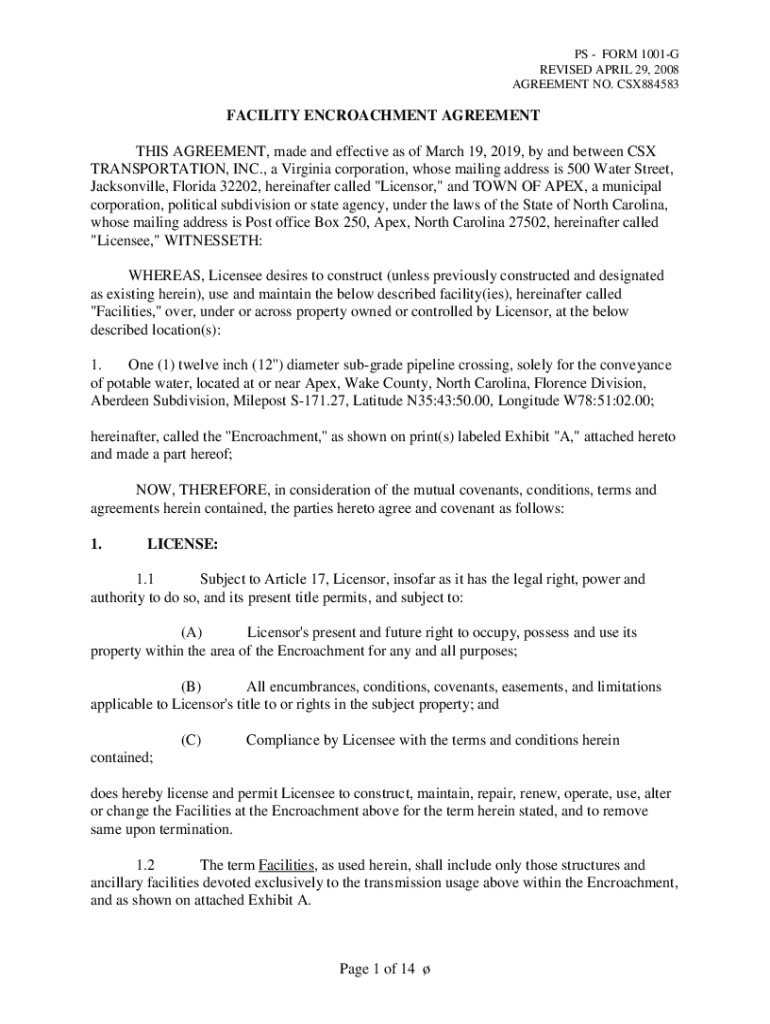

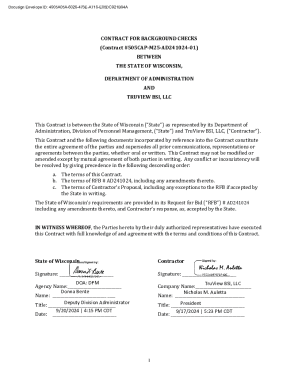

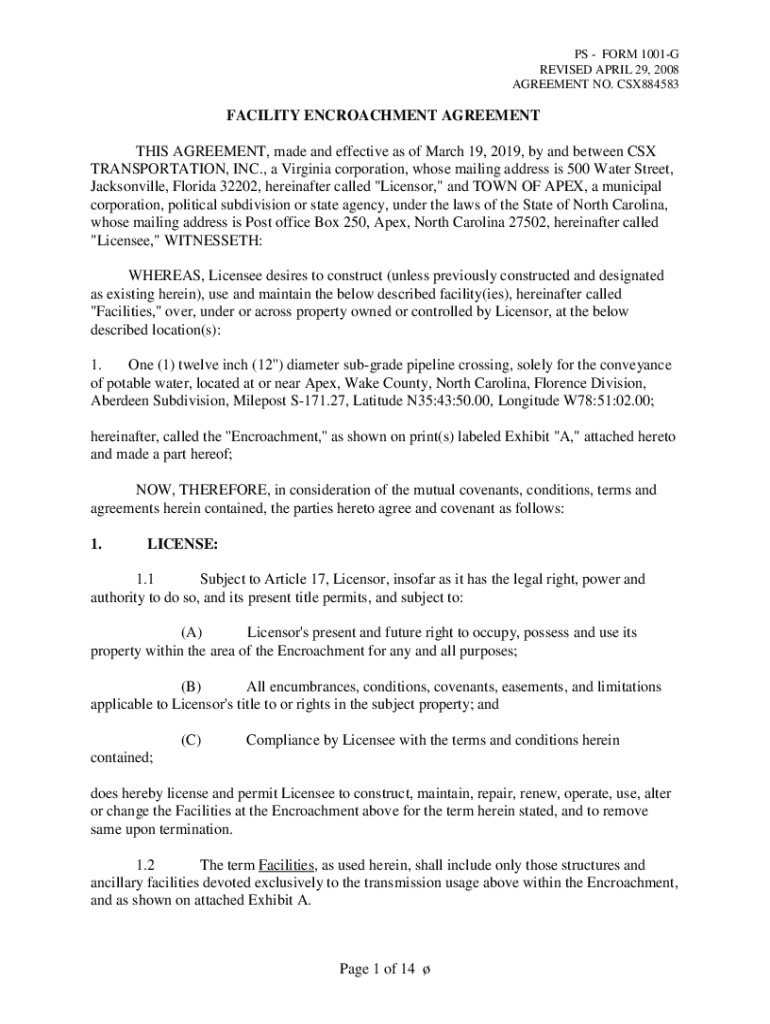

Get the free form 1001-g revised april 29, 2008 agreement no. csx884583

Get, Create, Make and Sign form 1001-g revised april

How to edit form 1001-g revised april online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 1001-g revised april

How to fill out form 1001-g revised april

Who needs form 1001-g revised april?

