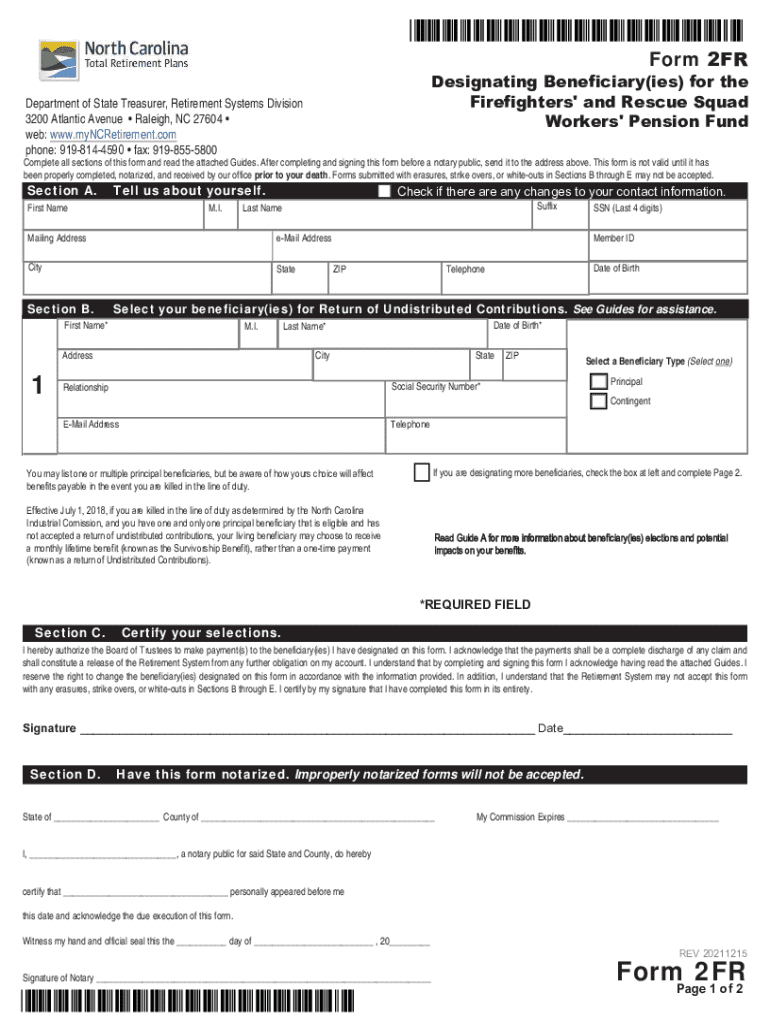

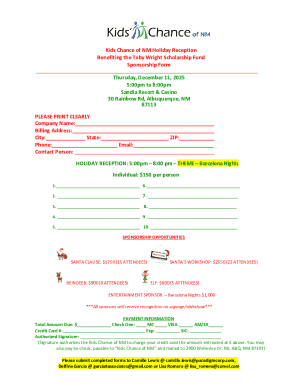

Get the free Beneficiary Designation Form for Retired Members

Get, Create, Make and Sign beneficiary designation form for

Editing beneficiary designation form for online

Uncompromising security for your PDF editing and eSignature needs

How to fill out beneficiary designation form for

How to fill out beneficiary designation form for

Who needs beneficiary designation form for?

