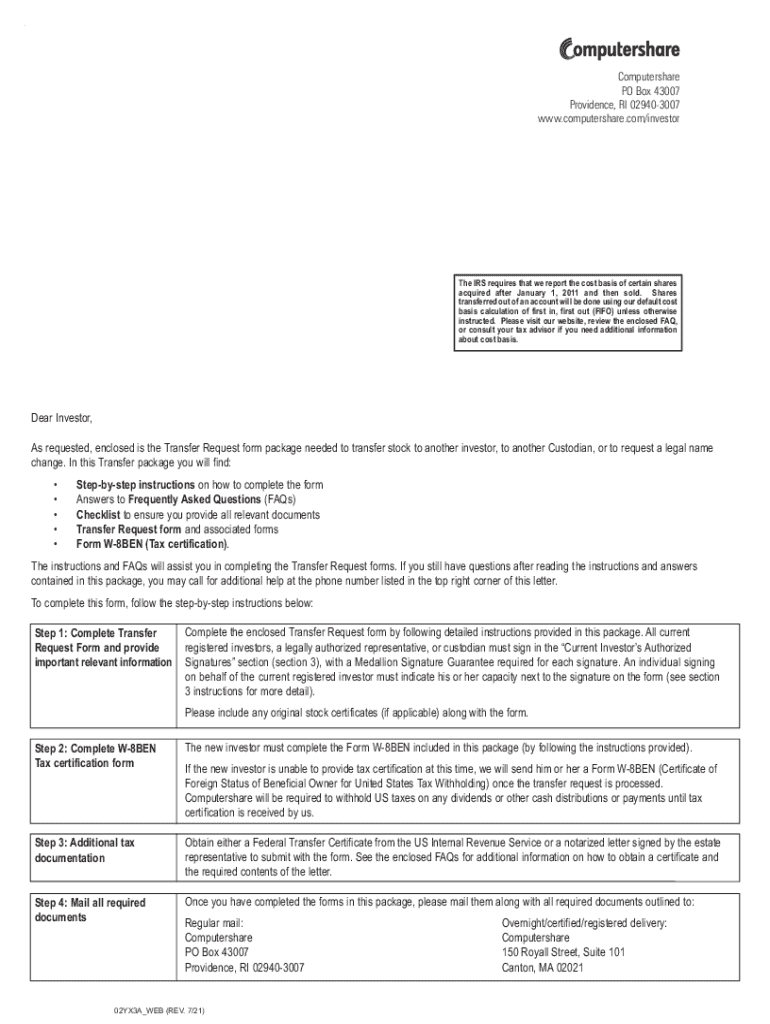

Get the free Cost Basis is wrong on ComputerShare. It should have ...

Get, Create, Make and Sign cost basis is wrong

How to edit cost basis is wrong online

Uncompromising security for your PDF editing and eSignature needs

How to fill out cost basis is wrong

How to fill out cost basis is wrong

Who needs cost basis is wrong?

Cost basis is wrong form - How-to Guide

Understanding the cost basis and its importance

Cost basis refers to the original value of an asset for tax purposes, usually the purchase price, adjusted for factors like stock splits and dividends. For investors, understanding cost basis is critical; it plays a vital role in determining the capital gain or loss when an asset is sold. An accurate cost basis is paramount during tax season, as it directly influences your tax liability and compliance.

Inaccurate cost basis calculations can lead to significant financial repercussions. If your cost basis is recorded incorrectly, you could overstate or understate your capital gains, leading to incorrect tax returns. Taxpayers need to ensure that they're reporting the correct amount to avoid potential audits by the IRS, penalties, or interest on unpaid taxes.

Identifying common reasons for wrong cost basis

When handling investments, recognizing typical errors in cost basis reporting is crucial to ensuring accuracy. Common mistakes include misinterpretation of the purchase price, discrepancies in asset valuations, and failing to adjust for factors such as stock splits and dividend reinvestments. Incorrect reporting on Form 1099-B can also contribute to an erroneous cost basis.

Situational examples help illustrate these pitfalls. For instance, if an investor buys shares of a stock at $100 and later receives additional shares from a stock split, adjusting the cost basis is vital. If this adjustment isn't made, the investor could misreport gains when selling the shares, leading to unintended tax consequences.