How to Fill Out Form 1001-G Revised April: A Comprehensive Guide

Understanding Form 1001-G

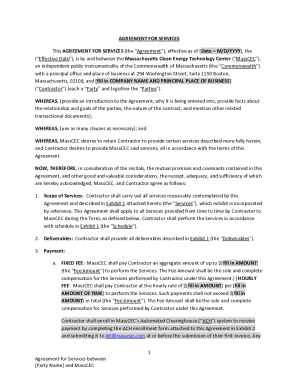

Form 1001-G, also known as the Revised April form, is a crucial document often utilized in various administrative and financial processes. Its primary purpose is to capture essential information pertaining to individuals and organizations engaged in specific transactions or reporting activities.

Accurate completion of Form 1001-G is vital. Not only does it ensure compliance with legal requirements, but it also prevents delays in processing applications and requests. Whether you are applying for benefits, making declarations, or reporting financial information, completing this form accurately can significantly affect the outcomes.

Where to access the form 1001-G

To access Form 1001-G, the most straightforward method is through pdfFiller. This online platform offers a direct download option for the form, ensuring that you always have the latest version at your fingertips. Simply search for Form 1001-G on pdfFiller's website, and you can download it easily.

Alternatively, there are other sources where you can find this form. Government websites and administrative agencies often provide downloadable versions. Always ensure you are getting the most recent version to avoid any discrepancies.

Step-by-step guide to completing form 1001-G

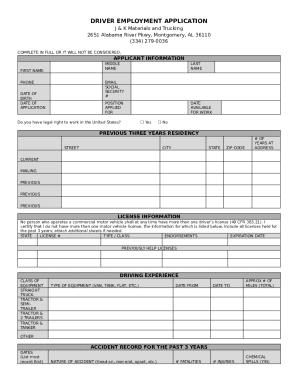

Completing Form 1001-G involves several key sections, each requiring precise input. Here’s a simple guide through the main sections:

Editing the form using pdfFiller

Once you've filled out Form 1001-G, pdfFiller allows you to upload and edit your document seamlessly. Make sure you’re familiar with these editing features to maximize efficiency.

When you upload your completed form to pdfFiller, you can easily edit text fields to adjust any inaccuracies. Moreover, if you need to add comments or annotations, the platform provides tools that let you do so without ruining the form's original layout.

eSigning your form 1001-G

Integrating an electronic signature into your Form 1001-G submission is not only convenient but also legally accepted in most jurisdictions. With pdfFiller, the process of eSigning is straightforward and secure.

To sign your document electronically, follow the steps provided by pdfFiller. This includes specifying your signature style and positioning it accurately within the document.

Collaborating with your team on form 1001-G

If you're working as part of a team, pdfFiller’s collaboration features simplify the process of reviewing and editing Form 1001-G. By utilizing these tools, everyone involved can stay on the same page.

You can share the form with selected individuals, allowing them to make necessary edits or leave comments directly on the document. This facilitates real-time collaboration and enhances overall efficiency.

Managing your form 1001-G after completion

After successfully completing Form 1001-G, proper management of the document is crucial. Using pdfFiller, you can store your documents securely in the cloud, ensuring that they are accessible anytime and anywhere.

Organizing your forms systematically helps in retrieving them promptly when needed. You can create folders based on categories, such as completed forms, pending submissions, or archived documents.

Troubleshooting common issues with form 1001-G

Encountering issues while filling out Form 1001-G can be frustrating. Common errors include missing information, incorrectly filled sections, or formatting issues. Being aware of these pitfalls can help you avoid them.

If you run into problems, examine the filled-out sections carefully. Look for any prompts or instructions provided with the form guiding you to correct these errors.

Frequently asked questions about form 1001-G

Many individuals have similar inquiries surrounding Form 1001-G, specifically concerning its submission guidelines, legal implications, and how to handle unique situations. Addressing these FAQs can enhance understanding and confidence in using the form.

Clarifications regarding the deadlines, acceptable submission methods, and potential consequences of inaccuracies are critical. Ensure you read all instructions provided with the form, as they often contain vital information tailored to your situation.

Leveraging pdfFiller for future document needs

Beyond Form 1001-G, pdfFiller supports the completion of a vast array of forms, allowing users to address their ever-changing document needs efficiently. Utilizing this platform empowers individuals and teams to embrace digital document management solutions fully.

Features such as bulk signing, template creation, and integrated storage solutions are designed to streamline project workflows. This fosters an environment where document completion and management become simplified and hassle-free.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my form 1001-g revised april directly from Gmail?

How do I edit form 1001-g revised april online?

Can I edit form 1001-g revised april on an Android device?

What is form 1001-g revised april?

Who is required to file form 1001-g revised april?

How to fill out form 1001-g revised april?

What is the purpose of form 1001-g revised april?

What information must be reported on form 1001-g revised april?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.