Get the free 8800 Instruction Manual. 8800A & 8800B Trace Moisture Analyzer

Get, Create, Make and Sign 8800 instruction manual 8800a

How to edit 8800 instruction manual 8800a online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 8800 instruction manual 8800a

How to fill out 8800 instruction manual 8800a

Who needs 8800 instruction manual 8800a?

Comprehensive Guide to the 8800 Instruction Manual 8800A Form

Understanding the 8800A form: An overview

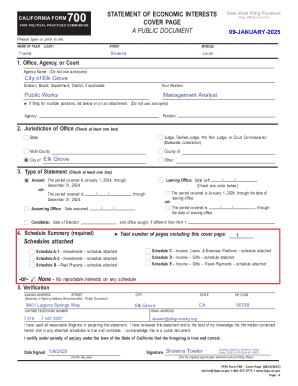

The 8800A form is a crucial document designed to simplify the tax reporting experience for both individuals and teams. Its primary purpose is to report specific financial information to tax authorities, ensuring that all submissions meet compliance requirements. Understanding when to use the 8800A form is essential—it generally becomes necessary when individuals or organizations reach specific income thresholds or experience particular financial situations that require transparent reporting.

Common scenarios for submission include changes in income levels, claiming tax credits and deductions, or filing previous transactions that were missed during the regular tax season. Familiarity with the 8800 instruction manual provides clarity on ensuring the form is filled out accurately and accurately reflects your financial standing.

Getting started with the 8800A form

Before starting to fill out the 8800A form, gather all necessary information and documents. This includes your Social Security Number (SSN) or Employer Identification Number (EIN), W-2s, 1099s, and any relevant records that indicate your sources of income. Having these documents ready can significantly streamline the process and reduce the chance of errors.

For completing the form, you will need specific tools: a reliable internet connection, access to the pdfFiller platform, and a computer or mobile device. These tools will facilitate easy editing, signing, and managing of your documents, helping you complete your filing obligations efficiently.

Step-by-step instructions for filling out the 8800A form

The process of filling out the 8800A form is straightforward when approached section by section. Below is a breakdown of the form's sections:

Editing and managing your 8800A form

Utilizing pdfFiller’s editing tools is essential to ensure your 8800A form is polished and professional. These tools allow you to easily insert or delete information as need be, and format text to meet your specific style preferences. This is vital in ensuring clarity and readability, particularly when submitting the form for review by tax authorities.

Once your form is completed, you have several options for saving and exporting it. pdfFiller allows you to store your document securely in the cloud, providing peace of mind that your sensitive information is protected. You can also choose different file formats for export, including PDF and Word, based on your needs.

eSigning the 8800A form

The eSigning process simplifies the often cumbersome task of collecting signatures on paper forms. pdfFiller’s eSignature features let you add your signature electronically, making the process faster and more secure. Ensure you understand the legal implications of eSigning to confirm that your submission adheres to all regulatory requirements.

This electronic method not only expedites the submission process but also mitigates risks associated with lost paperwork or delays due to mail.

Collaboration features for teams

For teams managing the 8800A form collaboratively, pdfFiller offers impressive features. Inviting collaborators to review your 8800A form facilitates better input and ensures accuracy. Real-time editing and feedback make it easy to incorporate multiple perspectives and corrections efficiently.

Furthermore, managing version control is critical. pdfFiller enables you to track changes and revert to previous versions if needed, ensuring that the most current information is accurately reflected.

Troubleshooting common issues with the 8800A form

Even with the best preparations, issues can arise when filling out the 8800A form. Common errors often include incorrect income reporting or missing information. To resolve these, carefully review all sections before submission, utilizing the guide to ensure compliance with the requirements.

It's beneficial to prepare for FAQs surrounding the 8800A submission process, particularly questions related to filing deadlines and corrections after submission.

Final steps before submission

Once you have filled the form, ensure you double-check all information for accuracy. This step is crucial for avoiding potential penalties or processing delays. Implement best practices for submitting your 8800A form by adhering to electronic filing options whenever possible, as it saves time and provides immediate proof of submission.

Ensure compliance with submission deadlines by marking key dates on your calendar. Timely submissions guard against unnecessary stress and financial implications.

Using pdfFiller to optimize your document management

For long-term document storage and management, pdfFiller offers various features, including secure cloud storage, allowing you to access your documents from anywhere. This is especially beneficial for individuals or teams that need to revisit or revise documents frequently.

The platform's ability to maintain your document workflow means your tax-related forms, including the 8800A, can be easily organized, accessed, and managed all in one place, promoting efficiency.

User testimonials and case studies

Many users have successfully navigated the complexities of submitting the 8800A form through pdfFiller. Testimonials highlight how streamlined the process has become due to cloud-based collaboration, real-time editing, and efficient eSigning features.

Case studies across diverse industries showcase how pdfFiller has transformed the experience for teams dealing with intensive paperwork, making tax compliance straightforward and stress-free.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my 8800 instruction manual 8800a in Gmail?

How can I modify 8800 instruction manual 8800a without leaving Google Drive?

Can I edit 8800 instruction manual 8800a on an Android device?

What is 8800 instruction manual 8800a?

Who is required to file 8800 instruction manual 8800a?

How to fill out 8800 instruction manual 8800a?

What is the purpose of 8800 instruction manual 8800a?

What information must be reported on 8800 instruction manual 8800a?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.