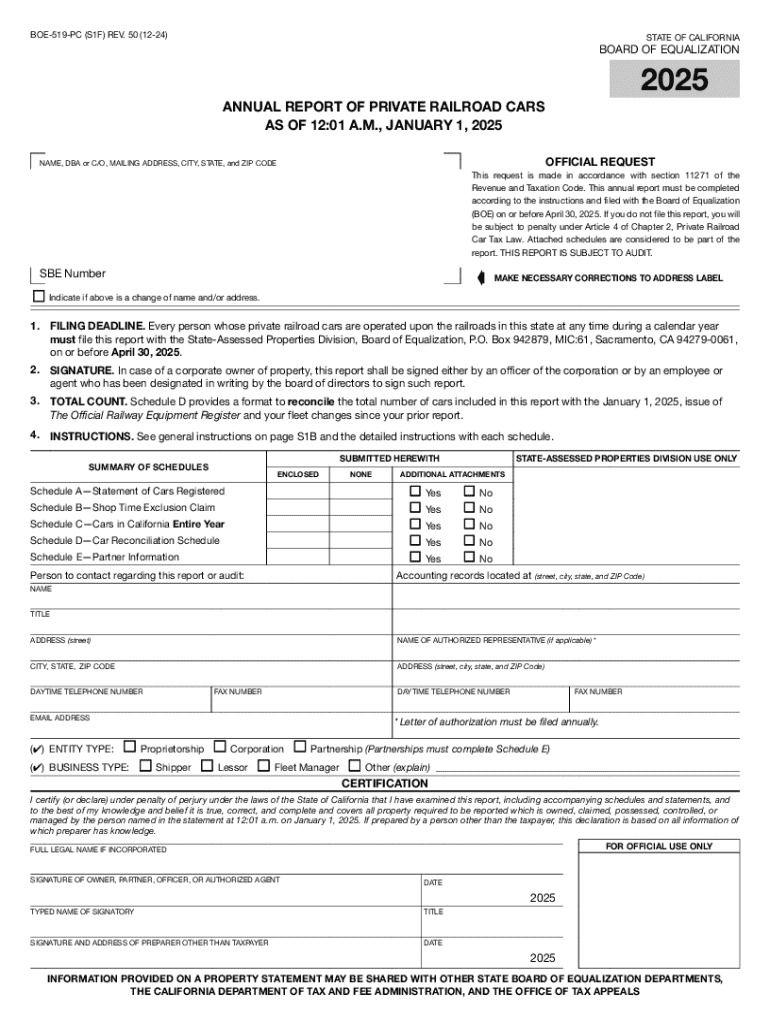

Get the free Form BOE-519-PC Annual Report of Private Railroad Cars - boe ca

Get, Create, Make and Sign form boe-519-pc annual report

Editing form boe-519-pc annual report online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form boe-519-pc annual report

How to fill out form boe-519-pc annual report

Who needs form boe-519-pc annual report?

