Get the free Tax - Forms - Search Page / mn.gov // Minnesota's State Portal

Get, Create, Make and Sign tax - forms

Editing tax - forms online

Uncompromising security for your PDF editing and eSignature needs

How to fill out tax - forms

How to fill out tax - forms

Who needs tax - forms?

Tax Forms: A Comprehensive Guide to Understanding, Filling, and Managing Your Tax Documentation

Understanding tax forms

Tax forms are essential documents used by individuals and businesses to report income, expenses, and other relevant financial information to tax authorities. Their importance cannot be overstated, as they form the basis for calculating tax liabilities and ensuring compliance with tax regulations. Failing to accurately complete tax forms can result in penalties or an incorrect assessment of taxes owed.

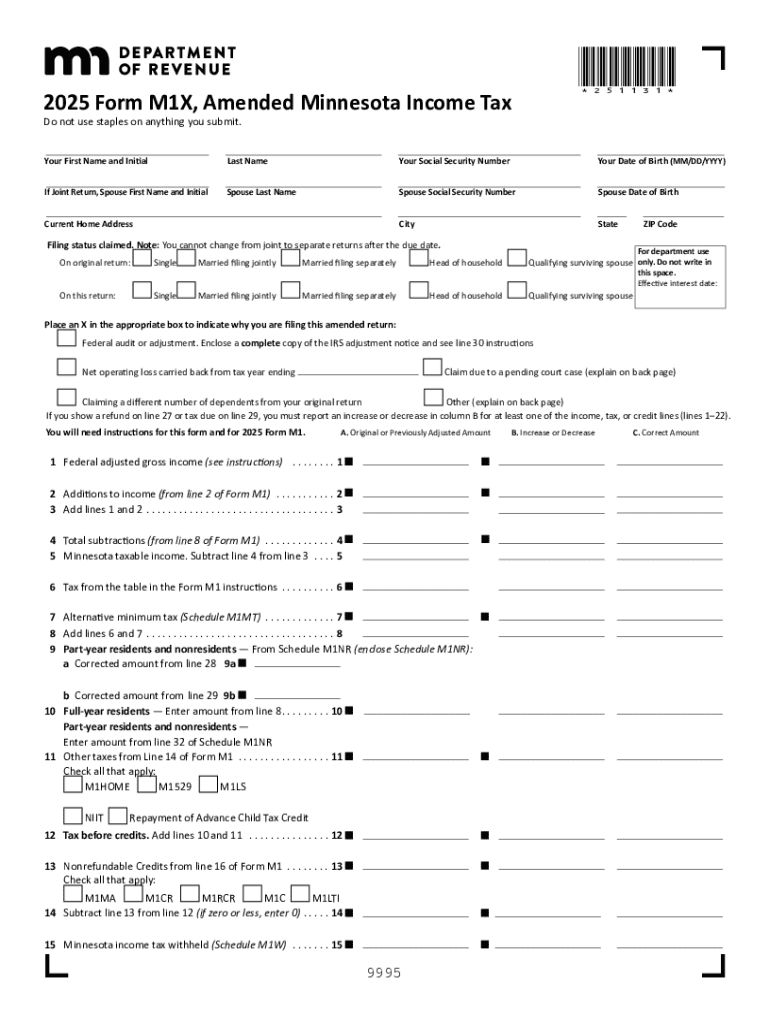

There are numerous types of tax forms, each serving a specific purpose. The W-2 form is used by employers to report employees' wages and taxes withheld, while the 1099 form is commonly employed for independent contractors and other non-employee compensation. The 1040 form is the standard individual income tax return form utilized to report personal income. Familiarizing yourself with these forms and their requirements is crucial for accurate tax filing.

It's vital to be aware of key deadlines associated with tax forms. For instance, employers must provide employees with their W-2 forms by January 31 each year, while individuals typically have until April 15 to file their tax returns. Accuracy in filling out these forms cannot be overstated, as even minor errors can lead to complications in tax calculations and potential audits.

Accessing tax forms

Accessing tax forms is straightforward, particularly in today's digital age. For individuals in California or anywhere in the United States, the official IRS website provides a user-friendly interface for downloading various tax forms. Simply navigate to the forms section, choose the required document, and download it in a suitable format.

