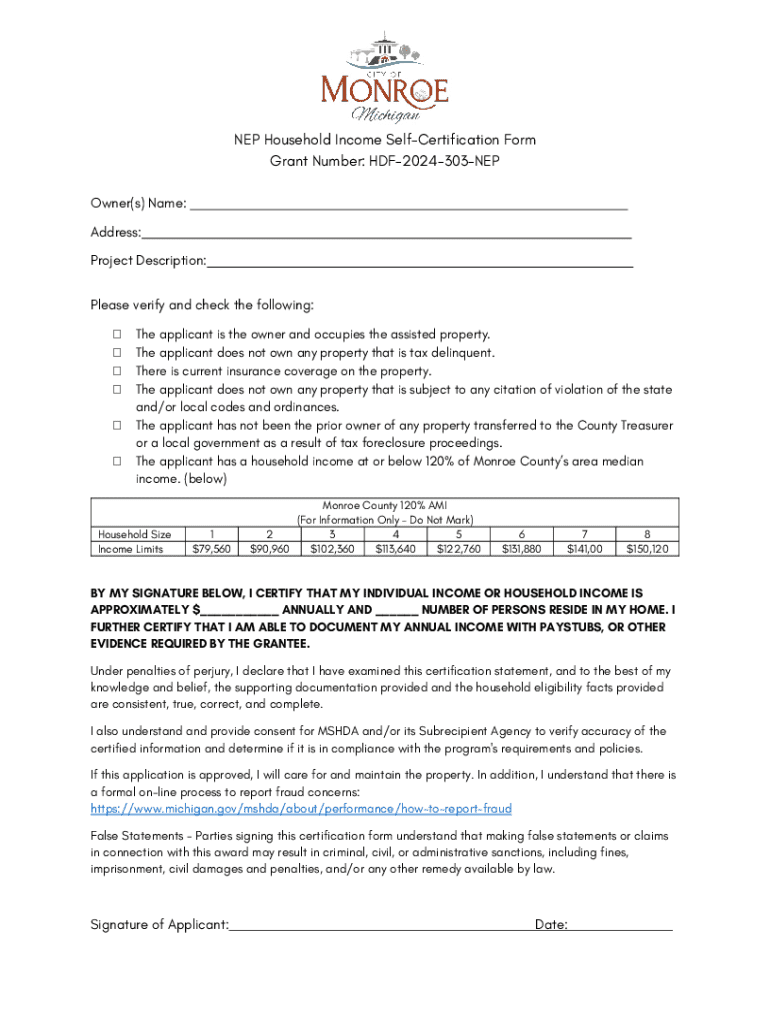

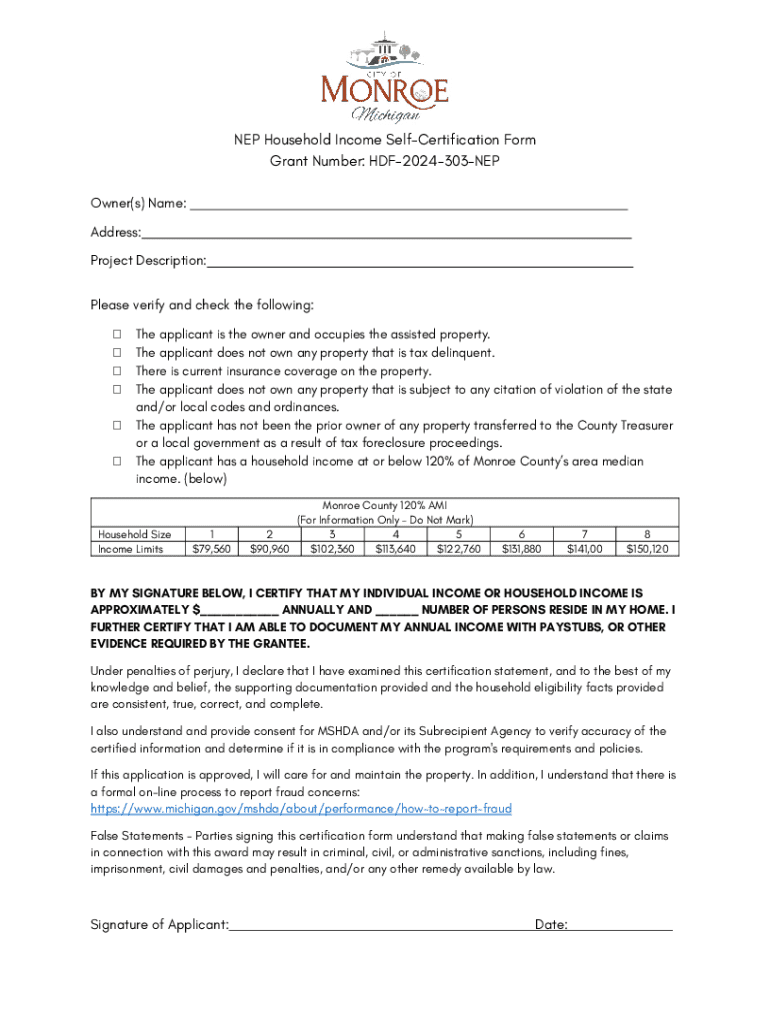

Get the free NEP Household Income Self-Certification Form

Get, Create, Make and Sign nep household income self-certification

How to edit nep household income self-certification online

Uncompromising security for your PDF editing and eSignature needs

How to fill out nep household income self-certification

How to fill out nep household income self-certification

Who needs nep household income self-certification?

A comprehensive guide to the NEP household income self-certification form

Overview of the NEP household income self-certification form

The NEP household income self-certification form serves as a vital tool for individuals and families seeking assistance based on their income levels. Accurately representing one’s income is essential, especially for accessing various benefits and assistance programs. This form not only simplifies the income reporting process but also facilitates financial assessments that can significantly impact eligibility for assistance.