Understanding the BOE-519-PC Annual Report Form: A Comprehensive Guide

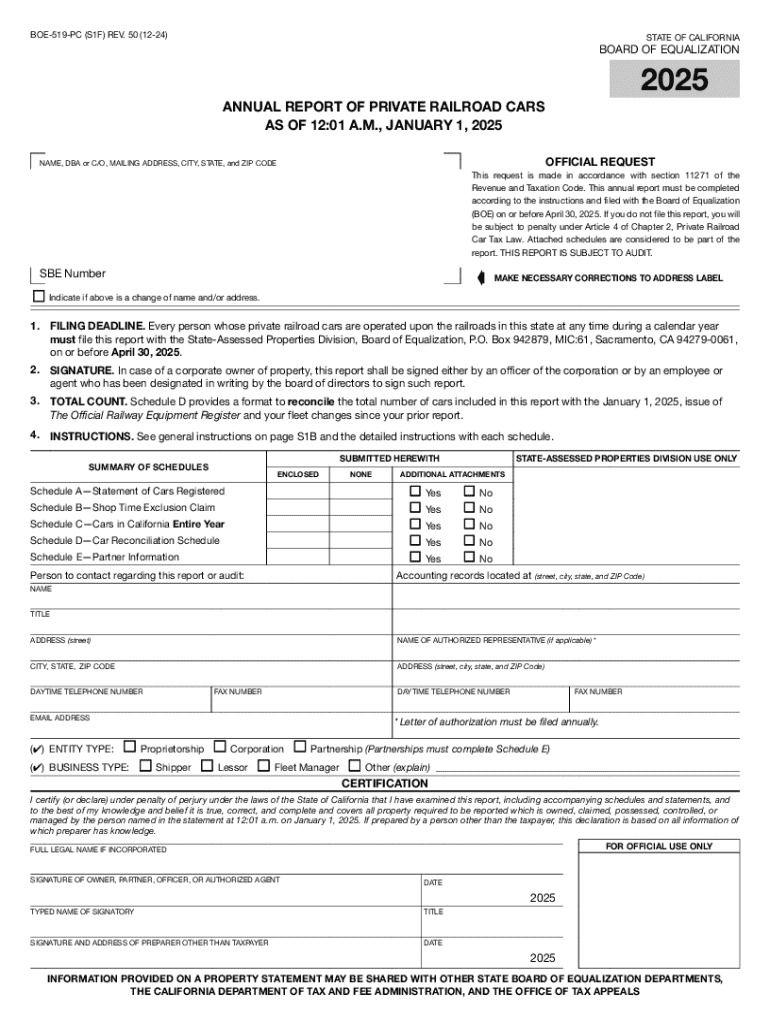

Overview of the BOE-519-PC annual report form

The BOE-519-PC form is a vital document used by taxpayers in California to report property values for assessment purposes. It plays a crucial role in ensuring property tax assessments are accurate and equitable, contributing to fair taxation within the state.

This form is primarily required from businesses and individuals who own property that is subject to property taxes. Typically, these reports must be submitted annually, with the deadline set by the California Board of Equalization (BOE). Missed deadlines can lead to penalties or increased scrutiny by assessing authorities.

The BOE-519-PC form is commonly utilized across various sectors, including real estate, agriculture, and business assets. By accurately reporting property values, individuals and organizations ensure compliance with tax obligations and maintain transparency in property ownership.

Key components of the BOE-519-PC form

Understanding the BOE-519-PC form involves familiarizing oneself with its key components. Each section serves a distinct purpose and must be filled out accurately to avoid discrepancies.

Step-by-step instructions for completing the BOE-519-PC

Completing the BOE-519-PC form requires thorough preparation. Taxpayers should start by gathering necessary documents, including past property statements and recent financial statements.

Next, it's important to understand the relevant financial metrics and terms that will appear on the form. Familiarity with these concepts will make the process smoother.

Common errors when filling out the form include incorrect identification information or inaccurate financial statements. Addressing these errors promptly can help avoid delays or issues with the BOE.

Tips for editing and signing the form

Once you have completed the form, utilizing online editing tools, such as those provided by pdfFiller, can streamline the review process. These tools allow users to make corrections quickly and easily, ensuring that the form is polished before submission.

Adding a digital signature can also enhance the efficiency of the submission process. pdfFiller facilitates secure digital signing, which ensures that signatures are legally binding while maintaining security measures to protect sensitive information.

For teams working collaboratively, pdfFiller offers various collaborative options, enabling multiple users to contribute to the form, track changes, and ensure everyone stays on the same page.

Managing the submission process

Understanding submission deadlines is crucial for maintaining compliance. The BOE usually requires annual submissions, but taxpayers may apply for extensions if necessary. It’s important to note that failing to file on time can lead to penalties, so planning ahead is essential.

To file the BOE-519-PC form electronically, users can leverage the capabilities of pdfFiller. This online platform offers an intuitive interface for downloading, editing, and submitting the form, making the process user-friendly.

Furthermore, after submission, it’s beneficial to track the status of your filing through pdfFiller. This function allows users to verify whether the form has been received and processing by the BOE.

Frequently asked questions about the BOE-519-PC form

Many taxpayers have questions regarding the BOE-519-PC form, and addressing these can help alleviate concerns during the submission process.

Additional resources and tools

For users seeking further assistance with the BOE-519-PC form, pdfFiller offers a range of downloadable resources and templates. These resources can enhance understanding and provide guidance on accurate completion.

Interactive tools, such as video tutorials within pdfFiller, can also be invaluable. These tutorials break down the filling process into manageable steps, helping users become more comfortable with the process.

Contact information for further assistance

For additional inquiries related to the BOE-519-PC form, taxpayers can reach out to the California Board of Equalization. Their staff is available to assist in answering complex questions and providing clarifications.

Furthermore, pdfFiller also offers support channels for any document-related questions. This includes email support and a FAQs section that addresses common issues faced by users.

Best practices for document management

To ensure compliance and maintain accurate records, organizing your forms digitally through pdfFiller is highly recommended. A well-organized digital library of documents will help alleviate stress during filing seasons and facilitate easy retrieval of past reports.

Additionally, maintaining clear records through property statement reporting ensures that you are prepared should any inquiries arise from the BOE or other authorities. Adopting a proactive approach to document management not only streamlines your processes but also safeguards your rights as a taxpayer.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for signing my form boe-519-pc annual report in Gmail?

How do I complete form boe-519-pc annual report on an iOS device?

Can I edit form boe-519-pc annual report on an Android device?

What is form boe-519-pc annual report?

Who is required to file form boe-519-pc annual report?

How to fill out form boe-519-pc annual report?

What is the purpose of form boe-519-pc annual report?

What information must be reported on form boe-519-pc annual report?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.