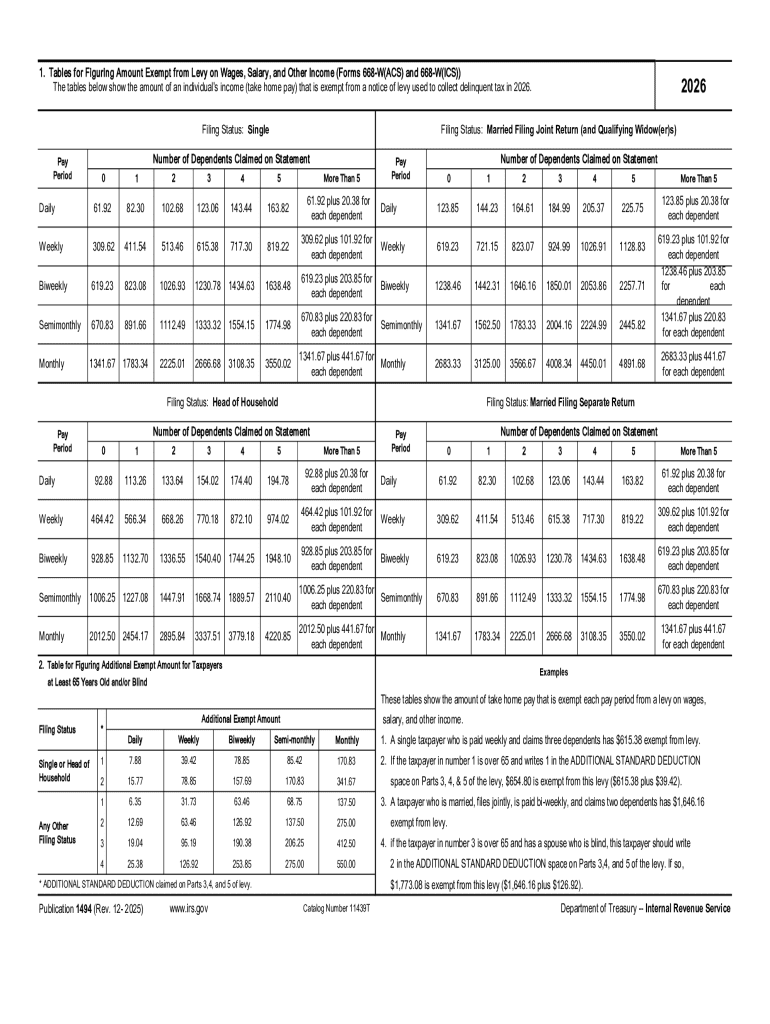

Get the free 1. Tables for Figuring Amount Exempt from Levy on Wages, ...

Get, Create, Make and Sign 1 tables for figuring

Editing 1 tables for figuring online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 1 tables for figuring

How to fill out publication 1494 rev 12-2025

Who needs publication 1494 rev 12-2025?

Mastering the Publication 1494 Rev 12-2025 Form: A Comprehensive Guide

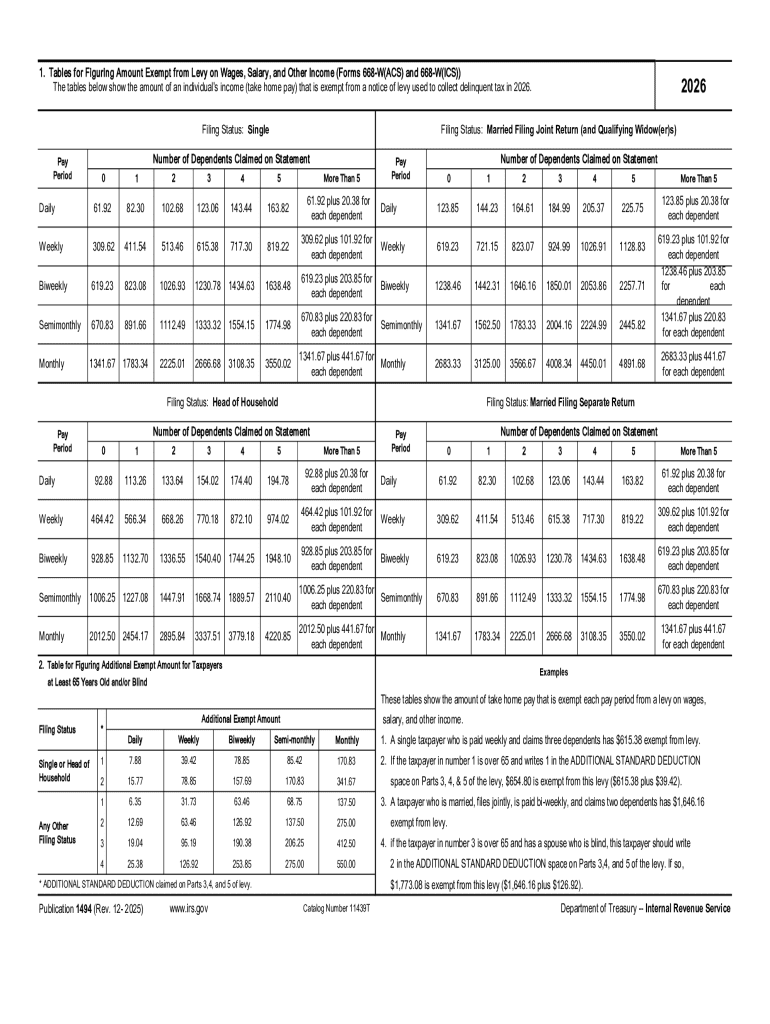

Overview of Publication 1494 Rev 12-2025 Form

The Publication 1494 Rev 12-2025 form is a crucial document for individuals and organizations navigating the intricacies of reporting their financial activities. This form is used primarily for reporting income and deductions related to various transactions and tax obligations. Completing the form accurately is paramount, as it not only ensures compliance with tax regulations but also provides a clear financial picture for stakeholders.

