IRS 8804 2025-2026 free printable template

Get, Create, Make and Sign IRS 8804

Editing IRS 8804 online

Uncompromising security for your PDF editing and eSignature needs

IRS 8804 Form Versions

How to fill out IRS 8804

How to fill out form 8804 rev december

Who needs form 8804 rev december?

Form 8804 Rev December: A Comprehensive Guide for Partnerships

Understanding Form 8804: An Essential Tax Document for Partnerships

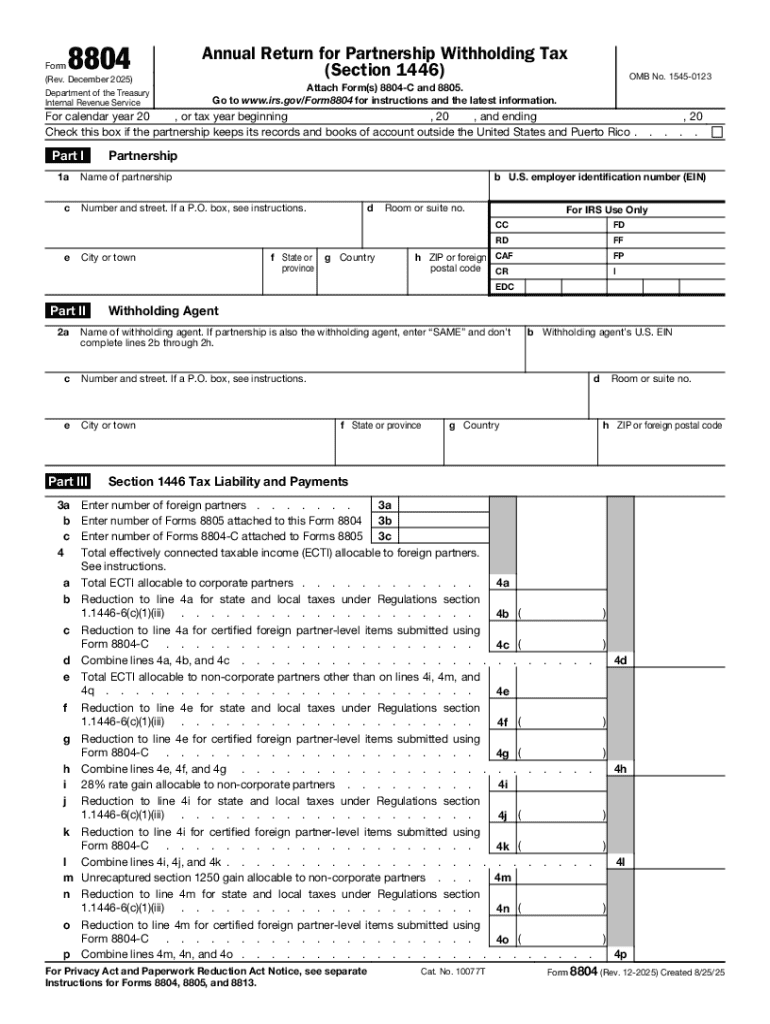

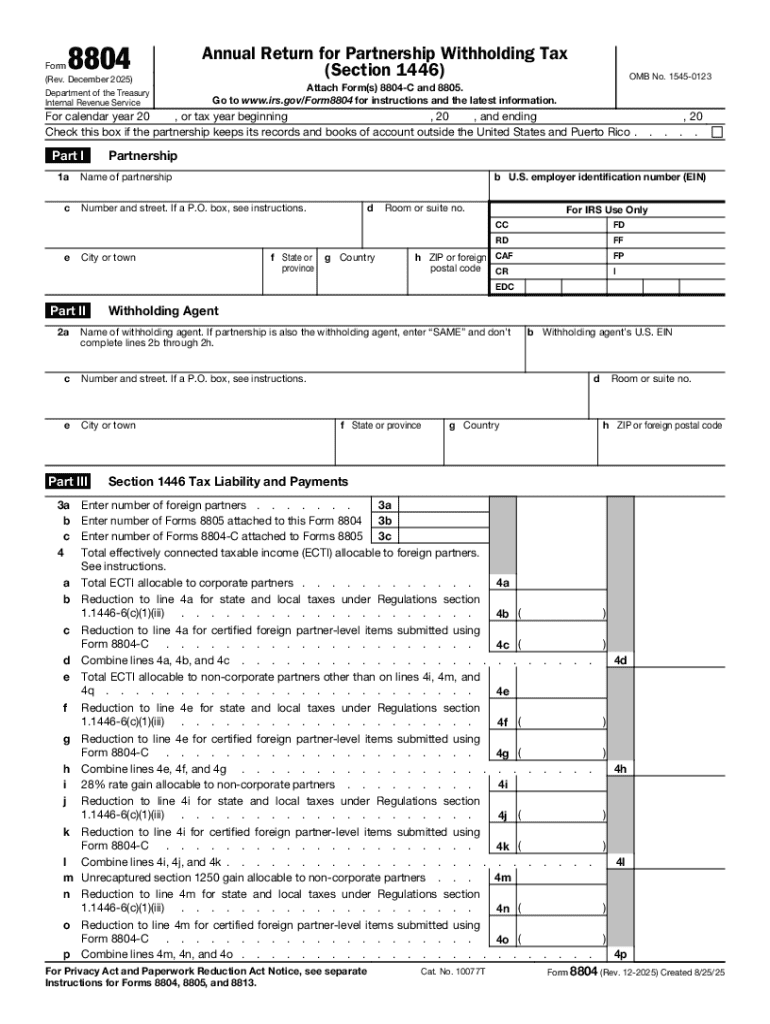

Form 8804 is a crucial document for larger partnerships that have foreign partners. Designed primarily to report tax withheld on effectively connected income derived from U.S. sources, it plays a significant role in the partnership's compliance obligations. This form serves not just as a tax return for partnerships but also ensures that the IRS can track tax liabilities incurred by foreign partners, thus protecting the U.S. tax base.

