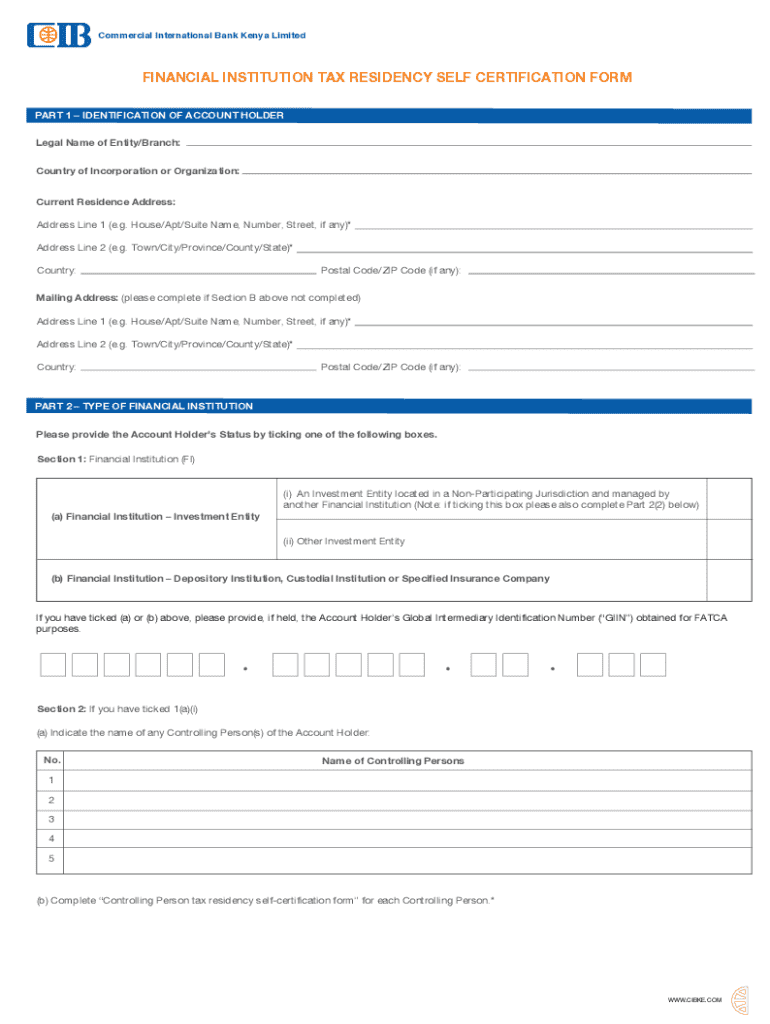

Get the free Financial Institution Tax residency self certification form

Get, Create, Make and Sign financial institution tax residency

How to edit financial institution tax residency online

Uncompromising security for your PDF editing and eSignature needs

How to fill out financial institution tax residency

How to fill out financial institution tax residency

Who needs financial institution tax residency?

Understanding the Financial Institution Tax Residency Form

Understanding the financial institution tax residency form

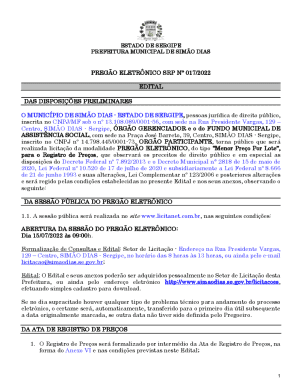

The financial institution tax residency form is a vital document required for individuals and entities to assert their tax residency status to financial institutions. This form is essential for tax compliance and reporting purposes, particularly in light of the international initiatives aimed at combating tax evasion. By declaring where you are a tax resident, this form ensures that you adhere to local and international tax regulations, which can help you avoid potential penalties and fines.

For financial institutions, the tax residency form is crucial for adhering to compliance requirements set by regulatory bodies. These regulations often require institutions to perform due diligence on their customers to accurately report financial accounts and transactions to tax authorities in their respective countries.

