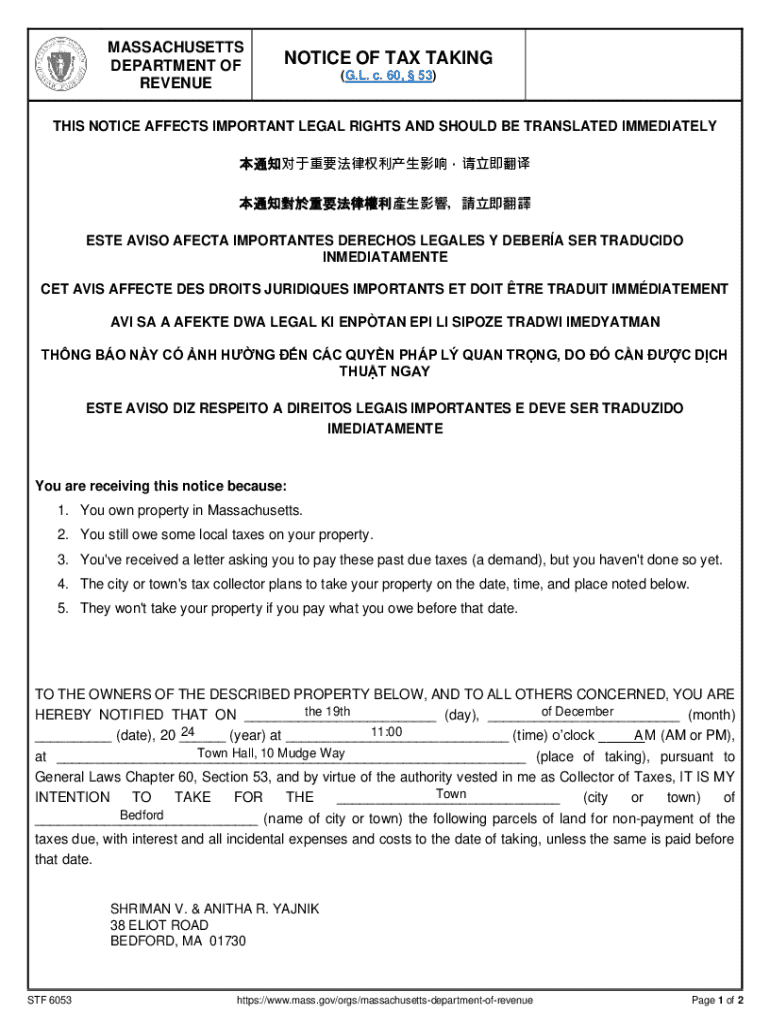

Get the free NOTICE OF TAX TAKING - (GL c. 60,53)

Get, Create, Make and Sign notice of tax taking

How to edit notice of tax taking online

Uncompromising security for your PDF editing and eSignature needs

How to fill out notice of tax taking

How to fill out notice of tax taking

Who needs notice of tax taking?