The importance of Form 8804 extends beyond simple compliance. It allows partnerships to fulfill their responsibilities as withholding agents for taxes owed by foreign partners. Understanding the nuances of why and how to file this form is vital for partnerships that aim to maintain good standing with the IRS and avoid potential penalties.

Key sections of Form 8804: A breakdown

Form 8804 is composed of several key sections that require careful attention. These sections are structured to capture all necessary information from the partnerships regarding tax obligations. This ensures that both the IRS and the partners have clear visibility into the partnerships’ tax responsibilities.

Each section of Form 8804 pertains to different reporting requirements and details – from the partnership's identifying information, to income effectively connected to business activities, and finally the calculation of withholding tax due. Understanding what each section requires can help mitigate common errors that may arise during filing.

Filing requirements and deadlines

Form 8804 must be filed annually, with specific due dates depending on the partnership's fiscal year. Typically, the form is due on the 15th day of the fourth month following the close of the partnership's tax year. It's essential to align the filing of Form 8804 with these deadlines to avoid any discrepancies in reporting.

Late filing can lead to significant penalties, which can accumulate based on the amount of tax due. It's crucial for partnerships to be aware that interest may apply as well, which can further complicate the financial implications of a late return.

Interrelationship with Form 8805

Form 8805 is another essential form that complements Form 8804. While Form 8804 is used to report the total tax withheld from foreign partners, Form 8805 is used to provide detailed information about each foreign partner's share of income, credits, and tax withheld.

These forms work in concert, as the information reported in Form 8804 feeds into what partners can expect to see on their Form 8805. By ensuring accuracy across both forms, partnerships can maintain proper records and compliance with IRS requirements, avoiding issues with their foreign partners.

Withholding rates for partnerships with foreign partners

The withholding rate that applies to foreign partners is typically set at 37% for U.S.-sourced effectively connected income. However, this rate may vary based on factors such as tax treaties that the U.S. has with the partner's country of residence, potentially allowing for reduced rates or exemptions.

Partnerships must be diligent about verifying the residency status of their foreign partners to determine applicable withholding rates correctly. Failure to do so might result in incorrect tax withholdings, further escalating financial and compliance risks.

Common scenarios: Are there exceptions to partnership withholding?

Certain scenarios exist where foreign partners may not be subject to the standard withholding requirements. For instance, if a partnership can demonstrate that the partner is not engaged in a U.S. trade or business, then withholding may not be necessary.

Additionally, certain exemptions under specific treaties can lead to reduced or eliminated withholding requirements, depending on the partner's country of residence. Recognizing these scenarios can provide partnerships with opportunities for tax efficiency and compliance.

Filing procedure for Form 8804 and Form 8805

The filing process for Form 8804 begins with gathering all necessary information, including the partnership's income details and foreign partner information. Partnerships should ensure they have a comprehensive understanding of both the financial landscape and tax obligations before completing the form.

To complete Form 8804 accurately, follow these steps: first, download the most recent form from the IRS website; then, systematically fill out each section as per the guidelines provided in the accompanying instructions; finally, double-check for accuracy before submitting, as errors can lead to complications.

Document management with pdfFiller

pdfFiller simplifies the process of filing Form 8804 by offering a streamlined platform for document management. With pdfFiller, users can easily edit, sign, and collaborate on their forms, ensuring the process is efficient and error-free.

The real-time editing and feedback features provided by pdfFiller empower teams to work together seamlessly, whether in an office or remote environment. This level of collaboration is instrumental in ensuring compliance and achieving timely submissions.

After submission: What to expect

After submitting Form 8804, it’s essential to track its status to confirm that it has been received and processed by the IRS. This can help partnerships understand if there are any issues or additional information required. Checking the IRS website or using any confirmation receipts provided upon submission can offer clarity.

If IRS inquiries arise post-submission, prompt responses are crucial. Partnerships should keep a detailed record of all communications and documentation to address any inquiries efficiently.

Insights from tax advisors

Consulting with tax advisors can provide partnerships with tailored insights regarding the complexities of Forms 8804 and 8805. These experts can offer critical guidance on compliance, minimizing potential errors, and optimizing withholding strategies.

Common questions from partnerships often revolve around the intricacies of withholding tax responsibilities and the implications of international tax treaties. Being proactive in seeking advice can enhance partnerships’ strategic decisions regarding their foreign partners.

People Also Ask about

Do I need to fill out form 8858?

How do I report a disregarded entity on 1040?

Can you electronically file form 8804?

What is the penalty for filing form 8804?

Who is required to file form 8804?

What is the IRS form for disregarded entity?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit IRS 8804 from Google Drive?

How do I edit IRS 8804 online?

Can I edit IRS 8804 on an iOS device?

What is form 8804 rev december?

Who is required to file form 8804 rev december?

How to fill out form 8804 rev december?

What is the purpose of form 8804 rev december?

What information must be reported on form 8804 rev december?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.