Comprehensive Guide to Beneficiary Designation Forms: What You Need to Know

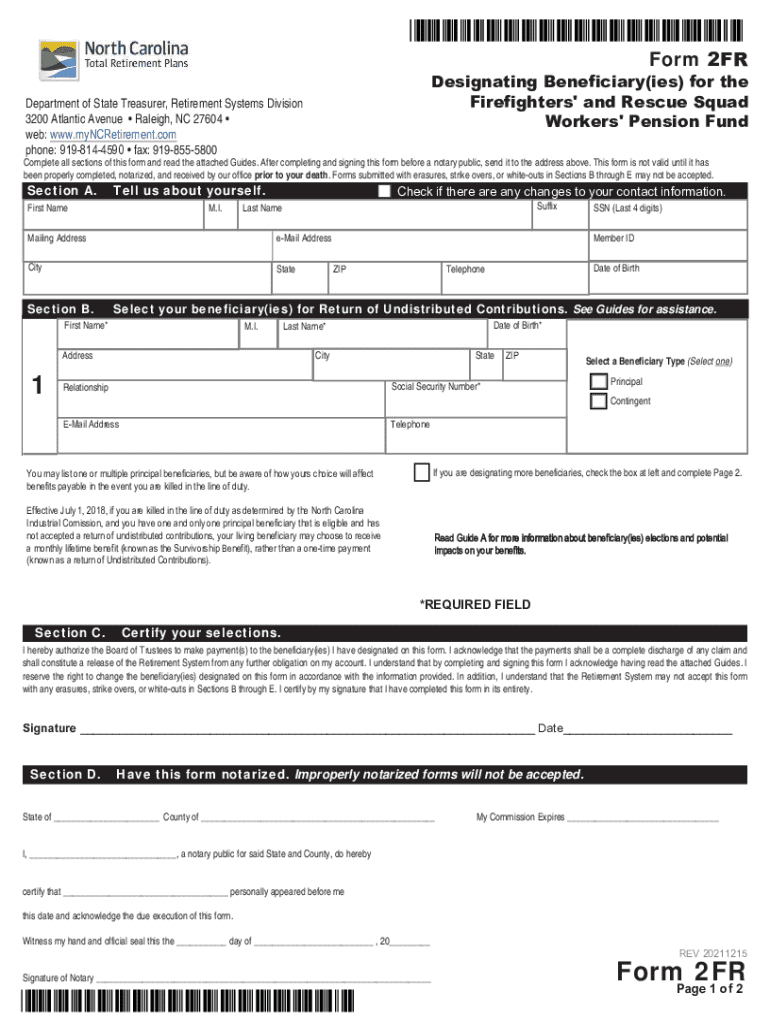

Understanding the beneficiary designation form

A beneficiary designation form is a critical document that allows individuals to specify who will receive their assets upon passing. Whether it's life insurance benefits, retirement accounts, or certain financial assets, this form outlines your preferences and intentions. Using a beneficiary designation form can simplify the transfer process, avoiding the complexities of probate, and ensuring that your loved ones receive their rightful share.

The importance of having a clear beneficiary designation in estate planning cannot be overstated. It not only facilitates the straightforward distribution of your assets but also minimizes potential disputes among family members. Confusion or ambiguity in asset distribution can lead to friction and strife among beneficiaries, which is why a comprehensive understanding of the beneficiary designation process is essential.

Anyone with assets that require transfer upon death, be it individuals, families, or even teams within organizations, should consider filling out a beneficiary designation form. This form is particularly pertinent for those dealing with life insurance benefits and retirement accounts, where ensuring clarity in beneficiary designation can prevent complications in asset management.

The process of designating a beneficiary

Designating a beneficiary involves careful consideration and a systematic process. Start by identifying your assets that require a beneficiary designation. This typically includes life insurance policies, retirement accounts (like 401(k) plans and IRAs), and investment accounts. Certain bank accounts may also allow for beneficiary designations, effectively facilitating asset transfer more conveniently.

Next, consider who you would like to designate as your primary and contingent beneficiaries. Primary beneficiaries are those who will receive the assets first, while contingent beneficiaries step in if the primary beneficiaries cannot. Evaluating the suitability of chosen beneficiaries is crucial. Not only should you consider their ability to manage the assets you wish to pass on, but also your relationship with them, especially in sensitive situations involving family members or business associates.

