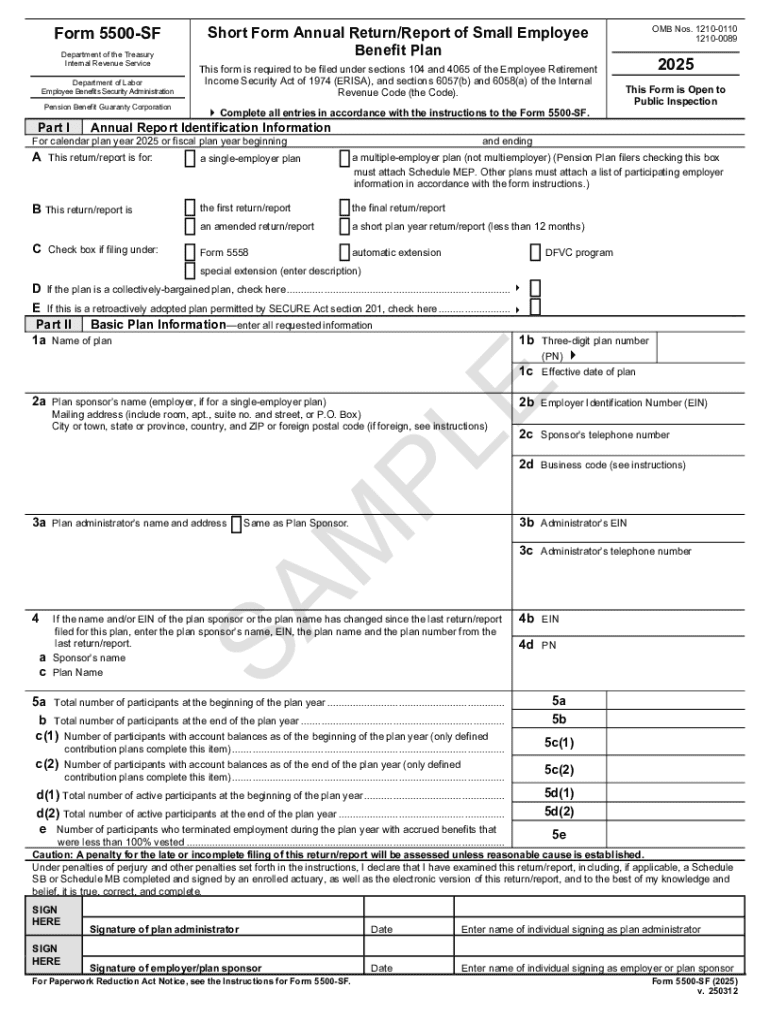

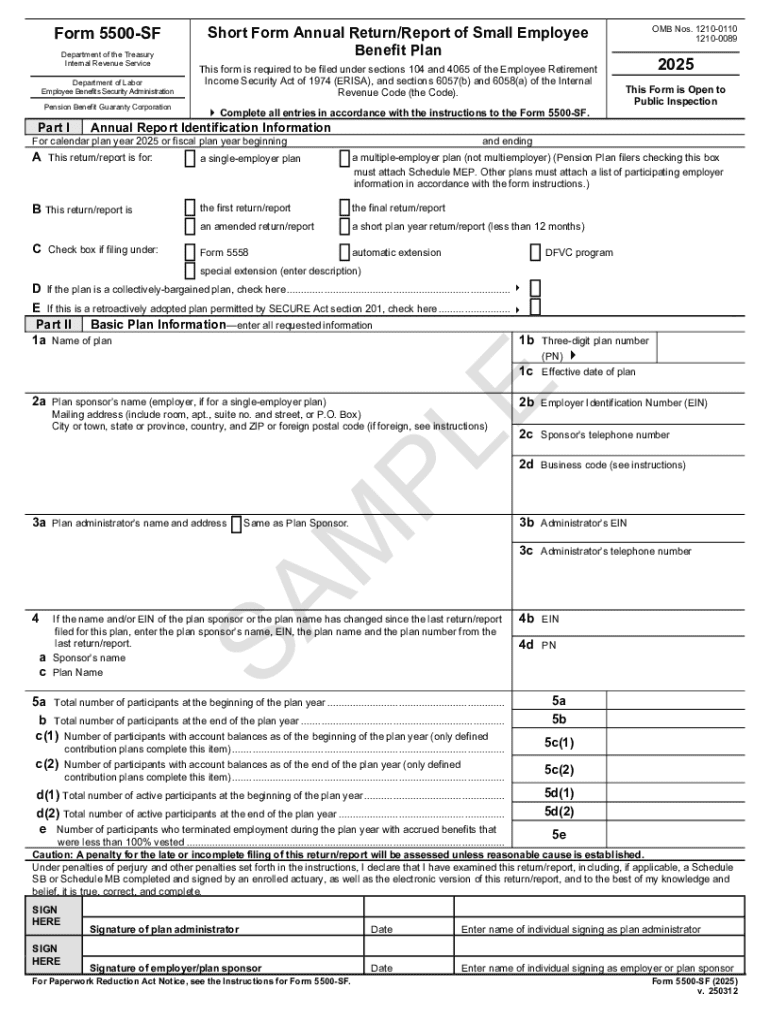

Get the free 2025 Form 5500SF. Form 5500-SF Short Form Annual Return/Report of Small Employee Ben...

Get, Create, Make and Sign 2025 form 5500sf form

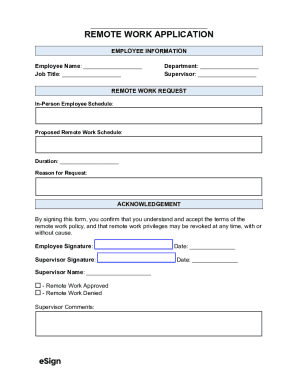

Editing 2025 form 5500sf form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2025 form 5500sf form

How to fill out 2025 form 5500sf form

Who needs 2025 form 5500sf form?

