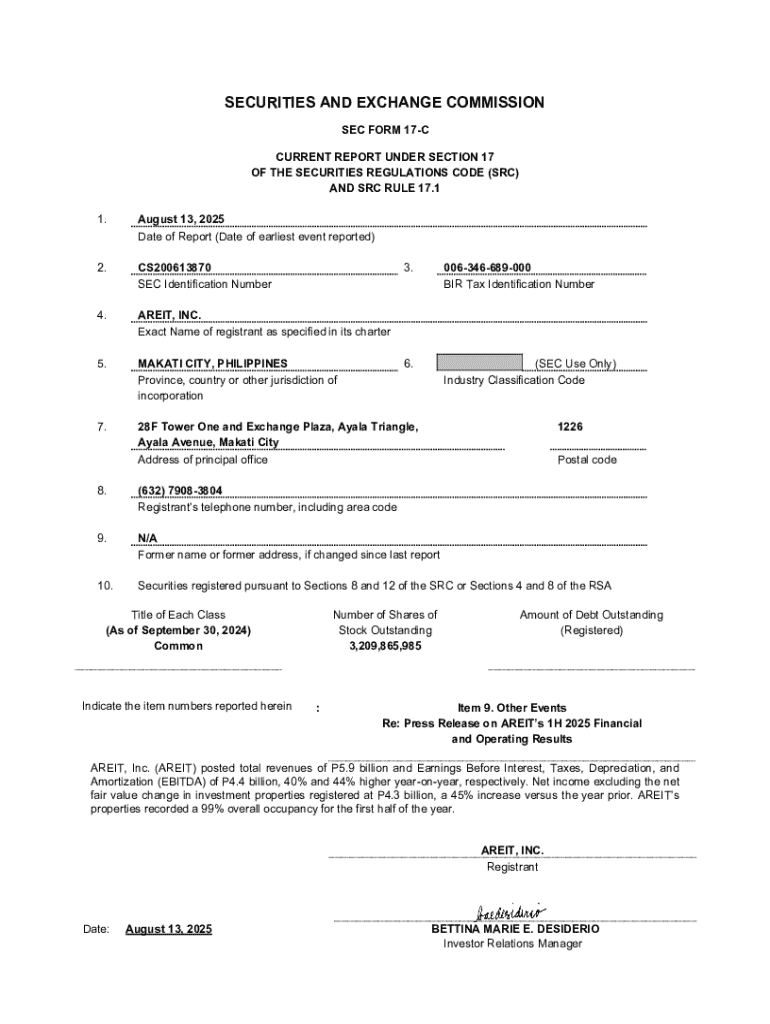

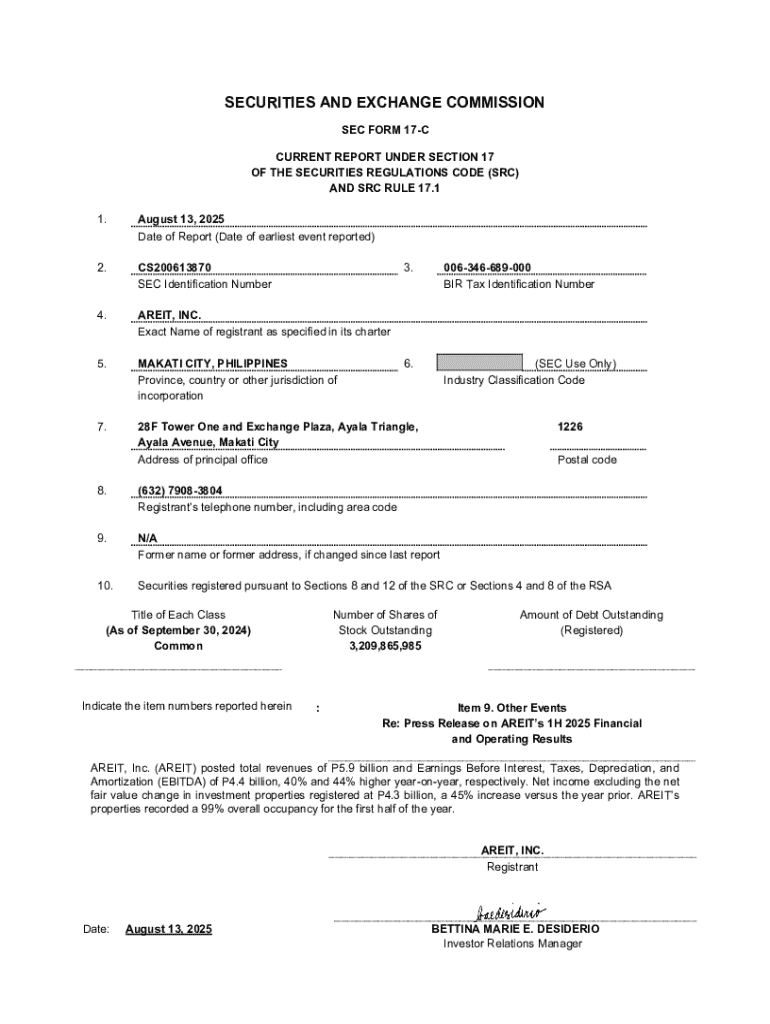

Get the free 9 billion and Earnings Before Interest, Taxes, Depreciation, and

Get, Create, Make and Sign 9 billion and earnings

Editing 9 billion and earnings online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 9 billion and earnings

How to fill out 9 billion and earnings

Who needs 9 billion and earnings?

9 billion and earnings form: Your comprehensive guide

Understanding the 9 billion and earnings form

The 9 billion and earnings form is a crucial document for various stakeholders, primarily individuals and businesses who need to report their financial earnings accurately. This reporting form not only serves to ensure compliance with tax laws but also plays an essential role in financial transparency. Stakeholders involved range from individual taxpayers and accountants to finance departments within corporations.

