Get the free Sales and Use Tax Government Certificate of Exemption

Get, Create, Make and Sign sales and use tax

How to edit sales and use tax online

Uncompromising security for your PDF editing and eSignature needs

How to fill out sales and use tax

How to fill out sales and use tax

Who needs sales and use tax?

Sales and Use Tax Form: A Comprehensive How-to Guide

Understanding sales and use tax

Sales and use tax is a critical component of state and local government financing. It is applied to the sale of goods and certain services, making it essential for individuals and businesses alike to understand. In essence, sales tax is collected by the retailer at the point of sale, while use tax is paid directly by the consumer for items purchased out of state but used locally.

Filing sales and use tax forms is imperative for ensuring compliance with tax regulations. Accurate and timely submissions help avoid penalties and interest on unpaid taxes, making it crucial for any taxpayer involved in purchasing goods or services that fall under tax jurisdiction.

The key difference between sales tax and use tax lies in the point of collection. While sales tax is collected by sellers during the transaction, use tax applies when individuals buy items without paying sales tax, often occurring in online sales or interstate purchases.

Who needs to file a sales and use tax form?

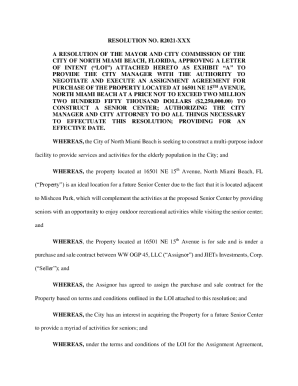

Both individuals and businesses are responsible for filing sales and use tax forms, but the specifics can vary based on their purchasing habits.

For individuals, taxable purchases include most retail sales, and exemptions typically involve necessities such as groceries or certain medical supplies. Understanding what qualifies as taxable within your jurisdiction is essential, as this can significantly influence your tax liability.

For businesses, filing requirements are determined by various factors, including the nature of their operations and the products they sell. Companies that maintain a physical presence in a state typically must collect sales tax on transactions made within that state. Common scenarios that necessitate filing the sales and use tax form include purchasing inventory, equipment, or operating supplies.

