Get the free Employer Health Insurance Forms

Get, Create, Make and Sign employer health insurance forms

How to edit employer health insurance forms online

Uncompromising security for your PDF editing and eSignature needs

How to fill out employer health insurance forms

How to fill out employer health insurance forms

Who needs employer health insurance forms?

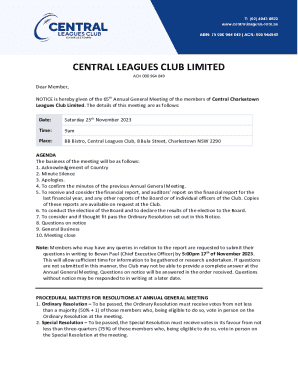

Navigating Employer Health Insurance Forms: A Comprehensive Guide

Understanding employer health insurance forms

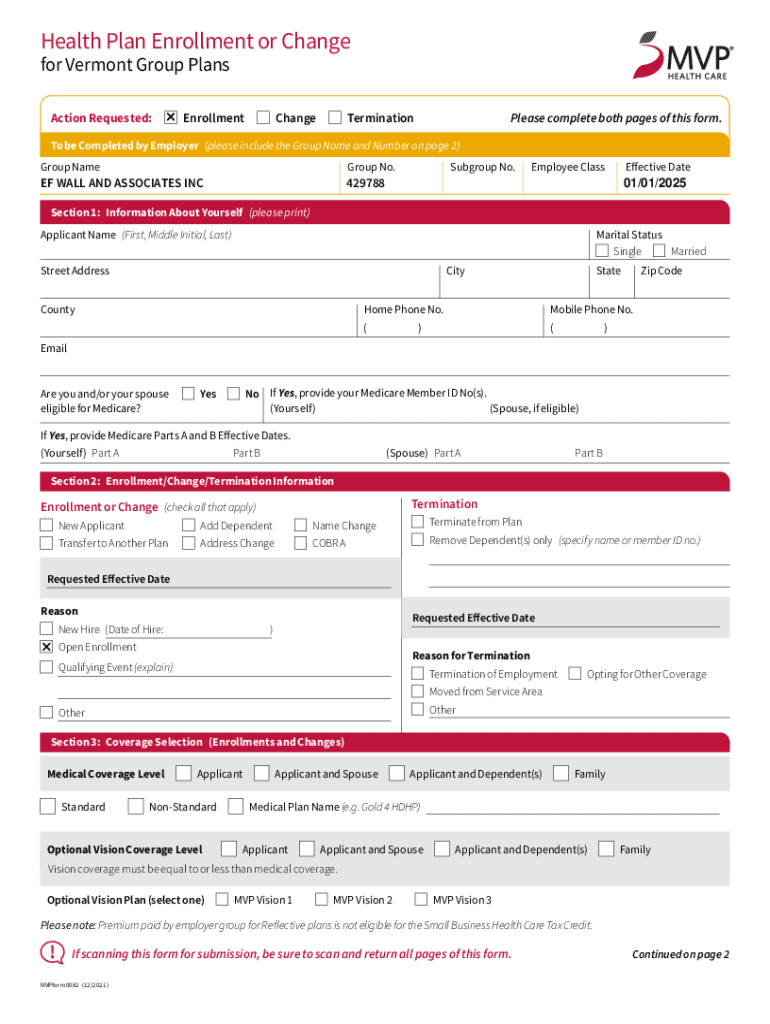

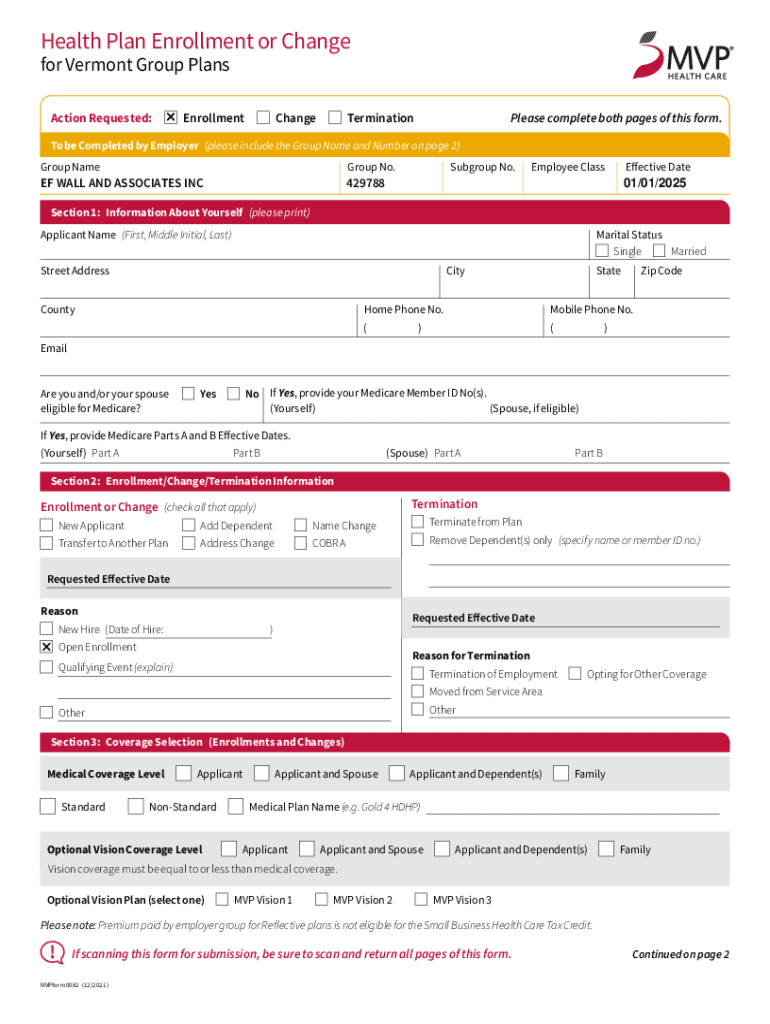

Employer health insurance forms are documents required by the IRS to report health coverage information provided to employees. As part of the Affordable Care Act (ACA), employers with a certain number of employees must complete these forms annually. These documents not only inform the IRS about the health coverage offered but also help employees determine if they met the health coverage requirements necessary to avoid penalties, thus intertwining both parties' financial responsibilities and rights.

Accurate filing of these forms is critical for both employers and employees. Employers can minimize penalties that may arise from inaccuracies while also ensuring that employees receive the appropriate tax credits or avoid penalties during tax season. Missing or improperly filled forms could potentially lead to unnecessary disputes and complications down the line.

Types of employer health insurance forms

Employers must familiarize themselves with several key forms: Form 1095-C, Form 1094-C, and the Summary of Benefits and Coverage (SBC). Each form serves a distinct purpose in the reporting process.

Understanding when and why each form is used ensures that both employer and employee responsibilities are clearly outlined, reflecting honest reporting and adherence to tax provisions.

Key sections of employer health insurance forms

Diving deeper, let's explore the key sections found within Form 1095-C and Form 1094-C. Each part of these forms has specific information required to ensure compliance with IRS guidelines.

For Form 1094-C, Section I summarizes the employers and any related entities while the certification section confirms eligibility for transition relief, helping employers clarify their compliance status.

Fill out employer health insurance forms step-by-step

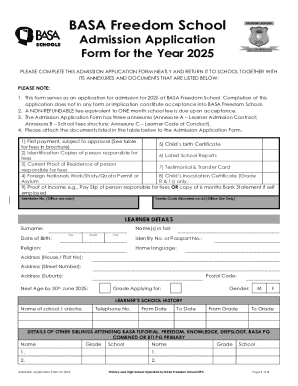

Before attempting to fill out these forms, gathering the necessary information is essential. This includes detailed employee information, like names, social security numbers, and health plan information. Employers should compile this data to simplify the process.

For Form 1095-C, start with Part I by entering employee and employer information accurately. In Part II, indicate the health coverage offered, specifying the months that coverage was active. Finally, in Part III, list covered individuals while ensuring accuracy and completeness.

Similarly, completing Form 1094-C involves summarizing employer information in Section I while Section II focuses on certifying eligibility for transition relief, providing crucial insights into the employer's coverage responsibilities.

Common errors and how to avoid them

Even minor mistakes can lead to significant complications when filling out employer health insurance forms. One of the most common errors includes incorrect employee identification details such as inaccurate Social Security Numbers or misspelled names, which can prevent the IRS from properly attributing coverage.

