Get the free Cardholder Dispute Form Hdfc - Fill and Sign Printable ...

Get, Create, Make and Sign cardholder dispute form hdfc

Editing cardholder dispute form hdfc online

Uncompromising security for your PDF editing and eSignature needs

How to fill out cardholder dispute form hdfc

How to fill out cardholder dispute form hdfc

Who needs cardholder dispute form hdfc?

Understanding the HDFC Cardholder Dispute Form: A Comprehensive Guide

Understanding the cardholder dispute process

Cardholder disputes are crucial for consumers who feel that transactions on their accounts are incorrect or unauthorized. These disputes serve as a customer's safeguard against errors, fraud, or unexpected charges, delivering peace of mind that their financial interests are protected.

Common reasons for cardholder disputes include fraudulent transactions, double charges, failure to receive purchased items, or discrepancies in billings. Recognizing these reasons helps streamline the dispute process and sets the stage for resolving issues efficiently.

HDFC Bank plays a pivotal role in addressing these disputes through customer support and financial protocols. The bank has specific policies in place ensuring that cardholder disputes are handled swiftly and fairly, with a clear timeline for resolution that provides customers with essential feedback throughout the process.

The HDFC cardholder dispute form: An essential tool

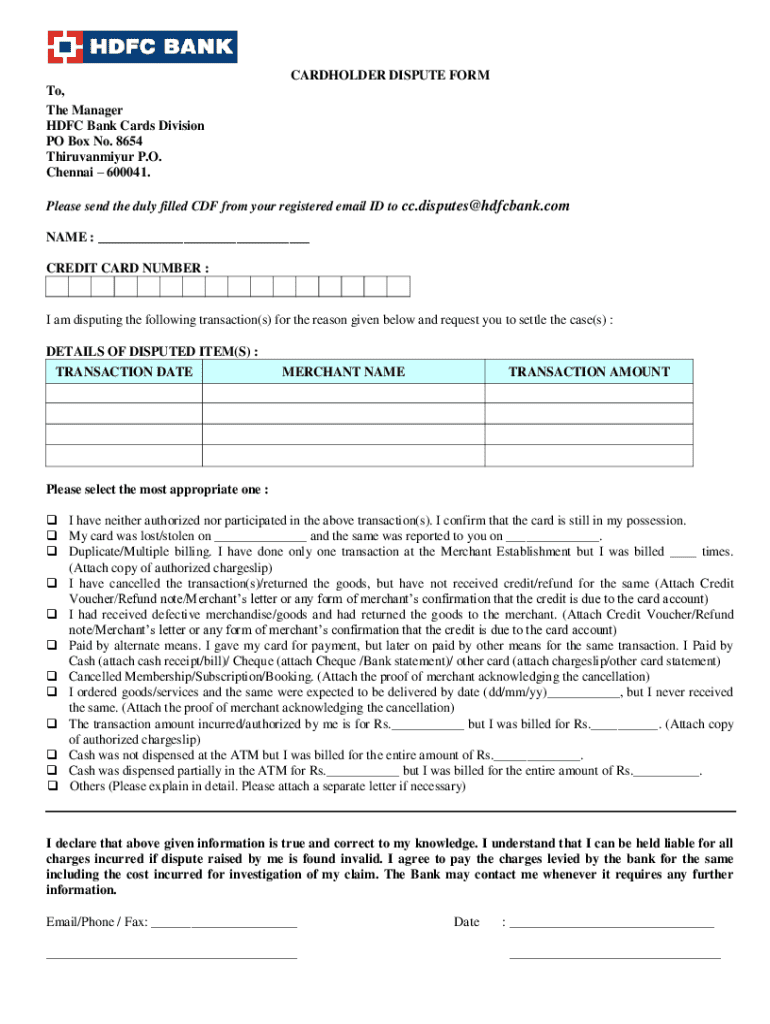

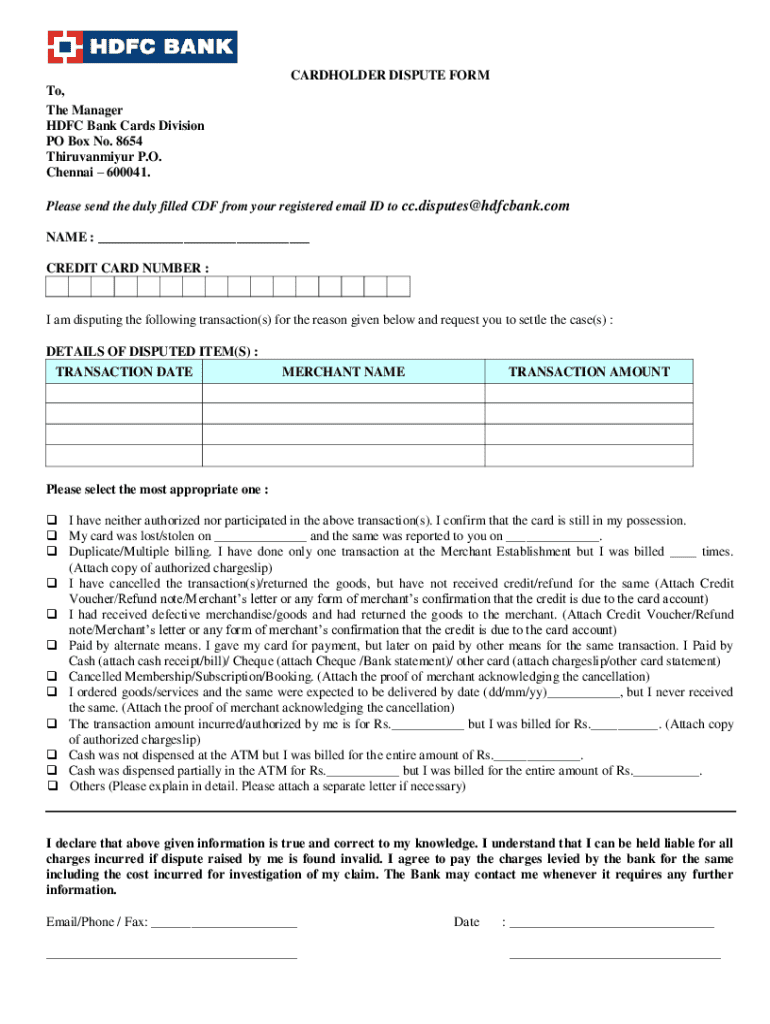

The HDFC Cardholder Dispute Form is a formal document that allows customers to report discrepancies or issues they encounter regarding their transactions. This form is significant because it serves as the official means of communicating disputes to the bank, ensuring that all relevant details are documented and processed.

Individuals should utilize the HDFC Cardholder Dispute Form in various scenarios, including fraudulent transactions, unauthorized charges, or when a merchant fails to deliver satisfactory service or products. By submitting this form, cardholders ensure that their concerns are formally recognized and addressed.

How to access the HDFC cardholder dispute form

HDFC Bank has made accessing the Cardholder Dispute Form straightforward, supporting both online and offline channels for customer convenience. For online access, cardholders can navigate the HDFC website, specifically the customer service section, where the form is readily available for download.

To locate the form on the HDFC website, follow these steps: log into your HDFC online banking account, go to the 'Help & Support’ section, access the 'Dispute Transactions' area, and find the link for the Cardholder Dispute Form. Alternatively, if you prefer an offline approach, you can obtain a physical copy of the form at any HDFC branch; simply ask a representative for assistance.

Detailed guide to filling out the HDFC cardholder dispute form

Filling out the HDFC Cardholder Dispute Form accurately is critical for a successful dispute resolution. The form is divided into several sections that require specific information, beginning with personal information such as name, address, card number, and contact details. Ensuring that these details are correct will help in expediting the resolution process.

Next, you must detail the disputed transaction. This includes the date of the transaction, the amount, the merchant's name, and the nature of the dispute itself, which helps HDFC understand the context. Finally, provide a concise and clear explanation for your dispute to avoid any misunderstandings. Using straightforward language, while being descriptive enough to convey your issue, is essential.

Submitting the HDFC cardholder dispute form

Once you've completed the HDFC Cardholder Dispute Form, the next step is submission. For electronic submissions, the form can usually be uploaded through the HDFC online banking portal. Navigate to the same 'Help & Support' section, where you initially found the form, and look for the option to 'Submit Dispute.'

