Get the free Alpha Insurance - proposal form

Get, Create, Make and Sign alpha insurance - proposal

How to edit alpha insurance - proposal online

Uncompromising security for your PDF editing and eSignature needs

How to fill out alpha insurance - proposal

How to fill out alpha insurance - proposal

Who needs alpha insurance - proposal?

Alpha Insurance - Proposal Form: A Comprehensive Guide

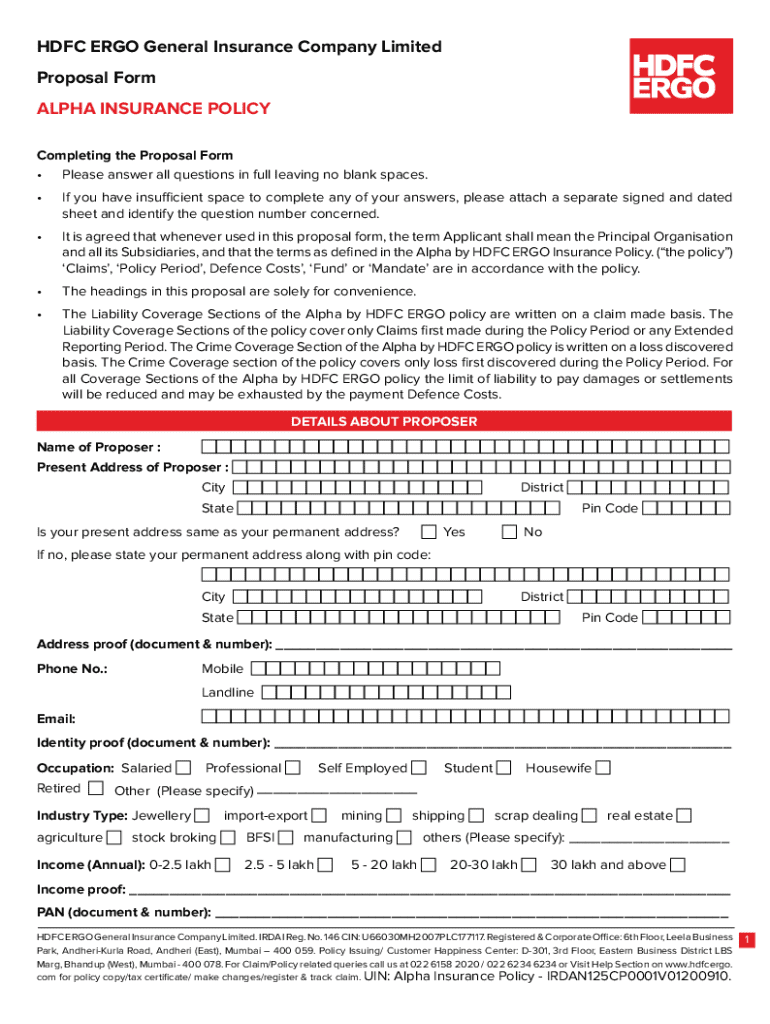

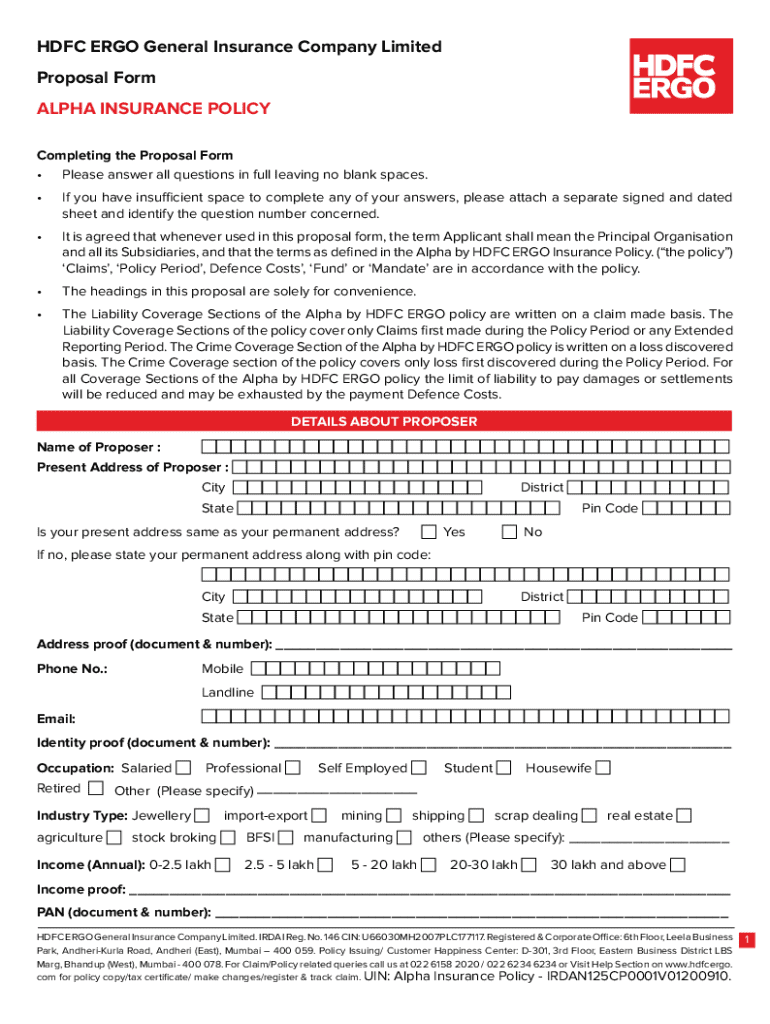

Understanding the Alpha Insurance proposal form

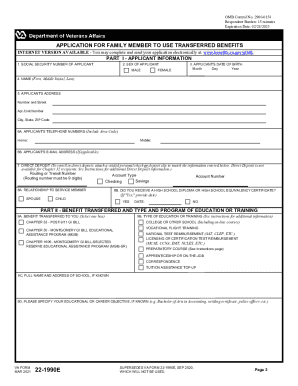

The Alpha Insurance proposal form is a critical component of the insurance application process, designed to collect essential information from individuals and teams seeking insurance services. This form acts as the initial touchpoint between the applicant and the insurance provider, ensuring that all necessary data is conveyed accurately and clearly.

Completing the proposal form accurately is vital as it can significantly impact the underwriting process and the premium rates that will be offered. For individuals and organizations, understanding this form helps in making informed decisions about the coverage they require.

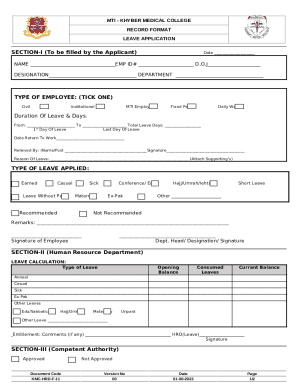

Key components of the proposal form

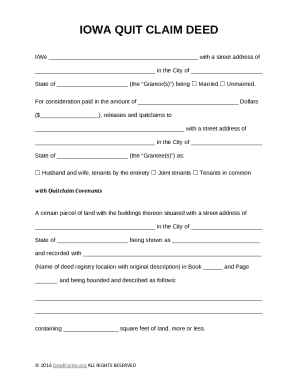

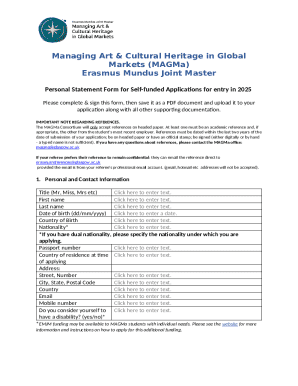

The Alpha Insurance proposal form typically includes several key components that are essential for both the applicant and the insurer. Personal identification details are required, such as name, address, and contact information. Additionally, applicants must outline their specific coverage needs, detailing the types of insurance they are interested in, be it health, property, or business insurance.

Step-by-step guide to filling out the proposal form

Filling out the Alpha Insurance proposal form requires careful preparation and attention to detail. Before beginning, it’s crucial to gather all necessary documents and information, including personal identification details and financial assessments such as income and current insurance coverage. Additionally, understanding your risk factors—like the nature of your property or business operations—will help in specifying your coverage needs.

