Get the free On April 22, 2016, Synchrony Financial (the Company) issued a press release setting ...

Get, Create, Make and Sign on april 22 2016

Editing on april 22 2016 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out on april 22 2016

How to fill out on april 22 2016

Who needs on april 22 2016?

Understanding the April 22, 2016, Form: A Comprehensive Guide

Overview of the April 22, 2016, form

The April 22, 2016, form is pivotal in various administrative and compliance processes. Specifically designed to capture essential data relevant to its context, this form serves as a key document for parties involved in finance, legal compliance, and regulatory submissions. Knowing the importance of this form can significantly impact an individual's or organization's ability to meet necessary requirements.

Key deadlines are often associated with submitting this form, making awareness of relevant dates critical. Missed deadlines can jeopardize one's standing in compliance-related matters. Typically, those required to use this form include businesses, organizations, or individuals subject to certain regulatory conditions. Each user’s responsibilities may vary based on their specific industry.

Purpose and applications of the April 22, 2016, form

The purpose of the April 22, 2016, form extends across various scenarios; for instance, it may be used for tax submissions, financial reports, or compliance checks. Its applications are broad, addressing the needs of individuals and entities alike. Industries such as finance, legal services, and construction commonly require this form to ensure reporting accuracy and compliance with regulatory standards.

Filling out the form accurately is vital, as inaccuracies can lead to delays or legal complications. Benefits include streamlined processes and enhanced transparency in dealings with regulatory bodies. Understanding its applications not only aids in compliance but also fosters trust between parties engaging in contractual responsibilities.

Detailed breakdown of the April 22, 2016, form sections

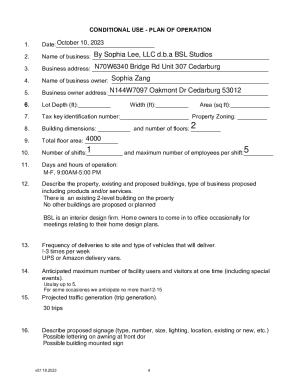

Section 1: Identifying information

This section demands specific personal and organizational details, such as names, addresses, and identification numbers. Accurate data entry minimizes common errors, like misspelling names or incorrect address formatting, which could lead to processing delays.

Section 2: Financial data input

Here, the form necessitates the input of comprehensive financial data. This includes details on income, expenses, assets, and liabilities. Users should gather documents like bank statements and tax returns to ensure that the reported figures reflect true financial standing, providing a transparent view that assists in further evaluations.

Section 3: Compliance and legal statements

Declarations and acknowledgments present in this section highlight the importance of lawful accuracy. Any discrepancies or false statements can result in legal ramifications. Parties are required to affirm their understanding of the legal implications tied to the information provided.

Section 4: Signatures and authorizations

This section identifies who is authorized to sign the form, often requiring managerial or executive signatures. Options for electronic signatures have gained prominence for their convenience and legal validation in many jurisdictions, allowing for a more streamlined signing process.

Step-by-step instructions for completing the April 22, 2016, form

Step 1: Gathering required documents

Before filling out the form, it’s crucial to collect all necessary documents. For this form, users typically need tax records, financial statements, and verification of identification numbers. Having these documents ready ensures a smoother preparation process.

Step 2: Filling out the form

In this step, each section must be filled out meticulously. Users should go section by section and follow detailed instructions to ensure clarity. Remember to double-check entries to avoid common mistakes.

Step 3: Reviewing and confirming information

Before submission, conducting a thorough review of the completed form is essential. Checking for errors not only saves time but also enhances confidence in the accuracy of the submission. Peer reviews can provide additional assurance, catching potential mistakes that may have been overlooked.

Interactive tools for completing the form

PDF editing features

pdfFiller’s PDF editing capabilities simplify the completion of the April 22, 2016, form. Users can make adjustments, annotate, and highlight important sections with ease, enhancing the clarity of the content ultimately submitted.

Real-time collaboration

Collaborating in real-time with team members through pdfFiller provides a platform for collective input and correction, ensuring that the final submission reflects a comprehensive agreement among all relevant stakeholders.

eSignature integration

The integration of eSignature functionalities streamlines the signing process, making it not only faster but also compliant with legal standards. This feature significantly simplifies obtaining necessary approvals without the hassle of physical document exchanges.

Common challenges and solutions

When completing the April 22, 2016, form, users may encounter common challenges such as unclear instructions, technical issues, or confusion around deadlines. Having clarity on the form's requirements can alleviate common frustrations.

Expert tips include breaking the process into manageable parts and seeking guidance when needed. Real-world examples can also inspire confidence; for instance, professionals who regularly use the form highlight the advantages of consulting with peers or mentors for best practices.

FAQs about the April 22, 2016, form

Addressing common queries can prevent misunderstandings. Many people wonder about the legal obligations associated with filling out the form and the timelines involved in submissions. It's crucial to understand that penalties can arise from late filings.

Moreover, clarity on potential rejections can boost users’ confidence. Providing accurate and complete information minimizes rejection risks and fosters a more efficient submission process.

Compliance and filing deadlines

Understanding submission timelines is critical for compliance with the April 22, 2016, form. Often, deadlines may coincide with fiscal quarters or specific regulatory cycles. Failure to comply with these deadlines can result in fines or missed opportunities.

Best practices for timely submissions include creating reminders and checking regulatory guidance to stay updated on any changes, helping users avoid unnecessary pitfalls in their compliance journey.

Final thoughts on the importance of accurate form management

Accurate form management transcends mere compliance; it plays a critical role in organizational record-keeping and reporting integrity. Embracing tools like pdfFiller not only optimizes document management strategies but also equips users to navigate increasingly complex regulatory landscapes.

Staying on top of compliance needs and leveraging efficient solutions will equip individuals and teams to manage their forms better, thus improving overall operational efficiency. With trends continuously evolving, adapting proactive strategies for document handling remains essential for sustained success.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit on april 22 2016 on an iOS device?

How can I fill out on april 22 2016 on an iOS device?

Can I edit on april 22 2016 on an Android device?

What is on April 22, 2016?

Who is required to file on April 22, 2016?

How to fill out on April 22, 2016?

What is the purpose of on April 22, 2016?

What information must be reported on on April 22, 2016?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.