Before submitting, employers should take time to thoroughly review all filled forms, preferably involving a tax professional to reduce the risk of errors. Utilizing PDFfiller can simplify this process by allowing for electronic edits and real-time collaboration.

eSignature and document management

Employers can greatly benefit from electronic submission and document management. Platforms like PDFfiller allow for efficient eSigning, making it easier to sign forms without the hassle of printing, signing, and scanning.

Employers can manage and store their forms safely in a cloud environment, ensuring access from anywhere and providing peace of mind that all documents are securely stored.

Frequently asked questions (FAQs)

Understanding the various facets of employer health insurance forms brings about numerous questions. For instance, many employees ask why these forms are crucial to their financial health and what to do if they receive a form in error. The bitterness of tax penalties can be avoided by diligently reviewing forms beforehand.

Compliance and deadlines for filing

Timeliness is essential when it comes to filing employer health insurance forms. Key deadlines for submitting Forms 1095-C and 1094-C typically fall during the first quarter of the year. For instance, forms should be sent to employees by January 31 and submitted to the IRS by February 28 if filing paper forms, or March 31 if filing electronically.

Consequences of late submission can include hefty fines aimed at promoting timely compliance. Keeping track of regulatory changes is crucial, and resources, including IRS guidelines, provide valuable insights to stay informed.

Interactive tools for document management

Here, PDFfiller shines as a tool that offers interactive form features that simplify the completion process of employer health insurance forms. Users can save, share, and securely store their documents all in one platform.

These tools enhance the process for both individual users and larger teams, making it efficient to manage multiple forms and stay organized throughout the filing year.

Conclusion: Empowering employers with efficient document solutions

Navigating the complexities of employer health insurance forms can be overwhelming, but leveraging a cloud-based platform like PDFfiller transforms this chore into a streamlined experience. The benefits of using such solutions go beyond mere completion of forms; they enhance collaboration, improve accuracy, and ultimately save time and resources.

Employers seeking efficient management of their health insurance forms will find PDFfiller an invaluable resource that simplifies the filing process while ensuring compliance with necessary regulations. In doing so, they not only empower themselves but also protect their employees' interests effectively.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get employer health insurance forms?

How do I edit employer health insurance forms in Chrome?

Can I edit employer health insurance forms on an iOS device?

What is employer health insurance forms?

Who is required to file employer health insurance forms?

How to fill out employer health insurance forms?

What is the purpose of employer health insurance forms?

What information must be reported on employer health insurance forms?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.