Get the free In-Kind Contributions for Nonprofits: Reporting Rules on Form

Get, Create, Make and Sign in-kind contributions for nonprofits

How to edit in-kind contributions for nonprofits online

Uncompromising security for your PDF editing and eSignature needs

How to fill out in-kind contributions for nonprofits

How to fill out in-kind contributions for nonprofits

Who needs in-kind contributions for nonprofits?

In-kind contributions for nonprofits form: A comprehensive guide

Overview of in-kind contributions

In-kind contributions refer to donations of goods or services that are provided instead of cash. These contributions play a crucial role in the operations of nonprofits, enabling them to acquire necessary resources without financial outlays. When engaging with various stakeholders, nonprofits can leverage in-kind contributions to fulfill operational needs, support programs, and enhance community impact.

The importance of in-kind contributions for nonprofits cannot be understated. They are vital in supporting mission-driven work, particularly for organizations with limited budgets. In-kind donations can significantly reduce expenses on necessities, thus allowing nonprofits to allocate more funds directly for program delivery.

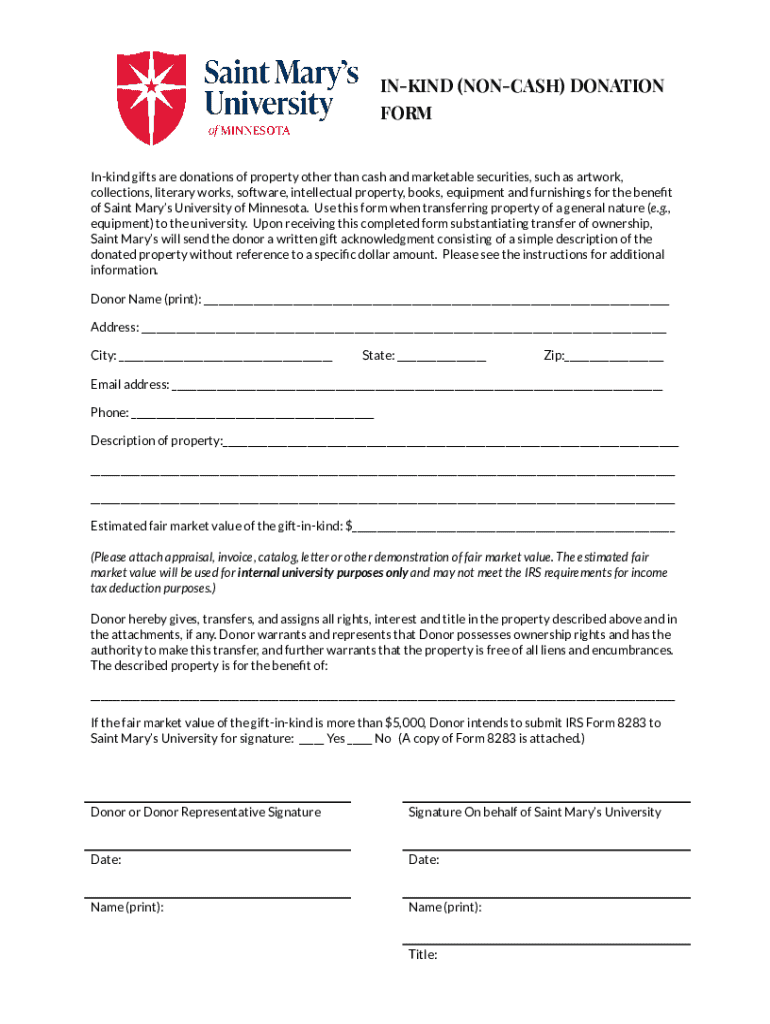

The purpose of the in-kind contributions form

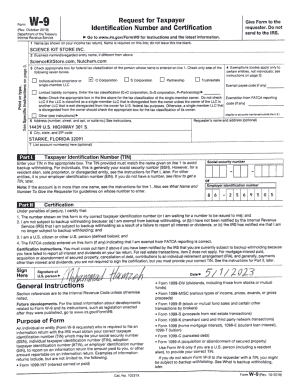

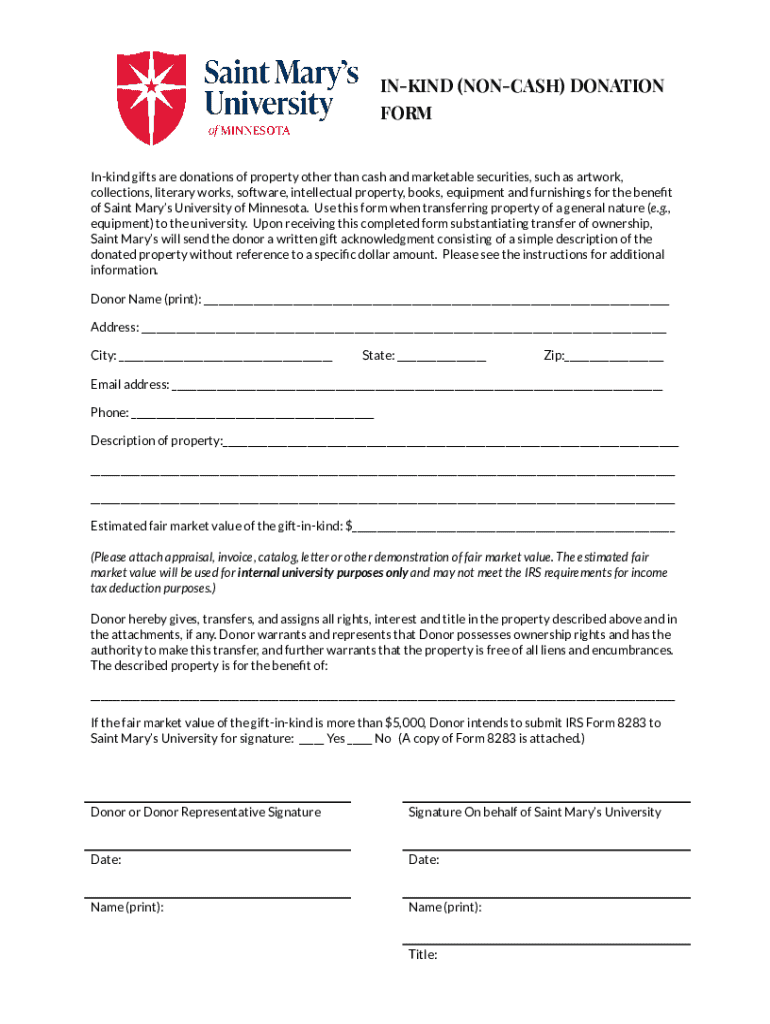

The in-kind contributions form serves to formally document donated goods and services. This essential document helps both donors and nonprofits confirm the value and details of contributions, which is critical for legal and tax considerations. For donors, it provides evidence for tax deductions, while nonprofits must maintain accurate records to ensure compliance with various regulations.

Furthermore, this form enhances transparency and accountability within nonprofit operations. Proper documentation fosters trust between nonprofits and their supporters, ensuring that contributions are appropriately valued and recognized.

