Get the free dormant form

Get, Create, Make and Sign dormant account activation form

How to edit dormant form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out dormant form

How to fill out inactive and dormant account

Who needs inactive and dormant account?

Understanding and Managing Inactive and Dormant Account Forms

Understanding inactive and dormant accounts

Inactive accounts typically refer to financial or user accounts that have not had any activity for a defined period, often defined by the institution. Banks may classify an account as inactive after a duration of 3 to 12 months without deposits or withdrawals. Common reasons for inactivity include forgetting the account, changes in personal circumstances, or switching to different banking options.

Dormant accounts are distinct from inactive accounts; they involve a longer period of inactivity, usually spanning several years. Legal and financial implications are serious for dormant accounts, primarily when they fall under specific regulations requiring account holders to reclaim their funds or face forfeiture to the state.

The importance of managing account status

Reactivating inactive accounts can unveil financial opportunities. Users might discover forgotten funds, loyalty rewards, or other benefits. Additionally, maintaining current contact information aids institutions in reaching out, potentially avoiding account classification as dormant. Users can mitigate loss while maximizing gains by being proactive.

On the other hand, dormant accounts pose certain risks. Institutions may charge monthly fees on accounts left unmonitored while the potential for fraudulent activity increases if there is no user engagement to identify suspicious transactions. Institutions may find it necessary to lock or close these accounts, leading to loss of funds or access to future services.

