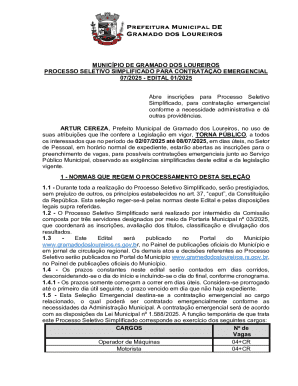

Get the free Worksheet - X 2020-2021 French

Get, Create, Make and Sign worksheet - x 2020-2021

Editing worksheet - x 2020-2021 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out worksheet - x 2020-2021

How to fill out worksheet - x 2020-2021

Who needs worksheet - x 2020-2021?

Comprehensive Guide to the Worksheet - 2 Form

Comprehensive overview of the worksheet - 2 form

The Worksheet - X 2 Form is a vital document utilized to streamline the process of applying for various tax-related benefits, including the recovery rebate credit. Designed for taxpayers and individuals, this form helps to ensure that recipients of economic impact payments can report their stimulus payments accurately and take advantage of any applicable deductions available to them. Understanding the worksheet's purpose is crucial for successful completion and compliance with tax regulations.

Completing the Worksheet - X accurately is imperative without risking delays in tax refunds or potential audits. Misreporting or omitting information could lead to complications, prompting tax authorities to seek clarifications or adjustments. This is especially relevant in the context of changes introduced due to economic conditions, where understanding how to navigate these forms can assist in maximizing the taxpayer's benefits.

Key features of the worksheet - 2 form

The Worksheet - X 2 Form is designed with user-friendliness in mind. Its layout incorporates sections that clearly delineate required information, simplifying the way users engage with the content. Key design elements usually include clear headings, guided instructions, and allocated spaces for necessary data entry. These features empower users to navigate the form easily while ensuring each aspect is filled out thoroughly.

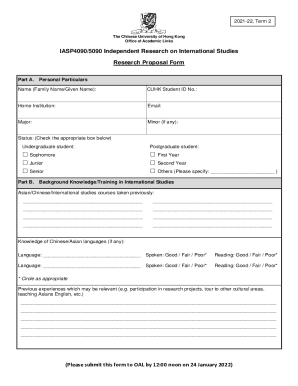

Typically, the worksheet includes sections covering personal information, eligibility criteria for the recovery rebate credit, and detailed financial inputs concerning recent income tax returns. Engaging with these sections meticulously allows individuals to ensure they provide complete documentation substantiating any stimulus payments or economic impact they received, facilitating a smoother application process.

Step-by-step instructions for filling out the worksheet -

Filling out the Worksheet - X 2 Form might seem daunting, but by following a set of organized steps, individuals can ensure accurate completion. Start with gathering all necessary information, such as income tax returns, stimulus payment details, and other pertinent documentation. Having these documents ready can greatly facilitate the data entry process and help prevent errors that could affect submission.

In navigating the form fields, take the time to read through all sections methodically. Each field requires specific information; thus, a detailed breakdown is beneficial. When entering data, pay particular attention to common pitfalls like incorrect numerical formats, missing signatures, or overlooked sections. After completing the form, meticulous reviews ensure accuracy, so utilize a checklist to verify that all required items are correctly filled and any necessary edits made.

Editing and customizing the worksheet -

To enhance usability, pdfFiller provides various editing tools to modify the Worksheet - X 2 Form as needed. Users can easily input changes directly within the document, ensuring real-time updates without the hassle of starting over. The platform supports multiple formats for uploads, making it convenient for users to transition existing documents to editable forms.

Moreover, adding additional notes or comments within the worksheet promotes clarity, facilitating teamwork and collaboration. This feature is particularly useful for tax professionals working on multiple returns, ensuring that they can leave reminders or highlight important details without overwhelming the standard layout of the form.

Signing and sharing the worksheet -

Once the Worksheet - X 2 Form is fully completed, the next step involves signing and sharing the document. pdfFiller offers robust e-signature options, making it simple for users to sign off electronically without printing or scanning. This feature significantly streamlines the process, allowing for quick turnaround times and reducing the form's overall administrative burden.