Given its importance, understanding the specifics of this form can facilitate better financial management and compliance with regulatory requirements. By ensuring accurate reporting, users not only avoid potential penalties but also optimize their tax liabilities, making the comprehension of every element within this form indispensable.

Purpose and use cases

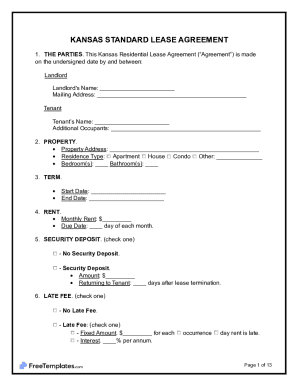

The primary purpose of the 9 billion and earnings form is to collect detailed income information for tax calculations. This form needs to be filled out by various entities including individuals, businesses, and organizations who must report their earnings for tax purposes. Situations where this form is required include filing annual tax returns, completing audits, or applying for loans.

Individuals like freelancers and contractors often utilize this form to report income received throughout the year. Teams from finance departments within institutions complete this form to ensure collective earnings are documented properly. Understanding these diverse scenarios helps in tailoring the completion process for various users and their specific contexts.

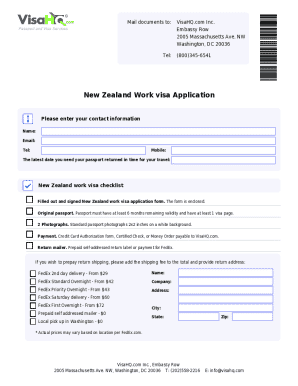

Navigating the 9 billion and earnings form

Accessing the 9 billion and earnings form is the first step towards efficient financial reporting. Users can usually find this form on government tax agency websites or financial service providers. To locate the form online, follow these steps:

Once downloaded, users can open the form with any standard PDF reader, ensuring they have the necessary tools to fill it out efficiently.

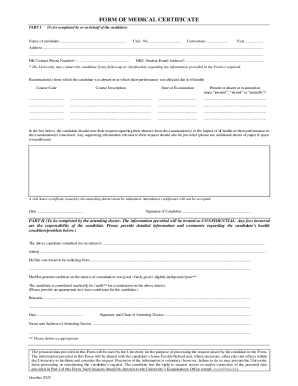

Detailed breakdown of the form components

Each section of the 9 billion and earnings form serves a specific purpose and requires specific data. Here’s a comprehensive look at its components:

To achieve precise reporting, users should pay special attention to each data point, as errors can lead to compliance issues or financial discrepancies.

Step-by-step instructions for completion

Filling out the 9 billion and earnings form requires meticulous attention. Here are detailed instructions to assist you:

After completing the form, conduct a final review by making sure there are no overlooked errors. This checklist can help ensure compliance and accuracy.

Editing and modifying the 9 billion and earnings form

Sometimes, edits on the 9 billion and earnings form may be necessary after initial completion. Utilizing pdfFiller’s editing tools can facilitate this process. Editing forms in PDF format is simple; users can navigate to the edit section, alter text as required, and add annotations if needed.

By understanding how to edit and amend submissions, users can confidently manage their reporting.

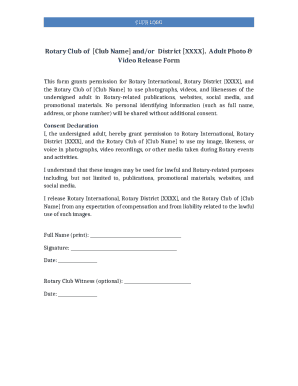

eSigning the 9 billion and earnings form

eSigning the 9 billion and earnings form is becoming increasingly essential in today’s digital workflow. The legal standing of eSigned documents is recognized, providing benefits that streamline the submission process.

Implementing eSigning not only speedens the process but also enhances document security, with encrypted signing options available.

Sharing and collaborating on the 9 billion and earnings form

Collaboration on the 9 billion and earnings form is necessary when multiple individuals or departments are involved in financial reporting. pdfFiller provides various sharing options that foster teamwork while maintaining document security.

Incorporating feedback from team members is crucial. Use pdfFiller's comment and revision tracking features to implement changes efficiently.

Best practices for managing your 9 billion and earnings forms

Efficient management of the 9 billion and earnings form is essential for maintaining compliance and organization. Create a structured filing system for your documents, ensuring everything is categorized and easily retrievable.

Tracking submission deadlines can also prevent missed filings. Employ calendar reminders and dedicated software to keep important dates organized.

Common issues and troubleshooting

It's not uncommon for users to face challenges while filling out the 9 billion and earnings form. Certain issues frequently arise, such as input errors or system glitches. Familiarizing yourself with common mistakes can mitigate future problems.

For further assistance, pdfFiller offers support options, including user guides and customer service representatives available to help navigate any issues.

Insights into the future of financial reporting

The landscape of financial reporting is evolving, and trends show an increasing reliance on digital solutions such as pdfFiller for form processing. These innovations lead to enhanced efficiency, compliance, and accuracy in earnings reporting.

As these trends continue, pdfFiller stands ready to guide users, offering a seamless platform that empowers individuals and teams to report their earnings accurately and efficiently.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit 9 billion and earnings online?

How do I make edits in 9 billion and earnings without leaving Chrome?

How do I complete 9 billion and earnings on an iOS device?

What is 9 billion and earnings?

Who is required to file 9 billion and earnings?

How to fill out 9 billion and earnings?

What is the purpose of 9 billion and earnings?

What information must be reported on 9 billion and earnings?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.