Get the free Machinery Breakdown Insurance-Proposal Form. ...

Get, Create, Make and Sign machinery breakdown insurance-proposal form

Editing machinery breakdown insurance-proposal form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out machinery breakdown insurance-proposal form

How to fill out machinery breakdown insurance-proposal form

Who needs machinery breakdown insurance-proposal form?

Comprehensive Guide to Machinery Breakdown Insurance Proposal Form

Understanding machinery breakdown insurance

Machinery breakdown insurance protects businesses against financial losses arising from the breakdown of machinery. This type of insurance covers the costs of repairs, replacement, and sometimes even the income lost due to machinery not being operational. While some might consider it ancillary, the reality is that a machinery breakdown can lead to substantial financial burdens, particularly for industries reliant on continuous operations, such as manufacturing, construction, and logistics.

The significance of having machinery breakdown insurance cannot be overstated. In a world where machinery plays a pivotal role in business processes, even a minor breakdown can result in significant downtime. By securing the right insurance, companies can minimize risks, ensuring continuity in operations while safeguarding their bottom line. Terminology related to this insurance should be understood to make well-informed decisions; terms like 'covered events,' 'exclusions,' and 'deductibles' are crucial to grasp.

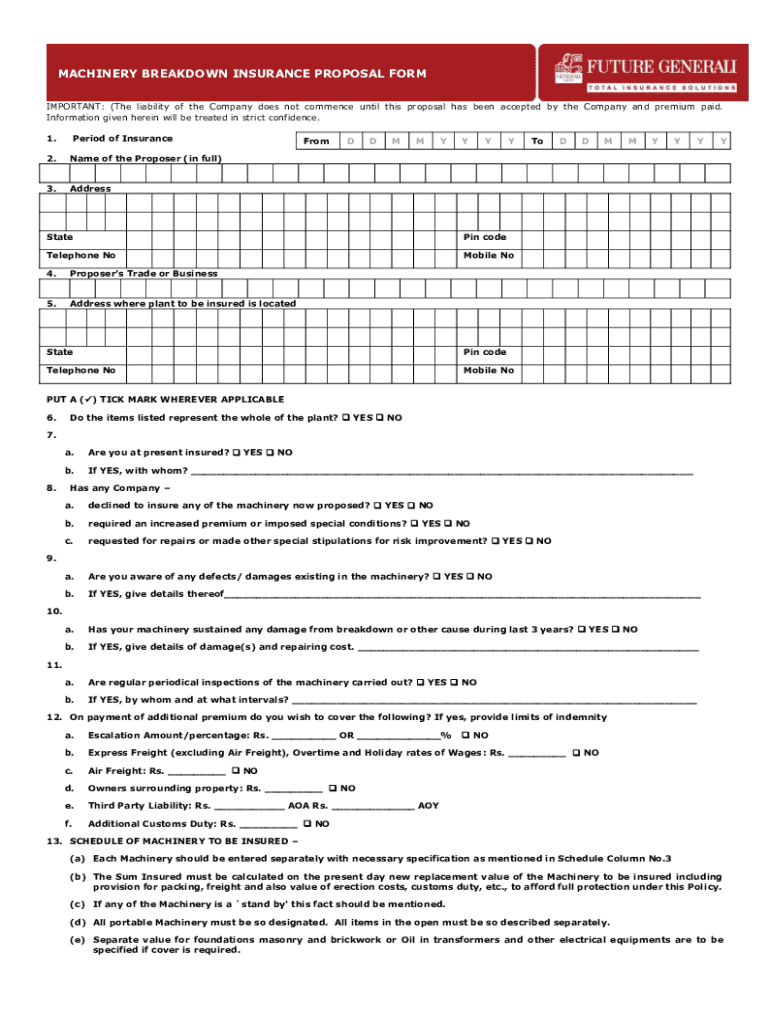

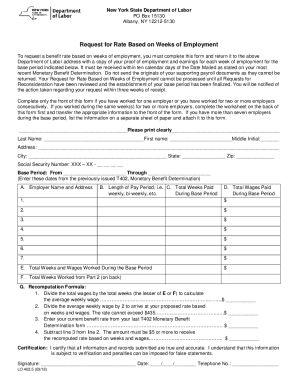

The machinery breakdown insurance proposal form explained

The machinery breakdown insurance proposal form is a critical document for businesses looking to secure coverage. This form acts as a preliminary assessment tool that provides insurers necessary information about the machinery to be insured and the specific coverage needs. Accurate completion of this proposal is essential; missing or incorrect information can delay approval or even lead to purchase of inadequate coverage.