If you prefer to submit the form via traditional channels, you may mail it to the address provided on the form. Ensure that you send it through a reliable courier service for tracking purposes. Additionally, you can visit any local HDFC branch to submit the form in person. This way, you can receive immediate confirmation from a representative.

After submission: What to expect

Understanding what occurs after you submit the HDFC Cardholder Dispute Form is essential for managing your expectations. Generally, HDFC Bank indicates a timeline for processing disputes, typically ranging from a few days to several weeks, depending on the complexity of the dispute.

To keep track of your dispute status, HDFC provides online tracking options via the online banking portal. Alternatively, customers can contact customer support for updates on their dispute's progress. Documentation of your communications with the bank is advisable during this period.

Tips for effective dispute management

Keeping thorough records of all communications during your dispute process is not just prudent; it's crucial. Document interactions like calls or any correspondence, as this information can bolster your case if disputes escalate or require further classification.

Follow-up on your dispute effectively. Should you notice any delays beyond the standard processing timeframe, do not hesitate to reach out to HDFC. Lastly, if your dispute is declined, it's important to know your rights and options. You may consider escalating the issue or seeking advice from consumer protection agencies.

HDFC dispute resolution best practices

Engaging constructively with HDFC customer support representatives can significantly impact your dispute resolution experience. Approach each interaction with a clear overview of your issue, and prepare relevant questions to promote an efficient dialogue.

Using additional consumer protection resources can help arm you with knowledge about your rights and dispute options. Consider utilizing tools available through organizations focused on consumer advocacy, as well as local resources that may offer personalized support for cardholders.

Leveraging pdfFiller for enhanced document management

When navigating the HDFC Cardholder Dispute process, pdfFiller can significantly enhance your experience. With features supporting editing, eSigning, and collaboration, pdfFiller empowers users to manage their dispute forms seamlessly, ensuring they are filled out accurately and submitted efficiently.

Moreover, pdfFiller offers access from anywhere via cloud-based document management. This flexibility means users can edit and submit forms on-the-go, accommodating busy schedules, while ensuring sensitive data remains secure and organized.

Frequently asked questions (FAQs)

Many customers often have queries regarding the HDFC Cardholder Dispute Form. A common question is, 'What happens if I miss the dispute deadline?' HDFC typically provides a timeframe within which disputes must be filed. Missing this may lead to automatic dismissal unless valid reasons are provided.

Another frequently asked question is, 'Can I dispute multiple transactions at once?' Yes, provided the scenarios surrounding each dispute are similar, HDFC allows customers to consolidate disputes into a single submission, but clarity in each case remains crucial.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit cardholder dispute form hdfc in Chrome?

How can I edit cardholder dispute form hdfc on a smartphone?

Can I edit cardholder dispute form hdfc on an iOS device?

What is cardholder dispute form hdfc?

Who is required to file cardholder dispute form hdfc?

How to fill out cardholder dispute form hdfc?

What is the purpose of cardholder dispute form hdfc?

What information must be reported on cardholder dispute form hdfc?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.