Get the free Workers' Compensation Self Insurance Third-Party ...

Get, Create, Make and Sign workers039 compensation self insurance

How to edit workers039 compensation self insurance online

Uncompromising security for your PDF editing and eSignature needs

How to fill out workers039 compensation self insurance

How to fill out workers039 compensation self insurance

Who needs workers039 compensation self insurance?

A Comprehensive Guide to the Workers039 Compensation Self Insurance Form

Understanding workers039 compensation and self-insurance

Workers039 compensation is a crucial system designed to provide financial and medical benefits to employees who may suffer from work-related injuries or illnesses. This insurance is pivotal as it not only safeguards employees but also protects employers from legal disputes stemming from workplace accidents. An effective workers039 compensation system ensures that employees receive adequate care and compensation while allowing businesses to manage their liabilities responsibly.

Self-insurance is an alternative to conventional workers039 compensation insurance, allowing businesses to retain financial responsibility for employee injuries rather than transferring this risk to an insurance carrier. This model can present unique advantages such as lowered premium costs, increased cash flow, and enhanced control over claims management. Companies that choose self-insurance often find it a more flexible approach that aligns better with their risk management strategies.

When to choose a self-insurance model

Selecting a self-insurance model hinges on a few critical factors, primarily the size of the business and the extent of risk exposure it faces. Companies with a stable financial background and a lower frequency of claims often consider self-insurance. For instance, small to medium-sized enterprises may opt for this route if they can demonstrate consistent workforce safety records and strong financial reserves.

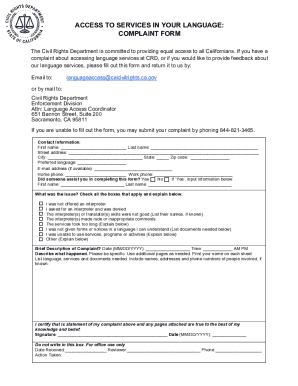

Moreover, analyzing state regulations is vital. States have distinct rules surrounding self-insurance, requiring businesses to meet certain financial criteria to qualify. For instance, businesses in Penang may encounter specific regulations dictated by the state government. Compliance with these local laws is crucial not only for securing self-insurance but also for ensuring the organization operates within legal boundaries.

The workers039 compensation self-insurance form defined

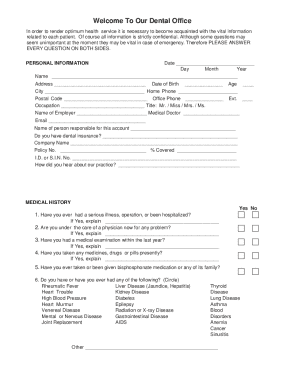

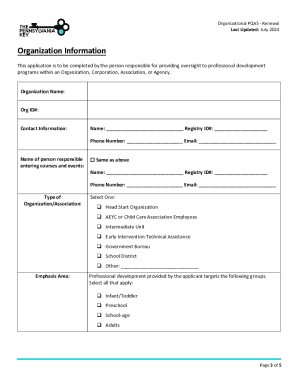

The workers039 compensation self-insurance form is a legal document that enables businesses to formally register their intent to self-insure. This form plays an essential role in ensuring compliance, serving as a record of the company's commitment to covering workers039 compensation obligations independently. Completing this form accurately is vital for maintaining legal standing and fulfilling state requirements.

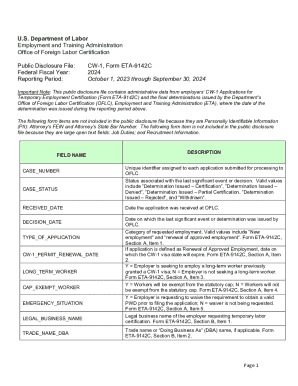

Required data typically includes the company name, address, coverage details, and financial backing information. Businesses can obtain the self-insurance form from the pdfFiller platform, which offers easy navigation and access to formats required in various states. Additionally, consulting state government websites can provide alternative avenues for obtaining this form.

Step-by-step guide to filling out the workers039 compensation self-insurance form

Filling out the workers039 compensation self-insurance form requires careful attention to detail. First, in Section 1, employers must provide accurate information, including their official name and business address. Ensuring that this data corresponds with state registrations is critical to avoid discrepancies. Any errors made in this section can delay processing and compliance.

