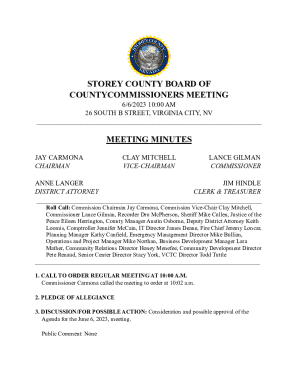

Get the free In-Kind Donation Form Template

Get, Create, Make and Sign in-kind donation form template

How to edit in-kind donation form template online

Uncompromising security for your PDF editing and eSignature needs

How to fill out in-kind donation form template

How to fill out in-kind donation form template

Who needs in-kind donation form template?

In-kind donation form template form: A comprehensive guide

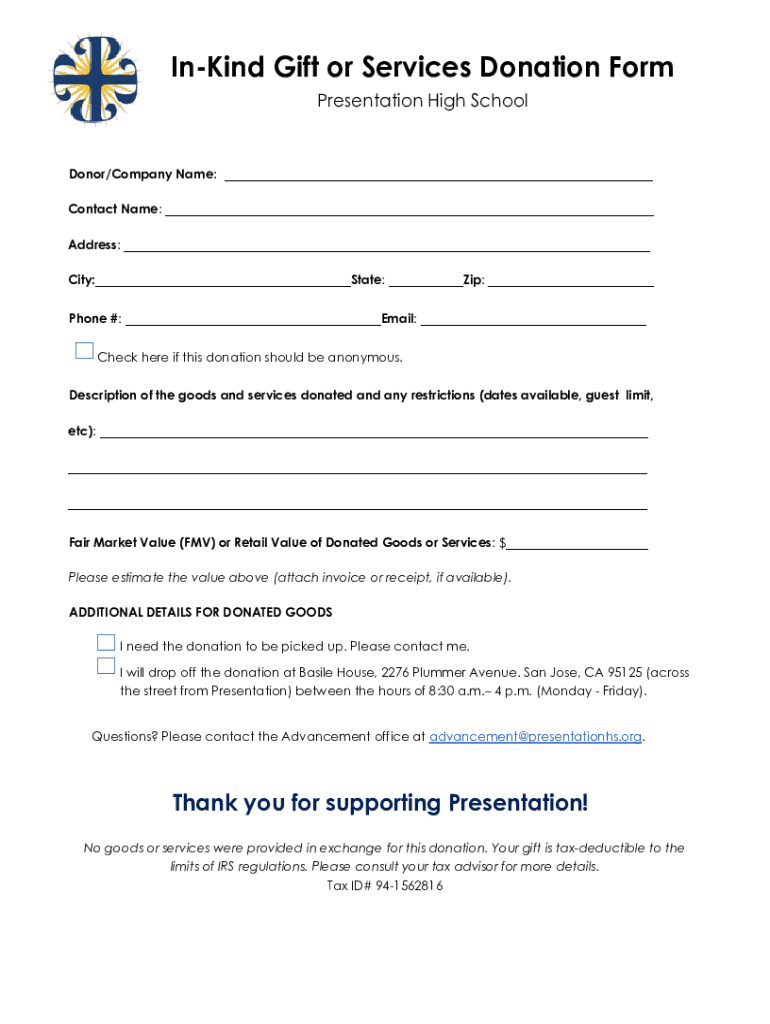

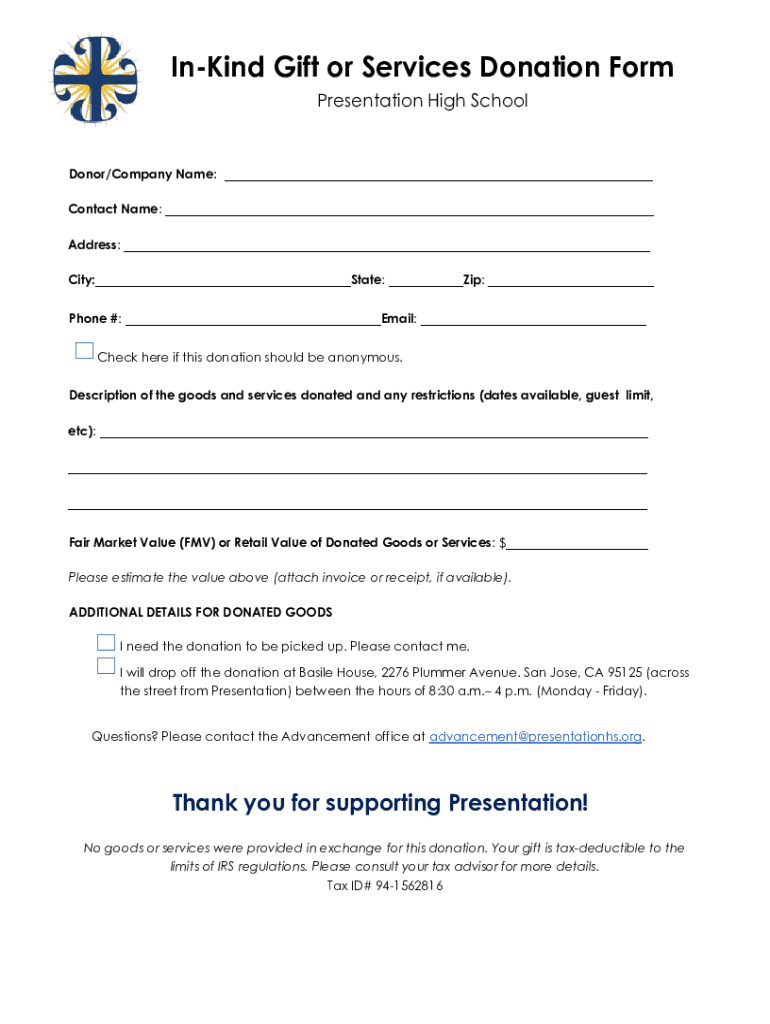

In-kind donation form overview

In-kind donations are gifts of goods or services rather than cash. They play a significant role in supporting non-profit organizations, enabling them to serve their communities effectively. The in-kind donation form template form simplifies the process of documenting these contributions, ensuring that both donors and organizations have clear records of what has been given and received.

Using a standardized form is crucial for various reasons. It formalizes the donation process, enhances accountability, and assists in tracking donations for reporting purposes. Moreover, having a template helps streamline daily operations, making it easier for both parties to manage contributions efficiently.

Features of the in-kind donation form template

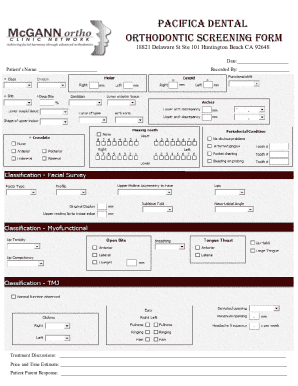

An effective in-kind donation form template includes comprehensive fields for crucial information. This ensures all necessary details about the donation are captured clearly and accurately, facilitating smooth transactions and great record management. Essential sections typically include donor details, a description of the donation, an estimated value assessment, and any special instructions or conditions related to the donation.

Interactive elements in the form enhance usability, guiding donors through the process. Checkbox options can be provided for various types of donations, while dropdown menus simplify the selection of donation categories for users. Additionally, customization capabilities allow organizations to incorporate their branding and modify sections of the template to meet specific needs.

How to access the in-kind donation form template

Accessing the in-kind donation form template on pdfFiller is straightforward and user-friendly. Begin by visiting the pdfFiller website, where you can either sign up for a new account or log in if you are already registered. Once logged in, a simple search within the template library will help you locate the in-kind donation form template quickly.

PdfFiller also offers various download options. Users can choose from PDF, Word, or custom formats to ensure the form meets their organizational needs. This flexibility allows teams to integrate the form into their existing documentation and workflows with ease.

Filling out the in-kind donation form

Completing the in-kind donation form accurately is critical to ensuring the donation process runs smoothly. Start by filling out the donor information section. This includes the donor's name, address, and contact information, allowing the organization to verify the donation and communicate any necessary information back to the donor.

