Get the free Estate Planning Worksheet - Denton

Get, Create, Make and Sign estate planning worksheet

Editing estate planning worksheet online

Uncompromising security for your PDF editing and eSignature needs

How to fill out estate planning worksheet

How to fill out estate planning worksheet

Who needs estate planning worksheet?

Estate Planning Worksheet Form: A Comprehensive Guide

Understanding estate planning

Estate planning is a crucial process for ensuring your assets are distributed according to your wishes after your passing. It involves making important decisions that can significantly impact your family's financial well-being and legacy.

The importance of estate planning cannot be overstated. It protects your assets from potential disputes and mismanagement, ensuring that your loved ones are taken care of in the event of your death. It also helps to avoid legal complications that can arise when a person dies without a clearly articulated plan.

Several myths surround estate planning, leading many individuals to postpone this essential task. Some believe it is only for the wealthy, while others think a will isn't necessary until they are older. In reality, everyone can benefit from having a comprehensive estate plan, regardless of their financial status or age.

Essential components of an estate plan

A well-rounded estate plan typically includes several critical components, each serving a unique purpose. One of the most important elements is the last will and testament, which details how your assets should be distributed upon your death.

Creating a will involves outlining your wishes clearly and can include appointing guardians for minor children, if applicable. Following the will, trusts can be utilized to manage assets for beneficiaries, especially when dealing with minors or individuals who may not be financially savvy.

