Get the free Book 104 2025 Colorado Individual Income Tax Filing Guide. If you are using a screen...

Get, Create, Make and Sign book 104 2025 colorado

Editing book 104 2025 colorado online

Uncompromising security for your PDF editing and eSignature needs

How to fill out book 104 2025 colorado

How to fill out book 104 2025 colorado

Who needs book 104 2025 colorado?

A comprehensive guide to the Book Colorado form

Understanding the Book 104 form

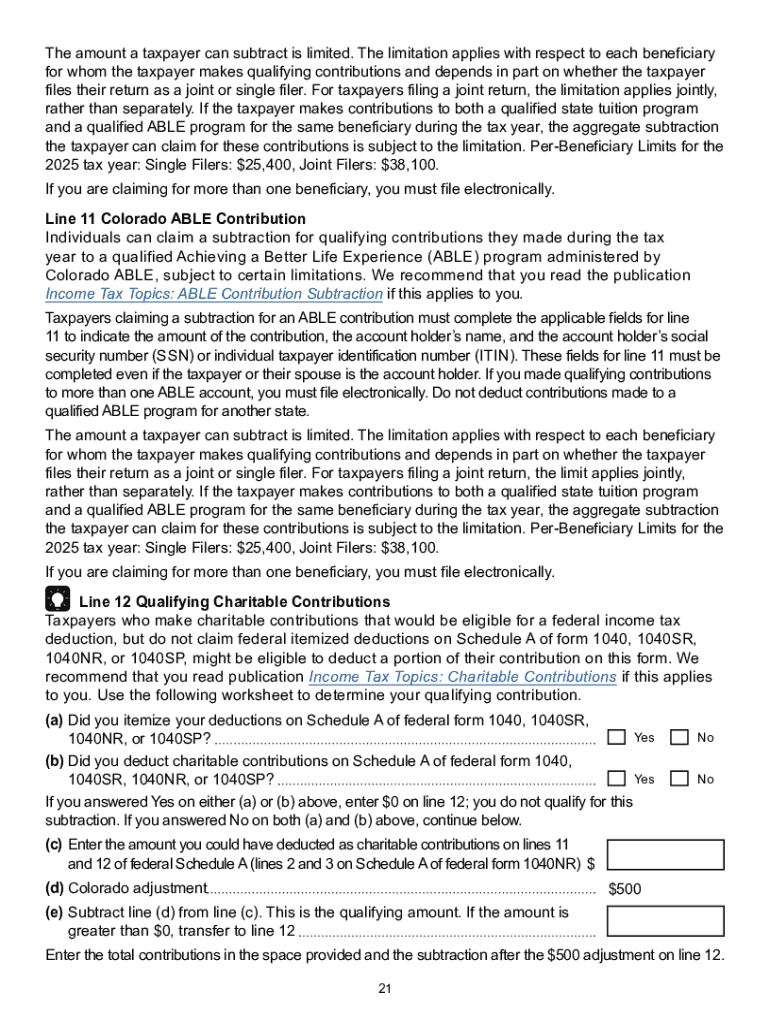

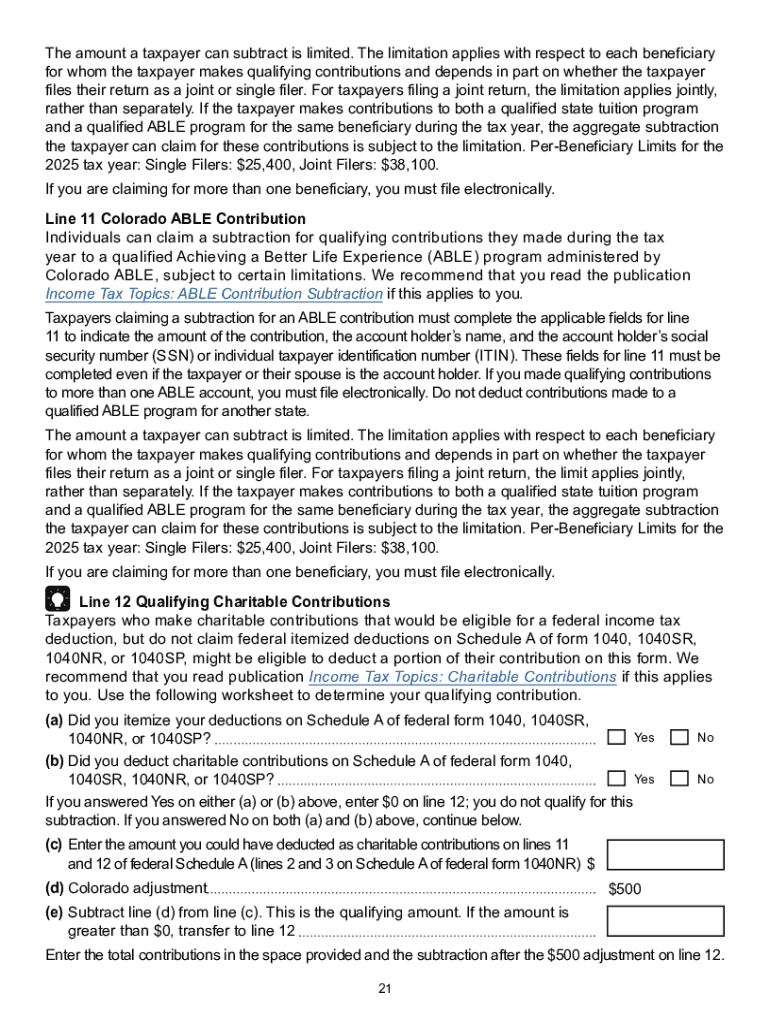

The Book 104 form is a vital tax document used by residents of Colorado to report their income and calculate their state tax liability. Essentially, it is Colorado's version of the federal income tax return, designed to provide the state with information about taxpayers' earnings, deductions, and credits. The accurate filing of this form ensures compliance with state tax laws and helps avoid potential penalties.

Given its significance, it is crucial for individuals and teams to approach the completion of the Book 104 form with diligence. Incorrect or incomplete filings can lead to delays in processing or, worse, an audit. Every detail counts, from personal information to income types, which is why being well-prepared is essential.

Key updates for the 2025 tax year

As with any tax year, the Book 104 form has undergone several updates for 2025. These updates may include adjustments to tax rates, new deductions, or credits introduced to stimulate the economy. Understanding these changes is vital for taxpayers, as they could significantly impact your tax calculations. For instance, any new eligibility criteria for deductions may change your approach to reporting income.

Taxpayers should be vigilant about these updates to ensure they do not miss out on potential savings. A lack of awareness can lead to higher tax liabilities, adversely affecting personal finances. Consulting updated resources or tax professionals can illuminate these changes, ensuring a thorough understanding.