2025 Form 5500SF Form: Your Comprehensive Guide to Compliance and Submission

Understanding the Form 5500SF: An overview

Form 5500SF, or the Short Form Annual Return/Report of Small Employee Benefit Plan, is designed specifically for small pension plans. Its primary purpose is to simplify the reporting process for small plans, allowing them to meet federal filing requirements under the Employee Retirement Income Security Act (ERISA). This form is a critical component of pension plan reporting, ensuring that participants have access to necessary information regarding their benefits and that the government can effectively monitor compliance.

Unlike Form 5500, which is used for larger plans, and Form 5500-EZ, which is intended for one-participant plans, Form 5500SF serves a specific niche. Generally, it applies to plans with fewer than 100 participants and that meet certain criteria, making it crucial for small businesses and their employees. Understanding its nuances can save plan sponsors from costly penalties and promote compliance.

Eligibility criteria for using Form 5500SF

To file Form 5500SF, certain eligibility criteria must be met. Primarily, this form is for small pension and welfare plans, specifically those that cover fewer than 100 participants at the beginning of the plan year. Typically, the plans that can utilize this form include defined benefit plans, defined contribution plans, and certain health and welfare benefit plans.

Plan sponsors must also ensure compliance with specific requirements, such as the maintenance of accurate financial records and participant data throughout the year. If a plan exceeds the 100-participant threshold, a transition to filing the regular Form 5500 is necessary. Understanding these eligibility details is vital for ensuring accurate and timely filings, which ultimately protect the benefits of participants.

Step-by-step guide to completing Form 5500SF

Filling out Form 5500SF may seem daunting, but breaking it down into steps can simplify the process. Here is a step-by-step guide

Electronic filing requirements for Form 5500SF

All Form 5500 filings, including Form 5500SF, must be submitted electronically using the U.S. Department of Labor’s EFAST2 system. E-filing not only makes the process more efficient but also ensures compliance with federal regulations. Users must set up an account with EFAST2 to begin the electronic filing process.

Several platforms and tools can facilitate the e-filing process, making it accessible for plan sponsors. Compliance standards are stringent, so plan sponsors should ensure their filings meet all established guidelines to prevent rejections. Familiarizing oneself with the EFAST2 interface and its requirements is important for a smooth filing experience.

Managing your filing: Follow-up actions after submission

Once you submit Form 5500SF, it’s essential to monitor its status. The EFAST2 system allows plan sponsors to check the filing status of their submissions—this can help confirm acceptance or indicate if corrections are necessary.

Understanding what happens post-submission is crucial for compliance. After submission, the Department of Labor reviews the filing for completeness and accuracy. It’s advisable to maintain thorough records of your filing, including copies of the submitted form and any supporting documentation, as these may be required for verification in the event of an audit.

Interactive tools for Form 5500SF preparation

pdfFiller provides robust digital tools designed to streamline the Form 5500SF preparation process. With an intuitive interface, pdfFiller allows users to fill out, edit, and sign forms effortlessly. The platform enhances collaboration, enabling multiple stakeholders to review and finalize documents securely.

To utilize pdfFiller for Form 5500SF, simply upload your existing form or start from scratch using their templates. As a cloud-based document management system, pdfFiller ensures easy access from anywhere, making it easier than ever for plan sponsors to comply with filing requirements efficiently.

Common questions and resources

Understanding the nuances of Form 5500SF often leads to several common questions. For instance, filing deadlines typically fall on the last day of the seventh month following the end of the plan year, with extensions available under specific conditions. Failing to file can lead to significant penalties, underscoring the importance of adhering to submission timelines.

Resources such as the Department of Labor's website and tax professionals can provide further guidance. Companies can also access downloadable PDF templates through pdfFiller to facilitate the preparation process, ensuring they have all necessary information at hand while filling out the form.

Troubleshooting tips

In the event that your Form 5500SF is rejected, first identify the causes behind the rejection. Common issues include discrepancies in participant numbers or missing signatures. It is crucial to address these errors promptly—typically, a corrected submission is required no later than 30 days after the original rejection.

To appeal or address issues with the IRS, ensure you gather all necessary documentation supporting your claim. Promptly following through with corrections and keeping detailed records of your communications can help resolve any disputes effectively.

Additional help and resources

Plan sponsors seeking professional assistance can access support from tax advisors specializing in employee benefits and retirement plans. Additionally, the IRS provides a wealth of resources on its website, helping sponsors navigate the complexities of Form 5500SF.

Consider engaging with community forums or support groups where plan sponsors share their experiences and solutions. Collaboration can be incredibly beneficial for troubleshooting and compliance challenges.

Long-term considerations for pension plans

Compliance with regulations, including proper filing of Form 5500SF, is essential for the sustainability of pension plans. Beyond the immediate requirements, staying informed about potential future updates to the form and its regulations will benefit plan sponsors in the long run.

Ongoing education about changes in laws governing employee benefit plans can enhance effective plan management. By keeping abreast of industry standards and best practices, sponsors can provide the best outcomes for their participants and adhere to compliance measures consistently.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the 2025 form 5500sf form in Chrome?

Can I create an eSignature for the 2025 form 5500sf form in Gmail?

How do I fill out 2025 form 5500sf form using my mobile device?

What is 2025 form 5500sf form?

Who is required to file 2025 form 5500sf form?

How to fill out 2025 form 5500sf form?

What is the purpose of 2025 form 5500sf form?

What information must be reported on 2025 form 5500sf form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.