Filling out the beneficiary designation form

Once you've settled on your assets and your beneficiaries, the next step is completing the beneficiary designation form itself. Required information typically includes your personal details, such as your full name and contact information, alongside relevant policy numbers or account numbers tied to your assets. You will also need to provide details about your chosen beneficiaries, including their full name, relationship to you, and how you wish the allocation of benefits to be distributed among them.

To fill out your beneficiary designation form conveniently, pdfFiller offers a user-friendly platform. You can easily search for and download the required forms. pdfFiller allows users to engage with interactive tools for editing and signing, which can significantly streamline the process.

When completing the form, avoid common mistakes such as misspellings in the names of beneficiaries or incorrect percentages of asset allocation. Best practices for ensuring accuracy include double-checking each entry and making sure that all information adheres to the requirements set by the financial institution or insurance company.

Submitting your beneficiary designation form

After completing the beneficiary designation form, it's crucial to review and sign it properly. Double-check each entry for any potential errors before submission. Take advantage of pdfFiller's electronic signature feature, which allows you to sign the document securely and conveniently. This modern approach can provide an added layer of safety, ensuring that your intentions are documented properly.

For submitting, follow the specific instructions outlined by the entity that requires the designation form. Whether you need to submit online or offline, ensure you keep copies of the completed form and confirmation of submission. This documentation serves as verifiable proof of your intentions and can help resolve potential disputes down the line.

Managing and updating your beneficiary designation

It's vital to know when to update your beneficiary designations. Life events such as marriage, divorce, or the birth of children are significant triggers to revisit this documentation. Failing to do so can lead to unintended or undesired outcomes with asset distribution that may not align with your current wishes.

Accessing previous forms through pdfFiller is straightforward. You can retrieve and edit beneficiary forms whenever necessary, thanks to the platform's robust storage and editing capabilities. This feature is especially useful for revising designations when beneficiaries need to be added or removed, allowing for a seamless re-designation process with the aid of interactive tools.

Special considerations

Designating beneficiaries isn't always straightforward, especially in complex situations. For example, if you're considering naming minors as beneficiaries, it's essential to think about who will manage the assets until they reach adulthood. Setting up a trust may be necessary to ensure that the assets are managed responsibly.

Handling disputes among beneficiaries is another key consideration. Clear communication about your intentions and possibly consulting with legal professionals can help mitigate potential conflicts. Knowledge of state-specific regulations is also vital, as laws governing beneficiary designations can vary significantly from one region to another. Understanding these laws ensures your decisions comply with local stipulations.

FAQ: Common inquiries about beneficiary designation forms

One common question about beneficiary designations is how often you should review your designations. Ideally, you should reevaluate your designations annually or whenever a significant life change occurs. Another frequent inquiry relates to what happens if a beneficiary predeceases you. In most cases, the next contingent beneficiary will receive the assets. However, if no contingent beneficiaries are named, those assets may need to be addressed through the probate process.

Understanding these nuances helps ensure that your beneficiary designations remain effective and aligned with your current wishes and situations.

Empowering your document management with pdfFiller

Using pdfFiller for your beneficiary designation needs comes with numerous benefits. The platform streamlines the editing and signing processes, ensuring a seamless experience. With cloud-based access, you can manage your documents from any location, providing convenience and peace of mind. Furthermore, pdfFiller's collaboration features make it easy for teams managing shared assets, ensuring everyone involved has the necessary information at their fingertips.

Overall, pdfFiller empowers users to manage their documents effectively, facilitating a straightforward approach to completing, editing, and signing beneficiary designation forms. By utilizing this powerful tool, you can ensure that your intentions are clearly expressed and readily accessible when needed.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my beneficiary designation form for directly from Gmail?

How do I edit beneficiary designation form for in Chrome?

Can I edit beneficiary designation form for on an iOS device?

What is beneficiary designation form for?

Who is required to file beneficiary designation form for?

How to fill out beneficiary designation form for?

What is the purpose of beneficiary designation form for?

What information must be reported on beneficiary designation form for?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.