Guide to the Notice of Tax Taking Form

Understanding the notice of tax taking form

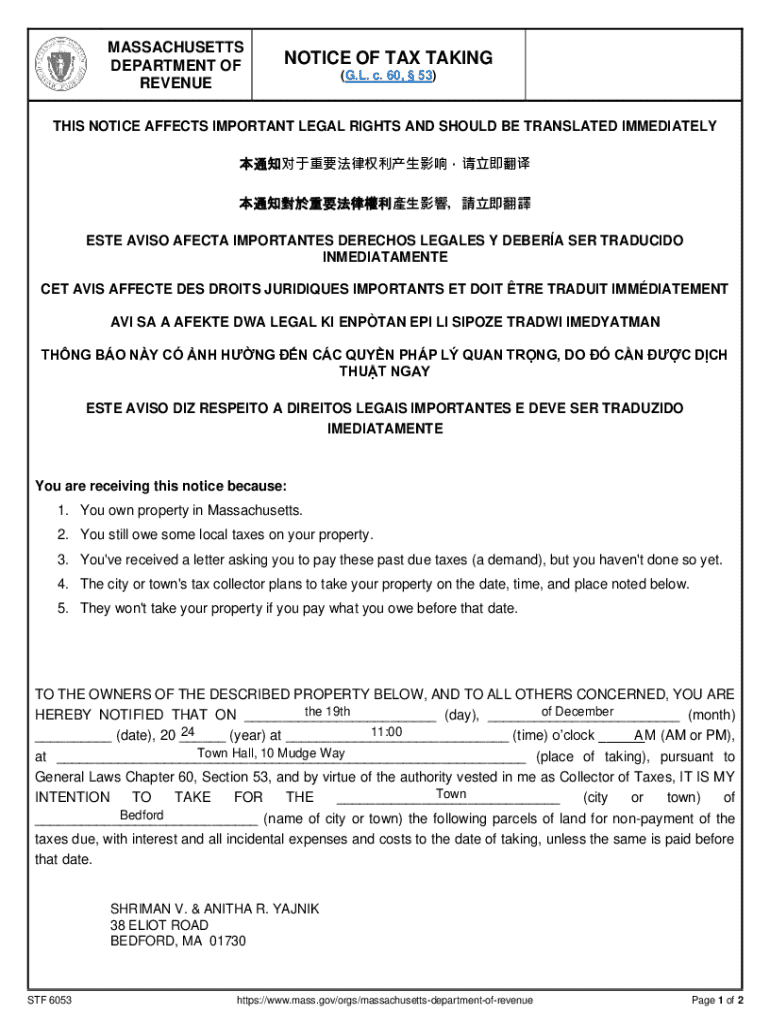

The Notice of Tax Taking Form is a critical document that tax authorities utilize to inform property owners of unpaid taxes on their property. This formal notification serves as both a warning and a procedural step in the collection process, detailing outstanding tax obligations. For property owners and taxpayers, understanding this form is vital as it encapsulates their financial responsibilities and the consequences of non-compliance.

For homeowners, landlords, and even businesses, receiving this notification can have significant implications. A failure to act promptly can lead to severe penalties, including liens or even the potential loss of property. Therefore, comprehending the nuances of the Notice of Tax Taking Form is crucial for anyone who owns real estate, ensuring that they can navigate the tax landscape efficiently.

Key components of the notice of tax taking form

Understanding the components of a Notice of Tax Taking Form is essential for sufficiency and accuracy. This form typically includes various required information that should be carefully filled out to avoid errors that could lead to further complications. First and foremost, property details must be correctly stated, such as the property address and identification numbers that uniquely recognize the property within the tax system.

Taxpayer information is another crucial aspect of the form. It includes the name of the property owner, contact information, and possibly multiple owners’ names if applicable. The tax amounts due and the deadlines for payment must also be clearly presented. This part of the document typically contains crucial payment instructions, explaining how and where to remit the outstanding tax amounts.

Sections of the form also include a notification of tax taking, which explicitly communicates the urgency of the matter. Payment instructions delineate various methods for settling obligations, whether online or through traditional means, while an acknowledgment of receipt section allows property owners to confirm that they have received the notice.

If you are uncertain about specific components of the form, common questions often revolve around what to do when errors appear or which local offices to contact for assistance. Keeping yourself informed can streamline the process and diminish potential friction.

Step-by-step guide to completing the notice of tax taking form

Completing the Notice of Tax Taking Form accurately is crucial. Start by gathering all necessary information. Begin with property identification, leveraging county tax records to retrieve required data. It’s important to have the most current records at hand, ensuring accuracy in what is submitted.

The second step is accessing the form. To do this, one can typically locate the form online through the official website of local tax authorities, such as your county’s department of revenue. Once found, `pdfFiller` users can easily download the form and prepare for input.

When filling out the form, it’s advisable to look at each section thoroughly. Be meticulous with details like the spelling of names and accuracy of numbers to avoid delays or error messages later. Common mistakes to avoid include leaving sections blank or providing outdated contact information.

