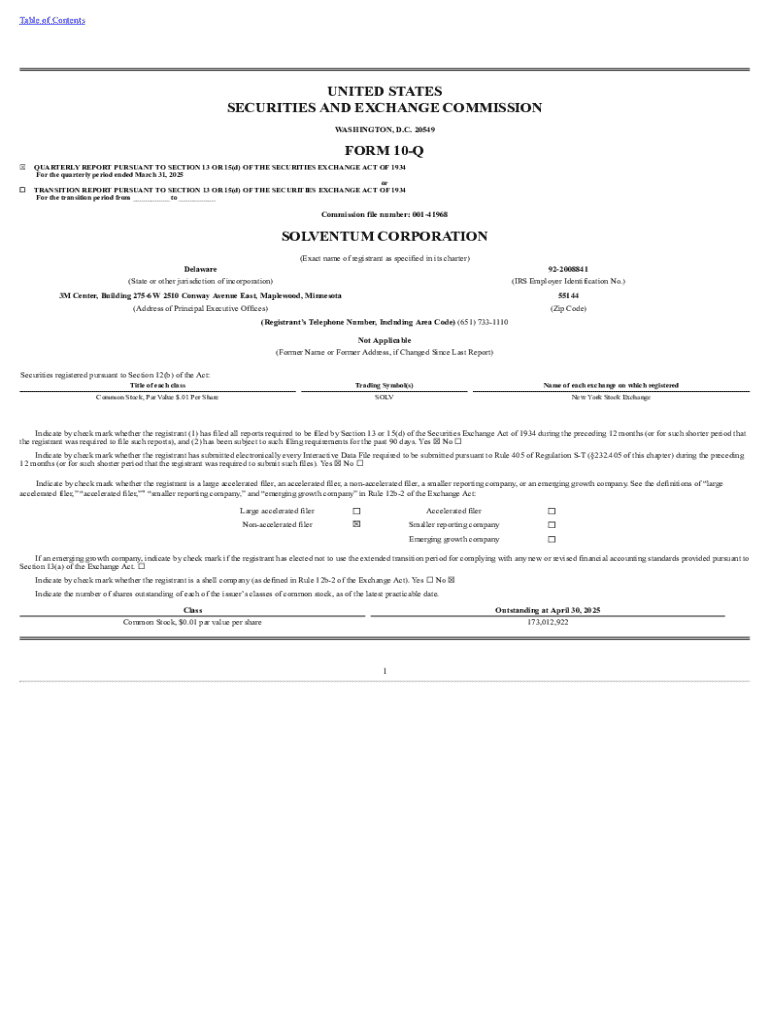

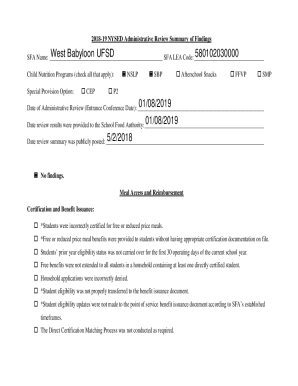

Get the free Form 10-Q for Solventum Corp filed 05/09/2025. 10-Q filed 05/09/2025

Get, Create, Make and Sign form 10-q for solventum

Editing form 10-q for solventum online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 10-q for solventum

How to fill out form 10-q for solventum

Who needs form 10-q for solventum?

Comprehensive guide to filling out the Form 10-Q for Solventum

Overview of Form 10-Q

Form 10-Q is a regulatory document that public companies, including Solventum, must submit quarterly to the U.S. Securities and Exchange Commission (SEC). This form provides a comprehensive snapshot of a company's financial performance, highlighting critical metrics that inform stakeholders and potential investors about the current state of the business. Unlike the annual Form 10-K, which details the company’s yearly performance, the 10-Q is more focused and reflects the company’s recent financial health and activities.

The importance of Form 10-Q cannot be overstated; it not only enhances transparency but also serves as a vital tool for investors, analysts, and creditors to gauge the financial stability of a company like Solventum. Additionally, it generates insights into trends and economic conditions that could influence future performance. A typical Form 10-Q includes various sections, each serving a distinct purpose to ensure completeness.

Specific considerations for Solventum

When filling out Form 10-Q for Solventum, there are unique aspects to consider due to its industry positioning and financial strategy. As a company operating in [specific sector], it is essential to align financial reporting with industry standards and practices. For instance, industry-specific metrics, such as revenue growth rate or customer acquisition cost, should be clearly highlighted to emphasize Solventum's performance in the context of its market.

Important metrics that Solventum should emphasize in its Form 10-Q include earnings before interest and taxes (EBIT), net income, and cash flow from operations. These metrics provide investors insight into operational efficiency and profitability. Additionally, it’s crucial to include details about any regulatory adjustments, competitive landscape changes, or other dynamics impacting performance, ensuring the report is both informative and comprehensive.

