Get the free 500% Notes Due 2033

Get, Create, Make and Sign 500 notes due 2033

Editing 500 notes due 2033 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 500 notes due 2033

How to fill out 500 notes due 2033

Who needs 500 notes due 2033?

Your Complete Guide to the 500 Notes Due 2033 Form

Understanding the 500 notes due 2033 form

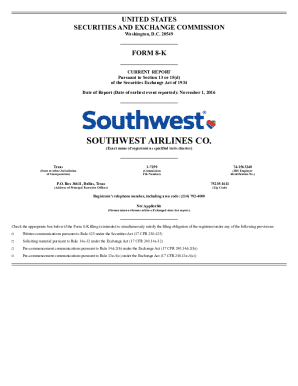

The 500 notes due 2033 form refers to a specific financial document representing a group of senior notes with a maturity date set for 2033. These notes are essentially debt instruments that corporations or institutions use to raise capital. Investors who purchase these notes effectively lend money to the issuer in exchange for periodic interest payments, providing them with a steady income stream until the notes mature. The significance of such a deadline in financial terms cannot be overstated, as it marks the end of the borrowing period and the requirement for the issuer to repay the principal amount.

The context of a 2033 maturity date may reflect various market conditions prevailing at the time of issuance or projected economic conditions that can influence the issuing entity's ability to meet its liabilities. Investors and regulators alike pay close attention to these notes due to their implications on financial health and market stability.

Key features of the 500 notes due 2033 form

The 500 notes due 2033 form encompasses several key components essential for its validity and effectiveness. For example, information required typically includes the total amount of notes issued, the interest rate, payment schedule, and the details of the issuer. Additionally, contact information for the responsible accounting or finance officer should be included to ensure seamless communication regarding any queries or concerns. A detailed breakdown of this information is imperative to validate the form.

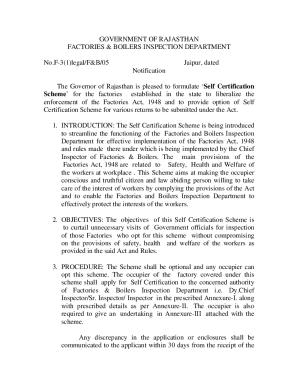

One unique attribute of the 500 notes format is its adherence to specific legal guidelines, such as those outlined in the Financial Services and Markets Act 2000. This may incorporate guidelines regarding public disclosures and provide clear insight into how the proceeds will be used, which is particularly relevant in low-carbon or environmentally sustainable initiatives.

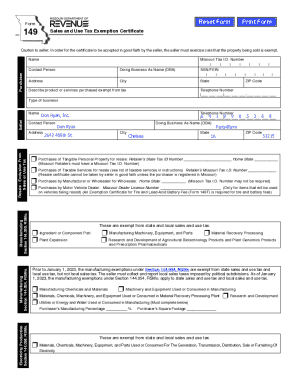

How to fill out the 500 notes due 2033 form

Filling out the 500 notes due 2033 form can seem daunting, but with a systematic approach, it can be tackled more easily. First, gather all necessary information and documentation, including previous financial records indicating the status of existing notes and any proposed uses for the new capital raised. Being organized beforehand eliminates confusion later on.

Next, proceed to fill out each section with the required data. Make sure to double-check each entry, especially figures such as the amount of notes being issued and their corresponding interest rates. Lastly, be mindful of common mistakes, such as miscalculating total liabilities or failing to attach necessary supporting documents, which can lead to delays or complications in processing.

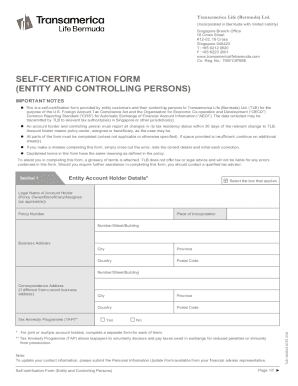

Tools for editing and signing the 500 notes due 2033 form

Utilizing tools like pdfFiller's cloud-based solutions can significantly enhance your efficiency when working with the 500 notes due 2033 form. With pdfFiller, users have access to a range of editing features that allow for easy adjustments and updates to the document. Additionally, eSignature capabilities streamline the process of obtaining necessary approvals without the hassle of printing and scanning, making it particularly efficient.