The key objectives of this form include ensuring that the income reported is an authentic reflection of what individuals and families earn. This representation is crucial for programs aimed at helping low-income households, allowing for a fair assessment of eligibility and reducing the risk of abuse within assistance programs.

Eligibility criteria for completing the NEP form

The NEP household income self-certification form is designed for a broad range of users. It is applicable to individuals, families, and eligible organizations needing to report their income for various benefits. Enterprises or non-profits that require financial assistance or are involved in community outreach can also utilize this form to ensure their income is appropriately documented.

To qualify for using this self-certification form, applicants must meet specific requirements, including providing accurate financial information and, in some cases, supporting documentation to back up their claims. Ensuring that you meet these criteria before filling out the form can streamline the application process significantly.

Preparing to complete the form

Before you fill out the NEP household income self-certification form, gather all required documents and information necessary for complete and accurate disclosures. Key documents include proof of income such as pay stubs, tax returns, or benefits documentation. Employment records can also provide a transparent overview of your financial situation.

Honesty is paramount when completing this form. Any inaccuracies or omissions can lead to complications in processing applications for assistance, potentially resulting in denied claims or even legal repercussions. Therefore, taking the time to ensure that all information provided is both precise and thorough is crucial.

Step-by-step guide to filling out the NEP household income self-certification form

**Step 1: Accessing the form** - The NEP form can typically be accessed through relevant financial or local community organization websites, with pdfFiller providing an easy-to-navigate platform for this purpose. Look for the NEP form in the templates section to get started effortlessly.

**Step 2: Filling out personal information** - Including accurate personal details is essential. Ensure that names, addresses, and contact information are up to date. Common mistakes include typos or outdated information, which can delay processing.

**Step 3: Reporting income** - Declare all sources of income thoroughly. This includes wages from employment, self-employment income, rental income, and any government benefits. Providing documentation such as recent pay stubs, bank statements, or tax returns reinforces the legitimacy of your claims.

**Step 4: Sign and date the form** - After completing all sections, ensure that the form is signed and dated—whether electronically through pdfFiller or manually. This step confirms the authenticity of the information presented and complies with legal standards.

Editing and customizing the NEP form via pdfFiller

Once you've accessed the NEP household income self-certification form on pdfFiller, users can take advantage of the platform's comprehensive editing features. pdfFiller offers tools that allow you to customize the form according to your specific situation and needs.

Interactive tools make it easy to fill out and modify the form, ensuring that every detail aligns with your financial circumstances. Additionally, users can collaborate by sharing the form with family members or advisors for verification, thereby enhancing accuracy and completeness.

Submitting the NEP household income self-certification form

Once the form is completed, you'll need to submit it. pdfFiller allows for seamless online submission, which is typically the most efficient method. Make sure to follow the guidelines for submission to ensure prompt processing of your application.

Mail-in options are also available; however, be mindful of deadlines and processing times associated with postal submissions. Keeping a copy for your records and tracking submission status will help manage follow-ups.

Troubleshooting common issues

When filling out or submitting the NEP household income self-certification form, you may encounter various hurdles. Common challenges can range from technical issues with the pdfFiller platform to uncertainties about what to include in specific sections of the form.

Solutions generally involve carefully reviewing the form for errors and consulting the pdfFiller support team for additional guidance. Understanding that it is okay to seek professional help when necessary can ensure that your documentation remains error-free and complies with all regulatory standards.

Frequently asked questions (FAQs)

Understanding the nuances of the NEP household income self-certification form raises several important questions. Primarily, users often inquire about the exact purpose of the form and how it influences their eligibility for assistance.

It’s also crucial to grasp the implications of submitting inaccurate information. Misrepresentation not only jeopardizes assistance eligibility but can also lead to repercussions from financial institutions or governmental bodies. Knowing income thresholds and limits set by relevant agencies can further clarify how the form functions within larger financial ecosystems.

Related documentation and resources

Completing the NEP household income self-certification form may require additional documentation for various applications. Alongside this form, users might need to provide tax documents or verification letters from employers, depending on the specific assistance program.

Explore additional templates on pdfFiller to enhance your financial documentation processes, ensuring that all forms align with your specific needs. Utilizing a cohesive set of documents increases both the efficiency and reliability of your applications.

Contact information for further assistance

For users seeking help with the NEP household income self-certification form, pdfFiller provides an array of support resources. These include live chat options for real-time assistance, as well as customer service avenues for broader inquiries.

Email and phone support are also available for users needing help with more complex issues. Reaching out to support can clarify questions and ensure that your documentation is processed effectively.

Updates and legal considerations

Staying informed about updates related to the NEP household income self-certification form is critical. Changes in legal requirements or procedural updates can affect how you complete and submit this form.

Maintaining awareness of the latest guidelines ensures compliance and helps prevent issues during the application review process. Regularly visit the relevant sections on pdfFiller or associated financial assistance platforms to stay current.

Connect with the community

Interacting with others who have navigated the NEP household income self-certification form can provide invaluable insights. Online forums and support groups dedicate their discussions to shared experiences regarding the form and its implications for financial assistance.

By connecting with others, users can share tips, receive support, and engage in meaningful discussions that enhance their understanding of the form and its processes.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my nep household income self-certification directly from Gmail?

How can I edit nep household income self-certification on a smartphone?

Can I edit nep household income self-certification on an iOS device?

What is nep household income self-certification?

Who is required to file nep household income self-certification?

How to fill out nep household income self-certification?

What is the purpose of nep household income self-certification?

What information must be reported on nep household income self-certification?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.