Preparing to fill out the Book 104 form

Before diving into the Book 104 form, it’s imperative to gather all necessary documents and information. This preparation not only streamlines the process but also minimizes the risk of errors. Key documents you will need include your W-2 forms, 1099 forms for any freelance work, receipts for deductible expenses, and any other financial records. Ensuring you have all these in one place can greatly simplify the filing process.

Moreover, personal information such as your Social Security number (SSN), mailing address, and banking details will also be necessary, especially if you are expecting a refund via direct deposit. Confirm that all this information is accurate, as simple mistakes in these details can lead to significant delays.

Common mistakes to avoid

Tax filing is complex, and individuals often make common mistakes. Among these, one of the most frequent errors is failing to report all sources of income. It’s essential that you include every form of income—no matter how small—as the State of Colorado requires a full accounting for accurate tax computations.

Another common pitfall is overlooking deductions that taxpayers are eligible for. Thoroughly researching available deductions specific to Colorado can save you money. Additionally, ensure to proofread your form before submission to capture any spelling mistakes, particularly regarding your name and SSN.

Detailed instructions for completing the Book 104 form

To navigate the Book 104 form effectively, a section-by-section breakdown can be beneficial. First, the Personal Information Section requires accuracy; any discrepancy here can lead to complications. Make sure to double-check that your name, address, and SSN are correctly entered.