Preparing necessary information

Start by organizing your personal identification documents. This includes your driver's license, social security number, and any other official documentation that verifies your identity. Next, evaluate your financial situation, identifying your income streams and any current insurance policies. This helps in determining the amount of coverage you need and aids in providing accurate information on the proposal form.

Filling out the form

When you start filling out the alpha insurance proposal form, pay close attention to each section. The 'Personal Information' section will require your name, address, and contact details. Ensure that your information is current and accurately represented.

To ensure accuracy and completeness, cross-check all fields before submission. Additionally, avoid common mistakes such as leaving sections incomplete or misrepresenting information, as these can delay your application or result in unfavorable outcomes.

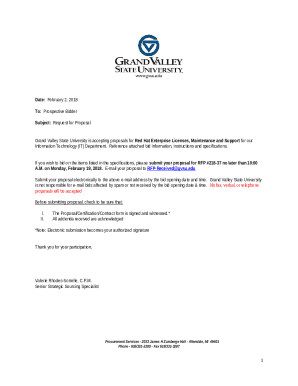

Interactive tools for streamlined completion

Utilizing tools like pdfFiller can significantly enhance your experience when filling out the Alpha Insurance proposal form. With its editing features, you can modify the proposal form easily, making it accessible regardless of your location. The platform allows users to utilize features for auto-filling information based on saved profiles, thus saving time and effort.

Utilizing pdfFiller's editing features

To make modifications to your proposal form on pdfFiller, simply upload the document to the platform. Next, leaverage editing tools to input your information. You can even add electronic signatures seamlessly using the built-in features. This process not only simplifies your workflow but also guarantees that your proposal form is complete and accurate before submission.

Collaborative features for teams

PdfFiller also supports collaboration among multiple users, allowing teams to work on the same proposal form simultaneously. You can invite team members to review and edit the form, share comments, and track changes. This collaborative aspect ensures that all perspectives are considered, leading to a more thorough and accurate proposal.