Step-by-step instructions for completing Form 10-Q

Completing Form 10-Q requires thorough preparation, ensuring all necessary information is available. This process starts with gathering relevant financial data and other documentation that reflect Solventum’s financial activities during the quarter. Key regulatory guidelines and standards, including GAAP (Generally Accepted Accounting Principles), must be followed rigorously to guarantee compliance.

Once all necessary documents are compiled, focus on the financial statement section. Begin by preparing the balance sheet, which outlines assets, liabilities, and shareholders' equity at the end of the reporting period. Next, formulate the income statement, detailing revenues, expenses, and net earnings for the quarter. Finally, compile the cash flow statement, which showcases cash inflows and outflows over the same period.

Writing management’s discussion and analysis (&A)

The MD&A section is critical for providing contextual insights into Solventum's financial statements. It should address several key points, including significant operational changes, market conditions, and forecasts that could impact future performance. Writing this section requires clarity and conciseness, ensuring that stakeholders can easily interpret the information presented without unnecessary jargon.

Best practices for writing the MD&A include prioritizing clarity by using straightforward language, prioritizing relevant data, and ensuring that any forward-looking statements are supported by solid reasoning or evidence. Analysts and investors appreciate transparency regarding management's perspective on operational challenges or opportunities, which helps foster a trusting relationship with stakeholders.

Compiling required disclosures

Legal disclosures in Form 10-Q should not be overlooked, as these provide transparency about risks and potential liabilities that could affect the company's performance. It is essential to identify specific risk factors unique to Solventum, such as changes in regulatory frameworks or economic uncertainties. By doing so, the company can pre-emptively address investor concerns, showing due diligence and awareness of the business environment.

While compiling these required disclosures, it’s beneficial to structure them clearly. Use bullet points or numbered lists to help readers easily digest each point. Additionally, provide adequate explanations for risks and how the company is prepared to address them. This proactive approach not only safeguards compliance but also enhances the company's credibility among stakeholders.

Tools and features on pdfFiller for completing Form 10-Q

Utilizing pdfFiller for completing the Form 10-Q offers several advantages. This platform is designed specifically with user-friendliness in mind, making it easy for Solventum's team to edit PDF documents collaboratively. The cloud-based nature of pdfFiller allows real-time editing, which can facilitate teamwork across departments, providing a seamless workflow environment.

In addition to its editing capabilities, pdfFiller boasts eSignature solutions that can expedite the approval process. This feature ensures that once the form is finalized, it can be signed digitally, simplifying the submission process significantly. Moreover, pdfFiller's document management features allow users to store and access all versions of the document without the risk of losing crucial information, making the whole filing process more efficient.

FAQs about completing Form 10-Q for Solventum

Common questions often arise when teams work on Form 10-Q submissions. One frequent concern is what to do if a filing deadline is missed. In such cases, it’s vital to address the situation promptly by contacting the SEC and determining the next steps or potential penalties. Being upfront and transparent can often mitigate negative repercussions.

Another common question is how to handle revisions once the form has been submitted. If subsequent information necessitates a correction, companies should file an amendment through the SEC's EDGAR system in a timely manner. Providing updated information reassures stakeholders and reflects a commitment to maintaining accurate and transparent financial reporting.

Interactive tools for document management

pdfFiller is equipped with a range of interactive tools to enhance document management, particularly when filling out Form 10-Q. The platform allows users to preview and edit documents easily, ensuring that each section meets the required standards before submission. Moreover, real-time collaboration features enable team members to engage and provide input simultaneously, making the process more efficient.

Additionally, tracking changes and maintaining version history are crucial features that pdfFiller offers. This functionality allows users to view past edits, ensuring that no important information is lost during the editing process. These tools are essential for maintaining accuracy and consistency, which are paramount when working on regulatory filings like Form 10-Q.

Other filings to be aware of

Understanding Form 10-K is essential as it complements Form 10-Q by providing a comprehensive annual overview, encapsulating essential business strategies and long-term risks. In contrast, Form 10-Q focuses on quarterly performance, but both documents must adhere to SEC compliance standards. This regulatory requirement is aimed at ensuring that all publicly traded companies, including Solventum, maintain transparency and accountability in their financial reporting.

Additionally, it's beneficial to grasp the nuances of quarterly vs. annual reporting. Quarterlies may address immediate operational shifts, while annual reports delve into broader strategic directions. Both filings establish a narrative about the company’s trajectory, allowing stakeholders to make informed decisions based on comprehensive insights. Staying compliant with both types of documentation reinforces credibility and enhances investors' trust.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit form 10-q for solventum in Chrome?

Can I create an electronic signature for signing my form 10-q for solventum in Gmail?

Can I edit form 10-q for solventum on an Android device?

What is form 10-q for solventum?

Who is required to file form 10-q for solventum?

How to fill out form 10-q for solventum?

What is the purpose of form 10-q for solventum?

What information must be reported on form 10-q for solventum?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.