Next is Income Reporting, where you will list all earnings. Common sources include salaries, freelance work, rental income, and interest from savings. Each type of income has specific lines on the form, so it’s crucial to follow the instructions closely.

When it comes to Deductions and Credits, you need to identify what you qualify for, such as the Colorado Child Tax Credit or deductions for medical expenses. Familiarizing yourself with these options can lead to substantial tax savings. Finally, in the tax calculation section, confirm your calculations to ensure accuracy—this step is crucial for determining your final tax liability or refund.

Tips for using pdfFiller to complete the Book 104 form

Using pdfFiller to complete your Book 104 form can enhance your filing experience significantly. The platform allows you to edit PDFs seamlessly, ensuring that the document remains organized and visually appealing. To begin, simply upload the Book 104 form to pdfFiller’s user-friendly interface.

From there, you can fill out the necessary fields, utilize tools for annotating or highlighting critical information, and even leverage templates that can simplify the process. PdfFiller’s cloud-based platform ensures that you can access your forms from anywhere, making it especially convenient for those who are often on the go.

Signing and submitting the Book 104 form

Once you have completed the Book 104 form, the next step is to sign it. Colorado regulations allow for eSignatures, which offer a quick and secure way to authenticate your document. Ensure that your eSignature complies with state requirements by confirming the platforms that provide legally binding eSigning solutions.

Using pdfFiller to add your eSignature is straightforward. After you have filled in your form, simply select the eSignature option, and follow the prompts to add your signature securely. Once signed, you have several submission options: either submit electronically or print and mail your form to the appropriate tax office. If you choose the electronic route, tracking your submission status may also be facilitated through the platform.

Managing your Book 104 form post-submission

Once you have submitted your Book 104 form, efficient document management becomes essential. Properly storing and archiving forms is crucial for future reference. Utilize pdfFiller’s secure storage options, which allow you to organize and retrieve documents swiftly when needed. This can prove particularly useful if the state requests additional documentation or if you need to refer back to your submission.

Understanding post-submission procedures is equally important. After submission, processing times can vary, and it’s wise to be prepared for potential audits. Familiarize yourself with how to respond if the state contacts you for further clarification. Learning how to handle discrepancies or follow-up requests can help you manage any issues that arise efficiently.

Frequently asked questions about the Book 104 form

Many taxpayers have common inquiries regarding the Book 104 form. Questions often include concerns about what to do if a mistake is made on the form or how to handle situations involving missing documents. It’s advisable to review the Colorado Department of Revenue’s website for detailed guidance on these recurring issues.

Additionally, you can seek assistance from various resources available online, from tax service providers to community forums where other taxpayers share their experiences. This collaborative approach can offer insights and solutions that may not be immediately obvious.

Case studies

Examining real-life examples of successful Book 104 filings can provide valuable insights. For instance, a family who diligently tracked their expenses discovered eligible deductions they previously overlooked, ultimately leading to a significant tax refund. By staying organized and informed, they maximized their savings and streamlined their filing process.

Another case worth noting involved an individual who encountered an audit due to a minor error in their income reporting. By leveraging their records and promptly addressing the state’s requests, they resolved the issue without serious repercussions. These scenarios highlight the importance of thorough preparation and a knowledgeable approach to managing individual tax responsibilities.

Interactive tools and resources

Utilizing interactive tools available on the pdfFiller platform can greatly enhance user experience. These tools include document templates, editing features, and collaboration options that empower users to manage their Book 104 form efficiently. Leveraging these resources ensures that every aspect of your tax filing is handled with care and precision.

Furthermore, pdfFiller also provides access to support and tutorials that guide users through complex processes. By engaging with these resources, you can enhance your understanding of the Book 104 form and take advantage of all features the platform has to offer, ensuring a seamless and effective tax filing experience.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my book 104 2025 colorado in Gmail?

How do I complete book 104 2025 colorado on an iOS device?

How do I complete book 104 2025 colorado on an Android device?

What is book 104 2025 colorado?

Who is required to file book 104 2025 colorado?

How to fill out book 104 2025 colorado?

What is the purpose of book 104 2025 colorado?

What information must be reported on book 104 2025 colorado?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.