Get the free Residency StatusDepartment of Revenue - Taxation

Get, Create, Make and Sign residency statusdepartment of revenue

Editing residency statusdepartment of revenue online

Uncompromising security for your PDF editing and eSignature needs

How to fill out residency statusdepartment of revenue

How to fill out residency statusdepartment of revenue

Who needs residency statusdepartment of revenue?

Understanding the Residency Status Department of Revenue Form

Understanding residency status

Residency status is a critical classification that determines an individual's tax obligations within a specific state. Essentially, it defines whether an individual resides in the state for tax purposes and influences the types of tax forms they must file along with the corresponding rates. Misclassification can lead to overpayment or underpayment of taxes, leading to potential legal complications. Hence, accurate determination of residency status is indispensable.

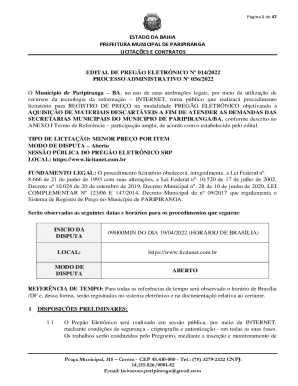

Recognizing the nuances of residency is essential for governance and tax administration. There are three primary classifications of residency status: full-year residents, part-year residents, and nonresidents. Full-year residents live in a state for the entire tax year and typically file a state income tax return accordingly. Part-year residents only meet the residency criteria for a portion of the year, often due to relocation or changes in living arrangements. Nonresidents, on the other hand, rarely or never live in the state and are thus only taxed on income sourced within that state.

Overview of Department of Revenue forms

The Department of Revenue plays a vital role in the administration of tax laws, ensuring compliance and collecting necessary revenue for government operations. To facilitate this process, several forms are associated with residency status, each designed to streamline the filing process for both individuals and tax professionals. Understanding these forms is essential for accurate reporting and tax compliance.

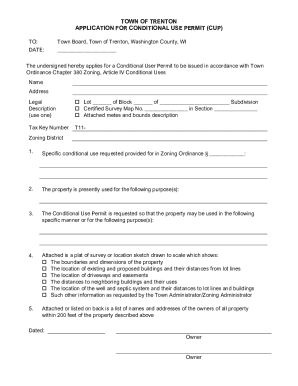

Among the most common forms are the Full-Year Resident Form, Part-Year Resident Form, and Nonresident Income Tax Form. Each form caters to the specific needs of the respective residency classification, stipulating the information required and the obligations tied to that residency status. Selecting the correct form significantly impacts the effective filing of state income tax returns.

What form to use based on your residency status

To select the appropriate residency status department of revenue form, one must first accurately identify their residency status. Factors including the duration of stay, intent to maintain residency, and the nature of income earned within the state contribute substantially to this determination. It’s crucial to assess these elements meticulously to avoid pitfalls in tax filing.

Frequently asked questions (FAQs) for determining residency can clarify gray areas. For instance, individuals may wonder about how temporary jobs or extended travels impact their status. In many cases, the length of time spent in a state and the establishment of a permanent home serve as primary indicators of residency. If you are uncertain after considering your situation, consult state guidelines or tax professionals to confirm your classification.

Step-by-step instructions for filling out the residency status form

When preparing to fill out a residency status department of revenue form, several pre-filling considerations should be taken into account. First and foremost, gather all necessary documentation, which may include proof of residence, tax identification numbers, and financial documents relevant to income declaration. Organizing these documents can simplify the process and reduce errors in filling out forms.

Digital tools are invaluable for managing documents and streamlining the filing process. Services like pdfFiller not only assist with keeping organized but also provide editing and electronic signature functionalities directly on the platform. Now, let’s delve into a detailed walkthrough for each form.

Full-Year Resident Form

The Full-Year Resident Form typically requires basic personal information, details of income earned, and deductions applicable to your residency. This form consists of sections that collect information about your total income, exemptions, and even state-specific tax credits, such as the Earned Income Tax Credit (EITC).

Part-Year Resident Form

For the Part-Year Resident Form, you’ll need to specify the period of residency and provide income reports for both the time spent residing in the state and any income sourced outside it. It’s crucial to appropriately allocate income in this section to avoid complications.

