Get the free Tax Preparation Client Intake Form

Get, Create, Make and Sign tax preparation client intake

Editing tax preparation client intake online

Uncompromising security for your PDF editing and eSignature needs

How to fill out tax preparation client intake

How to fill out tax preparation client intake

Who needs tax preparation client intake?

Tax preparation client intake form - a comprehensive guide

Understanding the Tax Preparation Client Intake Form

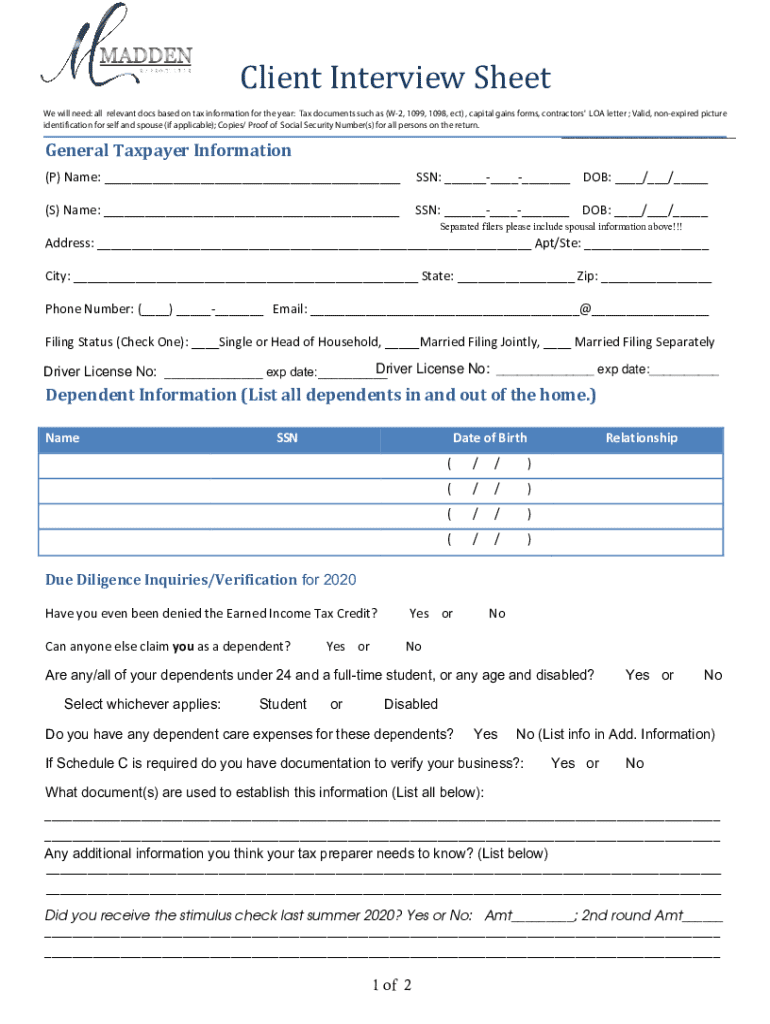

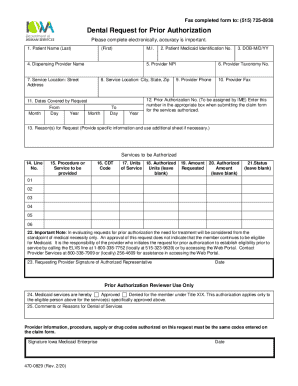

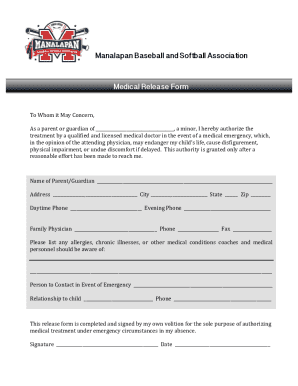

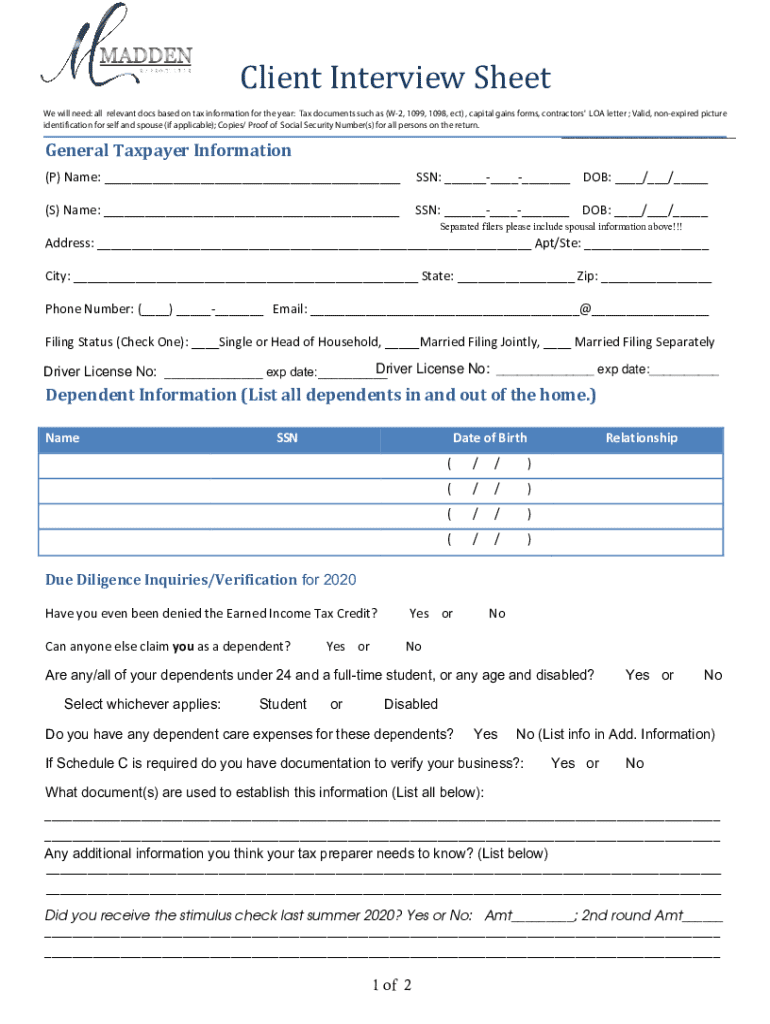

A tax preparation client intake form is a crucial document used by tax preparers to collect vital information from clients for filing their tax returns. This form serves multiple purposes, primarily to gather all necessary data needed to ensure an accurate and compliant submission to tax authorities. It encapsulates a wide range of details including personal identification, income sources, deductions, and credits, making it indispensable for both taxpayers and tax preparers.

The importance of the tax preparation client intake form cannot be understated. For preparers, it acts as a structured tool that streamlines the collection of data, ensuring no critical items are overlooked. For clients, it represents a thorough approach to managing sensitive financial information with confidentiality, which ensures that their tax return is prepared correctly and efficiently.

Key components of the form

The tax preparation client intake form typically contains several key components that help in organizing and efficiently obtaining relevant data. Each section of the form is designed to target specific information required by tax preparers to maximize accuracy. These components include:

Why use a tax preparation client intake form?

Utilizing a tax preparation client intake form significantly streamlines the tax preparation process. By having a predefined structure in place, preparers can efficiently gather the essential information that is crucial to the filing process. This preemptive data collection minimizes the back-and-forth communication often required between a tax preparer and their clients, saving valuable time for both parties.

Furthermore, employing an intake form greatly enhances accuracy and compliance. Errors in tax preparation can lead to penalties and unnecessary delays. A well-structured intake form minimizes the chances of errors during data collection, ensuring that all necessary information is captured right from the outset. As a result, clients can have peace of mind knowing their tax affairs are being handled with utmost diligence.

How to fill out a tax preparation client intake form: step-by-step guide

Filling out a tax preparation client intake form is straightforward when guidance is followed. Here's a detailed step-by-step guide:

Tools to simplify the filling process

pdfFiller offers a suite of tools designed to enhance your experience while using the tax preparation client intake form. Its interactive tools help streamline data entry, allowing for smooth filling and editing of the form. The eSignature feature empowers users to quickly approve documents electronically, enabling faster processing times.

Moreover, pdfFiller provides collaboration features that are particularly beneficial for teams. Multiple users can work on the same document, allowing for real-time updates and communication. This integration greatly improves the teamwork efficiency often required in a tax preparation scenario.

Common mistakes to avoid

While filling out a tax preparation client intake form, certain common mistakes should be avoided to ensure the accuracy of the information. Typical inaccuracies often occur in the personal information section. Taxpayers should verify that their names and Social Security numbers are reflected correctly to prevent filing issues.