Detailed breakdown of the in-kind contributions form

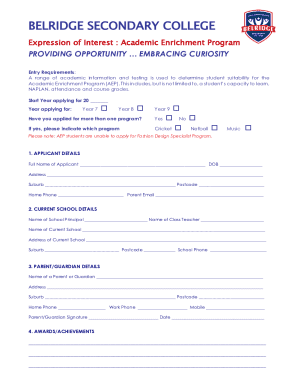

Understanding the components of the in-kind contributions form is crucial for effective utilization. First, the basic information section captures essential donor details, including their name, contact information, and organizational affiliation. Donors also need to indicate the date of the donation, aligning carefully with any related events or donation drives.

Next comes the contribution details, where donors specify what they are offering. This section should include a detailed description of each item or service provided along with the estimated fair market value. Accurate valuation is essential, as this figure impacts tax implications for the donor and records for the nonprofits involved.

Finally, the donor declaration section requires the donor to affirm the truthfulness of the information provided, complete with their signature and the date. This serves as a legal validation of their contributions.

How to fill out the in-kind contributions form

Filling out the in-kind contributions form can be straightforward if approached methodically. Start by gathering all the necessary information related to the donation. Ensure you have accurate estimates of the fair market value for everything being donated, which may involve research into similar items or services recently sold or offered.

When estimating value, consider factors such as original purchase price, age, condition, and demand for the item or service. Donors should also avoid common pitfalls, such as underestimating the value of unique items or misreporting service hours.

Utilizing pdfFiller can simplify the form-filling process. Its cloud-based platform supports easy document editing and signing, enabling users to avoid the paper trail while ensuring compliance with legal requirements.

