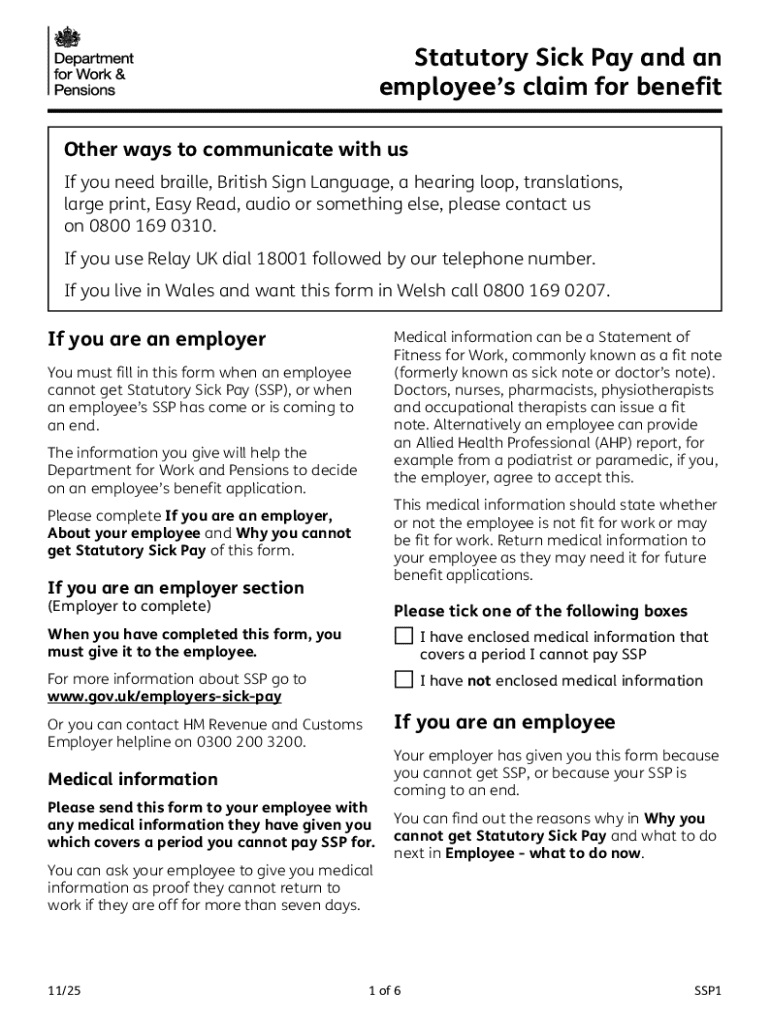

Get the free Statutory Sick Pay and an employees claim for benefit. Form SSP1

Get, Create, Make and Sign statutory sick pay and

How to edit statutory sick pay and online

Uncompromising security for your PDF editing and eSignature needs

How to fill out statutory sick pay and

How to fill out statutory sick pay and

Who needs statutory sick pay and?

Statutory Sick Pay and Form: A Comprehensive Guide

Understanding Statutory Sick Pay (SSP)

Statutory Sick Pay (SSP) serves as a financial safety net for employees in the UK who are unable to work due to illness. SSP was established to ensure that employees do not face financial hardship while recovering from health issues. The importance of SSP lies in its ability to provide a consistent income during periods of sickness, thereby promoting employee welfare and wellbeing.

SSP amounts to a fundamental component of employee benefits, assuring workers that they can manage their financial obligations even when they cannot earn a salary due to health reasons.

Eligibility criteria for SSP

To qualify for Statutory Sick Pay, employees must meet specific eligibility criteria. First, they must be classified as an employee, not a contractor or self-employed individual. Additionally, they must earn an average of at least £123 per week (as of the 2023 tax year).

Moreover, they should have been sick for at least four consecutive days, including weekends and holidays, while being unable to perform their duties. It is crucial to inform your employer about your sickness as per their policy, typically within a week of falling ill.

Duration and amount of SSP

Eligible employees can receive Statutory Sick Pay for up to 28 weeks. Importantly, the amount you receive does not vary based on your length of service or salary. As of current regulations, the standard rate of SSP is £109.40 per week, but this can be amended during government reviews.

Calculating the SSP you will receive is straightforward: simply refer to the weekly rate announced by the government, which can change over time. Ensuring you’re aware of these adjustments is vital for accurate budgeting during your sick leave.