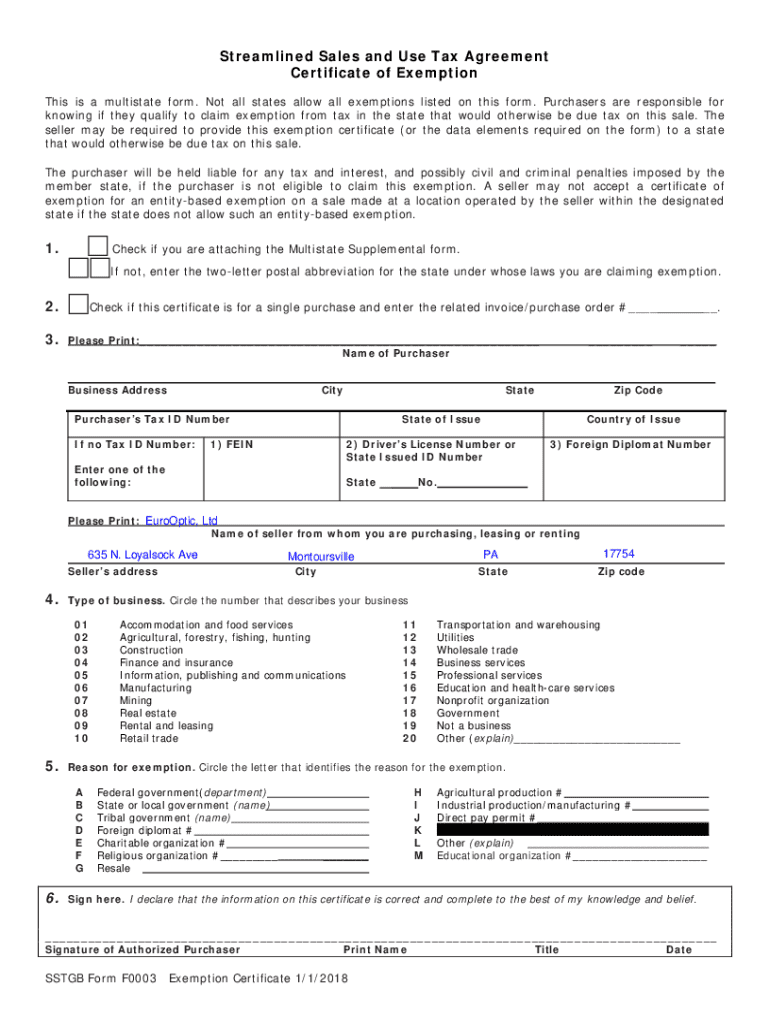

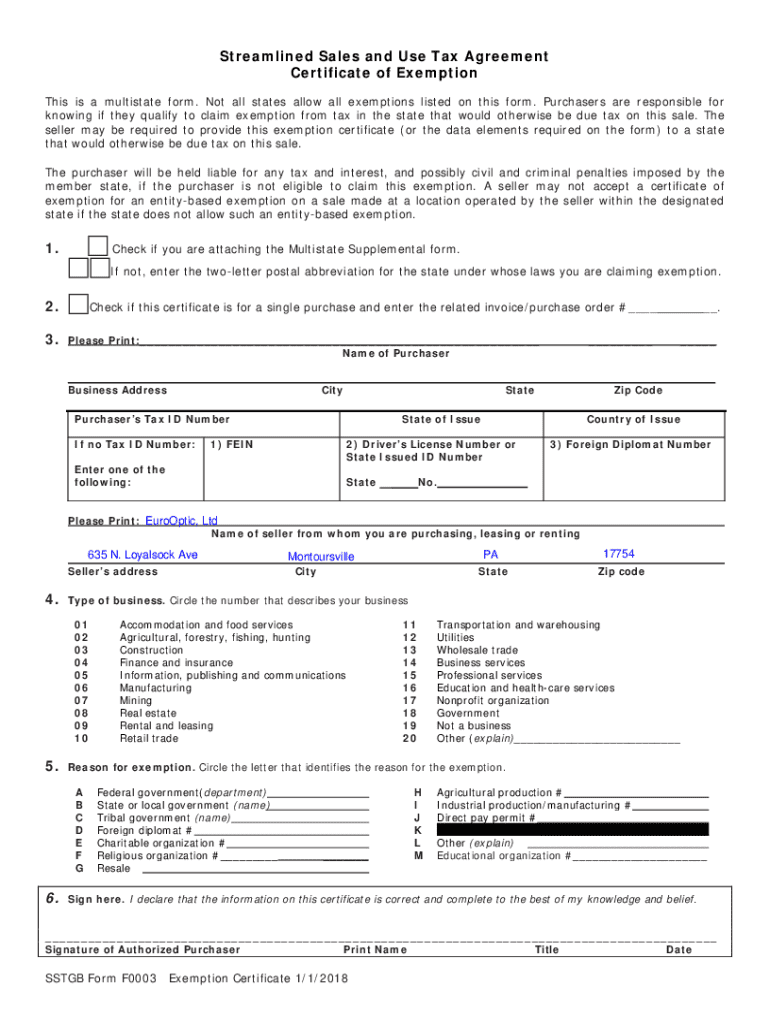

Overview of the sales and use tax form

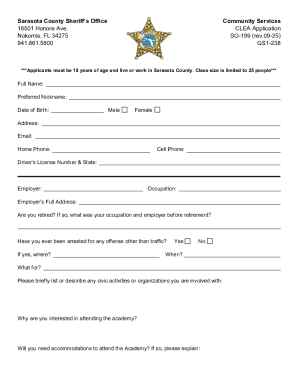

Sales and use tax forms are structured to capture essential information about the taxpayer and their purchases. The foremost components of the form generally include the personal or business information section, a detailed account of taxable purchases, and a section for claiming exemptions.

Filling out the form incorrectly can lead to delays or penalties. Common mistakes include inaccurate personal information, improper itemization of taxable purchases, or failing to provide adequate exemption documentation. Understanding each part of the form will facilitate an efficient submission process.

