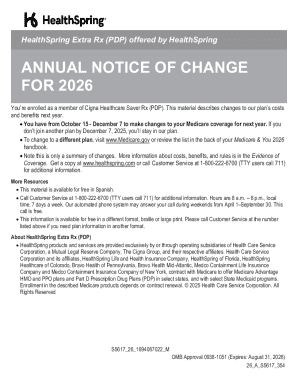

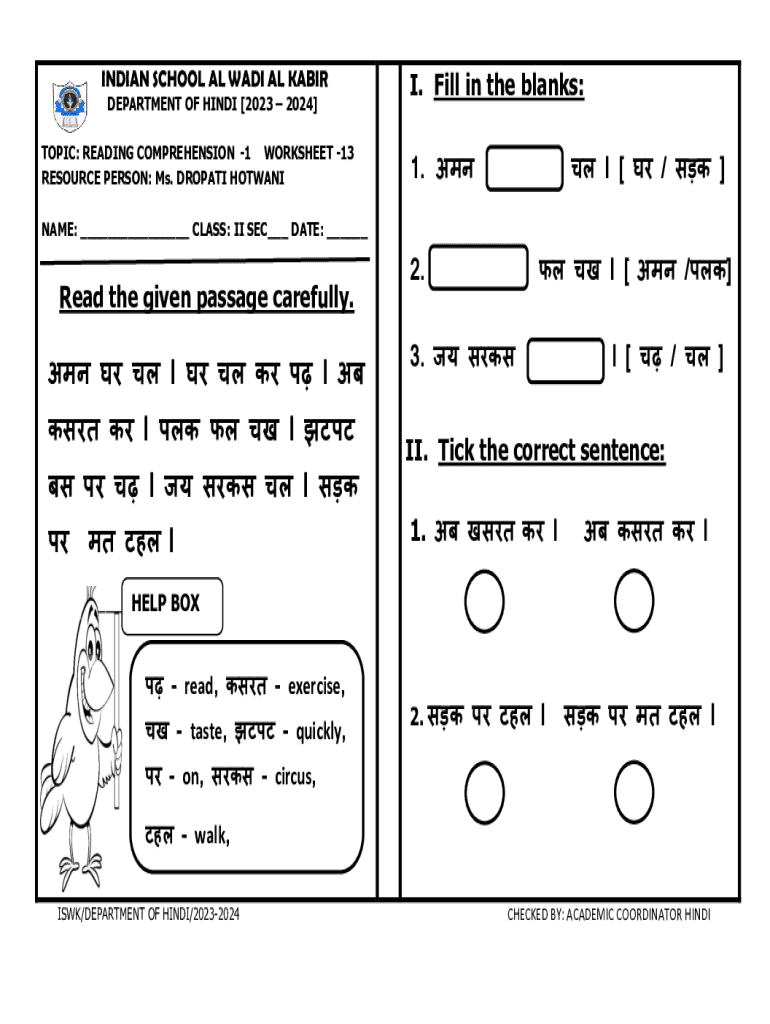

Get the free Worksheet - X 2023-2024 Hindi

Get, Create, Make and Sign worksheet - x 2023-2024

Editing worksheet - x 2023-2024 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out worksheet - x 2023-2024

How to fill out worksheet - x 2023-2024

Who needs worksheet - x 2023-2024?

Complete Guide to the Worksheet - 2 Form

Overview of the Worksheet 2 Form

The Worksheet - X 2 form is a critical document for individuals and teams preparing their tax returns. This form consolidates essential information required for accurate income tax filing, ensuring residents can capture various financial nuances affecting their exemptions, deductions, and credits.

Understanding the purpose of the Worksheet X is vital. It helps taxpayers report their eligible income, assess their filing status, and determine owed taxes or potential refund amounts. This makes it an indispensable tool in the tax preparation process, particularly in a year subject to evolving regulations.