Various entities, including businesses, freelancers, and non-profit organizations, will find this form applicable. Understanding who needs to use the Publication 1494 Rev 12-2025 form can help streamline the process and mitigate potential errors that arise from misinformation or oversight.

Key features of the Publication 1494 Rev 12-2025 Form

The structure of the Publication 1494 Rev 12-2025 form is designed to collect comprehensive data on income and expenses. Each section serves a specific purpose, ensuring that all relevant financial data is documented.

Step-by-Step Instructions for Completing the Form

Completing the Publication 1494 Rev 12-2025 form requires careful planning and organization. The first step is gathering all necessary information and documents. Essential documents may include previous tax returns, income statements, expense reports, and any relevant receipts.

To enhance clarity, organize your information systematically — perhaps by categorizing income and expenses. Each section of the form must be filled out accurately, and common mistakes, such as incorrect figures or missed fields, can significantly impact your submission.

Troubleshooting is also an essential skill when completing this form. Identifying common issues, such as incomplete information or inaccuracies, allows you to rectify them before submission. If errors are discovered after submission, amending the mistakes promptly can prevent future complications.

Editing and customizing your form

The pdfFiller platform offers a range of online editing tools to help you refine the Publication 1494 Rev 12-2025 form, ensuring it meets all necessary requirements. Users can customize the document with various fonts, colors, and layouts to enhance readability.

Additionally, adding annotations and comments can facilitate collaboration and provide context for specific entries. Using interactive features within pdfFiller allows you to focus on critical details rather than on formatting challenges.

Signing and finalizing the Publication 1494 Rev 12-2025 Form

Once the Publication 1494 Rev 12-2025 form is completed, signing and finalizing your submission is the next key step. The platform supports electronic signatures, providing a convenient option for users. It's essential to understand the legal implications of eSigning, as performing this action signifies your acknowledgment and acceptance of the content within the form.

Considering both electronic and physical submissions, electronic options are often faster and can help streamline processing times. However, understanding your audience and their preferred methods of submission is critical.

Managing your form post-completion

After submitting the Publication 1494 Rev 12-2025 form, managing the document’s lifecycle is essential. Safely saving and storing your completed form is crucial to ensure you can reference it in the future. Utilize a secure cloud storage solution to prevent data loss.

Sharing the form with relevant stakeholders or departments should be done with care. You may need to share summaries or specific data from the form for reporting or assessment purposes. Tracking submission and ensuring confirmation of receipt allows you to maintain accountability throughout the process.

Additional tools and resources available on pdfFiller

pdfFiller is equipped with comprehensive interactive tools designed to simplify the form completion process. Collaboration features enable team submissions, allowing multiple users to contribute to a single form interaction, reflecting real-time teamwork and input.

Besides this, pdfFiller provides access to templates and various forms similar to the Publication 1494 Rev 12-2025, which can save users time and effort. Utilizing these resources can significantly enhance your efficiency while working on financial documentation.

Frequently asked questions (FAQs)

Many users have queries regarding the Publication 1494 Rev 12-2025 form and its associated processes. Common inquiries may include how to handle specific sections or what particular terminology means when filling out the form. Understanding these elements is vital for ensuring compliance and accuracy.

Clarifying reporting obligations and recognizing which items are mandatory can significantly ease the process. Users should not hesitate to seek guidance to overcome confusion, particularly if they are new to the form.

Contact and support options

Should you encounter challenges or require assistance while completing the Publication 1494 Rev 12-2025 form, pdfFiller experts are readily available for support. Accessing customer service can provide you with troubleshooting assistance for any issues that may arise during the form completion process.

Utilizing these resources not only aids in resolving current difficulties, but fosters a deeper understanding of the form itself, ultimately benefiting future submissions.

User testimonials and success stories

Numerous individuals and organizations have successfully completed the Publication 1494 Rev 12-2025 form using the pdfFiller platform. Real-life testimonials illustrate how pdfFiller has streamlined the process, enabling users to complete the form swiftly and accurately.

Insights from these users reveal that the intuitive interface and collaborative features of pdfFiller significantly reduce the stress often associated with document management, making this platform an invaluable resource for anyone needing to handle the Publication 1494 Rev 12-2025 form.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my 1 tables for figuring in Gmail?

How do I make changes in 1 tables for figuring?

How do I edit 1 tables for figuring on an iOS device?

What is publication 1494 rev 12-2025?

Who is required to file publication 1494 rev 12-2025?

How to fill out publication 1494 rev 12-2025?

What is the purpose of publication 1494 rev 12-2025?

What information must be reported on publication 1494 rev 12-2025?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.