When filling out the proposal form, you will encounter various sections that require detailed information about your business operations and machinery. It is important to approach this document with precision, as the information provided will hinge the overall insurance premium and policy approval. Notably, honest representations can prevent future disputes or claim denials.

Preparing to fill out the proposal form

Before diving into the completion of your machinery breakdown insurance proposal form, it is essential to gather all necessary documents and information, which can streamline the process. Documentation such as previous insurance details, machine specifications, financial records, and a log of past incidences can prove invaluable. Having this information prepared not only expedites the process but also ensures that you present a comprehensive picture of your machinery and its operational needs.

Understanding your machinery and its usage is crucial. Consider questions like: What are the primary functions of each machine? Have any breakdowns occurred in the past? The answers will shape not only the coverage you seek but will also help in justifying the chosen coverage during the proposal assessment. Collecting detailed standards like maintenance records and use frequency can substantiate your requirements.

Step-by-step instructions for filling out the proposal form

Filling out the machinery breakdown insurance proposal form can seem daunting, but breaking it down into manageable sections makes it simpler. Here are the step-by-step instructions to help guide you through the process.

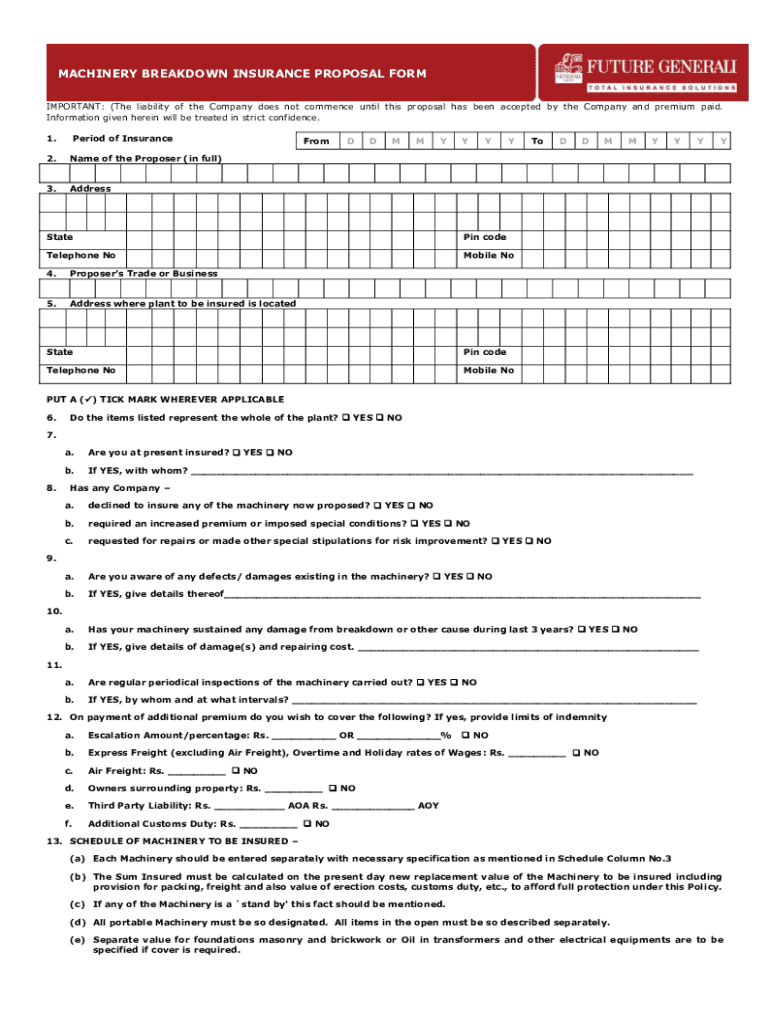

Section 1: Insured’s details

Start with the insured’s details. Include full name, address, and contact information. Be sure the name is the same as the legal business name to avoid discrepancies later.

Section 2: Machinery information

In Section 2, provide a comprehensive overview of the machinery. List the types and number of machinery you want insured, along with their ages, current market value, and physical conditions. This section helps insurers determine how much risk they are taking based on the machinery's status.

Section 3: Coverage requirements

Next, outline your coverage requirements. Clearly define the level of coverage you desire, whether that be full or partial, as well as any optional add-ons or endorsements you might wish to consider. This is your chance to customize your coverage.

Section 4: Claims history

Section 4 asks about your claims history. Disclose any previous claims or incidents related to machinery breakdowns, as this will impact your premium rates. Transparency is key, as omitting details can affect your future claims.

Section 5: Verification and signature

Lastly, review the entire proposal form to ensure accuracy. Sign the form digitally using tools like pdfFiller, ensuring that all provided information aligns with your business needs.