Understanding the target audience

The Worksheet X is designed for a wide audience, including individual taxpayers and small business teams. Essentially, anyone who needs to file an income tax return can benefit from this form, as it offers a structured way to document and calculate tax obligations effectively.

Some typical scenarios include freelancers claiming business expenses or families navigating educational credits. Moreover, teams handling multiple filings benefit from utilizing the form collaboratively through pdfFiller, enhancing their efficiency and accuracy.

Preparing to use the Worksheet

Before diving into the Worksheet X, gathering the required documentation is essential. Individuals should have personal identification information, income proof, and previous tax returns readily available. This information helps ensure accuracy in completing your current tax return efficiently and effectively.

Alongside necessary documents, digital tools greatly enhance the experiencel. By using pdfFiller, users can access features that facilitate document completion, sharing, and signing, greatly streamlining the overall process from start to finish.

Step-by-step guide to completing the Worksheet

Completing the Worksheet X can be broken down into manageable steps, ensuring no detail is overlooked. Start by accessing the form through the IRS website or directly via pdfFiller. The online version allows users to edit fields without the hassle of printing.

After accessing the form, the next step is to fill in the basic information, such as your name, address, and identification numbers. Accuracy is crucial here, as this information directly impacts your filing status and any exemptions or deductions you may claim.

Detailed criteria must be met for income reporting and deduction calculations. Understanding what qualifies for deductions—and being aware of any new additions for the 2 tax year—is critical for maximizing your potential tax savings.

Unique features of the Worksheet in 2

The Worksheet X has undergone several updates for the 2 tax year, aimed at improving user experience. New sections have been introduced, allowing for clearer reporting of credits and adjustments, reflecting changes in legislation that impact taxpayers' financial obligations.

Looking back at past versions, key improvements include streamlined sections and enhanced instructions that help users navigate commonly confusing areas like income tax deductions and contribution eligibility. These refinements are designed to minimize the likelihood of errors and maximize filing accuracy.

Frequently asked questions (FAQs)

Common issues arise while completing the Worksheet X, particularly around determining eligibility for deductions and reporting income accurately. Many taxpayers express confusion regarding new regulations introduced in previous tax seasons, which may affect their filing process this year.

Another frequent question is how to troubleshoot errors that may occur during form completion. Staying well-informed about the latest updates for the 2 tax year can prevent missteps and help streamline the filing process.

Finalizing and submitting the Worksheet

Once the Worksheet X is complete, users have several options for submission. Digital filing is increasingly preferred, as it allows for quicker processing times and reduces lost paperwork issues often associated with physical submissions.

For those opting for electronic submission, eSigning the Worksheet directly through pdfFiller simplifies the process. Additionally, retaining copies of the submitted form is crucial for future reference, especially if discrepancies arise with your tax return.

Additional tips and best practices

Utilizing pdfFiller to create a streamlined filing process offers several advantages. By leveraging its editing and collaboration features, teams can work together seamlessly regardless of location. This is particularly beneficial for groups with multiple tax submissions.

It's essential to ensure compliance during this process. The Worksheet X should be filled out as accurately as possible to avoid common pitfalls such as misreporting income or missing out on eligible deductions. Regularly consulting documentation or updates provided via pdfFiller can also enhance compliance.

Future considerations

As tax laws evolve, understanding potential changes for the next tax year should remain a top priority for all filers. Keeping up with updates about the Worksheet X and related documents can ensure accurate reporting and minimize inquiries from tax authorities.

Being proactive and staying informed through reliable platforms like pdfFiller not only enhances your filing experience but also positions you for success in future tax scenarios, as new exemptions or credits may become available.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the worksheet - x 2023-2024 electronically in Chrome?

Can I create an eSignature for the worksheet - x 2023-2024 in Gmail?

How do I complete worksheet - x 2023-2024 on an Android device?

What is worksheet - x 2023-2024?

Who is required to file worksheet - x 2023-2024?

How to fill out worksheet - x 2023-2024?

What is the purpose of worksheet - x 2023-2024?

What information must be reported on worksheet - x 2023-2024?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.