Get the free CRS Self CertificationControlling Person(s)

Get, Create, Make and Sign crs self certificationcontrolling persons

Editing crs self certificationcontrolling persons online

Uncompromising security for your PDF editing and eSignature needs

How to fill out crs self certificationcontrolling persons

How to fill out crs self certificationcontrolling persons

Who needs crs self certificationcontrolling persons?

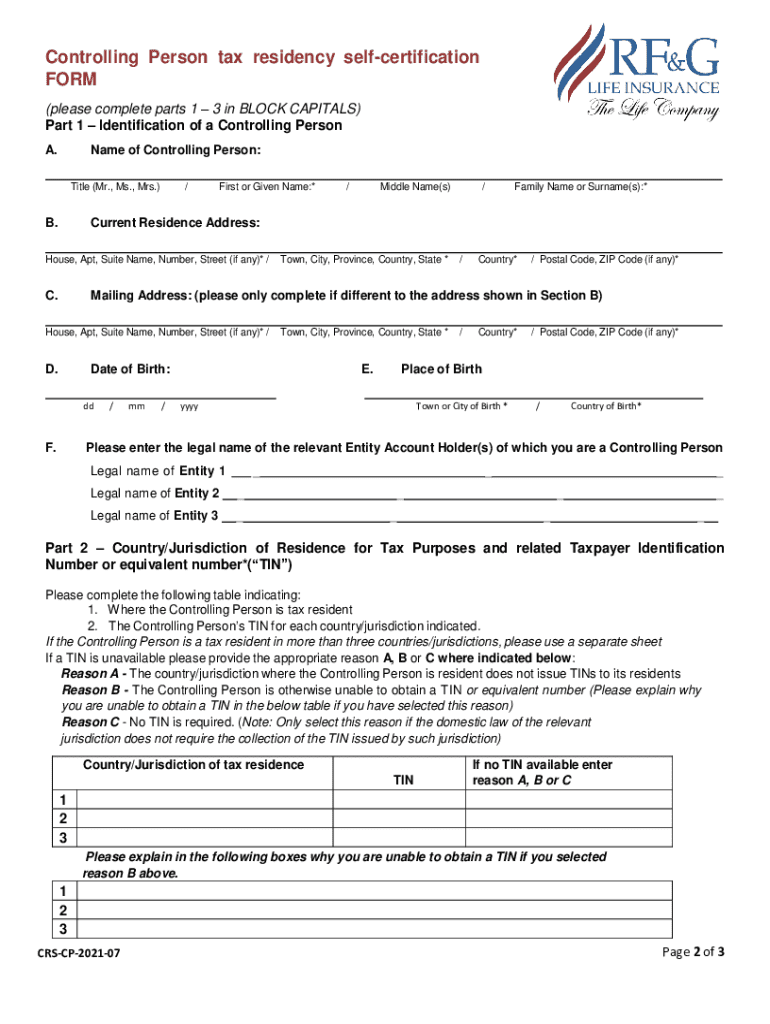

A Comprehensive Guide to CRS Self-Certification Controlling Persons Form

Understanding the CRS framework

The Common Reporting Standard (CRS) is an international tax compliance initiative developed by the Organisation for Economic Co-operation and Development (OECD). This framework aims to combat tax evasion by facilitating the automatic exchange of financial account information across borders. Its primary purpose is to ensure that tax authorities can access information about financial accounts held by non-residents, thereby increasing transparency and compliance in global finance.