Interactive tools for document management

Utilizing cloud-based platforms like pdfFiller enhances your ability to manage your machinery breakdown insurance proposal form efficiently. With pdfFiller, you can easily edit and fill out forms online, which allows for collaborative participation from stakeholders and team members. Its interactive features include signatures, streamlined document sharing, and real-time editing, so everyone can stay up to date.

Additional features in pdfFiller that cater to your insurance documentation needs include version history tracking, which helps you monitor changes and ensure that nothing is lost during collaboration. By leveraging these tools, you can turn what once seemed a daunting process into a more manageable task.

Common mistakes to avoid

While completing the machinery breakdown insurance proposal form, users often encounter pitfalls that can impede their insurance acquisition process. One common mistake is leaving sections incomplete, which can lead to delays or nullification of an application. Furthermore, misunderstanding the different coverage options and their implications can leave businesses underinsured.

It’s essential to double-check all entered machinery information for accuracy. Data such as the machine's current condition, value, and previous claims history is fundamental in determining the risk profile that the insurer will assess.

Frequently asked questions (FAQs)

Understanding the intricacies of the machinery breakdown insurance proposal form could raise several questions. One common question is, 'How long does the approval process take?' Generally, this process can vary based on the complexity of your application and the insurer, but it usually takes a few days to a couple of weeks.

Another frequent concern is related to coverage scenarios, such as 'What if my machinery is not covered?' In such cases, reviewing your policy details and speaking directly with your insurance agent can clarify your coverage options. Lastly, many applicants wonder if they can update their form after submission. Further clarifications or amendments can typically be made by discussing it with your insurer.

Final checks before submission

Prior to submitting your machinery breakdown insurance proposal form, conducting final checks ensures that the form is complete and accurate. A checklist can be immensely helpful at this stage. Verify that all sections are filled, review the data for accuracy, and confirm that necessary documents are prepared for submission.

Don’t hesitate to reach out to your insurance agent for any clarifications needed before the final submission. A proactive approach can save you from future hassles related to misunderstood terms or uncovered machinery.

Understanding the follow-up process

Once your machinery breakdown insurance proposal form is submitted, it's vital to understand the follow-up process. Insurers will typically notify you once they have reviewed your application, a process that can take varying lengths of time depending on the insurer's workload and the complexity of your application.

If your proposal is accepted, you can expect to move forward with finalizing your policy details. However, if your proposal is declined, don’t hesitate to ask for clarity on why that decision was made. Understanding such feedback can be valuable for future applications or adjustments you might need to make.

Resources for ongoing support

To ensure that your machinery breakdown insurance remains effective, staying informed about your policy and possible changes is crucial. Regularly review your document and update it as needed, especially if there are changes to your operational procedures or machinery.

Utilizing tools like pdfFiller for ongoing document management will keep your insurance documentation organized and accessible. With resources available online, you can continually stay updated and informed about the best practices and coverage options to adequately protect your investments.

Expert insights on insurance viability

Insights from industry experts shed light on securing machinery breakdown insurance effectively. Interviews reveal that understanding market trends and risk assessments play significant roles in customizing adequate coverage. Businesses that successfully navigate the landscape of insurance often share commonalities—pragmatic approaches to risk management and transparency during the proposal process.

Examining case studies where claims were successfully handled can provide valuable lessons regarding documentation and compliance with policy terms. These real-world examples emphasize that companies taking proactive measures not only secure better rates but also enjoy smoother claims processes down the line.

Preparing for renewal and updates

As the time for renewal approaches, reviewing your machinery breakdown insurance proposal form should be a priority. Given the ever-evolving nature of machinery and business operations, regular updates to the proposal can ensure you have the necessary coverage at all times. This proactive measure can significantly reduce the risk of gaps in coverage and unexpected claims denials.

Leveraging tools like pdfFiller for managing documents can facilitate this renewal process. Regular reminders set through the platform can alert you to impending renewals, while efficient document management helps keep your insurance relevant to your business needs. Maintaining open lines of communication with your insurance agent will also enhance your ability to navigate the renewal landscape efficiently.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get machinery breakdown insurance-proposal form?

How do I fill out the machinery breakdown insurance-proposal form form on my smartphone?

How do I complete machinery breakdown insurance-proposal form on an iOS device?

What is machinery breakdown insurance-proposal form?

Who is required to file machinery breakdown insurance-proposal form?

How to fill out machinery breakdown insurance-proposal form?

What is the purpose of machinery breakdown insurance-proposal form?

What information must be reported on machinery breakdown insurance-proposal form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.