Step-by-step guide to completing the sales and use tax form

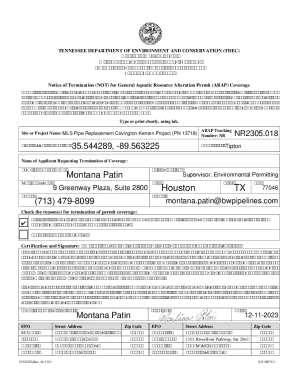

Preparation is key to successfully completing the sales and use tax form. Begin by gathering necessary documentation such as receipts for purchases, previous tax forms, and relevant exemption certificates. Reviewing local tax regulations will also ensure compliance with specific requirements in your state or locality.

When filling out the form, accuracy is paramount. First, enter your personal information precisely, ensuring it matches your legal documents. Next, itemize all taxable purchases, providing clear descriptions and amounts. If claiming exemptions, indicate this accurately and include supporting documentation where applicable.

After completing the form, a thorough review is necessary. Cross-check details to avoid discrepancies. Look out for common red flags such as math errors, missing information, or improperly claimed exemptions—all of which can impede your filing's acceptance.

Filing the sales and use tax form

There are various methods for filing sales and use tax forms, each with its pros and cons. Electronic filing through platforms like pdfFiller offers convenience and speed, reducing processing time. Alternatively, mail-in submissions allow for paper records but may delay acknowledgment from tax authorities.

Some jurisdictions also enable in-person filings, which can be beneficial for individuals seeking immediate confirmation. It's crucial to be mindful of key deadlines, as late filings can attract penalties or interest calculations on unpaid taxes.

Managing your sales and use tax form

Storing records of your filings is crucial for compliance and future referencing. Retaining necessary documentation such as filed forms and supporting evidence of tax payments helps make the process smoother in case of audits or reviews.

Using tools like pdfFiller allows for efficient document management and easy access to your electronic records. Set reminders for future filings—this proactive step ensures you never miss a deadline.

Tips for efficiently using pdfFiller

pdfFiller simplifies the process of managing your sales and use tax form. By utilizing its interactive editing tools, you can streamline workflows and ensure each document is accurately filled out and up-to-date.

Collaboration features enable you to share forms with team members or advisors for input. The legal e-signature option allows for quick approval processes without needing physical documentation in many cases.

FAQs about the sales and use tax form

Understanding how to navigate the sales and use tax form can raise many questions. For instance, what should you do if you make a mistake on your form? It’s important to know that errors can often be corrected, but timely action is crucial. If you realize a mistake post-submission, you can typically amend your form by following the specified procedures available through your local tax authority.

For assistance, many states provide resources and support services to help taxpayers. If you need to find additional support regarding your sales and use tax form, local tax authorities often have dedicated teams ready to help.

Understanding real-time updates and changes in sales and use tax regulations

Staying informed about changes in sales and use tax regulations is essential for compliant filing. Frequent modifications to tax laws can directly affect your liabilities and the forms you must submit. Thus, it is beneficial to keep updated through reliable sources.

pdfFiller keeps users updated by providing resources that highlight legal changes relevant to their tax requirements, ensuring that you are always filing the correct forms with the most current information.

Conclusion

Filing your sales and use tax form may seem daunting, but with a clear understanding and proper tools, it becomes a straightforward process. Familiarizing yourself with the form, gathering adequate documentation, and utilizing resources like pdfFiller can streamline your efforts significantly.

Encouragement to utilize pdfFiller for all your document management needs cannot be overstated. Whether it’s editing, signing, or storing your sales and use tax forms, pdfFiller empowers users to engage seamlessly with their documents through a cloud-based platform designed for efficiency.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my sales and use tax directly from Gmail?

How can I send sales and use tax to be eSigned by others?

Can I edit sales and use tax on an Android device?

What is sales and use tax?

Who is required to file sales and use tax?

How to fill out sales and use tax?

What is the purpose of sales and use tax?

What information must be reported on sales and use tax?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.