The interactive tools provided also simplify document management. Teams can collaborate in real-time, ensuring all inputs are gathered swiftly and changes are reflected immediately. Notifications regarding document status update all participants effectively, reducing the potential for miscommunication.

Managing your 500 notes due 2033 process

Efficiently managing the submission and tracking of the 500 notes due 2033 process is crucial. Be proactive by establishing a timeline that outlines critical dates for submission. Make note of potential consequences for delays, including penalties or interest rate adjustments. Create checkpoints throughout the process to assess progress and ensure that all necessary steps are taken on schedule.

Furthermore, organization plays a key role in efficient document management. Use categorization strategies to compartmentalize various documents associated with the notes, ensuring they are easily accessible when needed. Reminders and alerts can further aid in tracking deadlines, providing added assurance that critical dates won't be missed.

Frequently asked questions about the 500 notes due 2033 form

Common queries surrounding the 500 notes due 2033 form often center around eligibility and submission requirements. Generally, companies intending to raise capital through this form need to ensure that they comply with specific regulations set forth by governing bodies. Stakeholders may also ask about follow-up actions after submission, such as what happens if their notes are converted into equity or if they experience changes in market conditions.

Answers to these questions are critical for those involved in managing this financial documentation. Essential considerations include clarifying the process for keeping stakeholders informed about changes and determining appropriate responses to any shifts in financial strategy.

Related documents and resources

There may be several forms that accompany the 500 notes due 2033 form, ensuring that all necessary legal requirements are met. Related documents often include disclosures about the use of proceeds and any additional reporting requirements needed to comply with financial regulations. A thorough review of these documents enhances understanding and allows for better management of the issuance process.

Access to legal and compliance resources is also critical for ensuring that the entity adheres to guidelines laid out in the Financial Services and Markets Act 2000. Consulting with financial experts and legal advisors can provide additional insights and clarification on the requirements specific to your situation.

Press releases and updates

Keeping pace with any recent press releases related to the 500 notes due 2033 form is crucial, as updates may directly impact filing procedures or requirements. Financial landscapes are ever-changing, and timely information regarding new regulations or compliance expectations can prevent potential pitfalls.

Regularly checking for changes surrounding the form ensures that all stakeholders are aligned with current practices and can adapt their strategies accordingly, thus maintaining their credibility within the market and with regulatory agencies.

News & events relevant to 500 notes due

Engaging with educational opportunities surrounding financial documentation can prove advantageous, especially for those involved with the 500 notes due 2033 form. Upcoming seminars and webinars focusing on documentation best practices, regulatory compliance, and new market trends are valuable for current stakeholders.

Industry news is another area where market conditions can impact documentation practices. Keeping an eye on economic changes and their effects on interest rates or corporate borrowing strategies can inform future actions surrounding the issuance of notes.

Release details of the 500 notes due 2033 form

Insights into the development and updates of the 500 notes due 2033 form illustrate its historical context and how it has evolved. Understanding these modifications helps entities remain compliant while leveraging the issuance of senior notes effectively. Stakeholders must consider how revisions can redefine expectations, not only for compliance but also for market participation.

Looking forward, potential modifications to the form and its submission process may arise from shifts in market conditions, technological advancements, or evolving regulations. Anticipating these trends allows companies to navigate their financial strategies more effectively, capitalizing on opportunities.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find 500 notes due 2033?

How do I complete 500 notes due 2033 online?

How do I edit 500 notes due 2033 in Chrome?

What is 500 notes due 2033?

Who is required to file 500 notes due 2033?

How to fill out 500 notes due 2033?

What is the purpose of 500 notes due 2033?

What information must be reported on 500 notes due 2033?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.