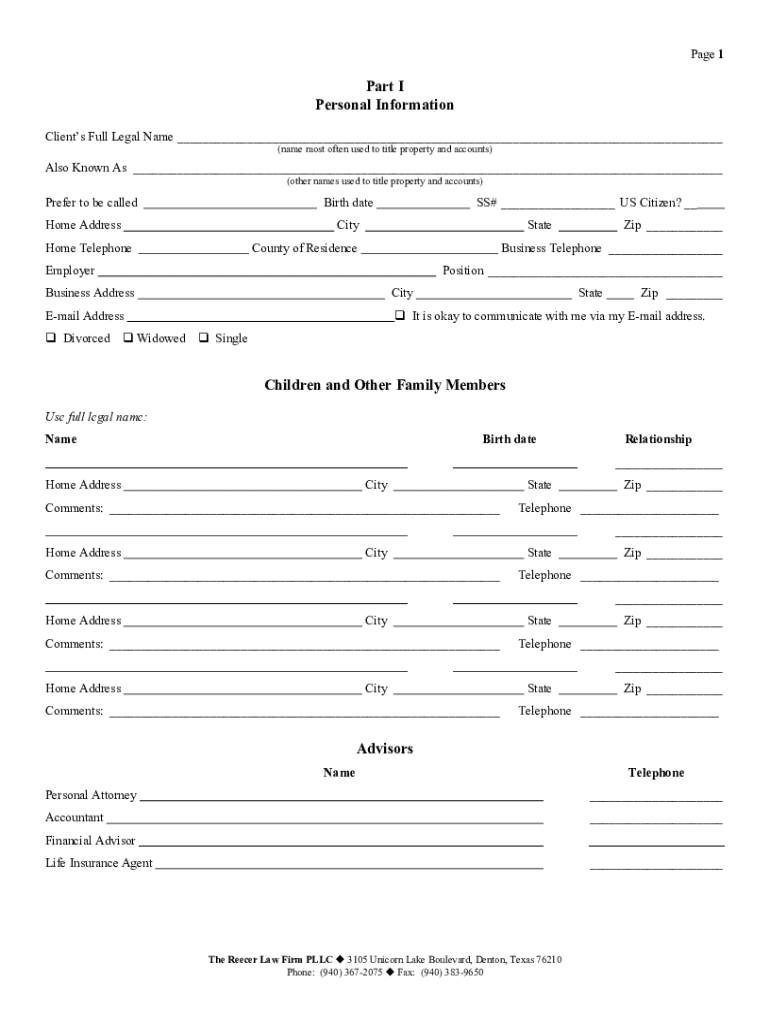

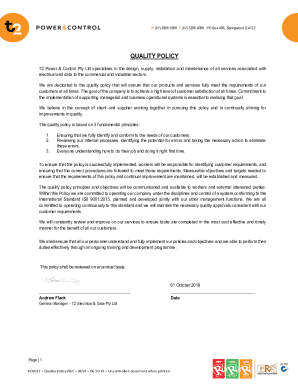

The estate planning worksheet form: An overview

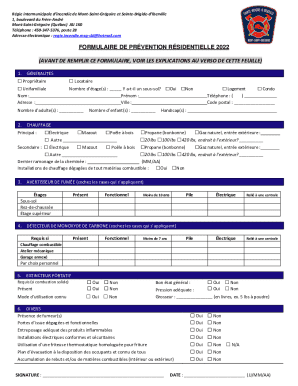

An estate planning worksheet form plays a pivotal role in organizing and executing your estate planning strategy. It serves as a practical tool to gather all pertinent information in one place, making the estate planning process more approachable and manageable.

The worksheet guides you through each critical aspect of your estate plan. By filling out the form, you can systematically assess your personal situation, outline your assets, list your beneficiaries, and include any specific instructions or wishes you may have.

Step-by-step instructions for filling out the estate planning worksheet form

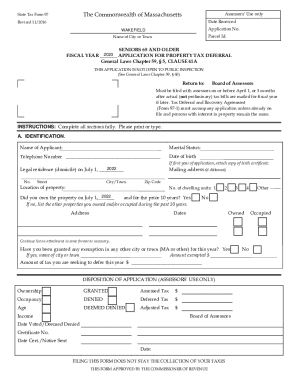

Filling out an estate planning worksheet can feel daunting, but it can be simplified into a series of manageable steps. Begin by collecting necessary documents such as bank statements, property deeds, and other financial documents that specify your assets.

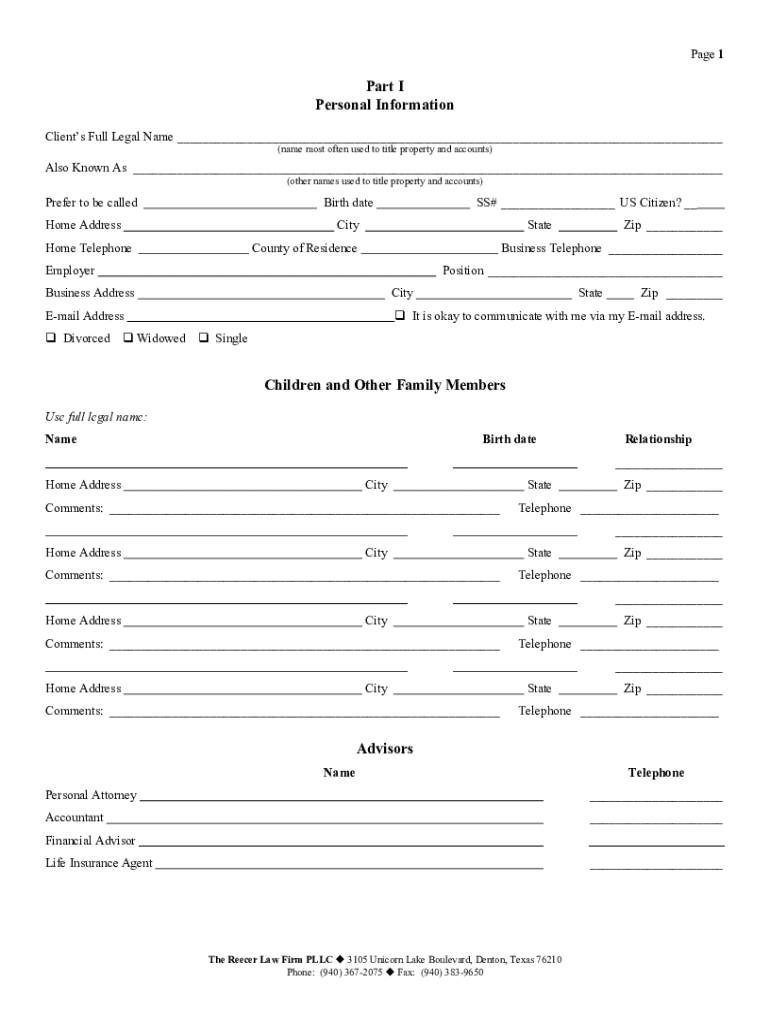

Once you have your documents organized, start with your personal information. Accuracy is vital here, as errors could lead to complications later on. Next, you will inventory your assets, detailing everything from real estate and bank accounts to valuable collections and investments.

