Get the free CRS-CPControlling-Person-Tax-Residency-Self- ...

Get, Create, Make and Sign crs-cpcontrolling-person-tax-residency-self

How to edit crs-cpcontrolling-person-tax-residency-self online

Uncompromising security for your PDF editing and eSignature needs

How to fill out crs-cpcontrolling-person-tax-residency-self

How to fill out crs-cpcontrolling-person-tax-residency-self

Who needs crs-cpcontrolling-person-tax-residency-self?

Understanding the CRS CP Controlling Person Tax Residency Self Form

Understanding the CRS CP Controlling Person Tax Residency Self Form

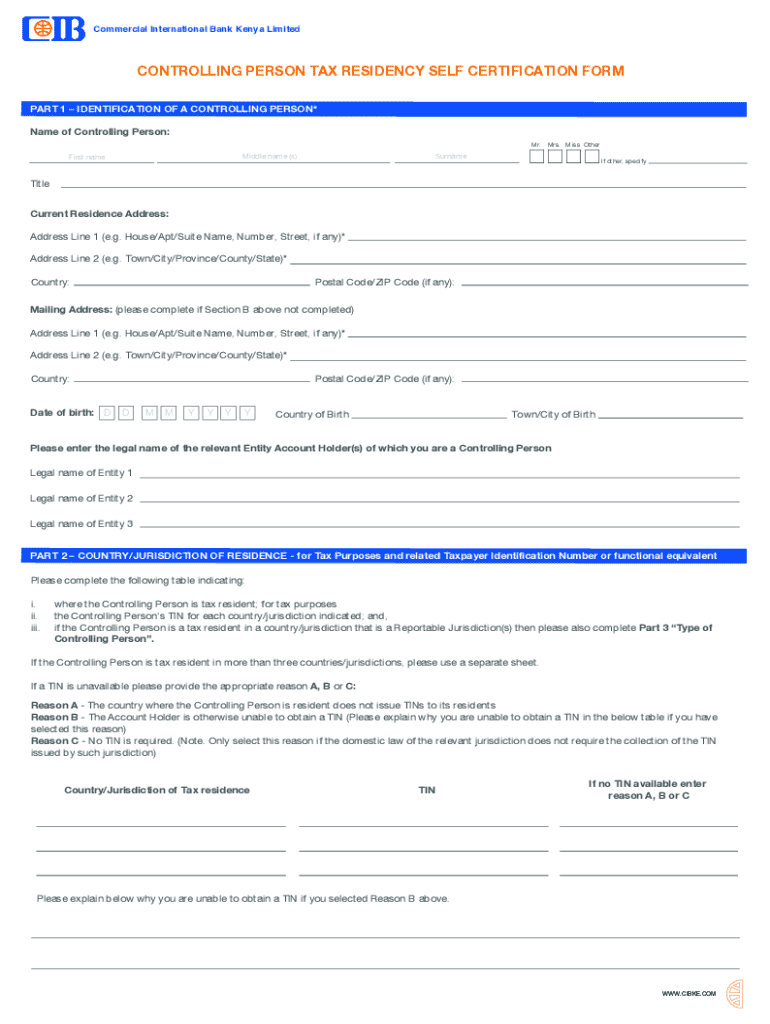

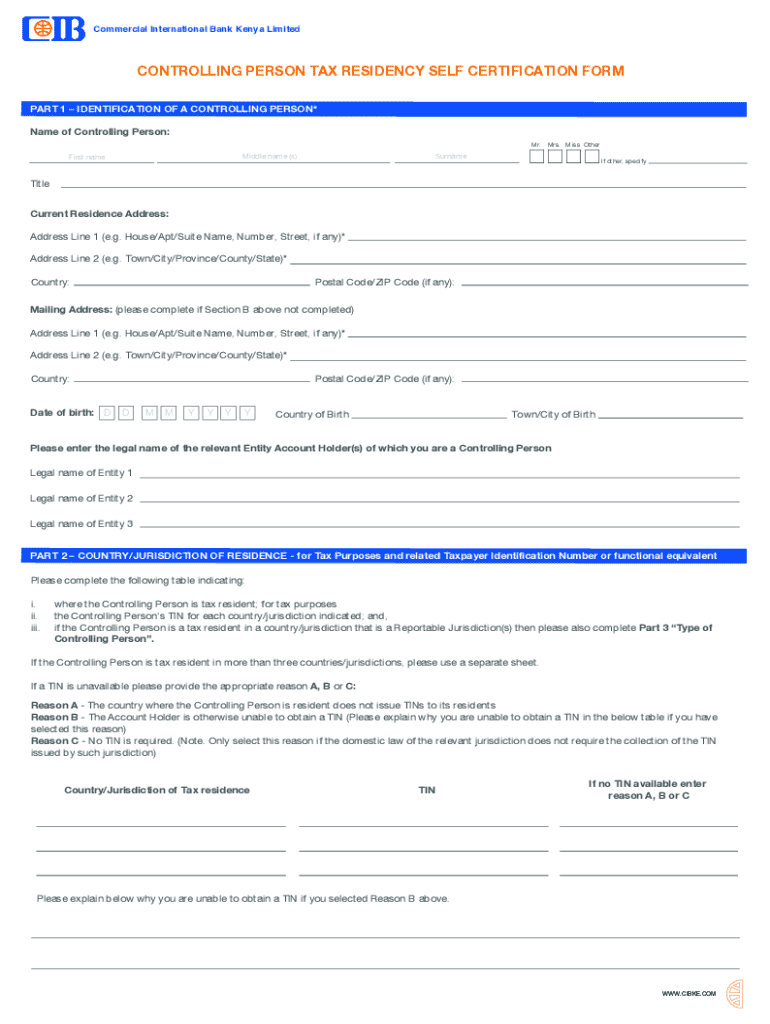

The CRS CP Controlling Person Tax Residency Self Form is a crucial document required under the Common Reporting Standard (CRS) framework established by the OECD. Its primary purpose is to identify the tax residency of individuals who hold controlling positions in entities. This form plays a vital role in ensuring compliance with international tax regulations, helping jurisdictions exchange information on financial accounts held by non-residents.