Nonresident Income Tax Form

The Nonresident Income Tax Form focuses primarily on income attributed to the state, requiring you to narrowly report earnings while excluding income earned elsewhere. Common mistakes here include failing to adequately document sources of income and mixing up whether an element is taxable or not. Be meticulous in stating your residency status.

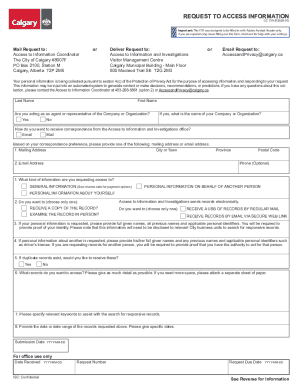

Editing and managing your form with pdfFiller

Once you've filled out your residency status form, using pdfFiller allows you to tweak and revise your document efficiently. The platform provides various features to edit the residency status department of revenue form, balancing ease of use with advanced functionalities for those requiring a more in-depth approach.

Online collaboration is made simple with pdfFiller—share the document with trusted advisors or family members for review and input. Moreover, e-signing is an essential feature offering enhanced security; you can sign your form electronically, ensuring that it meets regulatory standards without the need for physical meetings.

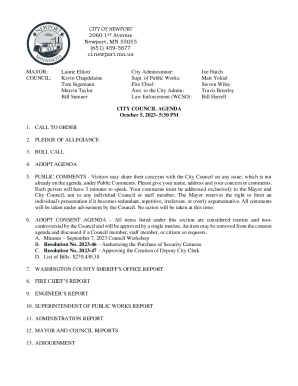

Submitting your form to the Department of Revenue

Submission of your completed residency status department of revenue form can be done through various avenues. Online submission is often the most efficient, usually facilitated through the state’s revenue department website. Make sure you follow the prompts for electronic filing diligently to avoid delays.

Should you choose to mail your submission, it’s vital to use the correct address based on your residency status and ensure accurate postage. Being abreast of important deadlines can streamline your filing process significantly. Once submitted, you may receive an acknowledgment to confirm that your form is being processed.

Additional considerations

Accurate definition of your residency status is paramount, as incorrect classification has far-reaching implications, including the risk of penalties or audits. Each state has unique definitions and varying forms governing residency status; therefore, awareness of these differences is crucial.

For complex scenarios, such as those involving multinational taxpayers or varying sources of income across multiple states, professional guidance is often recommended. Resources from the Department of Revenue and legal advisors can provide tailored advice suited to your specific situation.

Contact information for assistance

When in doubt, reaching out to the Department of Revenue is advisable for resolving queries. They often provide dedicated services to assist individuals in navigating residency status forms, available through phone lines or online chat options on their official website.

Besides state resources, utilizing pdfFiller’s customer support for assistance with any form-related questions can enhance your experience. Their knowledgeable team can guide you through the nuances of electronic filing, ensuring that you submit correct and complete documentation.

Frequently asked questions about residency status forms

When dealing with residency status forms, several common queries arise. Questions often revolve around clarifications of tax obligations based on residency or eligibility for certain deductions that may differ depending on how residency is classified. Individuals frequently wonder about the tax rates applicable to part-year residents or nonresidents.

Additionally, anxieties around potential audits or the need for documentation to support residency claims are prevalent. Clear understanding of these aspects can bolster the confidence in managing residency status forms and their implications on overall tax obligations.

Key takeaways

Navigating the residency status department of revenue forms requires clarity on your residency classification, awareness of the appropriate forms to use, and a thorough understanding of the filing process. Whether you are a full-year resident, part-year resident, or nonresident, recognizing how each category affects your tax obligations is crucial.

Using tools like pdfFiller enhances the completion of these forms, providing a user-friendly approach to editing, eSigning, and sharing, lending peace of mind in handling tax matters. Be proactive and thorough in your submissions to ensure compliant and accurate revenue reporting.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send residency statusdepartment of revenue for eSignature?

How do I complete residency statusdepartment of revenue online?

Can I sign the residency statusdepartment of revenue electronically in Chrome?

What is residency statusdepartment of revenue?

Who is required to file residency status department of revenue?

How to fill out residency status department of revenue?

What is the purpose of residency status department of revenue?

What information must be reported on residency status department of revenue?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.