Another frequent pitfall is omitting income sources. Clients must ensure that they list all income accurately, including less obvious sources like freelance work or investment income. Clients also need to clarify their understanding of deductions to avoid misunderstandings that can result in unintended omissions.

Customization options for your tax preparation client intake form

Customization can significantly enhance the relevance and usability of the tax preparation client intake form. pdfFiller allows users to create tailored forms that cater to specific client needs, adding or removing fields as necessary. This flexibility is especially beneficial for businesses in showcasing their branding in client engagement processes.

Once customized, users can easily save their forms in various formats, ensuring compatibility with other applications. There are also multiple options for sharing these forms with clients, whether through email or direct sharing links via pdfFiller, making the process seamless and user-friendly.

Alternatives and related forms

The tax preparation client intake form is one of several forms available for tax-related documentation. Other forms such as the Expense Report Form or 1099 Form cater to specific scenarios, such as business payments or self-employment income. Understanding when to use alternative forms can save time and streamline the filing process.

It is crucial for tax preparers and clients alike to be aware of these related forms and their purposes. Quick access to popular forms can be facilitated through platforms like pdfFiller, which ensures dynamic access to everything a taxpayer might need based on their specific circumstances.

Feedback and improvement

An essential aspect of any effective intake process is gathering client feedback. Collecting responses regarding the ease of the form, clarity of instructions, and overall experience can illuminate areas needing improvement. Client feedback can be sought through surveys or direct communication, emphasizing the importance of their opinions in refining the form further.

Once feedback is gathered, analyzing the results will guide future adjustments to the tax preparation client intake form. Continuous improvement of the form enhances its effectiveness and meets client needs better— fostering satisfaction and encouraging repeat business.

Thank you for using pdfFiller!

Thank you for taking the time to engage with pdfFiller for your tax preparation needs. We value our users’ feedback and invite you to share your experiences with the tax preparation client intake form. Engaging in feedback helps us improve our services and better serve you in the future.

Additionally, becoming part of the pdfFiller community opens doors to numerous resources and features, including tips and updates on enhancing document management further.

User rating poll

Your feedback matters to us! Please participate in our poll regarding your experience with the tax preparation client intake form. We would love to hear your thoughts, whether it was your satisfaction level, the ease of use, or any suggestions for improvements. Your insights are pivotal in shaping our services.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in tax preparation client intake without leaving Chrome?

How do I complete tax preparation client intake on an iOS device?

Can I edit tax preparation client intake on an Android device?

What is tax preparation client intake?

Who is required to file tax preparation client intake?

How to fill out tax preparation client intake?

What is the purpose of tax preparation client intake?

What information must be reported on tax preparation client intake?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.