In Section 2, companies detail their coverage information, specifying which employees are covered under the self-insurance model and the limits of that coverage. This section must reflect the organization’s risk profile accurately. Moving to Section 3, businesses declare their financial responsibility, indicating how they plan to cover claims. Including important details such as financial backing, reserves, and any supporting documentation enhances credibility. Lastly, Section 4 requires the employer’s signature, affirming the validity of the submission and allowing for electronic signing via pdfFiller for simplicity.

Editing and modifying your self-insurance form

pdfFiller offers robust editing tools to help users refine necessary documents, including the self-insurance form. These interactive features allow for easy modifications, whether you need to update information or correct any errors prior to submission. By visiting pdfFiller, users can engage with a straightforward editing interface that enhances efficiency.

Collaboration within teams is crucial when finalizing your documents. pdfFiller simplifies this process, allowing teams to share the form for collaborative input before submission. Utilizing the comments feature enables team members to provide feedback or ask questions, ensuring that the final document is as accurate and comprehensive as possible.

Common mistakes and how to avoid them

When completing the workers039 compensation self-insurance form, several common mistakes can significantly impair the submission process. Frequent pitfalls include misreporting financial data, failing to specify coverage limits, or neglecting to sign the document. Each of these errors can lead to rejections or delays, emphasizing the need for meticulous attention to detail.

To avoid such mistakes, double-checking all entries against documentation is essential. Moreover, securing professional advice from legal or insurance professionals can provide an added layer of reassurance. These experts can offer insights tailored to the specifics of your situation, ensuring compliance and accuracy in the completed form.

Managing your self-insurance documentation

Effective document management is paramount for businesses navigating self-insurance. Organizing and securely storing all related documentation—ranging from the self-insurance form to injury reports—is necessary for compliance and operational continuity. Utilizing a cloud-based platform such as pdfFiller enables easy access and organizational efficiency, ensuring businesses can retrieve critical documents when necessary.

Regularly reviewing and updating your self-insurance form is equally important. Maintaining current documentation not only ensures compliance but also reflects any changes in the business's risk exposure or operational structure. Setting periodic reminders to revisit these documents can enhance overall risk management strategies.

Navigating the claims process

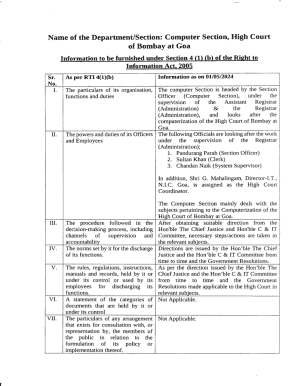

Understanding the claims process is essential once the self-insurance program is in place. If an employee files a claim, the employer must follow specific procedures that ensure claims are managed effectively and promptly. This includes reviewing the claim details, gathering necessary information, and determining the validity of the claim based on workplace safety protocols and the self-insured policy.

Key stakeholders in this process include the employer, the employee, and often, a third-party administrator or claims adjuster. Keeping consistent records of all claims is fundamental in defending against potential disputes. Moreover, maintaining detailed documentation helps streamline the claims process and supports the legitimacy of your self-insurance arrangement.

Conclusion and next steps

The workers039 compensation self-insurance form serves as an essential tool for businesses choosing to adopt self-insurance. It is critical for ensuring compliance with state regulations and effectively managing workplace risk. By leveraging pdfFiller’s tools, employers can simplify the management of this form and associated documentation, enhancing their operational efficiency.

As businesses contemplate their self-insurance options, integrating effective document management solutions from pdfFiller can simplify the process and yield substantial long-term benefits. This ensures employees are adequately supported while safeguarding the business’s financial wellbeing.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find workers039 compensation self insurance?

How do I edit workers039 compensation self insurance in Chrome?

How can I edit workers039 compensation self insurance on a smartphone?

What is workers039 compensation self insurance?

Who is required to file workers039 compensation self insurance?

How to fill out workers039 compensation self insurance?

What is the purpose of workers039 compensation self insurance?

What information must be reported on workers039 compensation self insurance?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.