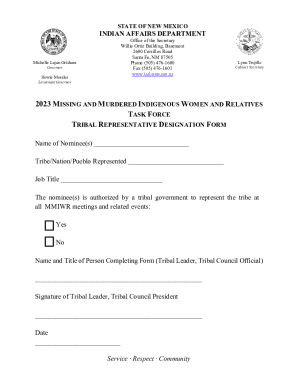

Get the free Online www2 illinois 4825 E Fax Email Print - hfs illinois

Get, Create, Make and Sign online www2 illinois 4825

How to edit online www2 illinois 4825 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out online www2 illinois 4825

How to fill out online www2 illinois 4825

Who needs online www2 illinois 4825?

Understanding the online www2 Illinois 4825 form: A comprehensive guide

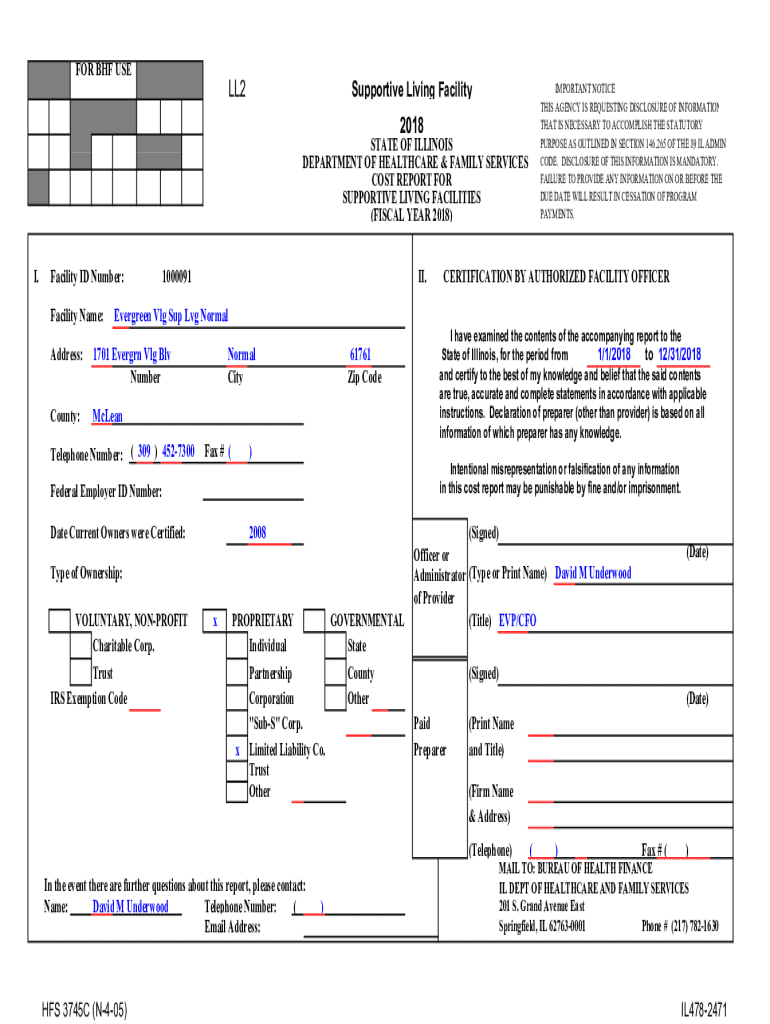

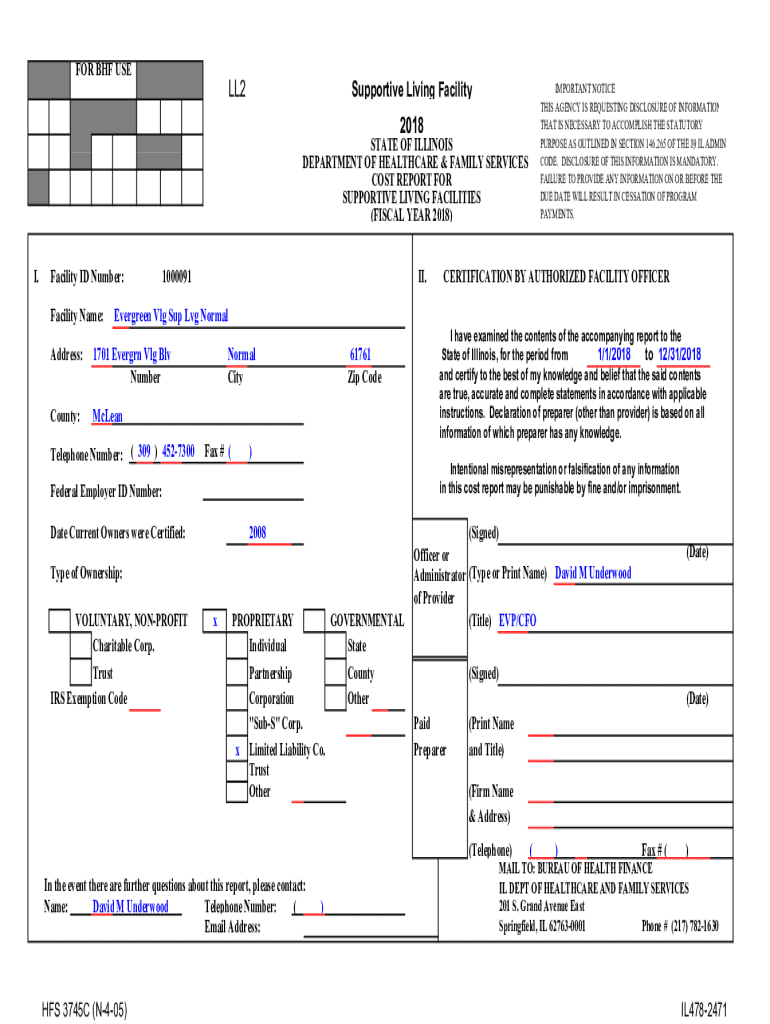

Overview of the Illinois 4825 Form

The Illinois 4825 form is a crucial document used for tax reporting within the state of Illinois. This form primarily serves to report various personal and business financial activities, enhancing the accuracy of tax submissions. Its role in tax reporting cannot be overstated; it ensures that both individuals and businesses comply with their tax obligations, preventing potential penalties or audits from the Illinois Department of Revenue.