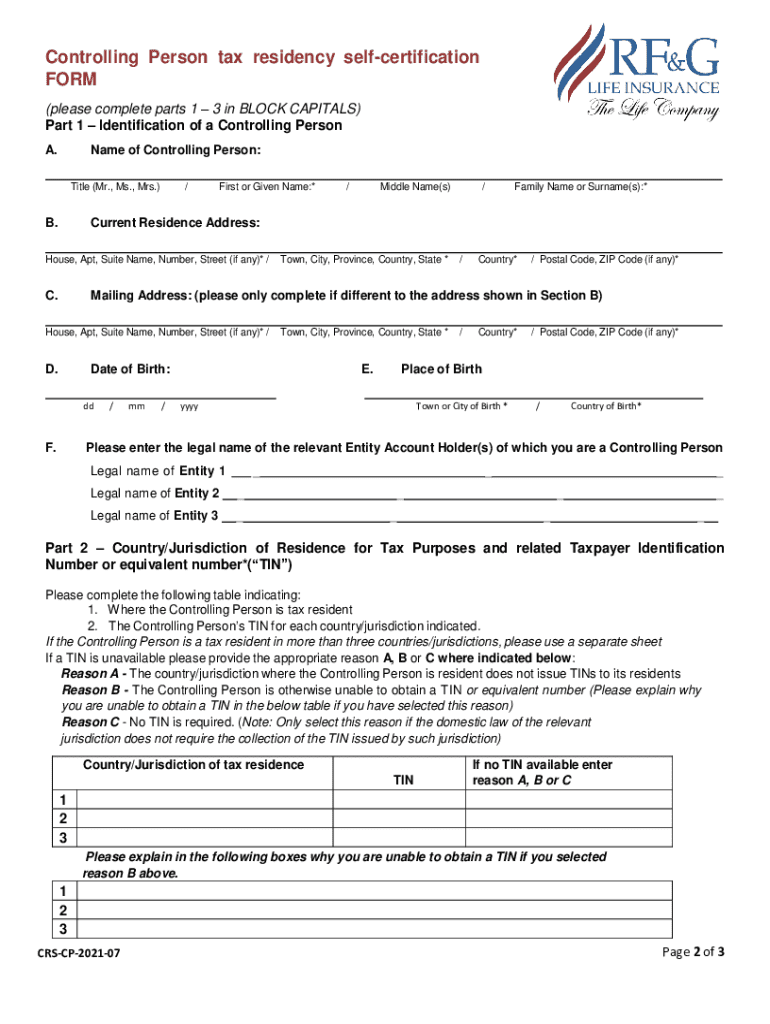

Within the CRS, several key terms are critical to understanding its implementation: 'Controlling Persons' refers to individuals who ultimately own or control an entity, 'Financial Institutions' are banks and other entities engaged in financial activities, and 'Reportable Accounts' are those subject to reporting under CRS. Each component plays a pivotal role in the overarching aims of the CRS, which fosters a shared responsibility among countries to guard against tax evasion.

What is the CRS Self-Certification Controlling Persons Form?

The CRS Self-Certification Controlling Persons Form is a critical document aimed at identifying the individuals who are deemed to be controlling persons of an entity. This form holds significant importance within financial institutions as it helps them assess and determine the tax residency of account holders. Knowing the controlling persons behind an entity aids institutions in complying with CRS obligations, thereby avoiding severe penalties associated with non-compliance.

Typically, the form must be completed by individuals who are found to be controlling persons of an entity that is opening an account or engaging in financial transactions requiring reporting. Completing the form ensures that the financial institution has accurate information to comply with regulatory requirements, as it facilitates the process of tax transparency and accountability.

Key components of the CRS Self-Certification Form

Understanding the structure of the CRS Self-Certification Controlling Persons Form is essential for accurate completion. This form typically begins with sections requiring personal information about the controlling person, including specific identification numbers and residency details. Key components include:

Step-by-step guide to completing the form

Filling out the CRS Self-Certification Controlling Persons Form may seem daunting, but following a structured approach can simplify the process immensely. Here’s a step-by-step guide to help you navigate this essential documentation:

Common mistakes to avoid when filling out the form

Filling out the CRS Self-Certification Controlling Persons Form can be complex, and several common mistakes can lead to delays or compliance issues. Recognizing these pitfalls is key to a smoother process:

Submitting the CRS Self-Certification Form

Once the CRS Self-Certification Controlling Persons Form is completed, the next step is submission. The form must be sent to the associated financial institution responsible for managing the account or financial dealings. Adoption of timely submission is critical, as each institution will have its deadlines for CRS compliance.

Best practices dictate that individuals frequently follow up on the submission to ensure all necessary paperwork is in order and acknowledged by the financial institution. Keeping a copy for personal records is strongly recommended.

Updating your CRS Self-Certification

Situations requiring updates to the CRS Self-Certification Controlling Persons Form can arise frequently. It is critical to identify when updates are needed, such as changes in residency status, alterations in the ownership structure of the entity, or the introduction of new controlling persons.

To amend previously submitted information, it's essential to fill out a new form accurately reflecting changes and resubmit it to the relevant financial institution. This keeps your account in compliance with current regulations.

Impact of non-compliance with CRS regulations

The consequences of failing to submit the CRS Self-Certification Controlling Persons Form can be severe. Financial institutions often face hefty fines and reputational risks associated with non-compliance. For individuals, non-compliance may lead to increased scrutiny from tax authorities, potential legal repercussions, and significant financial liabilities.

Awareness of local regulations related to CRS reporting is paramount to mitigate these risks. Being proactive in understanding requirements can save entities and individuals from serious complications.

Utilizing pdfFiller for efficient form management

pdfFiller emerges as a powerful tool for managing the CRS Self-Certification Controlling Persons Form, enhancing the efficiency of completion. With features designed for ease of use, pdfFiller allows users to fill out, edit, and sign forms directly from a secure cloud-based platform.

Specialized functionalities, such as digital signing capabilities, ensure the integrity and security of the documents. Additionally, collaboration tools make it easier for teams to work together on completing the form, ensuring accuracy and compliance.

Frequently asked questions (FAQs)

Navigating the CRS Self-Certification Controlling Persons Form can bring up numerous questions for users. Addressing common queries is essential for clarity regarding the form’s purpose and proper use. Some of the inquiries include:

Advanced tools and features in pdfFiller

The advanced capabilities offered by pdfFiller make it an unparalleled choice for handling the CRS Self-Certification Controlling Persons Form. Tools for automation enable users to streamline repetitive tasks, reducing the burden of manual entry and increasing accuracy across forms.

Integration with financial software ensures seamless data transfer, enhancing efficiency by minimizing errors. Additionally, the cloud storage benefits provide ubiquitous access to documents while ensuring high standards of security and confidentiality.

Testimonials and success stories

Numerous individuals and teams have successfully utilized pdfFiller for their CRS compliance needs, demonstrating the efficiency and efficacy of this tool. For example, businesses praised the platform for simplifying the completion and submission process, which led to prompt compliance with CRS regulations.

These success stories show how pdfFiller facilitated a smoother experience in form preparation, providing peace of mind to users by ensuring that they navigate their reporting obligations efficiently.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit crs self certificationcontrolling persons from Google Drive?

How do I make changes in crs self certificationcontrolling persons?

How do I fill out the crs self certificationcontrolling persons form on my smartphone?

What is crs self certificationcontrolling persons?

Who is required to file crs self certificationcontrolling persons?

How to fill out crs self certificationcontrolling persons?

What is the purpose of crs self certificationcontrolling persons?

What information must be reported on crs self certificationcontrolling persons?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.