Who needs to fill out this form?

Both individuals and entities engaged with financial institutions may need to fill out the financial institution tax residency form. Individuals who hold bank accounts, investment accounts, or any other financial products may be required to complete this form to ensure proper tax identification.

Entities, including businesses, partnerships, and trusts, also have an obligation to fill out the form as part of their compliance protocols. Failing to provide accurate residency details can lead to serious repercussions under international tax regulations, such as the Common Reporting Standard (CRS) established by the OECD.

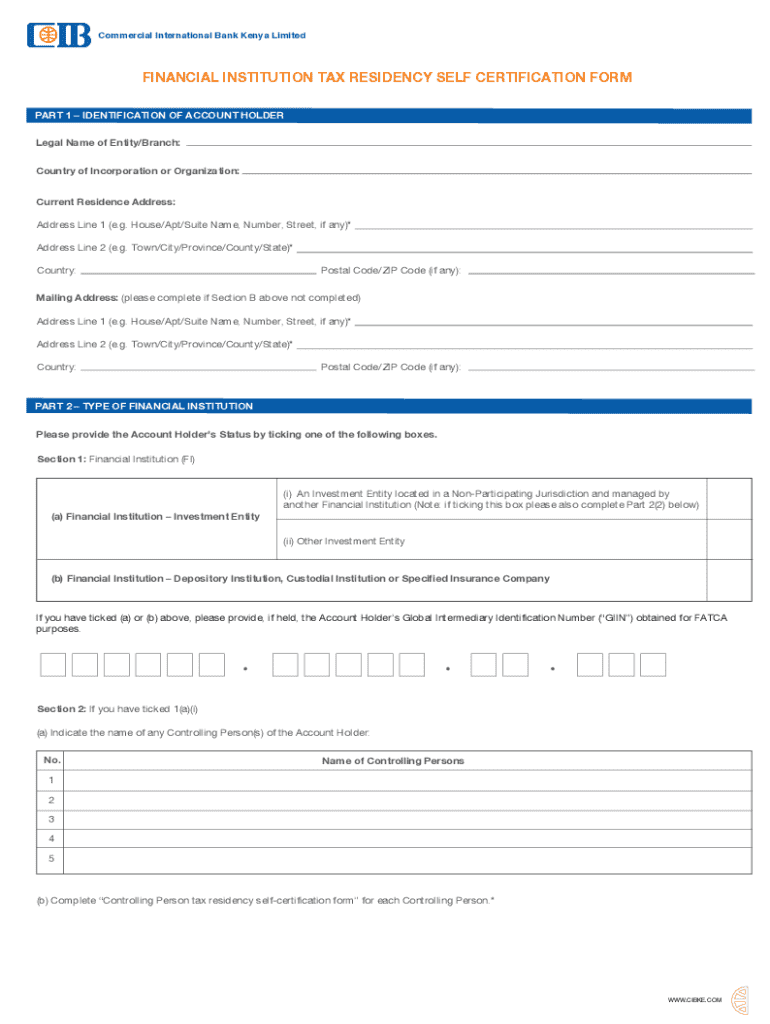

Key components of the form

The financial institution tax residency form includes several crucial sections that need to be meticulously filled out. The accuracy of these sections directly impacts the validity of the tax residency claim made on behalf of the individual or entity.

Each section typically includes the following components:

Commonly used terms explained

Understanding the terminology used in the financial institution tax residency form is crucial. Familiarity with these terms can aid in accurately completing the form and ensuring compliance.

Step-by-step instructions for filling out the form

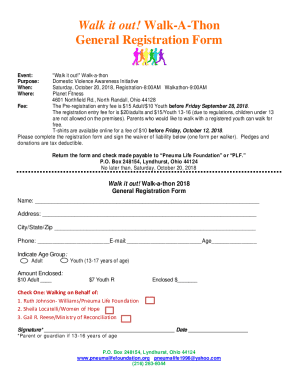

Properly completing the financial institution tax residency form requires careful preparation and execution. Here’s a detailed guide to successfully navigate each step of the process.