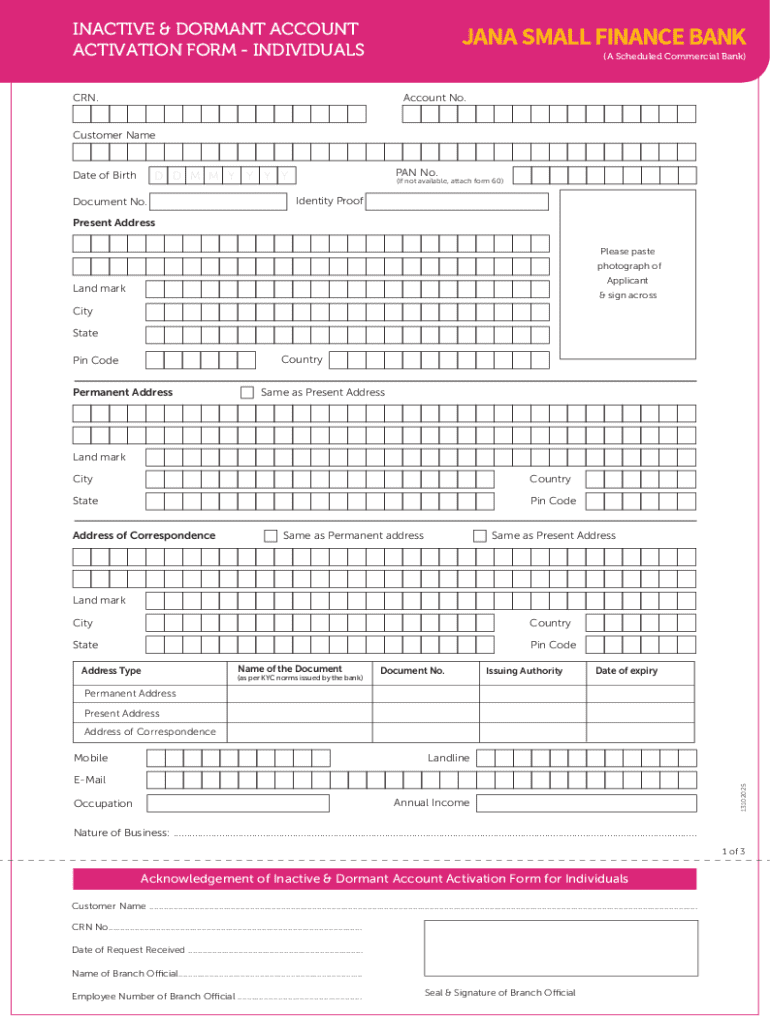

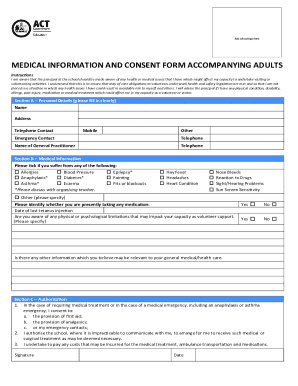

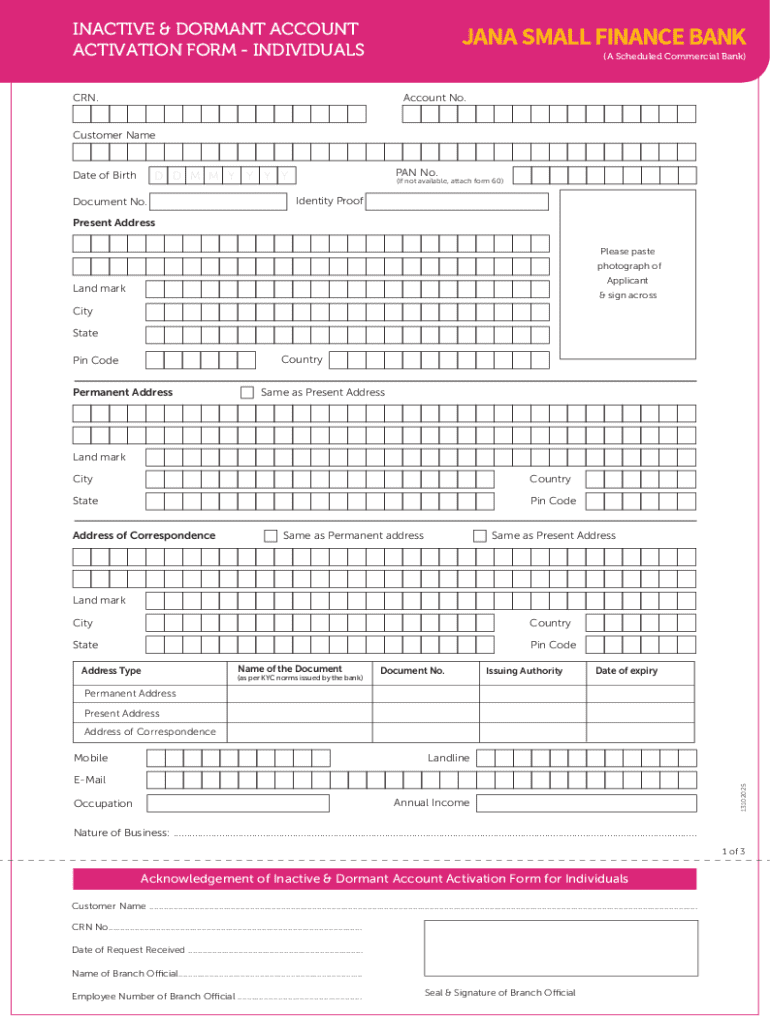

Overview of the inactive and dormant account form

The inactive and dormant account form serves vital roles for both account holders and institutions. Individuals typically encounter this form when they choose to reactivate an account after a period of inactivity or while registering with a new financial institution. The form is essential for providing necessary details to verify identity and assess account status.

Key features of the form usually include sections to input personal information, account numbers, and a declaration ensuring information accuracy and understanding of the terms. These fields act as checkpoints for the institutions to validate the input against their records, ensuring proper management and reopening of dormant or inactive accounts.

Step-by-step guide to filling out the inactive and dormant account form

Filling out the inactive and dormant account form can be straightforward when you follow these steps.

Step 1: Gather necessary information including government-issued ID, previous account statements, and any correspondence related to your account. Having these documents at hand simplifies the process and ensures accuracy.

Step 2: Fill out the personal information section with precision. Ensure the spelling of names, addresses, and other details are correct to avoid processing delays. A common mistake is typos in social security numbers or addresses, leading to rejection.

Step 3: Provide account details accurately. Locate your account number on previous statements or account access portals. Ensure any previous accounts linked to the same identification are listed for ease of management.

Step 4: Make sure to read the declaration and sign it. It highlights the importance of authenticity and intention in submitting the form. For electronic submissions, consider using pdfFiller to complete and submit with eSign functionalities.

Editing and customizing your form with pdfFiller

pdfFiller offers users an easy way to access the inactive and dormant account form online. Simply search for the form in the search bar or browse through categories. Once located, users can utilize built-in editing features to add comments and notes, thereby enhancing their document comprehension.

Utilizing editing features is straightforward. Users can rearrange sections, add additional information where necessary, and communicate updates effectively. Using pdfFiller, users can easily eSign their forms with just a few clicks, saving valuable time and ensuring they meet submission deadlines.

Submitting your inactive and dormant account form

After completing the form, you need to submit it effectively to ensure your account status changes. There are several submission methods available, including online submission directly through institutional websites, mailing the form to designated addresses, or faxing it if allowed.

Tracking your submission is crucial. If submitted online, there’s often a confirmation system through email or application notifications. Processing times typically range from a few days to a couple of weeks; thus, it’s wise to follow up if no response is received.

Troubleshooting common issues

Despite careful submission, there may be instances where forms are rejected or delayed. Common reasons for rejection often include inaccuracies in personal details or missing sections. To resolve these matters, double-check all fields before resubmission and ensure all necessary documents are attached.

If you require further assistance, contacting customer support for your financial institution or pdfFiller's customer service is advisable. They can provide guidance on how best to resolve specific issues that may arise.

Managing your accounts post-submission

Post-submission, regular monitoring of your account status is essential. Utilize tools with pdfFiller to keep track of any account activity to ensure nothing goes unnoticed. This proactive approach allows for immediate actions if any discrepancies arise.

Updating account information should remain a priority, as inaccuracies can lead to future complications. Simple online updates can often prevent accounts from becoming inactive down the line. Should you encounter issues again, refer back to your archived forms or conduct the account activation form process again diligently.

Conclusion and next steps

Managing inactive and dormant accounts through the appropriate forms can save individuals from unnecessary fees and lost funds. pdfFiller empowers users to take control of their financial documents, ensuring they can edit, sign, and store forms efficiently.

Explore additional templates and forms available on pdfFiller that cater to varied needs, enabling effective document management across different areas. With pdfFiller's capabilities, users can rest assured that they have the tools necessary for seamless document creation and management.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in dormant form?

How do I fill out dormant form using my mobile device?

How can I fill out dormant form on an iOS device?

What is inactive and dormant account?

Who is required to file inactive and dormant account?

How to fill out inactive and dormant account?

What is the purpose of inactive and dormant account?

What information must be reported on inactive and dormant account?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.