Alternatively, pdfFiller offers an extensive library of tax forms, allowing users to easily search and access necessary documents. This platform simplifies the process of obtaining forms, as users can fill them out directly within their browser, making it a convenient option for anyone needing tax documentation.

Filling out tax forms

Completing tax forms involves a series of systematic steps. When filling out a W-2 form, for example, start by entering the employer's information, including name, address, and Employer Identification Number (EIN). Next, accurately report the employee's wages, federal income tax withheld, social security wages, and any state tax information as applicable.

For 1099 forms, the process involves detailing payments made to non-employees. This includes the recipient's name, address, and Taxpayer Identification Number (TIN). Accurate reporting of amounts paid during the tax year is essential, as discrepancies can result in unnecessary inquiries from the IRS.

Editing & managing your tax forms

Once your tax forms are filled out, managing and editing them efficiently can streamline your tax preparation process. pdfFiller allows users to edit tax forms directly within its platform, making it easy to add annotations, comments, or even correct mistakes post-filing.

For those managing multiple documents, pdfFiller’s merging features can combine various tax documents into a single file, simplifying organization. Moreover, saving and organizing completed forms is essential for future reference. Utilizing pdfFiller’s cloud storage capabilities ensures that your tax documents are accessible from anywhere, eliminating the need for physical copies.

Electronic signature and submission

Signing tax forms electronically adds a layer of convenience and security to the tax filing process. With pdfFiller, users can easily add their electronic signature to any form, streamlining submission. This process provides a time-saving alternative to traditional pen-and-paper signing.

Once signed, users can submit their forms through various methods. E-filing has gained popularity, allowing for faster processing and typically faster refunds. Conversely, some individuals may prefer mailing physical copies. Regardless of the method chosen, keeping track of submission status is essential to confirm that forms were received and processed correctly.

Frequently asked questions (FAQs)

When it comes to tax forms, questions often arise. For example, if a mistake is made on a submitted form, the IRS allows for amendments. You can use Form 1040-X to rectify errors on your income tax return, ensuring your records are accurate. For missing tax forms, contact employers or clients promptly to request duplicates. It's crucial to maintain comprehensive records, especially if international tax forms or different requirements come into play.

Resources and interactive tools

pdfFiller offers a suite of interactive tax tools that empower users in their tax preparation journey. For instance, tax calculators can help estimate tax liabilities, while real-time editing features allow for seamless corrections and updates to forms. Additionally, users can find links to helpful government resources directly through pdfFiller’s platform.

These resources make it easier for individuals and teams to stay informed and organized while navigating the complexities of tax forms. Leveraging these tools ensures that you not only complete your tax filings accurately but also efficiently.

Best practices for tax form management

Effective tax form management begins long before the filing deadline. One best practice is to prepare your documentation ahead of time, ensuring all necessary records are gathered by the first quarter of the tax year. This proactive approach can alleviate stress and reduce the likelihood of last-minute errors in form completion.

Maintaining digital copies of all submitted tax forms is also critical, as it helps in easy retrieval for future reference. Organizing tax documentation by year and type can save valuable time during audits or inquiries. Using a reliable platform like pdfFiller enhances this process, ensuring that all digital forms are readily available and securely stored.

Stay updated on tax regulations

Tax laws are frequently updated, making it essential for individuals and teams to remain informed about changes that may affect form requirements. This is particularly relevant as new tax credits, deductions, or regulations can influence the types of forms that need to be submitted. Leveraging pdfFiller’s continuous updates ensures that you are aware of these shifts in regulations.

An annual review of your filing procedures is advisable, especially if your financial situation changes or if there are new forms introduced. By staying informed, you reduce the risk of encountering issues during the filing process.

Community feedback and improvements

User feedback plays a critical role in refining the process of filling out tax forms. pdfFiller encourages community input on their experiences with tax form management and utilizes this feedback to make necessary improvements to the platform.

Whether you have suggestions for additional forms or tools that might enhance your experience, pdfFiller welcomes your input. Engaging with the community fosters a collaborative approach to improving functionality to meet diverse user needs.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit tax - forms from Google Drive?

How do I fill out the tax - forms form on my smartphone?

How do I fill out tax - forms on an Android device?

What is tax - forms?

Who is required to file tax - forms?

How to fill out tax - forms?

What is the purpose of tax - forms?

What information must be reported on tax - forms?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.