Additionally, pdfFiller allows collaboration with colleagues, enabling users to invite team members to edit or review the form, fostering a team-oriented approach to document management. Following best practices in sharing, like using secure links and verifying recipient details, ensures that sensitive taxpayer data remains protected while facilitating efficient collaboration.

Managing the worksheet -

Effective management of the Worksheet - X 2 Form post-completion is crucial for long-term organization and accessibility. Users can choose between saving the document to their device or utilizing cloud storage options provided by pdfFiller. Opting for cloud storage not only frees local space but also allows for access from any device at any time, offering flexibility for those on the go or managing multiple accounts.

In addition, tracking changes and versions within pdfFiller keeps a history of all edits made to the form. This is particularly beneficial for teams, as it allows for accountability in collaborative environments. Setting up an organized archiving system for past versions ensures users can retrieve older documents as necessary without creating clutter in their accounts.

Interactive tools for enhanced usability

Adding more value to the Worksheet - X 2 Form, pdfFiller features integrated interactive tools designed to enhance user experience. For example, users can utilize built-in calculators or templates that provide assistance in estimating potential tax benefits or filling out financial data efficiently. These interactive components not only save time but also minimize the potential for errors in data entry.

The platform also includes help features allowing users to seek guidance or find answers to common issues directly within the interface. Frequently asked questions (FAQs) cater to typical user concerns such as understanding terms related to the recovery rebate credit or stimulus payments, making the entire process less intimidating.

Real-world applications of the worksheet - 2 form

The real-world applications of the Worksheet - X 2 Form span multiple industries and scenarios. Various taxpayers have reported successful outcomes when using this form to apply for the recovery rebate credit, particularly in the wake of the economic impact payments issued during the COVID-19 pandemic. Case studies have emerged illustrating how accurate completion of the form facilitated quicker refunds and enhanced clarity for tax authorities.

Users from different sectors—ranging from small business owners to full-time employees—have expressed satisfaction regarding the efficiency and intuitiveness of the Worksheet - X. Feedback shows that being able to consolidate all relevant information in one place drastically simplifies tax preparation, which is often a daunting annual task for individuals and teams alike.

Additional tips for maximizing your experience

Maximizing the benefits of the Worksheet - X 2 Form entails utilizing the advantages provided by pdfFiller’s cloud-based platform to its fullest. For instance, take advantage of the platform’s integration features with other software tools, such as accounting and payroll systems, to create a seamless workflow. This integration can alleviate manual data entry tasks, allowing for more time to focus on strategic financial aspects.

Staying updated on template changes or regulatory updates is also crucial. Tax laws evolve frequently, and understanding these changes can enhance eligibility for returning payments or credits. Regularly checking in on updates ensures that users are completing the Worksheet - X with the most current information and maximizing potential benefits.

More information

Users seeking personalized assistance can easily reach out to pdfFiller support for further guidance regarding the Worksheet - X 2 Form. Whether through live chat, email, or phone, support agents are available to resolve queries or provide tailored solutions to specific challenges faced during the completion and submission process.

Additionally, scheduling a live demo of pdfFiller's capabilities can provide users with firsthand experience in leveraging the full functionalities of the Worksheet - X. Furthermore, joining the pdfFiller community forum allows for shared experiences where users can learn from each other, encouraging best practices and collective knowledge sharing.

Footer navigation options

For users needing access to similar forms or additional tutorials, pdfFiller offers easily navigable links and resources. A comprehensive sitemap facilitates quick navigation, ensuring that users can seamlessly transition between various features, forms, and resources offered by pdfFiller. Enhancing accessibility to related materials further empowers users in their document management activities.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit worksheet - x 2020-2021 in Chrome?

Can I create an electronic signature for the worksheet - x 2020-2021 in Chrome?

How do I fill out worksheet - x 2020-2021 using my mobile device?

What is worksheet - x 2020-2021?

Who is required to file worksheet - x 2020-2021?

How to fill out worksheet - x 2020-2021?

What is the purpose of worksheet - x 2020-2021?

What information must be reported on worksheet - x 2020-2021?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.