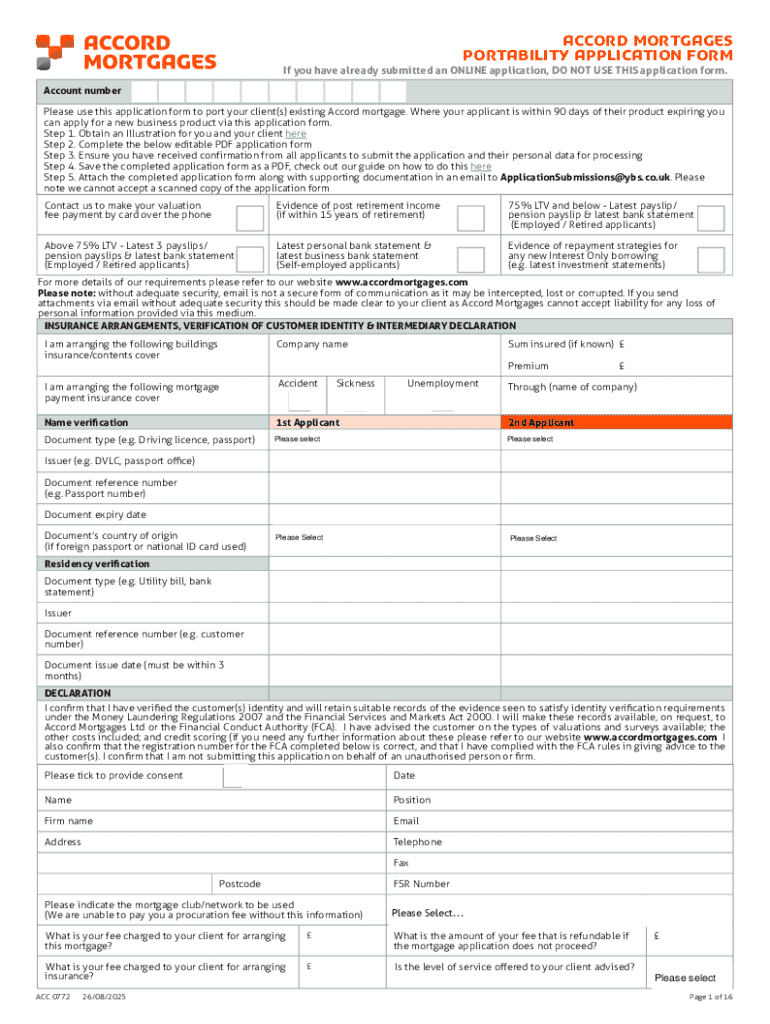

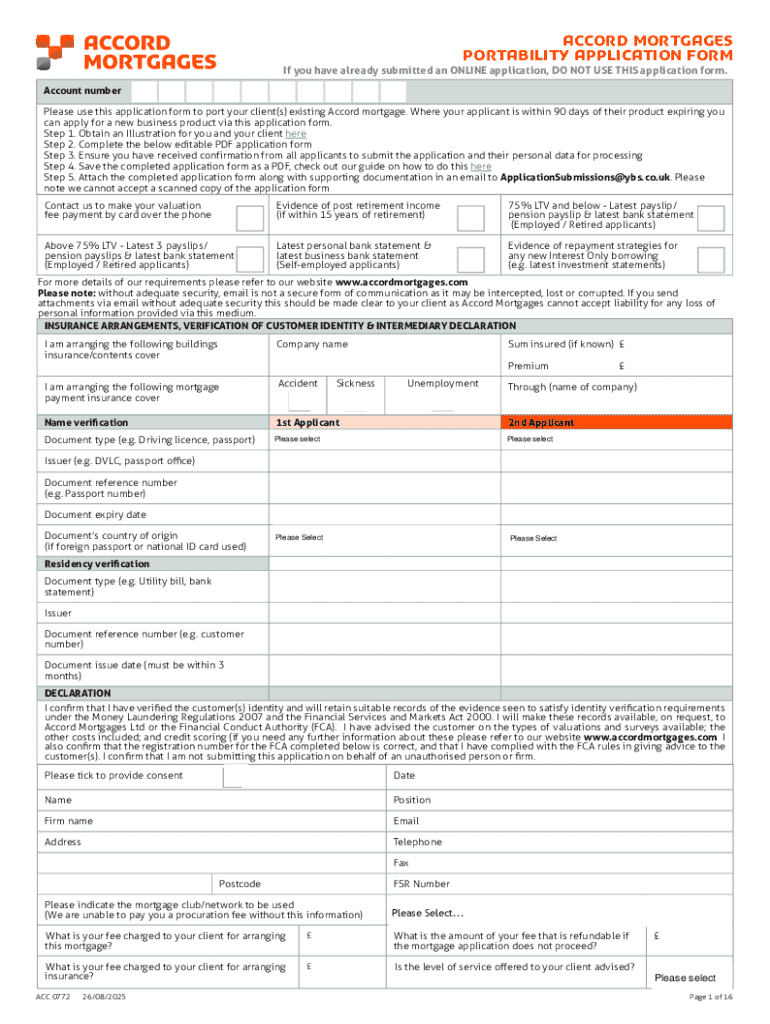

Get the free Portability mortgage application form ACC (ACC0772)

Get, Create, Make and Sign portability mortgage application form

How to edit portability mortgage application form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out portability mortgage application form

How to fill out portability mortgage application form

Who needs portability mortgage application form?