Tips for managing in-kind contributions

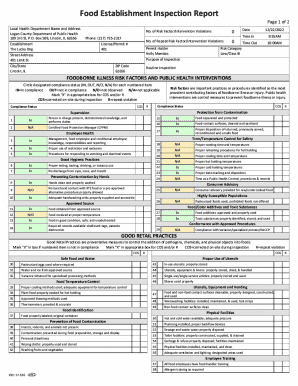

Effectively tracking and managing in-kind contributions is pivotal for nonprofits. Establishing best practices involves setting up a systematic process for logging and assessing donations as they come in. Maintaining a well-organized database or spreadsheet can help keep track of every contribution’s details, including donor information and the specific value attributed to each donation.

Record-keeping is crucial for tax purposes. Nonprofits should routinely review and retain these records for compliance. Using an online document management system like pdfFiller enables organizations to secure these documents and ensures that they easily accessible for future reference or audits.

Use cases for in-kind contributions

Numerous organizations have successfully utilized in-kind donations to further their missions. For example, a local food bank greatly benefited from a regional grocery chain donating surplus food items, which helped them serve hundreds of families in need. Another case involves a nonprofit focused on education that received free tutoring services from qualified volunteers, significantly enhancing their program’s effectiveness.

Such contributions not only fulfill pivotal needs but also strengthen ties with local businesses and the community, showcasing a collaborative spirit. Organizations can encourage business involvement through awareness campaigns, outlining the positive impacts of in-kind donations, and sharing personal stories of beneficiaries impacted by these contributions.

Other relevant templates for nonprofits

Various document templates can complement the in-kind contributions form, assisting nonprofits in their operations. For instance, creating a donation receipt template can help acknowledge contributions effectively and serve as a record for both parties.

Additionally, volunteer registration forms facilitate the onboarding of individuals willing to donate their time, while grant application templates help streamline the funding request process. Utilizing resources from pdfFiller ensures that these templates are customizable and accessible, promoting efficiency in documentation.

Frequently asked questions (FAQs)

Nonprofits and donors often have questions surrounding in-kind contributions, focusing primarily on tax deductibility. Generally, donors can deduct the fair market value of goods or services donated to a qualified nonprofit, provided they have the documentation necessary to substantiate the claim.

Nonprofits must ensure that they accurately report all in-kind contributions for transparency and compliance. Relying on accurate forms and records will help clarify the contribution's value and how it integrates into financial statements.

Interactive tools and resources

To assist nonprofits and potential donors, several interactive tools can aid in estimating the fair market value of donations. Using valuation calculators or guides provided by nonprofit associations can streamline this aspect. Additionally, leveraging third-party resources for workshops or webinars on managing donations can enhance understanding of the intricacies involved with in-kind contributions.

By incorporating these tools into their operational strategies, nonprofits can strengthen their fundraising efforts and maximize their outreach.

Signatures and finalization

Obtaining donor signatures on the in-kind contributions form is essential for legal validation. Without these signatures, the documentation may lack the credibility needed during audits or for tax purposes. Fortunately, pdfFiller streamlines this process by offering electronic signature options, making it easy for donors to complete forms securely and conveniently.

This feature not only speeds up the process but also aligns with the modern practices of document management and enhances the overall experience for all parties involved.

Case studies of in-kind contributions

Real-world examples illustrate the profound impact of in-kind contributions. For instance, a community theater received lighting equipment as an in-kind donation from a local company, which drastically improved production quality. Without this contribution, the theater would have faced significant budget constraints that could have limited their outreach.

Another noteworthy example is a health organization collaborating with a fitness center that donated fitness instructors for their wellness programs. This synergy not only benefited the nonprofit's mission but fostered deeper community engagement and recognition.

Next steps after completing the form

Once the in-kind contributions form is filled out and signed, nonprofits should take proactive steps towards acknowledging the donation. Sending a formal acknowledgment letter expressing gratitude can foster goodwill and strengthen donor relationships.

Strategies to maintain these relationships include regular updates on the impact of their contributions, inviting them to events, and recognizing their support publicly. Such engagement not only builds a community of support but also encourages ongoing involvement.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send in-kind contributions for nonprofits for eSignature?

Can I sign the in-kind contributions for nonprofits electronically in Chrome?

How do I edit in-kind contributions for nonprofits on an iOS device?

What is in-kind contributions for nonprofits?

Who is required to file in-kind contributions for nonprofits?

How to fill out in-kind contributions for nonprofits?

What is the purpose of in-kind contributions for nonprofits?

What information must be reported on in-kind contributions for nonprofits?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.