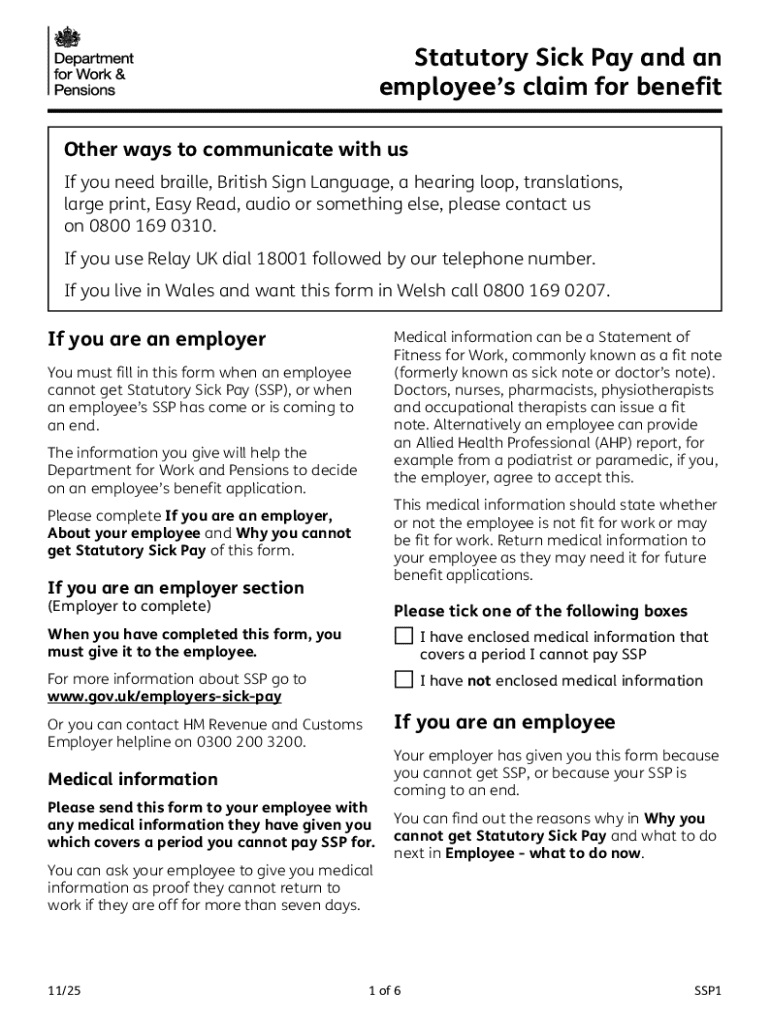

Key forms related to statutory sick pay

Claiming Statutory Sick Pay involves filling out specific forms accurately. The primary document used is the SSP1 form, which is necessary for your employer to prepare SSP payments effectively. This form serves as a notification about your sickness, ensuring that both you and your employer adhere to the legal compliances surrounding SSP claims.

Apart from the SSP1, you might need to complete a self-certificate for sickness that lasts up to seven days. For longer periods of sick leave, you will likely need a doctor's note as well.

Step-by-step guide to filling out the SSP1 form

Filling out the SSP1 form requires meticulous attention to detail. Before you begin, gather necessary information, such as your personal details, employment history, and specific sick leave dates. This preparation ensures a smoother form-filling experience.

Common mistakes to avoid when completing SSP forms

When completing your SSP forms, errors may lead to rejections of your claim, causing unnecessary delays. Errors to look out for include incorrect personal details, omitting dates of your sickness, or failing to sign the form.

To avoid these pitfalls, double-check all the information provided and compare it against your supporting documents, such as medical certificates. It’s also advantageous to maintain open communication with your HR department to clarify any uncertainties.

Submitting your SSP claim

Once your SSP form is complete, the next step is submission. You can submit your SSP forms online or via postal service. Each method has its advantages, with online submissions often being faster and more efficient.

When deciding which method to use, consider the preferences of your employer and keep abreast of possible processing times to plan your finances accordingly.

Tracking your claim status

After submitting your SSP claim, monitoring its progress is essential. You can typically track your claim through your employer’s portal or by directly contacting the relevant department.

For further inquiries or updates, you can reach out to HM Revenue and Customs (HMRC) directly, where they can provide clearer insights into the status of your claim.

Managing your SSP documentation

Documentation is critical in the SSP process. Best practices include storing all forms in a dedicated folder—both physical and digital. Maintaining organized records ensures that you can quickly access information necessary for any future claims or inquiries.

Using tools like pdfFiller simplifies the management of your SSP documents, allowing for easy editing, signing, and even collaborating with HR on specific forms.

Using pdfFiller for managing SSP documents

pdfFiller empowers users to seamlessly edit PDFs, eSign, collaborate, and manage documents all from a single, cloud-based platform. This can greatly reduce the hassle often associated with paperwork.

Additionally, pdfFiller offers interactive tools that allow users to fill out forms securely and efficiently. Collaborating with HR or payroll officers is made easier, ensuring that your claim is processed swiftly without errors.

Frequently asked questions (FAQs) about SSP

Common queries regarding SSP often include concerns about when payments begin after submission, what to do if my claim is denied, or how to appeal a decision. For the most accurate responses, referring to the HMRC website can clarify many uncertainties.

Moreover, debunking myths surrounding Statutory Sick Pay is essential, as misinformation can lead to unnecessary confusion about entitlements and requirements. Understanding changes in SSP regulations is vital to ensure you are informed of your rights and options.

Interactive tools to enhance your SSP experience

Interactive tools can greatly enhance your experience while claiming SSP. Calculating tools are available to estimate your SSP based on earnings, providing a clearer picture of expected financial support.

These tools not only streamline the process but also empower claimants to take charge of their SSP journey.

Contacting authorities for assistance

If you encounter issues during your SSP claim process, knowing when to seek legal guidance is crucial. Complex cases may require professional advice, especially concerning disputes with employers or HMRC.

Having these resources on hand can ensure you receive timely support and guidance as you navigate your SSP rights.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get statutory sick pay and?

Can I create an eSignature for the statutory sick pay and in Gmail?

How do I edit statutory sick pay and on an iOS device?

What is statutory sick pay?

Who is required to file statutory sick pay?

How to fill out statutory sick pay?

What is the purpose of statutory sick pay?

What information must be reported on statutory sick pay?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.