Preparing to fill out the form

Before you begin filling out the form, gather all necessary documents including identification proofs, TIN, and any related tax documentation. Understanding your financial institution's specific requirements can further streamline the process, reducing the risk of errors.

Detailed instructions for each section

Tips for avoiding common mistakes

To reduce the likelihood of errors while filling out the form, consider the following tips:

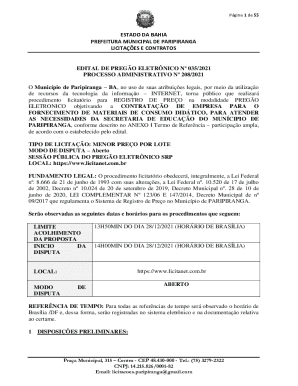

Editing and managing the form with pdfFiller

Once completed, maintaining and editing the financial institution tax residency form for future needs is equally important. pdfFiller provides features that address this requirement efficiently.

How to edit PDFs of the financial institution tax residency form

Using pdfFiller, you can easily edit your completed form to correct any errors or update relevant information. Here’s how to do it:

Collaborating with team members

If you’re filling out the form as part of a team, pdfFiller allows for easy collaboration. You can share forms with colleagues and receive input in real time.

eSigning directly in pdfFiller

Once the financial institution tax residency form is complete, it’s essential to sign it to validate the declaration. PDFfiller allows for electronic signatures, simplifying this process.

Storing and managing your form

Proper storage of your financial institution tax residency form is integral for future reference. pdfFiller provides a secure cloud platform where you can store all your documents.

Submitting the form

After accurately completing the financial institution tax residency form, the next step involves careful submission. This process can vary based on the financial institution's requirements.

Understanding submission requirements

Typically, your completed form needs to be submitted either physically or electronically to your bank or financial institution. Make sure to follow their submission guidelines closely to ensure proper processing.

Keeping track of your submission

Maintaining a record of your submission is crucial. Here are some tips for verification:

Frequently asked questions (FAQs)

What if make a mistake on my form?

If you realize an error after submission, it’s important to correct it promptly. Many financial institutions allow for amendments, so check their specific procedures for making corrections.

How often should update my tax residency form?

Changes in residency status, tax laws, or personal circumstances may necessitate updates to your form. It's wise to review your tax residency form annually or when significant financial changes occur.

Where can get help?

If you need assistance, consult with a tax professional or your financial institution for guidance on completing the form correctly. Additionally, utilizing resources from pdfFiller can provide further support.

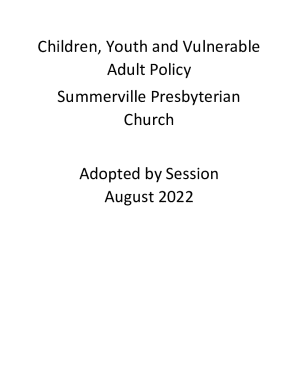

Security and privacy considerations

When handling sensitive information on the financial institution tax residency form, ensuring your data's security and privacy is paramount. Various laws protect personal data shared through such forms.

Understanding data privacy laws

Legislation like the General Data Protection Regulation (GDPR) mandates strict protocols regarding the storage and handling of personal data. Financial institutions and document management services must comply with these regulations to keep your information safe.

How pdfFiller ensures your information is safe

pdfFiller incorporates advanced encryption mechanisms and robust security protocols that safeguard your information. Your documents are stored in a secure cloud environment, minimizing risks associated with data breaches.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in financial institution tax residency without leaving Chrome?

How do I fill out the financial institution tax residency form on my smartphone?

How do I complete financial institution tax residency on an iOS device?

What is financial institution tax residency?

Who is required to file financial institution tax residency?

How to fill out financial institution tax residency?

What is the purpose of financial institution tax residency?

What information must be reported on financial institution tax residency?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.