Editing and making changes to your estate planning worksheet form

Estate plans should not be static; they require regular updates to reflect changes in your life circumstances. Significant life events such as marriage, divorce, the birth of a child, or a substantial change in financial status are all critical times to review and edit your estate planning documentation.

Maintaining a regular review schedule, such as annually, can ensure that your estate plan remains relevant and reflective of your current wishes and life circumstances. With tools like pdfFiller, making changes to your estate planning worksheet form is straightforward and efficient.

Managing and signing your estate planning documents

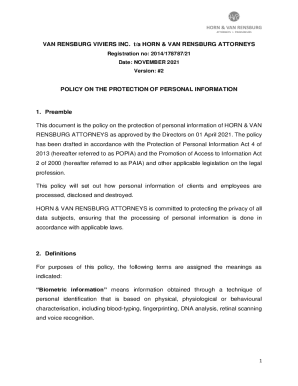

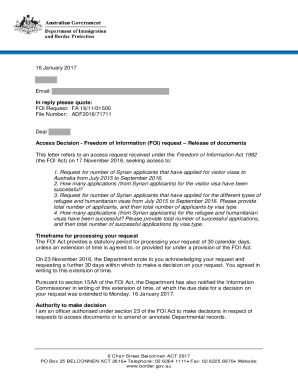

Once the estate planning worksheet form is completed, it is essential to consider how to manage and sign your documents properly. Different signing options are available, including electronic signatures and traditional handwritten signatures. It's critical to understand that electronic signatures can be legally valid under certain conditions.

Storing these documents securely is equally important. Utilizing cloud-based solutions can help keep your documents safe while allowing easy access from anywhere. Platforms like pdfFiller not only provide secure storage but also have ample security features to safeguard your information.

Collaborating with family and advisors

Engaging with family members in the estate planning process fosters transparency and understanding about your wishes. Discussing your plans openly can help prevent future family disputes and ensure that your intentions are clearly understood.

Additionally, collaborating with professionals such as lawyers, accountants, and financial advisors can provide the expertise needed to navigate the complexities of estate planning. Choosing the right professionals is based on their experience and understanding of your specific situation.

Key takeaways for effective estate planning

A strong estate plan is comprehensive and well tailored to your specific circumstances. It should account for all aspects of your life, from financial assets to personal wishes, ensuring that everything aligns with your intentions.

Understanding the legalities involved in estate planning helps ensure compliance with laws and minimizes the risk of disputes down the line. Regular reviews and updates of your estate plan, combined with the use of effective tools like the estate planning worksheet form and pdfFiller, allow for a proactive approach to managing your estate.

Frequently asked questions about estate planning

When it comes to estate planning, many individuals have common questions and misconceptions. One of the most prevalent questions is regarding the necessity of a will and if it's essential to have one at all.

Another common front revolves around trusts, particularly concerns about their complexity and whether they are worth the investment. Expert insights can dispel myths and clarify the various aspects of estate planning, making the process more manageable for everyone.

Related topics to explore

There are numerous adjacent topics worth exploring beyond just the estate planning worksheet form. Understanding trust funds and their uses can provide valuable insights into asset management and distribution.

Additionally, being knowledgeable about estate taxes and the role of an executor in estate planning can further enhance your understanding of the broader estate planning landscape. These insights will equip you with the tools needed to make informed decisions about your estate plan.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify estate planning worksheet without leaving Google Drive?

Can I sign the estate planning worksheet electronically in Chrome?

How can I fill out estate planning worksheet on an iOS device?

What is estate planning worksheet?

Who is required to file estate planning worksheet?

How to fill out estate planning worksheet?

What is the purpose of estate planning worksheet?

What information must be reported on estate planning worksheet?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.