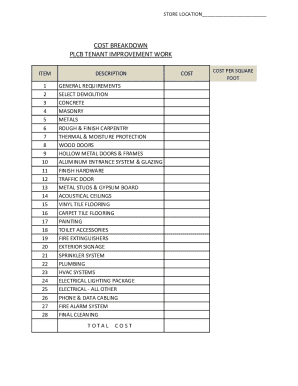

Steps to complete the mortgage release form

Completing a mortgage release form requires specific borrower and lender details. You'll need to input information about the borrower(s), the lender, the property address, and loan details, including the original loan amount and repayment dates. It's essential to ensure that all fields are filled out accurately to prevent processing delays.

While filling out the form, follow these detailed instructions: first, provide your and the lender's names as they appear on the mortgage documents. Next, accurately describe the property being released, including any parcel numbers if applicable. Be diligent in entering the loan details, paying particular attention to dates and amounts associated with the mortgage. Common mistakes include providing incorrect information or omitting necessary documents like transaction records that substantiate the loan completion.

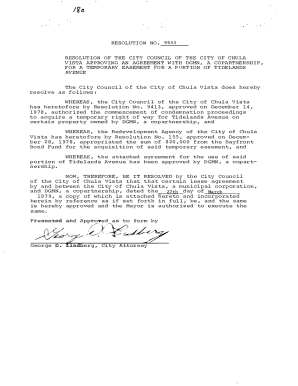

Signing and submitting the mortgage release form

Once the mortgage release form is completed, it must be signed before submission. Signatures can be obtained physically or electronically, depending on your lender’s stipulations. It's advisable to confirm with your lender whether they accept electronic signatures, as this can expedite the process significantly.

After signing, you’ll need to submit the form to the relevant authorities, typically your lender and your local recording office. Ensure you keep copies of both the completed form and any correspondence related to its submission. After submission, lenders may undertake a verification process to confirm that the information is accurate and complete before facilitating the release.

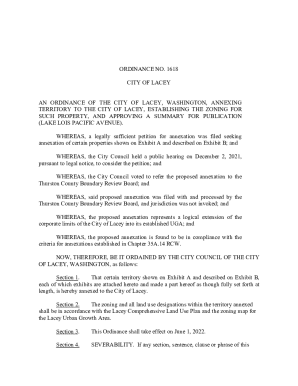

What happens after submitting the mortgage release form?

After you’ve submitted your mortgage release form, there is a processing time during which the lender and recording office will verify the details. Depending on the efficiency of the lender and local regulations, this processing could take anywhere from a few days to several weeks. Homeowners typically receive a confirmation of the release once processed.

In terms of documentation, you’ll likely receive a copy of the satisfaction of mortgage, which serves as official confirmation that the lien has been released from the property. It’s critical to ensure this documentation is properly recorded with your local recording office as it establishes clear property titles and protects against future title disputes.

Frequently asked questions about mortgage release forms

Homeowners often wonder what they should do if they never receive confirmation of their mortgage release. In such cases, it's vital to follow up with the lender to ensure there were no errors in processing. Similarly, if a lender refuses to issue a release, borrowers should seek clarification regarding the reasons behind the refusal, as understanding the lender's policies can often identify feasible solutions.

Also, the validity of a mortgage release is typically indefinite; however, borrowers should maintain copies of the release in their records. It is also worth noting that mortgage release requirements can vary by state, with some regions necessitating specific language or additional documentation within the form.

Additional considerations when dealing with mortgage releases

Navigating mortgage releases can have implications on your credit score. Once the mortgage is released, it generally reflects positively on your credit profile, potentially improving your creditworthiness. Additionally, keeping records of the satisfaction of mortgage is essential for future transactions, as these documents validate that you’re free from debt related to the property.

Legal implications also vary across jurisdictions; some states may have specific laws regarding the timeframe lenders have to file the release after satisfaction has occurred. Understanding these nuances not only shields you from potential issues but also enables you to advocate effectively on your behalf regarding any unjust delay in the release process.

Using pdfFiller for seamless document management

For managing your mortgage release form, pdfFiller offers an elegant solution to simplify the process. With cloud-based access, users can retrieve and manage documents from any location, ensuring convenience and flexibility. pdfFiller’s editing and eSigning capabilities streamline the completion of both the mortgage release form and other essential documents used throughout the mortgage process.

Utilizing pdfFiller for your mortgage release form involves a few straightforward steps: first, upload your form directly to the platform. Next, edit the necessary fields to ensure that the form is correctly filled out. Finally, leverage the eSigning feature to confidently sign your documents, which can then be shared with your lender or any other relevant parties, facilitating a smoother release process.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit mortgage release form satisfaction from Google Drive?

How can I get mortgage release form satisfaction?

How do I edit mortgage release form satisfaction online?

What is mortgage release form satisfaction?

Who is required to file mortgage release form satisfaction?

How to fill out mortgage release form satisfaction?

What is the purpose of mortgage release form satisfaction?

What information must be reported on mortgage release form satisfaction?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.