Portability Mortgage Application Form - How-to Guide

Understanding portability in mortgages

Mortgage portability refers to the ability to transfer a current mortgage from one property to another without incurring penalties. This feature is especially beneficial for homeowners wishing to maintain their existing mortgage rate when they move to a new home. Porting can help save money when interest rates have increased since you first acquired your mortgage, as it allows you to retain lower terms.

There are several significant benefits to porting a mortgage. First, you can avoid hefty penalties associated with breaking a mortgage if you sell your current property. Second, it allows you to secure your existing interest rate even when less favorable market conditions prevail. Overall, portability adds a layer of financial flexibility that can make a significant difference during real estate transitions.

Situations that might warrant porting include relocating for a job, needing a larger home due to a growing family, or simply wanting a change of scenery. Beyond financial considerations, these personal circumstances can greatly influence a homeowner's decision to port their mortgage rather than pursue a brand-new loan.

Key information about porting a mortgage

To successfully port a mortgage, borrowers must meet specific eligibility criteria. Typically, you must have an existing mortgage with a lender that allows portability. Some common requirements include being in good standing on your current mortgage, maintaining consistent payment history, and ensuring the new property meets the lender’s criteria.

Potential fees and charges that may apply during the porting process can significantly impact the decision. Early repayment charges may arise for breaking the existing mortgage before its term ends, especially if porting is not sanctioned. Additionally, buyers should consider potential costs associated with the new property, such as closing costs, inspections, and any additional fees required by the lender.

Steps to submit a porting application

The porting application process begins by reviewing your current mortgage terms. Familiarizing yourself with your lender’s specific porting policy is crucial, as each lender may have unique stipulations. Pay attention to potential penalties and fees you could incur by not following the right procedures.

After grasping your current terms, the next step is to communicate directly with your lender. Prepare relevant questions, such as how porting will affect your loan balance, timelines, and any necessary documentation required to initiate the process. Clear communication helps you navigate potential challenges and sets realistic expectations.

Once you have gathered this information, it’s time to prepare the necessary documentation to support your application. This typically includes proof of income, current mortgage information, and anything specific your lender may request. Utilizing tools like pdfFiller allows you to streamline the process, enabling efficient collection and submission of these documents.

The next crucial step is to complete the portability mortgage application form accurately. pdfFiller provides a user-friendly platform to fill out, edit, and sign forms easily. Ensure all fields are completed precisely to avoid delays in processing your application.

Once the application form is complete, submitting your application promptly is essential. With pdfFiller, you can file your application electronically, receive confirmation of submission, and track your application status, ensuring a smooth and efficient process.

Common questions about porting mortgage applications

Homeowners often wonder what happens if their new property costs more or less than their existing mortgage. Should the new property exceed the current loan amount, additional financing may be necessary. Conversely, if the new property costs less, you could end up with surplus equity that may influence your mortgage terms.

The duration of the porting process varies widely, dependent on factors such as the lender's efficiency and the completeness of your documentation. Generally, expect several weeks to process from initiation to approval. Understanding this timeframe is key in aligning your home-buying timeline with your mortgage needs.

In the event your application is denied, reach out to your lender for feedback. They can provide insights into the denial's reasons, which can guide your next steps. Additionally, assess your options for appealing the decision or possibly adjusting your application.

Awareness of deadlines for submitting a porting application is also important. Most lenders require applications to be processed within a specific timeframe, often tied to your mortgage terms. Being proactive in monitoring these timelines can prevent lapses that might lead to financial implications.

Utilizing pdfFiller for your mortgage documents

Using pdfFiller to manage your portability mortgage application form comes with several benefits. The platform simplifies document management and organization, allowing for easy access from anywhere. Its seamless eSigning features expedite the submission process, making it easier to finalize your application promptly.

Navigating pdfFiller for your porting application is straightforward. Start by accessing the platform and searching for the appropriate form template. The intuitive interface allows you to fill out, sign, and edit documents without hassle. Additionally, features such as auto-save ensure that your progress is stored, preventing loss of information.

Take advantage of interactive tools available on pdfFiller to streamline the filing process. You can annotate, highlight key areas of your application, and even collaborate with relevant stakeholders, ensuring you’re fully prepared for the submission stage.

Tips for a successful porting process

Staying organized is paramount during the porting process. Keep track of all important deadlines and documentation to ensure nothing falls through the cracks. Maintaining clear records also assists in facilitating communication with your lender and any real estate agents involved in the transaction.

Communicating effectively with all stakeholders can significantly enhance your porting experience. Periodic updates to your real estate agents or attorneys about your application status can help identify potential issues early and streamline the overall process.

Finally, prepare for potential hurdles that may arise during the porting process. Common challenges include complex documentation requirements or changes in your financial situation. Having contingency plans in place can help you navigate these hurdles more efficiently.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute portability mortgage application form online?

How can I edit portability mortgage application form on a smartphone?

Can I edit portability mortgage application form on an iOS device?

What is portability mortgage application form?

Who is required to file portability mortgage application form?

How to fill out portability mortgage application form?

What is the purpose of portability mortgage application form?

What information must be reported on portability mortgage application form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.