Specific circumstances triggering the need to file the Illinois 4825 form can include changes in income, business operations, or significant financial transactions. Individuals who have undergone life changes, such as marriage or inheritance, may also need to utilize this form. Moreover, businesses experiencing income fluctuations or adjustments in tax liability are required to file the 4825 form to maintain compliance.

Accessing the Illinois 4825 Form Online

Accessing the Illinois 4825 form online is straightforward. The form can be located on the official Illinois government website, which provides users with up-to-date information and resources related to tax forms. Users should navigate directly to the appropriate section focusing on tax forms to find the Illinois 4825 form.

Direct access to the form is available through the official [www2 Illinois website]() where the latest versions are hosted. Additionally, for those seeking alternative formats, pdfFiller offers the Illinois 4825 form in editable PDF format, allowing users to fill and submit it conveniently from any device.

Step-by-step guide to filling out the Illinois 4825 form

Filling out the Illinois 4825 form requires careful attention to detail. The first step is gathering all necessary information, which typically includes personal data such as your name, Social Security number, and address. Furthermore, detailed financial information reflecting your income and deductions is crucial for accurate reporting.

Once the information is gathered, you can move on to filling each section of the form. It's important to read the instructions for each line carefully. Common pitfalls include incorrectly entering figures or overlooking required signatures. To avoid these mistakes, double-check your entries and consider using sample entries will help illustrate correct completion.

Signatures and submission of the Illinois 4825 form

Submitting the Illinois 4825 form correctly includes the necessity of proper signatures. Electronic signatures, facilitated through platforms like pdfFiller, help simplify the signing process, ensuring compliance with legal standards. After signing the form, users can choose to submit it online through the designated portals or opt for mail-in submission.

Understanding filing deadlines is crucial to avoid penalties. It’s recommended to check the current year deadlines and ensure all submissions are complete before the due date. Additionally, tracking your submission status can prevent any last-minute complications.

Common issues and FAQs related to the Illinois 4825 form

As with any tax form, common issues may arise during the completion of the Illinois 4825 form. For instance, mistakes after submission can often cause anxiety. If an error is found, it is essential to correct it through the appropriate channels provided by the Illinois Department of Revenue. Maintaining open lines of communication and promptly addressing mistakes is critical for maintaining compliance.

Inquiries such as how to check the status of your form or other related questions often arise. Resources such as the Illinois Department of Revenue website can provide valuable assistance. pdfFiller also offers comprehensive support tools to guide users through potential issues, ensuring an efficient workflow.

Tools and resources available on pdfFiller

pdfFiller offers excellent features that significantly enhance form management. With cloud storage capabilities, users can secure documents and access them from anywhere. Additionally, collaboration features allow multiple stakeholders to work on the form seamlessly, thus improving efficiency and accuracy.

Interactive tools such as calculators and tailored form templates for Illinois tax needs simplify the filing process. Users can select templates designed for their specific requirements, making the task of filling out taxes much less daunting.

Final tips for managing your Illinois 4825 form documentation

Proper tax document management is everything. Best practices involve keeping meticulous records of all tax-related documents, including the Illinois 4825 form. Organizing these documents using pdfFiller’s capabilities allows for easier reference throughout the tax year and during audits.

Staying informed about the latest Illinois tax regulations is vital to ensure compliance and avoid legal issues. Regularly review updates on the Illinois Department of Revenue's website or subscribe to tax news updates to maintain current knowledge.

User testimonials and case studies

Countless users have experienced improved tax management with the assistance of pdfFiller. Testimonials from individuals indicate a streamlined filing process, reducing the overall time spent on paperwork. Businesses have also reported enhanced collaboration within teams through the platform, leading to higher success rates in accurate filing.

Real-life case studies demonstrate how pdfFiller has transformed the way users handle their forms. For instance, a small business highlighted that shifts to pdfFiller resulted in a 50% reduction in time spent managing their tax documents. This efficiency not only saved them time but also improved their compliance rate.

Comparison with other tax forms and resources

The Illinois 4825 form offers unique advantages compared to other tax forms available. It addresses specific financial scenarios, differentiating it from general forms like the Illinois 1040. Understanding which form to choose is imperative based on individual or business circumstances, as the Illinois 4825 might provide particular benefits in certain scenarios.

For those with complicated tax situations, consulting with professionals or utilizing other relevant tax forms may be beneficial alongside the Illinois 4825 form. Having the correct documentation is key to ensuring a smooth filing process and compliance with Illinois tax laws.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my online www2 illinois 4825 in Gmail?

How can I send online www2 illinois 4825 to be eSigned by others?

How do I edit online www2 illinois 4825 on an iOS device?

What is online www2 illinois 4825?

Who is required to file online www2 illinois 4825?

How to fill out online www2 illinois 4825?

What is the purpose of online www2 illinois 4825?

What information must be reported on online www2 illinois 4825?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.