Next, provide a clear description of the donated items. Detail should include quantity, condition, and specifics about each item. This is vital for the charity’s inventory records. Accurately estimating the value of the donation is also essential; this ensures that both parties have a fair understanding of the donation's worth. Many donors may overlook this step, so it’s crucial to provide guidance on how to arrive at a realistic value.

Editing and customizing your form

PdfFiller provides intuitive tools that make editing and customizing your in-kind donation form a breeze. Once you’ve selected your template, you can utilize a user-friendly editor to modify existing sections or add entirely new fields as needed. This adaptability allows you to tailor the form to your specific organizational requirements, ensuring it meets unique donor needs and aligns with your branding.

Including your organization's logo and color scheme reinforces branding and creates a professional look. Additionally, you can rearrange the layout or include specific questions relevant to your organization, ultimately enhancing the form's usability. Remember, a personalized form can improve interaction and satisfaction for both donors and recipients.

Signing the in-kind donation form

Signing the in-kind donation form can be done electronically, providing convenience for both the donor and the organization. PdfFiller’s platform supports e-signatures, which are legally binding in many jurisdictions. When signing online, users can easily navigate to the signature field within the form and securely sign using a mouse or digital device directly within the interface.

Ensure all required information is filled out before proceeding to sign. The e-signature provides a seamless way to finalize the donation form without the hassle of printing, signing by hand, and scanning. This digital approach speeds up the entire donation process and ensures records are kept accurately.

Submitting your in-kind donation form

Once filled out and signed, it’s important to submit the in-kind donation form correctly. Establishing best practices for submission helps maintain organization and effectively tracks all received donations. Depending on the organization's requirements, you may have options such as emailing the completed form or uploading it directly to a dedicated portal.

After submission, it's prudent to confirm that the organization has received your donation. This could involve following up with an email or checking in directly. Additionally, keeping a copy of submitted forms and any correspondence regarding the donation can be beneficial for personal records and tax purposes.

Managing in-kind donations with pdfFiller

Using pdfFiller not only simplifies the creation and submission of in-kind donation forms; it also provides tools for tracking and managing these donations effectively. Organizations can monitor donation records, ensuring that all contributions are accounted for and properly valued. This functionality is essential for inventory management, financial reporting, and organizational audit requirements.

Collaboration tools within pdfFiller allow team members to work together on donation records in real time, facilitating seamless communication and task assignments. Archives of completed forms can also be stored easily within the platform, ensuring that important documents are readily accessible when needed. This feature is particularly beneficial for tracking trends in donations over time and enabling better planning for future needs.

Additional tools and resources

Beyond the in-kind donation form template, pdfFiller offers a variety of other donation-related templates that organizations can utilize. These include forms for monetary donations, volunteer applications, and sponsorship requests, all designed to streamline various aspects of non-profit operations. Additionally, pdfFiller provides interactive tools for estimating donation values that can guide donors in assessing what their contributions are worth.

Moreover, community stories about successful in-kind donations can inspire both donors and organizations to understand the impact of their contributions. Showcasing these stories fosters a sense of community and camaraderie, encouraging more individuals to take part in such charitable activities.

FAQs about in-kind donation forms

Many individuals preparing to donate may have questions about the in-kind donation form template form. Common inquiries often revolve around the use of the template, understanding how to assess values accurately, and even tax implications related to donations. By having access to a comprehensive FAQ section on pdfFiller, users can seek immediate answers to these pressing questions.

Additionally, resources providing further guidance on in-kind donations can help individuals and organizations stay informed about best practices and ever-changing regulations. Staying knowledgeable about the relevant aspects ensures a smooth and effective donation process.

Footer navigation

Users interested in expanding their knowledge regarding non-profit operations can explore various related links provided by pdfFiller. This includes access to articles on best practices for donations, contact information for support, and additional tools available on the platform. Ensuring that both donors and organizations have all the necessary resources enhances the overall donation experience, making it rewarding for everyone involved.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send in-kind donation form template to be eSigned by others?

Where do I find in-kind donation form template?

How do I edit in-kind donation form template in Chrome?

What is in-kind donation form template?

Who is required to file in-kind donation form template?

How to fill out in-kind donation form template?

What is the purpose of in-kind donation form template?

What information must be reported on in-kind donation form template?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.