Compliance with tax regulations is imperative, as it not only prevents legal repercussions but also contributes to greater financial transparency globally. Filling out this form correctly can mitigate risks associated with tax evasion, as financial institutions are mandated to report information about accounts held by those identified as controlling persons.

Who is considered a controlling person?

A controlling person is typically defined as an individual who exercises ultimate control over an entity. This control can be through voting rights or ownership of a significant percentage of shares or interests in the entity. Specific criteria vary between jurisdictions, but they generally encompass directors, partners, and senior management members.

Entities that often have controlling persons include corporations, partnerships, and trusts. Recognizing who constitutes a controlling person is critical for industries ranging from banking to real estate, ensuring these individuals fulfill their tax obligations.

Importance of the CRS in global tax compliance

The Common Reporting Standard (CRS) is a global framework that standardizes the collection and reporting of financial account information to combat tax evasion. Since its introduction in 2014, over 100 jurisdictions have adopted the CRS, making it a cornerstone for international tax compliance.

The primary objectives of the CRS include enhancing transparency, facilitating the automatic exchange of financial account information among jurisdictions, and reducing the opportunities for tax evasion. By standardizing this process, the CRS helps create a fairer tax landscape and promotes accountability among taxpayers.

For individuals and institutions involved in cross-border transactions, understanding their tax residency status is vital, as it dictates the reporting requirements. Non-compliance can lead to mismatching data and hefty fines, underscoring the necessity of forms like the CRS CP Controlling Person Tax Residency Self Form.

Step-by-step guide to completing the form

Completing the CRS CP Controlling Person Tax Residency Self Form requires meticulous preparation. Gathering the necessary documents and understanding the information needed ahead of time will simplify the process. Commonly required documents include residency certificates, identification documents, and details of the entity in question.

Some tips for successfully organizing your data include categorizing your documents based on sections of the form and ensuring all details are current and accurate. Here's a detailed breakdown of the form segments:

Tips for ensuring accuracy and compliance

Accuracy and compliance are pivotal when submitting the CRS CP Controlling Person Tax Residency Self Form. Some common errors to avoid include misinterpreting residency rules, which can lead to incorrect information, and failing to provide complete responses. Double-checking each entry can help prevent these costly mistakes.

Best practices for document submission include reviewing your completed form several times before submission and verifying that all required fields are filled out correctly. Secure methods of submission can include using encrypted emails or certified postal services to ensure your information remains confidential.

Interactive tools for managing your tax forms

pdfFiller offers robust features to enhance your experience when dealing with the CRS CP Controlling Person Tax Residency Self Form. Its user-friendly platform allows you to create, edit, and manage your forms efficiently from any device. With pdfFiller, you can streamline the form completion process, which is particularly helpful for teams facing tight deadlines.

One standout feature of pdfFiller is the ability to collaborate within a secure environment, allowing multiple users to work on the form simultaneously, which fosters accuracy and reduces processing time.

eSigning your form with confidence

The eSigning process for the CRS CP Controlling Person Tax Residency Self Form through pdfFiller is straightforward and secure. eSignatures hold the same legal validity as handwritten signatures in many jurisdictions, which makes this feature especially valuable for busy professionals who require flexibility without compromising on security.

By using pdfFiller's eSigning capabilities, you can expedite the signing process while ensuring compliance with legal standards, which ultimately assists in maintaining the integrity of your submitted forms.

Frequently asked questions about the CRS CP Controlling Person Tax Residency Self Form

Additional considerations for specific scenarios

Tax residency implications differ significantly for non-residents. When completing the CRS CP Controlling Person Tax Residency Self Form, non-residents need to consider their specific situation, including treaties that may affect their tax status. It’s vital to seek guidance tailored to individual circumstances.

For individuals with ties in multiple jurisdictions, understanding residency rules becomes even more complex. Strategies for managing tax residency across countries include documenting substantial connections, such as permanent establishments and domicile. Failing to comply with tax residency obligations can lead to hefty penalties, underlining the importance of precision in the form submission.

Advanced insights on CRS compliance

The future of CRS tax compliance is likely to evolve with technological advancements and increasing international cooperation. Trends indicate that jurisdictions will adopt more stringent measures to uphold compliance, and individuals and businesses should be prepared for these changes.

Integrating tax compliance into everyday business practices is becoming essential. This involves regular training sessions for employees regarding tax obligations and the importance of the CRS CP Controlling Person Tax Residency Self Form. By fostering a culture of compliance, organizations can significantly reduce risks associated with tax non-compliance.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit crs-cpcontrolling-person-tax-residency-self from Google Drive?

Can I create an electronic signature for the crs-cpcontrolling-person-tax-residency-self in Chrome?

How do I complete crs-cpcontrolling-person-tax-residency-self on an Android device?

What is crs-cpcontrolling-person-tax-residency-self?

Who is required to file crs-cpcontrolling-person-tax-residency-self?

How to fill out crs-cpcontrolling-person-tax-residency-self?

What is the purpose of crs-cpcontrolling-person-tax-residency-self?

What information must be reported on crs-cpcontrolling-person-tax-residency-self?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.