Steps to correct your wrong cost basis

To address an inaccurate cost basis, start by thoroughly evaluating your current cost basis information. Gather all relevant documents, including purchase and sales records, and importantly, your Form 1099-B. Carefully inspect these documents for inconsistencies, ensuring that the figures align with all transactions conducted during the tax year.

Once you've assembled your documents, it's time to work on recalculating your cost basis. Begin by breaking down the transactions in a step-by-step format, ensuring that you adjust for all necessary factors, including stock splits and reinvested dividends. Utilizing tools such as spreadsheets or financial software can greatly assist in managing these calculations effectively and maintaining up-to-date records.

Correcting cost basis on tax forms

When amending your tax returns to reflect the correct cost basis, it's crucial to understand the requirements for Form 8949 and Schedule D. These forms are where you report capital gains and losses, with specific sections requiring accurate cost basis entries. Distinguishing between short-term and long-term gains on these forms is essential for correct reporting.

If necessary, you may need to file an amended tax return using Form 1040-X. The process involves outlining the changes, including a detailed explanation of why the adjustments to the cost basis are necessary. Keep in mind that amending your return may help avoid unwanted scrutiny from the IRS.

Interactive tools for cost basis calculations

Making sense of cost basis can become significantly easier with the right tools. pdfFiller offers an interactive Cost Basis Calculator that empowers users to easily derive their cost basis figures. Accessing this tool requires just a few clicks, allowing users to track adjustments conveniently over time.

Cloud-based document management is also essential in this context. pdfFiller provides easy retrieval of documents across devices, making it conveniently accessible to both individuals and teams. This feature enhances collaboration and enables streamlined management of multiple investment portfolios, ensuring that cost basis calculations are current and accurate.

Best practices for ensuring accurate cost basis going forward

To avoid mistakes in the future, maintaining detailed financial records is essential. Investors should establish a system to document every transaction promptly, tracking the acquisition costs, sale prices, and any adjustments, such as stock splits or dividends. Ensuring that each financial transaction is updated in real-time allows for seamless tax reporting later on.

Regular reviews of cost basis information should be part of an investor's routine. To prevent issues at tax time, it's advisable to check cost basis records at least once a quarter, ensuring that any changes in prices, stock splits, or dividends are accounted for. Incorporating technology can help streamline this continuous monitoring process while mitigating the risk of human error.

Essential forms and templates related to cost basis

Understanding and accessing the right forms is crucial for proper tax reporting. A comprehensive overview of required forms like Form 1099-B and Form 8949 is necessary. Each document must be filled out accurately, reflecting the correct cost basis to ensure compliance. pdfFiller provides a user-friendly platform where users can easily access and fill these forms, leading to more efficient and accurate reporting.

For those who need help organizing their documents, utilizing customized templates is beneficial. pdfFiller offers a variety of templates tailored to simplify record-keeping and streamline documentation efforts specific to unique investment situations. By personalizing these templates, it becomes easier to maintain an accurate accounting of cost basis and related information.

FAQs: Addressing common concerns about cost basis

If you receive a form reporting an incorrect cost basis, take immediate action to address the issue. Begin by contacting the brokerage or issuer to ask for clarification. Often, they may need to issue a corrected Form 1099-B, which can entirely change your reporting. Be proactive to prevent long-term issues with the IRS.

If you’re facing an incorrect cost basis reported by your broker, there is a process to appeal. This typically involves providing documentation of your accurate purchase price and any adjustments needed. Working with a tax professional could facilitate this process and ensure you're advocating correctly for your interests.

Final thoughts on managing your cost basis effectively

Empowering users with knowledge about managing their cost basis is vital for future transactions. By understanding the importance of accurate financial reporting and actively seeking tools to assist in this process, individuals can minimize errors and optimize their investment future. Being informed means being prepared, especially during tax season.

pdfFiller stands out as a powerful supporter in managing document workflows. By simplifying the handling of documents related to cost basis and ensuring accuracy in reporting, it allows users to focus more on growing their investments rather than getting bogged down by paperwork.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my cost basis is wrong directly from Gmail?

How can I modify cost basis is wrong without leaving Google Drive?

How do I execute cost basis is wrong online?

What is cost basis is wrong?

Who is required to file cost basis is wrong?

How to fill out cost basis is wrong?

What is the purpose of cost basis is wrong?

What information must be reported on cost basis is wrong?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.