After completing the form, review it for accuracy. Make sure to double-check all information and, if necessary, seek help from a tax professional to guide you through the complexities.

Filing and submitting the notice of tax taking form

Once the Notice of Tax Taking Form is completed, the next step is filing it. Typically, submission is done to your local tax office or revenue department. Be sure to confirm the exact location to ensure your form reaches the right office without incident.

Accepted methods for submission can vary. Online submissions may be available directly through the tax office’s website, a convenient option for many. Alternately, consider mail-in options where the form can be securely sent through registered or certified mail options to confirm delivery.

Some local offices may permit in-person submissions as well, providing an opportunity for immediate confirmation of receipt. Be aware of deadlines for submission, which are often strict; missing these could lead to penalties or complications in your tax obligations.

Managing responses to your notice of tax taking form

After submitting the Notice of Tax Taking Form, you should be prepared for notifications from tax authorities. These might include confirmation of receipt or further instructions depending on your tax situation. It’s crucial to stay attentive to any correspondence that arises from the tax office.

Upon receiving a response, take the necessary steps outlined in their communication. This may involve additional information requests or clarification on your tax obligations. If you encounter ambiguity, do not hesitate to contact the appropriate tax authority for assistance to alleviate potential confusion and to ensure compliance with all requirements.

In addition, if your case requires it, you may need to file a penalty abatement request if you missed the deadline due to unforeseen circumstances. Gathering evidence of valid reasons can help in the acceptance of such requests.

Editing and digitally signing your notice of tax taking form

For users on `pdfFiller`, editing the Notice of Tax Taking Form is a straightforward process. Start by uploading the document to the platform, enabling you to utilize interactive editing tools that the platform offers. This includes text boxes, date fields, and other customizable options that facilitate the editing process.

Once you have made necessary changes, consider utilizing the eSignature feature to sign the document digitally. This method not only speeds up the signing process but also ensures compliance with legal standards for electronic signatures. Step-by-step signing instructions are readily accessible on the `pdfFiller` platform to guide you through.

Tools and resources for effective document management

Utilizing tools available on `pdfFiller` can significantly enhance document management efficiency. Interactive features allow for easy collaboration with team members, which can be particularly beneficial when multiple parties are involved in addressing the Notice of Tax Taking Form.

In conjunction with collaborative features, users can benefit from document storage solutions that help keep all tax-related documents organized. For instance, keeping track of tax deadlines is essential; setting calendar reminders for payment dates can help prevent last-minute scrambles and potential penalties.

Common issues and troubleshooting

Navigating the Notice of Tax Taking Form process can present challenges, particularly if errors are made on the form. If you realize you’ve made a mistake post-submission, contact your tax authority immediately to determine the best course of action for amendments. Most agencies offer guidance for correcting simple errors to maintain your compliance.

Disputes regarding tax-taking can arise, where you believe that the information stated in the notice is inaccurate. If this occurs, gather your documentation and reach out directly to the tax authority. Having clear, organized paperwork can facilitate smoother resolution.

Conclusion on navigating the notice of tax taking process

In summary, understanding and managing the Notice of Tax Taking Form can be complex but entirely manageable with the right approach and resources. By following the structured steps outlined in this guide, property owners and taxpayers can ensure compliance with tax obligations, mitigating penalties through proactive management.

Utilizing platforms like `pdfFiller` not only simplifies the completion and submission process but also provides users with the tools necessary to keep track of essential tax documentation effectively. Being proactive about tax responsibilities will save time and reduce stress, ultimately leading to better financial management.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit notice of tax taking online?

Can I create an electronic signature for the notice of tax taking in Chrome?

Can I create an electronic signature for signing my notice of tax taking in Gmail?

What is notice of tax taking?

Who is required to file notice of tax taking?

How to fill out notice of tax taking?

What is the purpose of notice of tax taking?

What information must be reported on notice of tax taking?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.