Essential tips for managing your insurance proposal

Before submitting your Alpha Insurance proposal form, it’s crucial to conduct a thorough review. This step ensures that you haven’t overlooked any essential details. Key elements to double-check include the accuracy of the personal information, coverage details, and any declarations made.

Reviewing your proposal form

Solicit feedback from peers if you’re working in a team. Multiple eyes can catch errors that you may have missed. Upon finalizing the proposal form, proceed to submit it electronically. Ensure that you follow best practices such as utilizing secured channels for submission to protect your sensitive data.

What to expect after submission

Once you submit your proposal form, be prepared for a confirmation from Alpha Insurance acknowledging receipt of your application. Await follow-ups regarding any additional information they may require for processing your proposal. Staying responsive during this phase can expedite the underwriting process.

Storing and accessing your proposal

PdfFiller allows you to securely store your completed proposal form. You can access previous submissions and revisions at any time, ensuring that everything is easily retrievable for future reference. This cloud-based storage solution not only simplifies document management but also enhances the security of your sensitive information.

Understanding the impact of your proposal

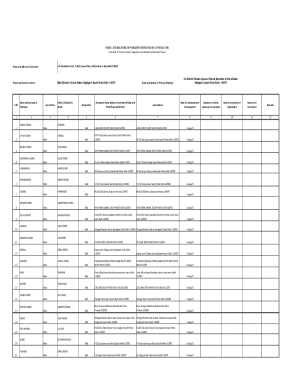

After submitting your proposal form, you'll want to evaluate the coverage options provided based on the data you submitted. Insurance providers will tailor their quotes considering your application details, and understanding these options is crucial for making informed decisions.

Evaluating coverage options

When reviewing quotes, consider key factors that may influence the premium rates offered. These factors often include the type and amount of coverage requested, the risk profile associated with the insured property or activity, and your claims history. A well-prepared proposal can lead to more favorable insurance terms.

Next steps after submission

If your proposal is approved, take time to read through the policy terms and conditions thoroughly. Understanding the coverage you are entitled to, along with any exclusions or limitations, will ensure that you are adequately protected. Don’t hesitate to ask your insurance provider for clarifications on any areas you find confusing.

Case studies: Real-life insights

Examining real-life examples of insurance proposals can yield valuable insights into effective strategies. For instance, a well-constructed proposal with comprehensive information may result in favorable coverage and better premiums. Learning from past successes is a beneficial practice when considering your proposal.

Successful insurance proposals

One illustrative case involved a small business seeking coverage for multiple properties. The owner meticulously filled out the proposal form, providing detailed descriptions of each property and their respective risks. This comprehensive approach led to a tailored coverage plan that prioritized his business’s needs effectively.

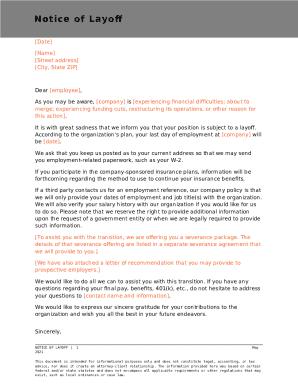

Lessons from denied proposals

Conversely, reviewing denied proposals reveals common pitfalls. Many applicants fail to provide complete financial histories or misrepresent their risk factors, leading to rejection. Addressing these issues upfront increases your chances of approval significantly.

Frequently asked questions

Throughout the proposal process, applicants often have questions. Common queries revolve around the timeline for processing proposals, required documentation, and contingencies arising post-submission.

Clarifications about the proposal process

Being informed improves your overall experience. Should you encounter challenges while filling out or submitting the Alpha Insurance proposal form, resources such as customer service and online FAQs can provide the necessary support and guidance.

Troubleshooting common issues

If you find yourself facing common issues like missing signatures or incomplete sections, consider using pdfFiller’s feature to identify these problems before submission. Taking a proactive approach saves time and helps prevent delays in the application process.

Enhancing your experience with pdfFiller

Beyond the proposal form, pdfFiller offers a plethora of tools to manage various document types, making it an essential resource for all your document needs. Whether it’s contracts, reports, or other forms, the platform’s capabilities can streamline your workflow significantly.

Additional features for document management

With pdfFiller, you can easily categorize and store documents in a centralized location. This organization method ensures you can retrieve any document swiftly when needed, optimizing your operational efficiency. Its cloud-based nature allows you to access your documents from anywhere, facilitating remote work scenarios.

Leveraging cloud-based solutions

Cloud storage benefits extend beyond accessibility. By keeping your documents online, you not only enhance collaboration among team members but also ensure that all changes are saved automatically, reducing the risk of losing important information. With these cloud-based solutions, managing documents becomes easier than ever.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in alpha insurance - proposal without leaving Chrome?

Can I create an electronic signature for the alpha insurance - proposal in Chrome?

Can I edit alpha insurance - proposal on an Android device?

What is alpha insurance - proposal?

Who is required to file alpha insurance - proposal?

How to fill out alpha insurance - proposal?

What is the purpose of alpha insurance - proposal?

What information must be reported on alpha insurance - proposal?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.